From a 40% Stake to a Sharp Drop to 24%: Phoenix Optics Embarks on a Major Strategic Retreat!

![]() 12/29 2025

12/29 2025

![]() 430

430

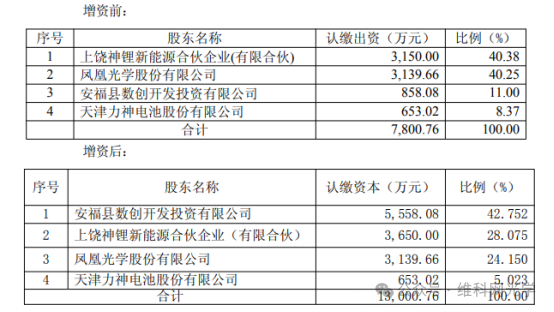

On December 27, Phoenix Optics made an announcement stating that its invested entity, Fengli New Energy (Huizhou) Co., Ltd. (hereinafter referred to as "Fengli New Energy"), in light of business development requirements, has plans to augment its capital and expand its share base. Anfu County Digital Innovation Development Investment Co., Ltd., a stakeholder in Fengli New Energy, is set to inject RMB 47 million to acquire RMB 47 million worth of newly issued registered capital in Fengli New Energy. Similarly, Shangrao Shenli New Energy Partnership (Limited Partnership), another shareholder, will contribute RMB 5 million to subscribe for an equivalent amount in newly added registered capital of Fengli New Energy. Notably, Phoenix Optics has chosen to forgo its preemptive subscription rights for this capital increase.

Upon completion of this capital increase, Phoenix Optics' ownership stake in Fengli New Energy will undergo a corresponding dilution, with its equity interest decreasing from 40.25% to 24.150%.

Phoenix Optics clarified that its decision to relinquish the preemptive subscription rights for the capital increase in its invested company, Fengli New Energy, was reached after a thorough assessment of its own circumstances, business strategies, and the prevailing operational landscape of Fengli New Energy. This move is in harmony with the company's overarching planning and long-term interests.

This strategic decision underscores Phoenix Optics' pivotal trade-offs amidst industry cycles and its own strategic positioning. Presently, the lithium battery sector is navigating through a profound adjustment phase, marked by overcapacity and pronounced price volatility. In such a scenario, making additional investments in companies within the industrial chain entails substantial financial risks. By opting out of the capital increase, Phoenix Optics aims to sidestep potential long-term losses in its new energy ventures.

Moreover, the initial investment might have been driven by intentions to establish a foothold in the new energy sector and seek technological and business synergies. However, this recent decision signals a shift in the company's strategic emphasis, clearly reflecting the management's resolve to "concentrate on the core business and streamline the strategic front."

As a listed company primarily focused on optoelectronics, Phoenix Optics' core strengths and strategic assets are deeply rooted in its main business. Allocating funds towards research and development, capacity enhancements, or bolstering working capital in its own optical business presents a far more certain and strategically valuable proposition than investing in a company with an uncertain future. Phoenix Optics' stance towards Fengli New Energy has now shifted more towards "preserving existing value" rather than "pursuing growth." Consequently, expectations for business synergies between the two entities should be significantly tempered moving forward.

In essence, Phoenix Optics' decision to forgo the preemptive subscription rights for the capital increase in Fengli New Energy represents a prudent strategic retreat aimed at solidifying the foundation of its core business. While it entails sacrificing long-term influence in the invested company, it ensures short-term financial stability and mitigates operational risks.