How do you view the fact that Fuyao Glass has refreshed its market capitalization to an all-time high?

![]() 10/22 2024

10/22 2024

![]() 584

584

This article is based on publicly available information and is intended solely for information exchange and does not constitute any investment advice

Since the peak adjustment in February 2021, only a tiny proportion of high-quality blue chips have managed to surpass their previous highs and set new records this year.

Fuyao Glass is a prime example of this.

Since its low in May last year, Fuyao Glass's share price has rebounded by 90%, significantly outperforming the Shanghai and Shenzhen 300 Index, which recorded a decline of -2.5% over the same period.

Fuyao Glass's share price surge against the market trend is primarily driven by its strong fundamentals, which offset the negative impact of the broader market. This suggests that Fuyao Glass's current fundamentals and expectations are favorable.

Investment is about anticipating the future. So, what about Fuyao Glass's growth potential in the future?

01 Fundamental Strength

On October 17, Fuyao Glass released its third-quarter financial report for the year. For the first three quarters, revenue reached 28.3 billion yuan, an increase of 18.8% year-on-year, with net profit attributable to shareholders at 5.479 billion yuan, up 32.79% year-on-year. Excluding exchange losses and reduced equity investment gains, total profit for the first three quarters increased by 49.4% year-on-year.

Figure: Key Financial Indicators of Fuyao Glass, Source: Wind

From 2019 to 2020, Fuyao Glass's net profit attributable to shareholders declined for two consecutive years due to the global automotive market downturn and the impact of the COVID-19 pandemic.

However, with the explosion of the new energy vehicle market starting in 2021, Fuyao Glass's performance rebounded to high growth rates. From Q3 2020 to Q3 2024, net profit attributable to shareholders increased from 1.723 billion yuan to 5.479 billion yuan, with a compound annual growth rate of 33.5%.

Against the backdrop of increasing competition in the automotive industry, Fuyao Glass's achievements are quite impressive.

Looking at profitability, as of the end of the third quarter this year, the company's gross profit margin was 37.8%, up 2.47% year-on-year, setting a new high since 2021. The latest net profit margin of 19.37% is a six-year high, approaching the 20%+ records set in 2010 and 2018.

There are three main factors contributing to this significant improvement in profitability:

Firstly, with the continuous optimization of capacity utilization and other operational aspects at its US plant, the profitability gap with the domestic market has narrowed. In the first half of 2024, the net profit margin in the US market was 11.52%, an increase of 4% year-on-year.

Secondly, the sharp decline in raw material prices, led by soda ash and natural gas, has driven an increase in gross margin. The main contract price of soda ash has fallen from a peak of around 3,000 yuan/ton in January last year to the current 1,450 yuan/ton, a decline of over 50%.

Thirdly, scale effects and the company's own "cost reduction and efficiency enhancement" initiatives have led to a steady decline in overall expense ratios. For example, the sales expense ratio has dropped significantly from 7.4% in 2020 to the latest 4.3%, while the administration expense ratio has declined from 10.43% in the same period to 7.36%. The R&D expense ratio has increased slightly.

Turning to dividends, since its listing in 1993, Fuyao Glass has distributed dividends every year, totaling 51.2 billion yuan, with an average annual dividend payout ratio of 55.9%. From 2020 to 2023, the dividend payout ratios were 75.26%, 82.95%, 68.6%, and 60.27%, respectively. The decrease in dividend payout ratios in recent years is related to the company's significant capital expenditures and capacity expansion plans.

Overall, Fuyao Glass's accelerated growth in performance and profitability following the explosion of the new energy vehicle market is the core logic behind its share price surge against the market trend.

02 Volume and Price Increases Expected

Regarding Fuyao Glass's growth potential, we will analyze it from two dimensions: volume and price.

Globally, automobile sales have consistently grown year after year, except for the 2008 subprime mortgage crisis and the 2020 COVID-19 pandemic. In 2020, global automobile sales plummeted by 14% to 79.67 million units, but have gradually recovered since then, reaching 92.45 million units in 2023, surpassing the pre-pandemic level of 2019 and approaching the all-time high of 95.66 million units.

Global automobile sales are expected to expand in line with global economic growth, albeit at a slower pace.

Given this global automobile market landscape, how will the automotive glass market pie be divided?

In 2023, Fuyao Glass's global market share reached 34% (with a domestic market share of 70%), up from just 10% in 2010 and 28% in 2020. Currently, Fuyao Glass has the highest global market share, significantly surpassing competitors like Nippon Sheet Glass, Saint-Gobain, and Asahi Glass.

These four companies together account for over 90% of the global market share, indicating that the automotive glass industry is highly monopolized with a favorable market structure. It will be difficult for new competitors to encroach on the market share of established players.

The high degree of monopoly is attributed to the high barriers to entry in the automotive glass industry:

On the one hand, the heavy asset-based business model and long investment payoff period discourage outside capital from entering the industry. On the other hand, automotive glass is not ordinary float glass and requires long-term technological accumulation. Moreover, due to product characteristics and transportation costs, production capacity is dispersed, necessitating global operational capabilities.

In the future, Fuyao Glass's market share is expected to continue rising. According to research by Guosen Securities, the company's market shares in China's OE, China's aftermarket, Europe, the US OE, and the US aftermarket are projected to increase from the current levels of 70%, 30%, 20%, 30%, and 40% to 80%, 50%, 30%+, 40%+, and 50%+ in the medium to long term, respectively.

There are two main reasons why Fuyao Glass is able to continuously increase its market share:

Firstly, Fuyao Glass has long focused on automotive glass and has continuously improved its cost efficiency in raw materials, manufacturing, labor, and energy, maintaining strong product competitiveness.

Secondly, Fuyao Glass benefits from the expanding market share of Chinese domestic automotive brands, who are more likely to use domestic automotive glass due to potential supply chain considerations.

With the explosion of the new energy vehicle market, Chinese automakers have become world leaders in electrification, intelligence, and connectivity, surpassing traditional German, Japanese, and Korean automakers in competitiveness. As they continue to expand their global market share, Fuyao Glass stands to benefit.

Apart from these factors, the amount of automotive glass used per vehicle is also on the rise.

One reason is the increasing popularity of SUVs. According to data from the China Passenger Car Association, SUVs accounted for 47.8% of the Chinese market in 2023, surpassing sedans for the first time. This trend has continued into 2024, with SUVs accounting for 49.6% of the market in the first half of the year. SUVs have larger spaces and thus require more automotive glass per vehicle.

Another reason is the evolution of vehicle roofs, from closed roofs to small sunroofs (0.2 square meters), to panoramic sunroofs (0.5-0.9 square meters), and finally to sky roofs (1.3-1.4 square meters).

In the Chinese market, the proportion of vehicles without sunroofs or with small sunroofs is decreasing, while the proportion of vehicles with panoramic sunroofs and sky roofs is increasing, contributing to an increase in the area of automotive glass used per vehicle, from approximately 4 square meters in 2019 to 4.2 square meters in 2023. As the penetration rate of sky roofs continues to rise, the area of automotive glass used per vehicle is expected to further increase.

In summary, factors such as modest global automobile sales growth, changes in market structure, the rising popularity of SUVs, and trends in vehicle roof designs are all conducive to Fuyao Glass's growth in terms of volume.

Of course, a good business is not just about volume; it's also crucial that prices can continue to rise. When both volume and price increase, it creates an excellent "money-printing" opportunity.

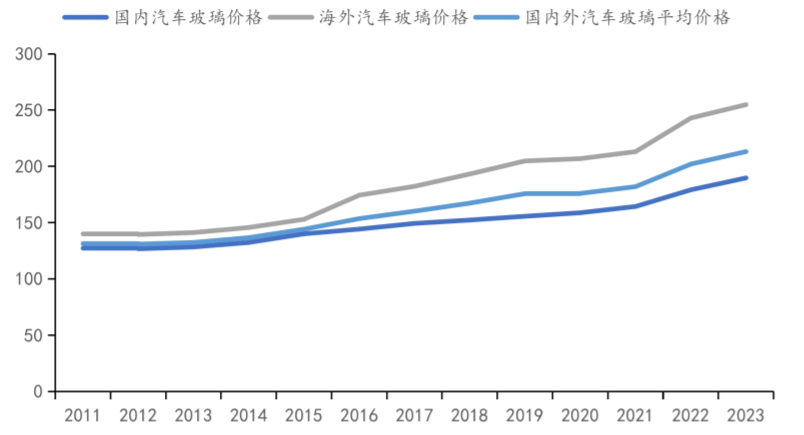

With the explosion of the new energy vehicle market, demand for automotive glass products has increased, leading to sustained price hikes. In 2023, Fuyao Glass's automotive glass price was 213.2 yuan per square meter, up 5.94% year-on-year, primarily due to an increase in the proportion of high value-added products such as smart panoramic sky roofs, dimmable glass, head-up display glass, and ultra-insulating glass. The proportion of high value-added products increased by over 9% year-on-year in 2023.

Figure: Change in Unit Price of Fuyao Glass's Automotive Glass, Source: Guohai Securities

With both volume and price increases, Fuyao Glass's future potential growth in performance is well-grounded.

03 Looking Ahead through Capital Expenditures

For Fuyao Glass to continue increasing its market share, expanding capital expenditures and production capacity are essential. Historically, Fuyao Glass's capital expenditures have preceded its revenue growth.

Since 2010, Fuyao Glass has experienced three rounds of peak capital expenditures. The first round was from 2010 to 2013, with expenditure increasing from 1.07 billion yuan to 1.88 billion yuan. This was reflected in revenue growth, which climbed to 13.6 billion yuan in 2015.

The second round was from 2014 to 2016, with expenditure rising from 2.79 billion yuan to 3.59 billion yuan, primarily to prepare production bases in Russia, the US, and domestic locations such as Shenyang and Tianjin. With a 2-3 year construction and commissioning cycle, Fuyao Glass should have entered a harvest period starting in 2016. However, the global economy was sluggish from 2017 to 2019, and the global automotive market remained in a downturn, leading to subpar performance for Fuyao Glass despite the new capacity coming online.

Nevertheless, the new capacity ultimately bore fruit from 2021 to 2023, with revenue growing continuously from 23.6 billion yuan to 33.16 billion yuan.

The third round of capital expenditures began in 2021, with expenditure increasing from 2.33 billion yuan to 4.47 billion yuan in 2023. In 2024, the company was even more aggressive, announcing plans to invest 3.25 billion yuan and 5.75 billion yuan in expanding glass production capacity in Fujian and Hefei, respectively.

From a capital expenditure cycle perspective, the growth certainty for Fuyao Glass in 2025-2026 is relatively strong (with significant potential to expand its global market share), while its competitors are largely contracting their capital expenditures.

For example, Nippon Sheet Glass, the second-largest player in global market share, has seen its capital expenditures plummet from 80.4 billion yen in 2019 to 24.7 billion yen in 2023, in stark contrast to Fuyao Glass's continued aggressive expansion.

In summary, Fuyao Glass is well-positioned in a high-quality market segment and stands to benefit from both volume and price increases. Coupled with the impending harvest period for its capital expenditures over the next 2-3 years, sustained high growth rates in performance are expected.

Based on this overarching logic, northbound funds have expressed their confidence with hard cash. As of September 30, northbound funds held 24.3 billion yuan worth of Fuyao Glass shares, ranking 14th among A-share heavyweights in terms of holdings; the shareholding ratio was 20.89%, ranking first.

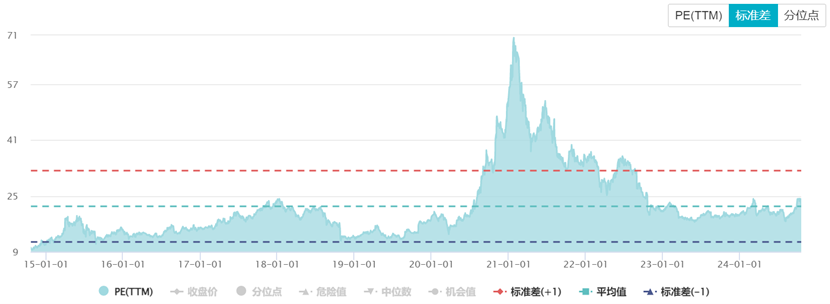

The capital market as a whole has also priced Fuyao Glass positively. Its current PE ratio of 21.9 is above the median valuation over the past decade (19.13x), indicating a reasonable valuation that is neither overly undervalued nor overvalued.

Figure: PE Ratio of Fuyao Glass, Source: Wind

Of course, Fuyao Glass also faces some potential risks. Approximately 45% of the company's overseas revenue comes from the US market, accounting for over 40% of its total overseas revenue. In August this year, the company's US subsidiary was subject to a surprise inspection by multiple US law enforcement agencies, including the Department of Homeland Security, causing market panic and a share price drop. However, the incident turned out to be a false alarm.

Another example is Fuyao Glass's production base in Russia, established to meet European market demand. However, due to geopolitical factors, the utilization rate of its 1.3 million unit capacity is currently only around 60%, significantly lower than that of its other major production bases.

In summary, geopolitical risks are one of the major operational risks faced by Chinese companies like Fuyao Glass, and it is essential to keep track of and be vigilant about them.