Shengfulai's performance declines: gross margin under pressure, cash dividend of 55 million followed by additional liquidity of 30 million

![]() 11/28 2024

11/28 2024

![]() 690

690

On October 18, Jiangxi Shengfulai Optical Technology Co., Ltd. disclosed the second round of review inquiry letters for listing on the Beijing Stock Exchange, and the company's listing process continued to advance. On November 26, the company responded to the second round of review inquiry letters.

Public information shows that in December 2023, Shengfulai submitted its listing application to the Beijing Stock Exchange and was accepted, with Zhongtian Guofu Securities as the sponsor. From the concerns raised by the regulatory authorities in the two rounds of review inquiry letters, Shengfulai's declining performance, the necessity of fundraising and investment, and financial internal control issues received more attention.

01

Revenue and net profit decline in 2024

Shengfulai specializes in the research and development, production, and sales of high-refractive-index glass beads and products, as well as optical films. The company's current products can be divided into two categories: high-refractive-index glass beads and products, and optical films, which are mainly used in road traffic safety, occupational protection and personal protection, public safety, advertising spray painting, consumer products, LED lighting and display, and other fields.

Shengfulai's prospectus remains at December 2023. Classified by business structure, about 60% of Shengfulai's revenue comes from high-refractive-index glass beads. From 2020 to 2022 and from January to June 2023 (hereinafter referred to as the reporting period), the revenue contributed by high-refractive-index glass beads was 136 million yuan, 161 million yuan, 146 million yuan, and 72.4331 million yuan, respectively, accounting for 59.58%, 58.3%, 57.04%, and 57.8% of the main business revenue during the corresponding periods.

The second highest contributor to revenue was the microprismatic reflective film business, which generated revenue of 44.893 million yuan, 59.2133 million yuan, 58.5328 million yuan, and 30.5814 million yuan during the period, accounting for 19.71%, 21.45%, 22.9%, and 24.41% of the main business revenue during the corresponding periods, respectively.

It is not difficult to see that in 2022, Shengfulai's main business revenue from high-refractive-index glass beads and microprismatic reflective films both declined compared to the previous year, which also affected the company's overall revenue performance during the period.

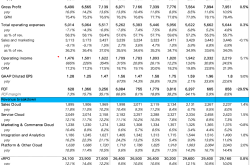

During the reporting period, Shengfulai achieved revenue of 228 million yuan, 277 million yuan, 256 million yuan, and 126 million yuan, with year-on-year growth rates of 21.4% and -7.62% in 2021 and 2022, respectively.

In terms of net profit and gross margin, which reflect the company's profitability, during the reporting period, Shengfulai's net profits were 40.12 million yuan, 51.239 million yuan, 39.5025 million yuan, and 20.0873 million yuan, respectively. After excluding non-recurring gains and losses, the net profits attributable to shareholders of the parent company were 35.7622 million yuan, 46.5905 million yuan, 31.3077 million yuan, and 17.0105 million yuan, respectively.

In 2022, Shengfulai's net profit after deducting non-recurring gains and losses fell by 32.8% year-on-year. The company disclosed that the decline in performance was mainly due to the decline in revenue from 1.93 refractive index glass beads. There are many enterprises producing 1.93 refractive index glass beads, and market competition is fierce. The unit price of 1.93 refractive index glass beads is relatively low.

During the reporting period, Shengfulai's gross margins were 36.14%, 33.07%, 30.15%, and 31.04%, respectively. The gross margins of the main business were 36.24%, 33.12%, 30.18%, and 31.08%, respectively, declining by 5.16 percentage points over three years and six months. In the first half of this year, the company's gross margin increased year-on-year to 32.21%.

According to data disclosed in the review inquiry letters, in 2023, Shengfulai achieved revenue of 266 million yuan, a year-on-year increase of 3.73%, and a net profit attributable to shareholders of the parent company after deducting non-recurring gains and losses of 37.0612 million yuan, a year-on-year increase of 18.36%. From January to June 2024, revenue was 112 million yuan, a year-on-year decrease of 10.54%; and the net profit attributable to shareholders of the parent company after deducting non-recurring gains and losses was 14.6615 million yuan, a year-on-year decrease of 13.81%. In the second round of review inquiry letters, the Beijing Stock Exchange required Shengfulai to answer and explain the reasons and rationality for the opposite performance changes in 2023 compared to comparable companies, quantify and analyze the specific reasons for the performance decline in the first half of 2024, and assess whether there is a risk of further decline in future performance.

The company stated that the year-on-year decline in performance in the first half of 2024 was mainly due to the combined impact of declining gross operating profit and increasing expenses, with the decline in gross operating profit being the primary reason. The main reasons for the decline in gross operating profit in the first half of 2024 were: (1) the sales revenue and gross margin contribution from JAPAN TRADE SERVICE CENTER, the main customer for high-refractive-index glass beads, declined year-on-year; and (2) the overall sales revenue and gross margin of microprismatic reflective film products declined due to market competition and decreased downstream demand.

According to the response to the second round of review inquiry letters, from January to September 2024, Shengfulai's revenue, net profit, and net profit attributable to shareholders of the parent company after deducting non-recurring gains and losses were 176 million yuan, 25.7479 million yuan, and 23.1887 million yuan, respectively, representing year-on-year decreases of 8.03%, 21.52%, and 15.68%, respectively. Compared with the first half of 2024, the decline in revenue narrowed, while the declines in net profit and net profit attributable to shareholders of the parent company after deducting non-recurring gains and losses increased, mainly due to an increase in other cost expenses such as taxes and period expenses compared to the same period last year. According to the company's post-period performance changes, the decline in sales revenue has narrowed, but net profit is still declining, mainly due to increases in administrative expenses, asset impairment losses, and credit impairment losses. The company is actively collecting payments to reduce accounts receivable balances, and administrative expenses in the fourth quarter are expected to decrease year-on-year. According to the 2024 profit forecast audit report, the company's revenue and net profit attributable to shareholders of the parent company after deducting non-recurring gains and losses in 2024 are expected to decrease by 9.66% and 9.29%, respectively, compared to 2023, indicating a relatively small expected decline in performance for the full year of 2024.

Shengfulai elaborated that the company's business cooperation with its main customers, whose revenue declined in the first half of 2024, is ongoing; the company has established long-term and stable cooperative relationships with its main customers, and the company's supply share is relatively large; the company maintains good cooperative relationships with existing customers by improving product quality and acquires business through various channels to develop new customers for existing products. The company attaches importance to innovative research and development of products to further expand new businesses and customers.

In the second half of 2024, Shengfulai's orders for high-refractive-index glass beads with JAPAN TRADE SERVICE CENTER have gradually recovered, and orders for microprismatic reflective films with giftec reflection ltd have further increased. Post-period revenue and orders on hand have increased compared to the first and second quarters of 2024, and factors contributing to the performance decline have gradually recovered.

02

Questions arise about whether the expanded production capacity can be absorbed, cash dividend of 55 million followed by additional liquidity

According to the prospectus, during the reporting period, Shengfulai had some issues with sales revenue confirmation and receipt documents, including flawed documents, irregular expense reimbursement approval procedures, lack of internal control in research and development hour statistics, inaccurate disclosure of related party information, inaccurate disclosure of the number of research and development personnel, loan transfers, personal card usage, cash transactions, third-party collections, and other irregularities in financial internal control.

During the reporting period, to meet the entrusted payment requirements of lending banks, Shengfulai transferred bank loans through subsidiaries or other suppliers. In 2020, the amount of loan transfers conducted by the company and its subsidiaries was 28.5136 million yuan.

During the reporting period, Shengfulai received payments related to the company's operations through personal bank accounts and Paypal accounts opened in the name of individuals. The personal bank account was closed at the end of June 2021, and the Paypal account was closed after transferring the account funds to the company's bank account in March 2022.

From 2020 to 2022, the amounts received by Shengfulai's personal accounts were 501,900 yuan, 95,900 yuan, and 1,100 yuan, respectively, all of which were payments received for the sale of waste products, scrap materials, samples, etc., accounting for 0.22%, 0.03%, and 0.00% of revenue during the corresponding periods, respectively.

From 2020 to 2021, Shengfulai made payments related to the company's operations through personal accounts. The amounts paid by the company's personal cards were 1.0616 million yuan and 188,200 yuan, respectively, for business entertainment expenses, consulting fees, employee compensation and benefits, and interest payments on fund lending, accounting for 0.73% and 0.10% of operating costs during the corresponding periods, respectively.

During the reporting period, Shengfulai's cash receipts were 82,300 yuan, 114,800 yuan, 200 yuan, and 400 yuan, respectively, and cash payments were 25,900 yuan, 45,000 yuan, 12,300 yuan, and 0 yuan, respectively.

For this IPO, Shengfulai plans to raise 204 million yuan, of which 174 million yuan will be invested in the construction of a project with an annual production capacity of 3,000 tons of high-refractive-index glass beads and a research and development center, and 30 million yuan will be used to supplement liquidity.

As of the end of June 2023, the capacity utilization rates of Shengfulai's high-refractive-index glass beads, microprismatic reflective films, and PC light diffusing plates (films) were 80.92%, 85%, and 51.03%, respectively. With capacity utilization not yet saturated, there are many external doubts about whether Shengfulai's expanded production capacity can be absorbed.

In the second round of review inquiry letters, the Beijing Stock Exchange required Shengfulai to explain whether downstream industry market demand continues to decline based on changes in capacity utilization and sales-production ratios during the reporting period, and to quantitatively analyze and supplement the feasibility of the company's ability to absorb the new production capacity from this fundraising and investment project, considering changes in post-period orders or demand from the issuer's existing major customers.

In addition, from 2020 to 2022, Shengfulai also completed three cash dividends totaling 54.9944 million yuan, accounting for 38.52% of the total net profit attributable to shareholders of the parent company during the reporting period. The large cash dividends on one hand and the need for liquidity supplementation from fundraising on the other may raise speculation about the necessity of Shengfulai's fundraising. (Produced by Gangwan Finance News)