A Decade of Sports Camera Battles: Who Wins, the Veterans or the New Dark Horses?

![]() 12/06 2024

12/06 2024

![]() 557

557

Text/Dou Wenxue

Editor/Ziye

The sports camera industry has developed rapidly in recent years.

According to data released by the Huajing Industry Research Institute, the global retail market size of handheld smart imaging devices has grown from 16.43 billion yuan in 2017 to 36.47 billion yuan in 2023, with a compound annual growth rate (CAGR) of 14.2%. Among them, sports cameras dominate, accounting for over 85% of the sports camera retail market size in 2023.

In addition, the global market size of sports cameras continues to expand, from 13.93 billion yuan in 2017 to 31.44 billion yuan in 2023.

With the booming market, sports camera brands are no longer dominated solely by GoPro, with up-and-coming brands such as Insta360 and DJI also emerging.

According to an industry research report by Frost & Sullivan, in the global consumer-grade panoramic camera market, Insta360, GoPro, and Ricoh accounted for about 90% of the market share in 2023. In the global sports camera market, GoPro, Insta360, DJI, and two other major vendors occupied over 74% of the market share in 2023.

GoPro faces significant challenges this year.

For example, its financial results for the second quarter of fiscal year 2024 were not optimistic. It also previously targeted competitor Insta360, listing almost all of Insta360's products and accusing them of infringing on its patents.

Meanwhile, in March this year, GoPro disclosed in a filing with the U.S. Securities and Exchange Commission that the company plans to reduce its global workforce by about 4%, with the business restructuring expected to incur total costs of approximately $7.5 million.

In contrast, Insta360 and DJI have been quietly focused on their businesses, continuously pushing the performance limits of their products and optimizing every detail, from size to sensors, waterproofing, and even sound recording.

In 2024, both brands have successively launched multiple products, maximizing cost-effectiveness.

Image source: DJI official WeChat public account

As the industry scale further expands and the consumer base grows, what kind of growth opportunities will these two 'dark horses' bring to sports cameras?

Founded in 2002, GoPro is undoubtedly the oldest player in the industry and has even become synonymous with sports cameras.

For a long time, GoPro maintained its dominant position in the sports camera industry. Even those unfamiliar with sports cameras knew that the small camera worn by celebrities on reality TV shows to capture extreme sports perspectives was called GoPro.

Image source: GoPro official WeChat public account

In 2014, the company's market value peaked at $13 billion, with its share price surging 140% in the first three months.

However, GoPro subsequently made consecutive strategic errors, not only choosing a 'sea of machines' strategy that neglected essential product features but also attempting a business transformation that put pressure on the company's performance.

GoPro's deviation also gave competitors an opportunity, with brands like Sony, HTC, and Xiaomi entering the sports camera market.

Insta360 was born during this period.

Unlike domestic brands that typically prioritize domestic and online markets before expanding internationally and offline, Insta360 focused on offline and international markets from the outset and released the Insta360 Nano in its second year, addressing the slow transmission and stitching speeds of panoramic cameras at the time and quickly gaining prominence in the market.

In 2017, Insta360 successfully gained attention on the internet with a stunning panoramic video from an 'eagle's perspective.' In 2018, Insta360 became the world's top shipper of panoramic cameras, outperforming long-established imaging product giants like Samsung and Ricoh.

In 2019, DJI also entered the sports camera space, releasing its first sports camera, the DJI Osmo Action, in May of that year.

As a newcomer to the industry, DJI infused its pioneering sports camera with technology comparable to GoPro's top products, excelling in wide-angle shooting and forcing GoPro's Tmall flagship store to offer discounts due to its competitive pricing.

According to reports from China Photography News at the time, within 48 hours of DJI officially releasing the Action (priced at 2,499 yuan), GoPro's Tmall store reduced the price of its top-performing Hero7 Black standard edition from 3,398 yuan to 2,798 yuan.

DJI has since released new sports cameras at a rate of roughly one per year. Just this September, DJI launched its first sports camera with 'Pro' in its name, the Osmo Action 5 Pro.

Amidst the industry's evolution, newcomers have made rapid progress, while the former industry leader, GoPro, has frequently made mistakes. Its products have been criticized for unstable systems, frequent crashes, and impractical updates that remove features some users rely on.

For example, the GoPro 12 removed the GPS logging feature because GoPro found that very few users applied GPS overlays to their content. Removing this feature allowed the product to achieve optimal battery life.

However, many people like to record their driving or cycling routes using GPS and mark them on a small map. While removing GPS improves battery life, it also loses users who need this feature.

Additionally, Insta360 and DJI continue to enhance the practicality of their products.

For example, Insta360 previously implemented features such as AI auto-editing, 'selfie stick invisibility', smart tracking, and 'bullet time,' transforming sports cameras from 'follow cameramen' into all-in-one 'shoot, edit, and refine' devices.

Selfie stick invisibility feature demonstration, image source: Insta360 official WeChat public account

DJI introduced 360° stabilization and night shooting in its fourth-generation products. The latest Osmo Action 5 Pro offers even more without increasing the price, featuring an upgraded 1/1.3-inch OV50H sensor from OmniVision, extended battery life of up to 4 hours, a larger and brighter dual OLED touchscreen, 47GB of built-in storage, and waterproofing up to 20 meters without a case.

This year, GoPro also made its 'anxiety' about domestic brands apparent.

In April, based on Section 337 of the U.S. Tariff Act of 1930, GoPro filed a complaint with the U.S. International Trade Commission, accusing specific cameras, camera systems, and accessories exported to, imported into, or sold in the U.S. of infringing on its patents. One of the two accused companies was Insta360.

Many market voices believe this was GoPro's urgent attempt to drive Insta360 out of the overseas market. Insta360 responded by stating its intention to resolve the issue through court proceedings and expressed confidence in winning the case.

From a financial perspective, GoPro indeed has reason to be anxious.

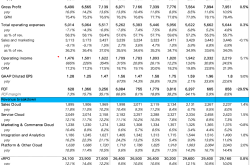

In the second quarter of fiscal year 2024, GoPro's total revenue was $250 million, a year-on-year decrease of about 13.8%. Its net loss was $15 million, a significant year-on-year decrease of 288%.

On the other hand, according to Jiemian News, Insta360's revenue surged in 2023, nearing 4 billion yuan, an increase of nearly 100% year-on-year.

Public data shows that Insta360's revenue exceeded 1 billion yuan in 2021, nearly ten times that of 2017. In 2022, its revenue exceeded 2 billion yuan, marking two consecutive years of revenue doubling.

Furthermore, according to the 2024 Global Smart Handheld Imaging Device Market Development White Paper released by Frost & Sullivan, in the global sports camera segment, domestic brands continue to break through with technological advantages, and Insta360 may surpass GoPro at the end of 2024.

The new dark horses are coming on strong, and the veterans must step up their game.

Product quality is crucial for sports cameras.

Due to their usage in extreme sports, travel selfies, reality TV shows, drone aerial photography, and other scenarios, sports cameras demand high performance in quality, pixel count, waterproofing, battery life, and stabilization.

Product upgrades by the three brands also focus on these aspects.

A horizontal comparison of the top sports camera products from each brand – Insta360 Ace Pro 2, DJI Osmo Action 5 Pro, and GoPro Hero 13 Black – reveals their respective advantages in specifications.

From left to right: Insta360 Ace Pro 2, DJI Osmo Action 5 Pro, GoPro Hero 13 Black, image sources: Insta360 official WeChat public account, DJI official website, GoPro official WeChat public account

In terms of size and weight, the Insta360 Ace Pro 2 is larger and heavier, while the latter two have almost identical dimensions and weights.

Specifically, the Insta360 Ace Pro 2 measures 71.9x52.2x38mm and weighs 177.2g; the DJI Osmo Action 5 Pro measures 70.5x44.2x32.8mm and weighs between 145g and 146g; the GoPro Hero 13 Black measures 71.8x50.8x33.6mm and weighs approximately 154g.

The Insta360 Ace Pro 2 is waterproof up to 12 meters without a case, the DJI Osmo Action 5 Pro up to 20 meters, and the GoPro Hero 13 Black only up to 10 meters.

In terms of sensors and pixel count, the two domestic brands outperform GoPro in sensor usage, achieving new levels of image clarity.

The Insta360 Ace Pro 2 is equipped with a 1/1.3-inch CMOS sensor with about 50 megapixels, supporting 8K30p video recording, 4K60p HDR, and 4K120p slow-motion shooting. It is also the industry's first sports camera with dual AI chips. The DJI Osmo Action 5 Pro features a 1/1.3-inch CMOS sensor with a maximum dynamic range of 13.5 stops and supports 40-megapixel photo shooting.

In contrast, the GoPro Hero 13 Black has a 1/1.9-inch sensor with a maximum pixel count of 27 megapixels, supporting 27-megapixel photo shooting, 5.3K video at 60 fps, 4K video at 120 fps, and 2.7K video at 240 fps.

In terms of battery life, the DJI Osmo Action 5 Pro lasts the longest.

The GoPro Hero 13 Black has a battery capacity of 1900mAh, supporting 5.3K video recording for up to 1.5 hours or 1080p full HD video recording for up to 2.5 hours. The Insta360 Ace Pro 2 and DJI Osmo Action 5 Pro have battery capacities of 1800mAh and 1950mAh, respectively, with runtimes of 180 minutes and 4 hours.

Brands are also focusing on details to enhance the user experience.

For example, the DJI Osmo Action 5 Pro has optimized its screen display, reducing the proportion of icons for parameters like battery life, playback, and recordable time, creating a clear contrast with the GoPro Hero 13 Black, whose screen display is more crowded, with icons occupying almost a third of the screen.

The DJI Osmo Action 5 Pro also comes with 47GB of built-in storage, providing a temporary solution when users forget their memory cards.

Insta360 has designed a removable windscreen for the Ace Pro 2, optimized its audio algorithms to improve recording performance, and enhanced the selfie experience with a 2.5-inch flip touchscreen, a 70% increase in screen pixel density, and a 6% increase in brightness compared to the previous generation, making it very friendly for Vloggers.

Insta360 Ace Pro 2 upgrade comparison, image source: Insta360 official WeChat public account

Furthermore, Insta360 has updated its 'GPS Sports Assistant' in the app, allowing the Ace Pro 2 to record speed, mileage, altitude, and other data without additional accessories and add them to videos.

In contrast, GoPro Hero 13 Black has not made many such detailed optimizations. Even in terms of sensor parameters, it lags behind its competitors. Some market voices believe that GoPro has 'given up' in 2024.

More importantly, in terms of pricing, Insta360 and DJI offer better value for money than GoPro.

The standard package of the Insta360 Ace Pro 2 is priced at 2698 yuan, and the dual-battery package at 2798 yuan. The DJI Osmo Action 5 Pro is priced at 2598 yuan.

In comparison, the GoPro Hero 13 Black is priced at 3298 yuan in China.

While the cost-effectiveness of sports cameras is not solely determined by pricing, and consumers may choose more expensive packages for a better experience, they will still select products based on overall experience when comparing options. If high-priced products do not deliver commensurate value, consumers may turn to competitors.

Therefore, Insta360 and DJI, which focus on cost-effectiveness, are increasingly recognized by consumers.

In the era of rapid short video development, sports camera shipments have been increasing.

According to data released by the Huajing Industry Research Institute, the CAGR of global sports camera shipments from 2017 to 2023 was 21.2%, and global sports camera shipments are expected to reach nearly 50 million units in 2024.

According to data released by RDI, the global sports action camera market size was 43.524 billion yuan in 2023, with the Chinese market accounting for 12.757 billion yuan.

It is estimated that the global sports action camera market size will reach 91.793 billion yuan by 2029, with an estimated average annual compound growth rate of 12.6% during the forecast period.

Zhou Mingzi, Executive Director of Frost & Sullivan Greater China, revealed to the National Business Daily that the rapid growth of the sports camera industry is mainly driven by the rise of short videos and new media, the demand for high-quality imaging devices among extreme sports and outdoor enthusiasts, technological innovation and diversification of application scenarios, as well as the promotion of the tourism market.

Each of these factors, whether camping, hiking, frisbee, rock climbing, cycling, or popular tourist cities like Harbin and Zibo, represents a huge consumer market, providing more diverse usage scenarios for sports cameras.

Image source: Insta360 official website

As the types of consumers purchasing sports cameras diversify, more non-professional users will emerge, pushing sports cameras towards greater automation, ease of operation, and user-friendliness.

Meanwhile, as most sports camera users need to quickly transfer videos to their phones and post them on social media, sports cameras may need faster transfer speeds, prompting further optimization of apps.

Additionally, the potential of Insta360's panoramic sports cameras has been recognized by the market.

According to data released by Frost & Sullivan, in terms of shipments, the global shipments of panoramic cameras in 2023 amounted to 1.96 million units. Europe and the United States are the major consumer markets for panoramic cameras, with shipments accounting for about half of the total. It is predicted that by 2027, the Chinese market will enter a phase of high growth, becoming one of the main growth points in the global panoramic camera market.

Competition in this field may also intensify in 2025.

For example, on November 10, Nicholas Woodman, CEO of GoPro, announced during the third-quarter earnings call that the company's flagship 360-degree panoramic action camera, the GoPro Max 2, would be delayed until 2025.

In addition, artificial intelligence (AI) technology is widely used in the imaging industry. Currently, action camera brands have already made layouts in this regard, utilizing AI to achieve more natural transitions in panoramic scenes, wider-angle shooting perspectives that are closer to real-life scenes, and functions such as intelligent tracking and face recognition.

In the future, both DJI, which already has experience with drones, and Insta360 and GoPro, may further delve into AI technology.

Expanding into international markets is also a necessary path for action camera brands.

Insta360 has primarily focused on overseas markets since its inception, and in 2023, its overseas revenue accounted for 80% of its total revenue.

In the future, as DJI and Insta360's action camera products continue to iterate and mature, their market share in overseas markets may further increase in 2025.

With the continuous update of new technologies and the further expansion of the market size, it is foreseeable that the race for action cameras is far from over. The company that finds the optimal balance between innovation and cost-effectiveness will define the future of the action camera industry.