Ziroom Turns to Overseas Markets for "Self-Rescue"

![]() 05/22 2024

05/22 2024

![]() 848

848

As the domestic long-term rental market continues to flourish, Ziroom has chosen to look overseas at this time.

On May 20th, Ziroom's international rental platform "Ziroom Bijin ZABIT" officially launched, initially providing high-quality rental services in Hong Kong, the United Kingdom, and the United States for Chinese overseas students.

For Ziroom, which is planning an IPO, going overseas is clearly a "new story" it wants to tell the capital market. However, it remains to be seen how much incremental value the highly ordered international rental market can bring to Ziroom's development revenue in the future.

Launching a New Target of "Millions of Properties"

It is reported that currently, Ziroom Bijin ZABIT has been launched on platforms such as the Ziroom APP and WeChat Mini Program. Obviously, Ziroom has been preparing for this successful overseas expansion for quite some time.

The first batch of properties is mainly located in Hong Kong, China, as well as in over 20 major cities and near universities in the UK, including London, Cambridge, Coventry, Birmingham, Bristol, Edinburgh, and others. There are a total of over 20,000 rooms, including centralized living products mainly comprising student apartments, serviced apartments, and hotel-style apartments, as well as decentralized living products including shared and whole rentals.

Currently, the above-mentioned properties have been fully launched and are open for viewing and signing.

Ziroom has even bigger dreams. According to introductions, Ziroom Bijin ZABIT will continue to expand into countries and regions such as the United States, Japan, Canada, Singapore, and Australia in the future, and is expected to provide millions of high-quality properties.

If this plan progresses smoothly, Ziroom's revenue from overseas markets will be several times, or even more, than its current domestic market.

According to data, after 13 years of development, Ziroom currently manages over 1 million properties in the Chinese mainland market, mainly distributed in 10 cities including Beijing, Shanghai, Shenzhen, Hangzhou, Nanjing, Chengdu, Wuhan, Guangzhou, Tianjin, and Suzhou.

This also raises two questions: Does the overseas market have enough customers to support it? And where do the properties come from?

According to the "2023 China Overseas Study White Paper," Hong Kong, the UK, and the US are the three most popular destinations for mainland Chinese students studying abroad.

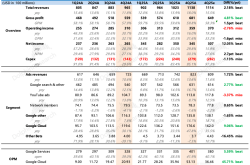

Data shows that the number of mainland Chinese students studying in Hong Kong is approximately 86,200 annually. In addition, talent recruitment is also continuously increasing the demand for rental housing in Hong Kong. According to open data from the Hong Kong Immigration Department, applications for various talent programs in 2023 exceeded 220,000, with about 135,000 approved. Among them, 90,000 people have already arrived in Hong Kong, several times higher than the expected target of 35,000.

However, the UK's student rental market is even broader. Data shows that the number of international students studying in the UK reaches 129,000 annually. The average monthly rent is as high as 11,508 yuan, and it is still increasing, forming a huge market of 17.8 billion yuan annually.

But at the same time, we also see that since 2020, the popularity of studying abroad has been gradually declining. According to the latest US Open Doors Report (2023), the number of international students studying in the US reached 1.057 million in 2023, an increase of 11.7% year-on-year, the highest growth rate in nearly 40 years. However, the number of mainland Chinese students continued to decline by 0.2%, reaching approximately 289,500, a decrease of about 600 people from the previous year, and their proportion also continued to decline to 27.4%.

Of course, even if we set aside the rental demand from Chinese students, the continuous growth of overseas students can still bring a large enough market space. How to meet this part of the rental demand has become an important issue for Ziroom to consider next.

To seize the large market of student apartments, before this, institutions such as KKR, Brookfield, Frasers Property, Singapore's Ascott, and Singapore fund Cambridge RE Partners have invested in acquiring related assets and renovating them into student apartments for rental. Far East Orchard has even directly acquired a 49% stake in Homes For Students, a UK-based student accommodation (PBSA) operator, to expand its management portfolio.

What approach will Ziroom adopt to achieve overseas market expansion? We still need to wait for Ziroom to provide a clear answer.

Value-Added Rentals, a Difficult Path to Self-Rescue

It is not difficult to understand Ziroom's eagerness to expand into overseas markets. Currently, Ziroom's development in the domestic market has already stagnated. As early as 2019, Ziroom announced that it had exceeded 1 million managed properties, but by 2023, this figure has not seen any growth.

During this time, Ziroom has been indulging in creating another "new story" - value-added rentals, changing the traditional C2B2C model of long-term rental apartments where the platform pays to acquire and renovate properties and earns profits from rent differences and vacancy periods.

Public data shows that the value-added rental business model includes two main components: renovation and leasing. The renovation services are provided by Ziroom, and the owner pays; leasing is handled by Ziroom, which promises a guaranteed minimum income to the owner. For any gains in the annual total rent that exceed the guaranteed rent, Ziroom and the owner will share according to an agreed-upon ratio.

If Ziroom manages well, the owner's occupancy rate will be high, and their income will naturally be high, allowing Ziroom to charge a higher commission. Conversely, if Ziroom manages poorly, the owner may not even have to pay a commission. Therefore, Ziroom believes that the value-added rental model, with its advantages such as no rent difference, no vacancy period, guaranteed income, and annual sharing, has stronger anti-risk capabilities and income appreciation potential.

Ziroom also hopes to find an effective path to profitability through value-added rentals.

According to public data, Ziroom accumulated losses of nearly 1.3 billion yuan in 2015, 2016, and 2017. Additionally, according to earlier disclosures from Ke, Ziroom's revenues from 2019 to 2021 were 309 million yuan, 128 million yuan, and 158 million yuan, respectively. It is evident that Ziroom is under considerable operational pressure.

To seek development, Ziroom's financing needs have also become more intense. Before 2020, long-term rental apartments were widely recognized as a good business, and Ziroom also attracted multiple rounds of investment. After SoftBank's $1 billion strategic investment in 2020, Ziroom's post-investment valuation reached $6.6 billion, 6.5 times that of 5i5j's market value.

However, in the three years since then, Ziroom has not disclosed any new financing progress. It is understood that during this period, it issued several corporate ABS through its subsidiary Beijing Ziroom Zhongcheng Yourong Information Technology.

Ziroom has also launched an IPO financing plan. Since 2023, there have been rumors of Ziroom's IPO in Hong Kong every so often, but no substantial actions have been seen. The market speculates that the large capital outlay and low profitability of long-term rental apartments, coupled with frequent management issues and corporate "explosions," have made it difficult for them to gain favor in the capital market.

From the current situation, this "new story" of value-added rentals has not been able to impress investors.

According to data disclosed by Ziroom in November 2023, since the launch of value-added rentals three years ago, properties using this model have accumulated to nearly 200,000 rooms. In 2022, Ziroom had approximately 350,000 owners under management and about 1.3 million Ziroom customers under lease, with an occupancy rate exceeding 90%.

If we calculate based on 1 million managed properties, the value-added rental model has only achieved a penetration of 20% of the properties.

In addition, many owners have reported issues such as poor renovation quality and lack of guarantees for value-added sharing in Ziroom's "value-added rental" properties. This reflects to some extent that the path of value-added rentals is not an easy one.

On the other hand, the influx of a large number of properties into the market and the decline in rental demand are also leading to a continuous decline in rents, thereby compressing Ziroom's original high-rent and service fee track.

To ensure occupancy rates, earlier on, Ziroom required entrusted owners to reduce rents during the contract period, and if they disagreed, they would be forced to terminate the contract and even had to compensate for the depreciation of the renovation. Otherwise, the contract would be forcibly terminated. Subsequently, news of "widespread forced terminations" spread widely.

For Ziroom, which is "struggling" in the domestic market, overseas market expansion may be a new path to "self-rescue." The market is also curious to see if the value-added rental model, which has always been "incompatible" in the domestic market, will work in overseas markets.