Commercialization of Robotaxi: Navigating the 'Triple Threshold' of Scale, Cost, and Liability

![]() 11/17 2025

11/17 2025

![]() 730

730

Transitioning from technical validation to commercial operation, the true realization of Robotaxi services hinges on surmounting a critical 'triple threshold'. This entails achieving a harmonious cycle of technological innovation, viable business models, and robust institutional frameworks.

Original Content by Xin Shang New Energy Vehicle Team

The autonomous driving sector has been abuzz with recent developments.

On November 6th, following their respective listings on the US stock market in 2024, Pony.ai and WeRide, often referred to as China's autonomous driving duo, made their debut on the Hong Kong Stock Exchange on the same day, establishing a 'Hong Kong + US' dual-market capital presence. Peng Jun, the founder and CEO of Pony.ai, emphasized that the company would channel its financing efforts towards large-scale commercialization. Similarly, Han Xu, the founder and CEO of WeRide, highlighted that the Hong Kong listing would serve as a springboard for the global, large-scale commercial deployment of autonomous driving technology.

Luobo Kuaipao, a frontrunner in the global Robotaxi arena, also reported significant growth in its latest operational data, with a notable surge in order volumes.

Across the ocean, Elon Musk had previously announced Tesla's ambition to eliminate safety drivers from its Robotaxi service by the end of 2025. Recently, Morgan Stanley analyst Adam Jonas posited that Tesla has sufficiently 'solved' the autonomous driving conundrum to 'remove safety drivers on a large scale in major metropolitan areas'. He forecasts that by the end of 2025, Tesla's global fleet of active vehicles will reach 8 million.  ▲Photo/X

▲Photo/X

Both in China and abroad, leading Robotaxi companies are racing to accelerate their path to large-scale commercialization. As the industry progresses towards scale and commercialization, a diverse array of players is emerging across the entire supply chain, enriching the competitive landscape of the Robotaxi sector.

This flurry of intense developments clearly signals that the Robotaxi industry is collectively moving beyond the initial stages of technological R&D and small-scale testing, entering a new era centered on mass production applications and large-scale commercial operations. Within this new cycle, companies are vying for leadership positions based on their unique competitive advantages. On this promising trajectory, a new industrial ecosystem is taking shape, and against this backdrop, a profound transformation centered on profitability and liability is quietly unfolding.

01 The Commercialization Race of Robotaxi

As an emerging tech industry that has not yet achieved widespread adoption, autonomous driving has seen companies undergo prolonged periods of heavy capital investment to drive technological advancements. To date, most leading global Robotaxi companies have not yet achieved large-scale profitability. To expedite profitability, expanding fleet sizes and reducing per-vehicle costs have become imperative strategies for companies.

Taking Pony.ai and WeRide as examples, as of 2024, Pony.ai reported a net loss of 3.26 billion yuan, while WeRide reported a net loss of 2.89 billion yuan. In the second quarter of 2025, WeRide's net loss stood at 406.4 million yuan, with an adjusted net loss of 300 million yuan; Pony.ai reported a net loss of 381.6 million yuan. Despite receiving recognition from capital markets for their technological and market prospects, the substantial capital investment and persistent losses remain significant challenges for both companies, as evidenced by their stock prices dropping below the IPO price on their first day of trading in Hong Kong.

▲Photo/AI Generated

▲Photo/AI Generated

The era of capital exuberance for technological and market prospects is waning. In this new phase, Robotaxi companies must present commercialization plans with greater certainty and practicality.

Pony.ai has set its profitability timeline at three to four years. Peng Jun, CEO of Pony.ai, recently stated publicly that the company would shift its strategic focus to total paid orders as the core objective, with an anticipated profitability timeline of three to four years. According to its prospectus, Pony.ai currently operates 720 Robotaxi vehicles, with plans to expand to 1,000 by the end of the year. Zhang Ning, Vice President of Pony.ai and Head of Robotaxi Business, believes that once the company reaches a fleet size of 1,000 vehicles, operations can become self-sustaining. He further stated, 'If 1,000 vehicles can achieve break-even, it implies that with 10,000 vehicles, we can have a considerable gross margin to support the business model.'

Han Xu, CEO of WeRide, stated that from a technological perspective, autonomous driving can certainly support profitability within five years, but additional commercial and policy factors need to be considered.

Besides WeRide and Pony.ai, Luobo Kuaipao, leveraging Baidu's technological and financial resources, has made significant strides on the path to scale. To date, it operates in 22 cities globally. According to China Business Journal, a relevant person from Baidu's Autonomous Driving Business Unit revealed that with expanded spatial-temporal coverage and improved operational efficiency, Luobo Kuaipao in Wuhan is nearing the break-even point and is expected to enter a fully profitable phase by 2025. However, Luobo Kuaipao has not yet disclosed specific revenue figures.

Another leading company in autonomous driving technology, Tesla, although currently with a smaller footprint in Robotaxi services, anticipates significant progress in scaling. On October 28th, Tesla announced plans to further launch Robotaxi operations in Nevada, Florida, and Arizona within 2025, with the potential to gradually eliminate in-car safety operators. Analysts predict that by the end of 2025, Tesla's global fleet of active vehicles will reach 8 million.

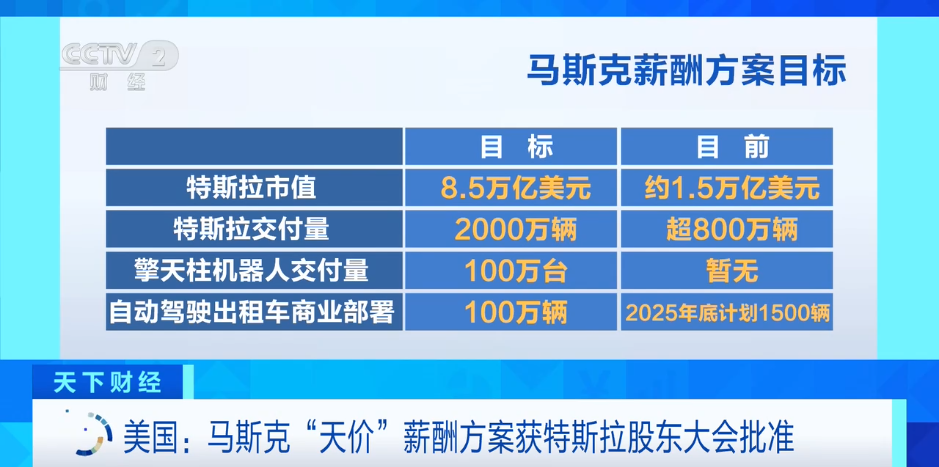

Additionally, Musk's trillion-dollar compensation package recently faced hurdles but was ultimately approved. To receive the full compensation, Musk must achieve multiple targets within the next 10 years, one of which is to have 1 million Robotaxi vehicles in commercial operation.  ▲Photo/CCTV Finance Screenshot

▲Photo/CCTV Finance Screenshot

Whether it's companies like Pony.ai and WeRide, which are relatively capital-constrained and need to raise funds through capital markets to navigate the pre-commercialization phase, or industry leaders like Luobo Kuaipao, which are on the verge of profitability, or Tesla, which currently has slower commercialization progress but expects large-scale commercialization in the future, all point to a clear industry consensus: the commercial implementation of autonomous driving has entered the final sprint stage, with the competitive focus shifting from 'technological validation' to a comprehensive competition of 'scale and profitability'.

02 Aggregation and Openness as New Trends

As the industry's main theme shifts from technological foundation to commercial implementation, besides Robotaxi companies adhering to full-stack self-research, numerous participants across the supply chain are becoming increasingly active.

Downstream in the supply chain, closer to end consumers, aggregation platforms are making their mark. Robotaxi, essentially a shared mobility-focused taxi service, is witnessing the entry of aggregation platforms, which, similar to their role in the ride-hailing sector, are reshaping the industry's competitive logic and ecological structure. These platforms do not directly build vehicles or develop autonomous driving technologies but leverage their massive traffic entry points, mature user operation systems, and efficient mapping and matching algorithms to become 'super hubs' connecting supply (Robotaxi fleets) and demand (users).

On November 5th, He Xiaopeng, Chairman of XPENG Motors, announced at XPENG Tech Day that the company would launch three L4-level Robotaxi models in 2026 and enter a global ecological cooperation with Gaode, initiating a 'mobility platform + front-end mass-produced Robotaxi' collaboration model. This model will first launch trial operations in Guangzhou and other locations, with plans to expand Robotaxi services globally in the future.

It is reported that before reaching a cooperation agreement with XPENG Motors, Robotaxi companies like WeRide and Pony.ai had already integrated with Gaode, allowing users to hail vehicles through the Gaode App in areas served by these companies. According to Wall Street See, within Gaode, the Robotaxi business may have been explicitly designated as a strategic-level business.

The importance of providing high-quality end-consumer services during the commercial implementation of Robotaxi is undeniable. Aggregation platforms, through cooperation with Robotaxi companies, integrate multiple Robotaxi services, enabling users to 'hail a vehicle with one click,' significantly enhancing service convenience and coverage.

In terms of technological research and development upstream in the supply chain, NVIDIA is reportedly incubating a Robotaxi project. Instead of pursuing full-stack self-research, this project focuses more on technological routes, aiming to provide a universal underlying technological architecture for Robotaxi. As a global leader in AI chips, NVIDIA has a natural technological advantage in entering the Robotaxi sector, an advantage that has already extended to the field of automotive intelligence. For instance, its latest Thor chip not only boasts unprecedented computing power but also achieves the integration of multiple domain functions such as intelligent driving, cabin, and vehicle control. Based on this, NVIDIA's provision of technological support for Robotaxi is feasible.

Currently, most Robotaxi companies are firmly committed to full-stack technological self-research. For example, Waymo follows a path of self-developed chips + full-stack algorithms + owned fleets, Tesla combines lightweight vehicle-road coordination with data closed loops, and Baidu's path involves the Apollo platform and corporate cooperation for operations, essentially keeping core technologies firmly in their hands to form differentiated advantages. This model undoubtedly requires substantial upfront investment in research and development and is one of the main reasons for the current high barriers to entry in the Robotaxi sector.

In the future, if NVIDIA officially enters the market as a technological enabler, providing mature technological solutions to automotive companies, it could significantly reduce the research and development and deployment difficulties of Robotaxi. This may not only change the existing competitive landscape but also help the industry break through the bottleneck of large-scale implementation and accelerate the commercialization process of autonomous driving technology.

For any industry to achieve large-scale commercialization, the clear division of labor and collaboration among upstream, midstream, and downstream players are crucial foundational elements. Whether it's the industrial integration by downstream aggregation platforms or the technological empowerment by upstream players like NVIDIA, all indicate that the Robotaxi industry is moving towards a more advanced stage of maturity. Against this backdrop, the full commercialization of Robotaxi will undoubtedly accelerate.

03 From Technological Reliability to Liability Closed Loop

As the Robotaxi industry accelerates towards large-scale commercial operations, technological reliability remains the cornerstone, but the competitive focus is gradually shifting from mere performance enhancement to the construction of a more complex 'liability closed loop.' This means that companies not only need to demonstrate the safety and efficiency of autonomous driving systems in most scenarios but must also ensure clear liability attribution, rapid response, and the establishment of user trust in the event of accidents, disputes, or ethical dilemmas. This also requires the improvement of policy systems and insurance terms as supporting measures.

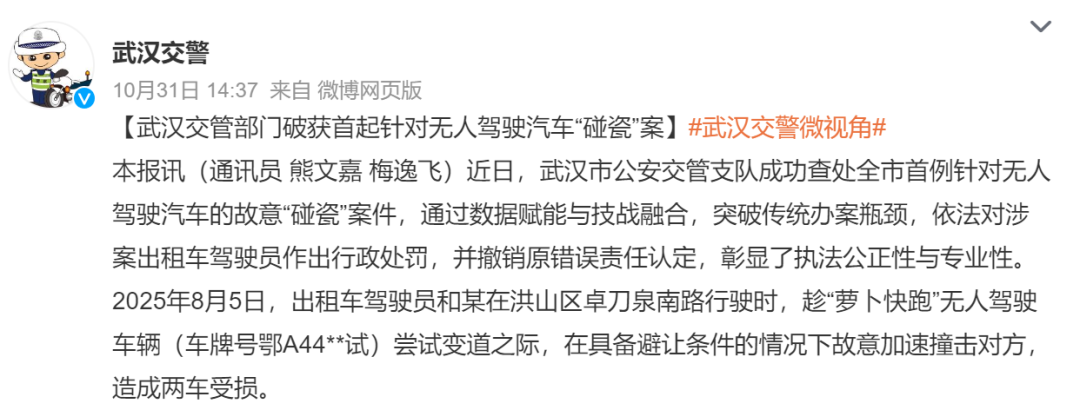

Recently, Wuhan witnessed the first intentional 'collision fraud' case where a taxi targeted the autonomous driving vehicle Luobo Kuaipao. During the investigation of this case, the detailed algorithm logs and cloud data from Luobo Kuaipao's vehicle became the primary evidence to identify the taxi's 'abnormal acceleration.' This marks that in future accidents involving intelligent connected vehicles, the most reliable 'witness' may be the operational data generated by code. This requires relevant laws and regulations to keep pace with the times and introduce regulatory and liability attribution standards specific to autonomous vehicles.

Meanwhile, insurance systems for Robotaxi are actively catching up.

Unlike traditional auto insurance, which is primarily formulated around human driving and includes rules for software and hardware safety performance for autonomous vehicles like Robotaxi, existing insurance products from insurance companies do not fully align, and global regulatory frameworks are still in the exploratory stage. However, with the accelerated commercial implementation of Robotaxi, significant progress has been made in systems and safeguards related to Robotaxi safety liability.

For example, in August of this year, Pony.ai officially commenced operations in Shanghai and collaborated with Ping An Property & Casualty Insurance to provide a dedicated insurance product portfolio for its L4-level Robotaxi, including compulsory traffic insurance, carrier liability insurance with coverage ranging from 1 million to 2 million yuan, and commercial third-party liability insurance with coverage of 5 million yuan. This means that if passengers are involved in an accident while riding in a Pony.ai Robotaxi in Shanghai and the autonomous taxi is deemed liable, the passengers in the vehicle will not bear any responsibility; if passengers are injured, they will receive compensation of up to 2 million yuan.

Recently, Tesla made headlines by announcing, for the first time, a new position: "Robotaxi Advanced Insurance Claims Specialist." According to the job description, the selected candidate will be tasked with overseeing and managing corporate insurance, risk management, and guarantee plans across the company's various business segments. They will also play a pivotal role in accident reporting and claims process management for Tesla's Robotaxi and ride-hailing services. This move suggests that Tesla is gearing up to take full responsibility for autonomous driving accidents in the future.

From commercial deployment to supply chain refinement, and from safety assurances to the establishment of legal and insurance frameworks, Robotaxi is constructing an interconnected ecosystem. However, to achieve widespread adoption, relevant companies must still overcome three major hurdles: scale, cost, and liability. In this evolving mobility landscape, large-scale operations and cost optimization go hand in hand, with upstream and downstream companies working synergistically. Additionally, data and insurance form a complex liability network. Looking ahead, when technological advancements, innovative business models, and institutional safeguards create a virtuous cycle, a new era of intelligent mobility will swiftly arrive.

- THE END -