Intelligent Communication Suffers Nearly 1.2 Billion Yuan in Losses: First-Half Performance Plummets, Designated as a Person Subject to Enforcement Four Times This Year

![]() 11/17 2025

11/17 2025

![]() 617

617

"Harbor Business Insight" by Shi Zifu and Wang Lu

Recently, Intelligent Communication Technology Co., Ltd. (hereinafter referred to as Intelligent Communication) filed a listing application with the Hong Kong Stock Exchange, with CITIC Securities and CCB International acting as co-sponsors.

While this marks its first listing attempt in Hong Kong, Intelligent Communication has been gearing up for this move for five years. Since preparing to seek a listing in 2021, the company has undergone three rounds of preparatory counseling and engaged three different sponsor institutions, all without success.

Specifically, in January 2021, Intelligent Communication signed a counseling agreement with CITIC Construction Investment Securities, which was mutually terminated on May 25, 2022. In June 2022, the company entered into another counseling agreement with Dongxing Securities, later terminated by mutual consent on August 31, 2023. In September 2023, Intelligent Communication signed a counseling agreement with CITIC Securities, which was also mutually terminated on September 28, 2025.

The company openly acknowledged in its Hong Kong stock prospectus that it had made attempts in January 2021, June 2022, and September 2023 to enter the Chinese stock market and prepare for an A-share listing application on the Science and Technology Innovation Board of the Shanghai Stock Exchange. It confirmed that it had not yet submitted any filings constituting a listing application to the China Securities Regulatory Commission.

So, how has Intelligent Communication fared in terms of its disclosed operating data in this latest listing endeavor? Can the company successfully tap into the Hong Kong stock capital market?

1

Under Significant Market Competition Pressure

According to its official website and Tianyancha (a Chinese business information query platform), Intelligent Communication was established in June 2015. The company stands as a leading provider of artificial intelligence technology and spatial intelligence solutions in China, with its products widely applicable in spatial intelligence application scenarios such as smart roads, autonomous driving, smart parking, smart charging, smart highways, low-altitude three-dimensional transportation, smart factories, and smart homes.

The company boasts five major brands: SUPER VISION, AITS (Ai Tong Xing), AIPARK (Ai Bo Che), AIC (Ai Chong Dian), and AIPILOT (Ling Hang Zhe).

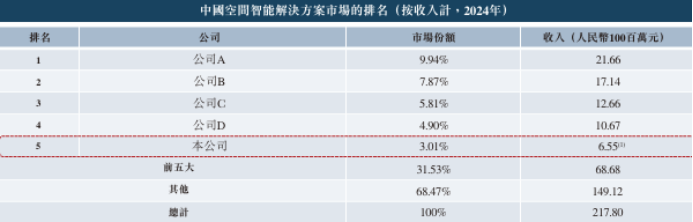

According to data from Frost & Sullivan, based on 2024 revenue, Intelligent Communication ranks fourth among all spatial intelligence solution providers in China's smart transportation industry, holding a 6.6% market share. The same source indicates that, based on 2024 revenue, the company ranks first among all spatial intelligence roadside solution providers in China's smart transportation industry, with a 19.3% market share.

The company admitted that the Chinese spatial intelligence solution market remains highly competitive and, although still relatively fragmented, has begun to see consolidation among leading companies in recent years, with a few top suppliers dominating the majority of the market share. These suppliers are typically large enterprises with years of industry experience and a broad customer base. In 2024, the company ranked fifth in the Chinese spatial intelligence solution market with a 3.0% market share.

From a market competition standpoint, although Intelligent Communication leads in smart transportation roadside solutions, the market remains fiercely competitive. Additionally, the company's other two indicators rank fourth and fifth, with a significant gap compared to peers, indicating substantial pressure for the company to maintain or even capture market share in the future.

2

Nearly 1.2 Billion Yuan in Continuous Losses, First-Half Performance Plummets

In terms of financial data, from 2022 to 2024 and the first half of this year (the reporting period), Intelligent Communication reported revenues of 538 million yuan, 618 million yuan, 699 million yuan, and 103 million yuan, respectively, with gross profits of 128 million yuan, 154 million yuan, 209 million yuan, and 13.542 million yuan, respectively, and gross profit margins of 23.7%, 25%, 29.9%, and 13.2%, respectively.

Over the past three years, the company's revenue and gross profit have shown a positive trend. However, the first half of this year saw a significant decline.

In the first half of 2024, the company achieved revenue of 210 million yuan, representing a year-on-year decline of over 50%. During the same period last year, the company's gross profit was 51.354 million yuan, with a gross profit margin of 24.4%, both experiencing substantial declines.

During the reporting period, the company's net profit continued to incur losses, amounting to 360 million yuan, 257 million yuan, 288 million yuan, and 273 million yuan, respectively. In the first half of 2024, the company's net loss was 179 million yuan, resulting in a cumulative loss of 1.178 billion yuan over three and a half years.

Intelligent Communication stated that the past net losses were primarily due to, among other factors, the impact of accounting treatment for changes in the fair value of financial instruments issued to investors. This refers to the value of financial instruments for pre-IPO investors, which amounted to 154 million yuan, 147 million yuan, 232 million yuan, and 163 million yuan during the respective periods. The company expects to incur a net loss in 2025, mainly because most major projects are planned to be completed in 2024, and it anticipates signing multiple new contracts in 2025. Meanwhile, it expects the revenue from these projects to be primarily recognized in the next one to two years, resulting in the company being unable to offset relevant costs in 2025, leading to a net loss.

From a revenue composition perspective, Intelligent Communication mainly relies on roadside spatial intelligence solutions. During the reporting period, roadside spatial intelligence solutions accounted for 42.2%, 46.0%, 66.8%, and 87.1% of revenue, respectively. Road network spatial intelligence solutions accounted for 11.7%, 30.9%, 24.1%, and 1.7%, respectively. AIoT spatial intelligence solutions accounted for 38.1%, 17.7%, 2.8%, and 7.9%, respectively.

3

Competition in Parking Business, Decline in Customer Numbers

It is reported that the company's roadside spatial intelligence solutions mainly refer to the aforementioned AIPARK brand. Simply put, AIPARK is essentially smart parking. In recent years, the market has seen numerous unmanned or smart parking brands emerge, with strong competitors facing AIPARK including Jieshun Technology (002609.SZ), ETCP, Fuji Smart, and Ketuo Co., Ltd.

According to Jieshun Technology's official website, the company was one of the earliest entrants into the parking industry in China and has become an industry-leading parking operation growth service provider. With "parking operation" as its core, based on multi-dimensional capabilities of "hardware + platform + operation" and "AI + parking," the company provides customers with a full ecosystem of parking operation solutions, including "investment + construction + management + operation," enabling more profitable parking operations and more convenient parking for car owners. Meanwhile, the company is also the first listed company in the industry, ranking first in market share, serving 140 million car owners, with annual parking fee payment settlements exceeding 15 billion yuan.

According to ETCP's official website, as of November 16 this year, it has registered over 82 million car owners. Ketuo Co., Ltd. stated that it has cumulatively supported over 68,000 parking lots and 300 million vehicles, covering over 13 million parking spaces in more than 60 countries and regions worldwide.

Automotive field observers believe that with the continuous increase in China's car ownership, market demand for parking continues to grow. Currently, the parking sector remains fiercely competitive, with no single dominant player or top five companies holding an absolute advantage. Therefore, if Intelligent Communication mainly relies on the parking business, its performance may face significant pressure. How to succeed in this highly competitive market also tests the company's comprehensive strength.

It is worth noting that Intelligent Communication's reliance on major clients continues to intensify. According to the prospectus, the company's clients mainly include government and institutional clients and state-owned enterprises that purchase solutions, as well as private enterprises. During the reporting period, the top five clients contributed approximately 49.2%, 57.1%, 50.1%, and 73.7% of the company's total revenue, respectively. The largest client contributed 20.5%, 17.9%, 17.6%, and 34.5% of the total revenue, respectively.

As of the first half of this year, the revenue contribution rates of the company's top five clients and largest client were relatively high, mainly due to the lower proportional decline in revenue for the top five clients and largest client compared to the overall decline in the company's total revenue during the same period.

During the same period, the company had 257, 179, 120, and 59 clients, respectively. Additionally, as of December 31, 2022, 2023, and 2024, and June 30, 2025, 9, 9, 20, and 30 clients, respectively, maintained a cooperative relationship with Intelligent Communication for no less than five years, aligning with the company's strategic value proposition.

It is evident that although the number of five-year clients has continued to increase, the company's total number of clients has declined by nearly 200 over three and a half years, showing a concerning downward trend.

4

High Asset-Liability Ratio, Designated as a Person Subject to Enforcement Four Times This Year

In terms of cash flow, during the reporting period, the net cash flow generated/(used) by the company's operating activities was -164 million yuan, 21.093 million yuan, -60.617 million yuan, and -88.464 million yuan, respectively, showing an overall fluctuating outflow trend. The cash and cash equivalents at the end of the year/period were 206 million yuan, 350 million yuan, 263 million yuan, and 199 million yuan, respectively.

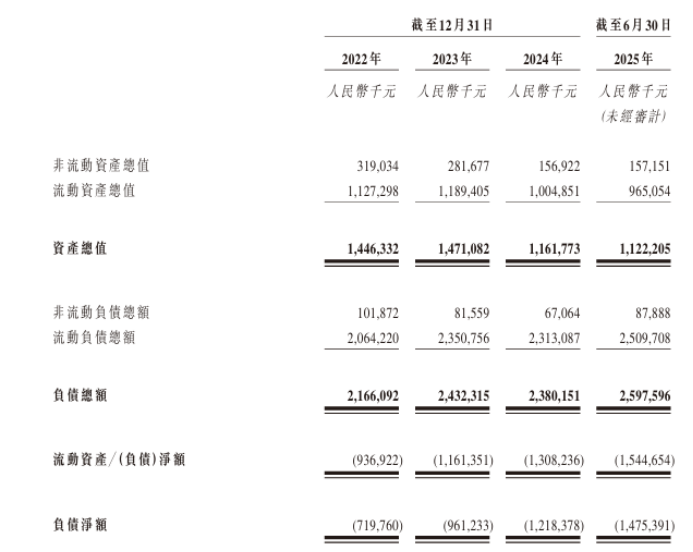

However, in terms of debt repayment capability, Intelligent Communication also faces significant pressure. During the aforementioned periods, the company's current ratios were 0.5, 0.5, 0.4, and 0.4, respectively, and quick ratios were 0.4, 0.4, 0.4, and 0.3, respectively. The total assets were 1.446 billion yuan, 1.471 billion yuan, 1.162 billion yuan, and 1.122 billion yuan, respectively, while the total liabilities were 2.166 billion yuan, 2.432 billion yuan, 2.380 billion yuan, and 2.598 billion yuan, respectively. After calculation, the company's asset-liability ratios were 149.79%, 165.33%, 204.82%, and 231.55%, respectively.

Regarding the use of the net proceeds from the IPO, the company stated that it will primarily be used to strengthen research on cutting-edge technologies, improve product and solution development, and advance proprietary technology platforms to expand business application scenarios. It will also provide funds for overseas business expansion and strengthen sales and marketing teams. Additionally, it will support the transformation of production processes towards a higher degree of automation and intelligence and be used for working capital and general corporate purposes.

According to Tianyancha, from 2018 to the present, the company has been designated as a person subject to enforcement 10 times, with four instances this year alone. On October 9, 2025, the company was designated as a person subject to enforcement by the Fengtai District People's Court in Beijing, with an enforcement amount of 1.59 million yuan. On September 9, the company was designated as a person subject to enforcement by the Hebei District People's Court in Tianjin, with an enforcement amount of 258,900 yuan. On March 6, the company was designated as a person subject to enforcement by the Qiaoxi District People's Court in Zhangjiakou, with an enforcement amount of 200,000 yuan. On February 19, the company was designated as a person subject to enforcement by the Qiaodong District People's Court in Zhangjiakou, with an enforcement amount of 39,000 yuan. (Produced by Harbor Finance)