Stepping Out of the Large Model Hype and Focusing on Urban Infrastructure: Nobitron Proves the Worth of Industrial AI

![]() 11/20 2025

11/20 2025

![]() 737

737

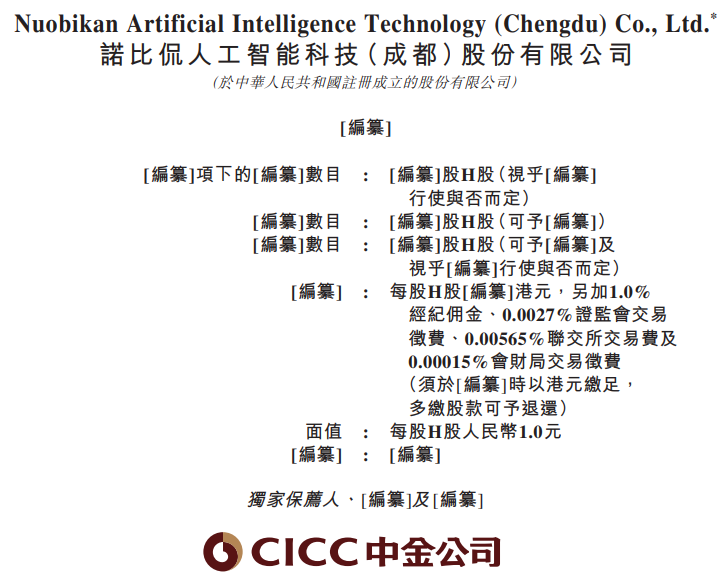

At a time when the commercial viability of large models remains untested and AI firms are generally hemorrhaging cash to stay afloat, an AI company based in Chengdu is making a bold push into the capital markets, armed with a track record of consistent profitability. Recently, Nobitron Artificial Intelligence Technology (Chengdu) Co., Ltd. (hereinafter referred to as 'Nobitron') has updated its prospectus, revealing plans to list on the Hong Kong Stock Exchange.

Amidst the multi-trillion-dollar modernization drive of urban infrastructure, Nobitron is leveraging a software-hardware integrated industrial model platform to chart a different course for Chinese AI—one that doesn't seek to revolutionize the world, but rather to make infrastructure smarter, safer, and more reliable.

Nobitron: From 'AI Hype' to Industrial Foundations

Over the past three years, the Chinese AI sector has witnessed a rollercoaster ride from frenzy to calm. Large model companies find themselves caught between soaring computing costs and the challenge of commercial implementation, while AI applications at the consumer end are trapped in a dilemma of having users but failing to monetize. Numerous AI startups remain stuck in the technology demonstration and pilot phases.

In stark contrast, Nobitron has consistently delivered profitable financial results during this same period.

The prospectus reveals that Nobitron's revenue reached RMB 253 million, RMB 364 million, and RMB 400 million in 2022, 2023, and 2024, respectively. Over the same period, its profit surged from RMB 63.16 million to RMB 115 million, with a stable profit margin hovering between 25% and 29%. For most AI companies still 'burning cash to spin stories,' such achievements are undeniably rare.

This rarity can be attributed to Nobitron's deep-rooted presence in the foundational scenarios of industries. While the AI startup boom surged towards large models and consumer-end applications, Nobitron chose to focus on serving the infrastructure sector. These industries boast stable budgets, rigid demands, and long-standing pain points, such as reliance on manual inspections and low efficiency.

Simultaneously, Nobitron's technological approach is both clear and pragmatic. It spans from the underlying NBK-INTARI platform to transferable and reusable AI industry models, and then to software-hardware integrated delivery solutions, forming a complete vertical technology closed loop. With the platform as the foundation, models as the core, and solutions as the revenue driver, the technology can be repeatedly leveraged and expanded across various scenarios.

Delving deeper, the rail transit scenario marked Nobitron's earliest breakthrough. According to China Insights Consultancy, in terms of revenue in 2023, Nobitron ranked as China's second-largest provider of AI+power supply system inspection and monitoring solutions and the seventh-largest provider of AI+rail transit inspection and monitoring solutions.

Furthermore, the complexity and high safety requirements of urban rail transit equipment make the value of AI applications more pronounced and difficult to replace.

In particular, Nobitron's accumulated algorithm models, data systems, and software-hardware adaptation capabilities hold potential for horizontal replication, extending from rail transit to power supply systems, urban governance, and other scenarios. While these choices may lack the immediate allure of consumer-facing AI, they offer commercial sustainability, providing Nobitron with a solid foundation for growth and self-sufficiency.

From the results, it's evident that Nobitron's growth is not fueled by storytelling but by systematically tackling 'challenging yet correct' scenarios in industrial settings, completing a closed loop from platform to model and then to solution.

The data on consecutive profits indicates that this technology route, dominated by scenario depth, has indeed found commercial levers in the infrastructure field. However, this does not imply that industrial AI has entered a stable phase.

The Hidden Concerns Amidst Vast Opportunities: Industrial AI Faces Challenges

In recent years, the digitalization trend of urban infrastructure in China has accelerated. According to China Insights Consultancy data, the market sizes of China's AI+transportation, AI+energy, and AI+urban governance solution industries reached RMB 270 billion, RMB 500 billion, and RMB 700 billion in 2024, respectively, and are projected to maintain robust growth.

Nobitron has a presence in all three major sectors and leads in multiple sub-segments. It ranks as the second-largest provider of AI+power supply system inspection and monitoring solutions and the seventh-largest provider of AI+rail transit inspection and monitoring solutions in China.

Its NBK-INTARI platform and industry model architecture possess cross-industry migration potential. The industry models accumulate industry experience, and understanding the 'physical world' of industries constitutes a competitive barrier.

Deep binding has transformed Nobitron from an AI supplier to an AI infrastructure provider, serving the safety, efficiency, and stable operation of infrastructure, with a longer and more sticky value chain.

As urban governance digitalization and energy system intelligence progress, AI has become an indispensable capability for infrastructure, offering vast space for Nobitron's business growth post-listing.

However, the vast space for infrastructure intelligence also means more participants, longer cycles, and more complex frictions. Nobitron has navigated its first growth curve, but as it ventures into broader industries, it must also confront the real pressures brought by technological iteration, accelerated competition, lengthy project cycles, and stricter regulation.

In other words, the story of industrial AI has just begun, and the real challenges are just unfolding.

Firstly, competition is intensifying. As infrastructure digitalization becomes a policy-driven direction, state-owned enterprises, technology companies affiliated with central enterprises, traditional industrial giants, and numerous AI startups are flocking into the sector, crowding the space and increasing the risk of solution homogenization.

Secondly, the pressure of technological iteration is high. Infrastructure scenarios are complex, with rapidly evolving equipment, special operating environments, and diverse data structures, necessitating continuous updates and training of industry models, and keeping research and development investment high in the long run.

Thirdly, the commercial pace is uncertain. Nobitron's existing customers are primarily public sector clients, with long project cycles, complex deliveries, and unpredictable payment schedules, posing high demands on cash flow management and making it difficult to achieve rapid growth through scale expansion.

Fourthly, regulatory risks are deepening. AI industry policies have shifted from encouraging innovation to emphasizing safety and compliance, involving algorithm transparency, data security, and industry access, with compliance costs also rising simultaneously.

These challenges underscore that the path of industrial AI remains a long and arduous journey. Although Nobitron leads with its technology platform and industry capabilities, to navigate the next technological cycle, it needs to maintain the speed of technological iteration, sustain the depth of industry understanding, and continue to gain a competitive edge.

Conclusion

Nobitron's listing not only validates the feasibility of industrial AI but also foreshadows the future tests it will face. However, the competition, technological iteration, and regulatory challenges it encounters also fill this path with uncertainty.

If the previous AI wave focused more on disruptive innovation, then the next AI wave may belong to companies that deeply understand scenarios, grasp industry laws, and can seamlessly integrate algorithms into the underlying operational logic of cities.