Self-Operated Platforms Forge a 'Safety Fortress': Insights from the Preference of Over 80% of Users

![]() 01/05 2026

01/05 2026

![]() 519

519

By 2025, China's ride-hailing sector has reached a pivotal stage of standardized growth.

Data from the Ministry of Transport reveals that as of October 31, 2025, a total of 393 ride-hailing platform companies nationwide have secured operational licenses, with a monthly order volume of 892 million. Ride-hailing has evolved from a novel travel option to a fundamental urban public service, with the market transitioning from an early 'capacity battle' to a 'quality competition'.

Against this backdrop, a joint consumer satisfaction survey on ride-hailing services, conducted by entities such as the Tianjin Consumers Association and the Research Center for E-Commerce Law at Peking University, has unveiled stark differences between self-operated and aggregation platforms in terms of market acceptance, consumer trust, and ecological impact.

01. Safety-Driven Consumer Shift

Survey results indicate that over 90% (99.37%) of respondents have utilized ride-hailing services, with only a negligible fraction (0.63%) lacking such experience.

Overall, respondents rated ride-hailing services positively, with 86.63% expressing high or moderate satisfaction.

In terms of market share, the survey data clearly shows consumers' preference for the two types of platforms: 80.66% of respondents explicitly stated they 'prefer self-operated ride-hailing platforms,' while only 19.34% favored aggregation platforms.

This preference reflects a shift in consumers' decision-making logic.

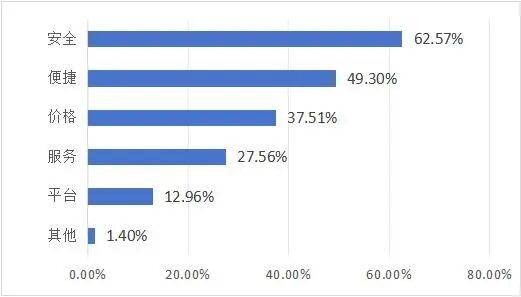

The survey highlights that 62.57% of respondents prioritize 'safety' when choosing ride-hailing services, significantly surpassing 'convenience' (49.30%) and 'price' (37.51%). This underscores that safety has become the cornerstone of consumers' decision-making process. Ride-hailing consumption has shifted from 'efficiency first' to a stage where 'safety and efficiency are equally paramount,' reflecting a desire for 'perceptible, traceable, and controllable' service certainty.

This shift is attributed to two key factors:

Firstly, among ride-hailing users, 78.39% are young and middle-aged individuals aged 18-45, with 92.5% being employed or public servants. This demographic constitutes the primary consumer base.

This group faces diverse travel scenarios: they require punctuality for morning commutes, personal safety for late-night returns from overtime, professionalism for business trips, and reliability for family outings, demanding higher service safety and stability.

Secondly, frequent safety incidents in ride-hailing and enhanced regulations have heightened consumers' sensitivity to travel safety, deepening their awareness of 'compliant services'.

This means that platforms' investments in safety features, driver vetting mechanisms, and trip safeguards, along with their transparency, have become pivotal factors influencing consumer choices.

Ms. Liu, an employee at a Beijing-based internet company who often works until 9 or 10 PM, relies on ride-hailing for her nightly commute and thus pays meticulous attention to safety verification processes.

'Before boarding, I always double-check the license plate number and driver's photo, but some platforms don't even display the driver's real name,' she admitted.

Such concerns are widespread. The experience survey revealed that only a few self-operated platforms, like Shouqi Yueche, fully disclose the driver's full name, while others merely show 'Mr.*'; multiple aggregation platforms also failed to provide driver photos in some instances.

Additionally, among the 24 experience samples, 21 lacked unified ride-hailing identifiers. These details expose lax offline safety management by some platforms, contradicting consumers' core demand for safety certainty.

This explains why self-operated ride-hailing platforms continue to dominate the market: their long-standing service control capabilities and safety responsibility image constitute an irreplaceable core competitiveness. Platforms like Didi have accurately captured this demand shift, constructing a comprehensive safety system that spans pre-trip, during-trip, and post-trip stages, precisely addressing consumers' core demand for 'certainty'.

02. The Game of Responsibility Boundaries and Trust

The divergence in consumers' perceptions of the two types of platforms essentially stems from differences in judgments about 'responsibility boundaries' and 'service stability'. This cognitive gap is not subjective bias but an objective result of the two platforms' operational models.

The trust foundation of self-operated platforms lies in their 'clear responsibility chain' and 'stable service standards'. 58.87% of respondents believe self-operated platforms have 'clearer safety vetting and accountability', 45.06% recognize their 'more efficient customer service and after-sales handling', and 37.05% consider their 'service quality more stable'.

This stems from the 'direct operation' model of self-operated platforms. As both information providers and direct organizers of transportation services, they manage drivers and vehicles directly, forming a concise responsibility chain of 'platform-driver-passenger'.

Breaking down safety, a top priority for consumers, self-operated platforms can implement a unified, end-to-end safety management system from driver onboarding to post-order support.

For instance, through technological innovation, they achieve full-process risk prevention: proprietary intelligent safety systems can identify high-risk trips, such as late-night long-distance journeys or route deviations, via big data analysis, automatically triggering safety alerts and interventions; real-time trip tracking and audio-video evidence retention provide dual technical and manual safeguards; for unsafe driving behaviors, platforms monitor via in-vehicle devices, providing timely feedback on actions like sudden acceleration, hard braking, or distracted driving and incorporating them into performance evaluations.

In case of disputes, self-operated platforms, as direct organizers and providers of transportation services, can connect drivers and passengers directly for 'one-stop resolution', better protecting consumer rights.

In contrast, aggregation platforms face cognitive pain points centered on 'quality-price imbalance' and 'ambiguous responsibilities'. 48.74% of respondents believe aggregation platforms 'may offer low prices with low quality', while 41.03% worry about 'unclear post-sales responsibility division', directly undermining consumer trust.

From a quality-price perspective, the core competitiveness of aggregation platforms lies in their 'price comparison function', attracting consumers by connecting multiple third-party platforms and offering 'low-price incentives'. However, under this model, smaller participating platforms, vying for orders, often lower prices, even to levels below operational costs.

The ambiguity in responsibility division is a more critical weakness of aggregation platforms. Their responsibility chain—'aggregation platform-third-party platform-driver-passenger'—involves more links, leading to frequent 'buck-passing'.

Surveys show that Tencent Ride and Gaode Maps require consumers to accurately click the circle before the price during booking to access fare details, then query specific licenses via the carrier's name in the top-left corner, with no post-order query channel; Baidu Maps provides licenses for multiple companies but makes it difficult to identify the 'business name' corresponding to the specific order's carrier.

It should be noted that aggregation platforms are not without advantages. 32.1% of respondents choose them for 'stronger capacity', 18.09% appreciate their 'diverse carrier options', and 8.6% favor their 'convenient price comparisons'. However, these strengths focus on 'choice diversity' rather than consumers' core concerns of 'safety' and 'service stability'.

03. Ecological Concerns Under the Aggregation Model

In reality, the differences between the two types of platforms not only affect consumers but also profoundly impact the industry ecosystem.

The 'traffic distribution' model of aggregation platforms significantly squeezes smaller third-party platforms, intensifying industry-wide competition and trapping them in a vicious cycle of 'low-price competition'.

For small and medium-sized ride-hailing platforms, joining aggregation platforms reduces them to mere capacity suppliers, forced to compete on price for orders. In some cities, order prices on aggregation platforms even fall below operational costs. To survive, smaller platforms adopt 'cost-cutting measures', most directly by 'lowering driver access standards' and 'reducing service investments'.

This 'squeezing' also affects drivers, creating a chain reaction in the industry ecosystem: smaller platforms, to control costs, often reduce driver commission rates. To increase income, drivers must work longer hours, 'accept any order', or even take risky detours to boost mileage fees. Under long-term pressure, drivers' service attitudes deteriorate, and driving focus diminishes, further degrading consumer experience and forming a vicious cycle of 'thin platform profits-low driver income-poor service quality'.

More severely, media reports reveal that many smaller platforms earn negligible net profits per order within aggregation systems, with some even relying on renting operational licenses or collecting driver deposits to sustain operations. This unhealthy model not only hinders platform development but also drags down industry service standards and safety thresholds.

From the survey by the Tianjin Consumers Association and other institutions, self-operated platforms, with their clear responsibility boundaries, stable service quality, and end-to-end safety guarantees, have become consumers' top choice. This outcome aligns with consumers' core demand for 'safe travel' and the policy direction of 'standardized development' in the ride-hailing industry.

While aggregation platforms offer advantages in capacity coverage and price comparison, their shortcomings in quality-price balance, responsibility division, and ecological impact urgently require resolution through model optimization.

Of course, for the industry, future development should not be an 'either-or' choice but rather 'complementary strengths' between the two types of platforms. The evolution of the ride-hailing industry reflects the digital transformation of China's urban public services. Only by balancing consumer rights, driver welfare, and platform sustainability can the industry truly achieve its core values of safety, efficiency, and convenience, becoming a reliable component of urban mobility systems.