Central Bank rescues the market with drastic measures

![]() 09/24 2024

09/24 2024

![]() 804

804

Written by Leju Finance Liu Zhiying

The central bank announced major policies: reducing the reserve requirement ratio, interest rates, and existing mortgage interest rates.

At 9:00 am on September 24, the State Council Information Office held a press conference. People's Bank of China Governor Pan Gongsheng announced at the press conference:

First, reduce the reserve requirement ratio and policy interest rates, driving down the benchmark market interest rates. In the near future, the reserve requirement ratio will be reduced by 0.5 percentage points, providing about 1 trillion yuan of long-term liquidity to the financial market. The policy interest rate of the central bank will be reduced, with the 7-day reverse repo rate cut by 0.2 percentage points, from the current 1.7% to 1.5%, guiding the loan prime rate and deposit interest rates to decline simultaneously, and maintaining the stability of commercial banks' net interest margins.

Second, reduce the interest rate on existing mortgages and unify the minimum down payment ratio for mortgages. Commercial banks will be guided to reduce the interest rate on existing mortgages to levels similar to new mortgages, with an estimated average reduction of approximately 0.5 percentage points. The minimum down payment ratio for second homes at the national level will be reduced from 25% to 15%, unifying the minimum down payment ratios for first and second homes.

Third, create new policy tools to support the development of the stock market. Swaps will be facilitated for securities, funds, and insurance companies, enabling eligible entities to obtain liquidity from the central bank through asset pledges, significantly enhancing their capital acquisition and stock accumulation capabilities. Special reloans will be created to guide banks to provide loans to listed companies and major shareholders, supporting share repurchases and increases.

As a result, the FTSE China A50 Index futures rallied, with gains expanding to 2%. Hong Kong stocks opened sharply higher, with the Hang Seng Index up 1.79% and the Hang Seng TECH Index up 2.37% at the open.

Pan Gongsheng noted that the policy to reduce interest rates on existing mortgages is expected to benefit 50 million households, representing 150 million people, and reduce the total annual interest expenses for households by approximately RMB 150 billion. The People's Bank of China will soon issue a document adjusting existing mortgage rates, but banks will need some time for necessary technical preparations. Additionally, the central bank will guide commercial banks to improve their mortgage pricing mechanisms, allowing bank customers to negotiate dynamic adjustments based on market principles.

Zhang Dawei, Chief Analyst at Centaline Property, stated that the current average interest rate on existing mortgages is approximately 3.92%. With a 50 basis point reduction, if calculated based on a commercial loan of RMB 1 million with a 30-year repayment period, the monthly mortgage payment would decrease by approximately RMB 280, resulting in a total savings of RMB 100,000 in interest expenses over 30 years.

Yan Yuejin, Deputy Dean of the Shanghai E-house Real Estate Research Institute, commented that the central bank's policies cover both existing mortgages and new home purchases, with a broad coverage and significant benefits. They play an active role in reducing housing costs, enhancing housing purchase confidence, and mitigating risks associated with existing mortgages. This topic is likely to be hotly debated among citizens and will help sustain consumer spending, representing the most robust and wide-reaching mortgage policy to date.

Regarding down payment ratios, this time, a lenient down payment ratio policy has been implemented for second homes or upgraded homes. Yan Yuejin noted that while the down payment ratio for second homes has been reduced in the past, it was still slightly higher than that for first homes. The current reduction to 15% will help lower the down payment ratio and purchase threshold for second homes or upgraded homes. Simply put, if a family purchases a second home worth RMB 2 million, the down payment would have previously been RMB 500,000 but is now reduced to RMB 300,000, a direct savings of RMB 200,000, naturally stimulating demand for upgraded or replacement homes.

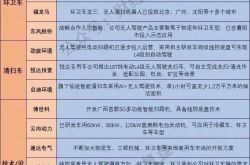

In addition to the above policies, the central bank has also introduced the following new real estate finance policies:

Extend the validity period of two real estate finance policy documents. Previously, the People's Bank of China and the State Administration of Foreign Exchange issued the "16 Financial Measures" and the policy on operating property loans, which played an active role in promoting the stable and healthy development of the real estate market and mitigating risks. Among these policies, the extension of existing financing for real estate enterprises and the phased policy on operating property loans were originally set to expire on December 31, 2024. However, the central bank and the State Administration of Foreign Exchange have decided to extend these policies to December 31, 2026.

Optimize the refinancing policy for affordable housing. To further incentivize banks and acquisition entities, the central bank has increased the proportion of funds contributed by the People's Bank of China for affordable housing refinancing from 60% to 100%. Previously, for every RMB 10 billion lent by commercial banks, the People's Bank of China provided RMB 6 billion. Now, for every RMB 10 billion lent by commercial banks, the People's Bank of China will provide RMB 10 billion in low-cost funds, accelerating the destocking process for commercial housing.

Support the acquisition of existing land from real estate enterprises. Building upon the use of some local government special bonds for land reserves, the central bank is exploring allowing policy banks and commercial banks to provide loans to support qualified enterprises in acquiring land from real estate enterprises through market-based mechanisms, thereby revitalizing existing land use and alleviating financial pressures on real estate enterprises. If necessary, the People's Bank of China can also provide refinancing support. The central bank and the State Administration of Foreign Exchange are still studying this policy.