BYD and Chery make big moves in car manufacturing in Qingdao

![]() 10/23 2024

10/23 2024

![]() 707

707

The Qingdao new energy vehicle industry, which has been dormant for a long time, has found new growth space in the overseas market.

On October 8, the first 20 BYD electric buses for South Africa were off the production line at the BYD Qingdao factory.

According to an agreement reached between the two parties in July this year, BYD will supply 120 electric buses to South Africa's renowned bus operator Golden Arrow, with all deliveries expected to be completed by the end of next year.

Earlier, still at the BYD Qingdao factory, on September 19, BYD delivered 100 pure electric buses to CUTCSA, Uruguay's largest electric bus operator.

Apart from BYD, Chery, known as the leader in China's automotive exports, has also made new moves in Qingdao.

In June this year, the construction project for Chery's KD (Knocked Down) parts (auto parts exported in kits) production workshop in Jimo District, Qingdao, officially commenced. During the National Day holiday, the construction of Chery's Qingdao KD parts production workshop progressed rapidly.

The construction project for Chery's KD parts production workshop is located on the east side of the Chery Qingdao base, and the construction includes building a new KD workshop, expanding the stamping workshop, and constructing connecting corridors.

According to the construction schedule, the KD workshop will have its equipment installed by the end of October; the expanded stamping workshop will have its equipment installed by the end of November; and the entire project is expected to be completed in March next year. Upon completion, the new KD workshop will be capable of producing and shipping 100,000 KD parts, with an annual output value of approximately RMB 32.5 billion.

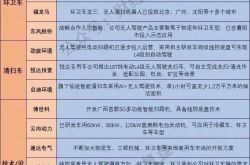

Automobile KD exports, simply put, refer to automakers exporting their auto parts to foreign countries, where they are assembled into complete vehicles for sale. This includes CKD (Completely Knocked Down) full kit assembly, SKD (Semi-Knocked Down) partial kit assembly, and DKD (Direct Knocked Down) complete vehicle assembly.

Compared to complete vehicle exports, KD exports can reduce transportation costs and facilitate enjoying local government policy support and tariff concessions.

Especially in the current context of intensifying trade barriers for China's new energy vehicle exports, KD exports can better resist trade shocks, highlighting their advantages.

As China's leader in automotive exports, Chery exported 937,100 vehicles in 2023, a year-on-year increase of 101.1%, maintaining its position as the top Chinese brand for passenger vehicle exports for 21 consecutive years.

According to the Qingdao Action Plan for High-Quality Development of the New Energy Vehicle Industry (2024-2025) (hereinafter referred to as the Action Plan), released at the end of May, Qingdao plans to build a nationally important base for new energy commercial vehicles and a high ground for export-driven new energy vehicle industry.

With the Chery Qingdao base and the advantages of its port for foreign trade, Qingdao's automotive exports are poised for even greater development opportunities.

On the one hand, focusing on BYD electric buses and Chery's Qingdao KD factory, Qingdao will further strengthen key industrial links, and at the same time, leverage the high requirements of KD factories for digital management of parts to create a "lighthouse factory," enhancing the scale and efficiency of Qingdao's new energy vehicle industry.

On the other hand, by continuously optimizing Qingdao's port logistics services and actively exploring KD export cooperation with cities such as Xi'an and Zhengzhou along the Yellow River Basin, Qingdao aims to expand its foreign trade output value and establish itself as the most important "exit port" for KD exports of automobiles in the Yellow River Basin.

(Welcome to follow the Qingdao Economic News Video Account and pay attention to the topic of "BYD and Chery's Big Moves in Car Manufacturing in Qingdao")

1

With the booming KD exports, coastal cities such as Qingdao, Xiamen, Shanghai, and Ningbo are actively developing KD exports leveraging their port advantages to boost local automakers' KD export business.

Chery's decision to locate its KD factory in Qingdao was largely driven by the convenience of Qingdao's port transportation.

In addition to KD exports, in June 2023, Chery's first batch of 500 EXEED Starlight vehicles set sail from Qingdao to global destinations, marking a new chapter in Chery's high-end automotive exports.

According to a report by Qingdao Finance and Economics Daily in March this year, Chery's export business through Qingdao amounted to billions of yuan.

Xiamen Kinglong United Automotive Industry Co., Ltd., a leading commercial vehicle manufacturer in Xiamen, has made KD exports its dominant business.

It is understood that Xiamen Kinglong currently has KD cooperation projects in 16 countries and regions, including Vietnam, Thailand, Ethiopia, and Kazakhstan. Among them, over 1,000 vehicles have been produced under the Kazakhstan KD project, nearly 1,000 under the Egypt KD project, and over 500 under the Nigeria KD project. In 2024, the company's KD projects are expected to account for more than 50% of its total exports.

Currently, coastal cities have become important transit points for automakers' KD exports.

In early 2023, BYD's complete knocked-down auto parts arrived at Qingdao Port via sea-rail intermodal transportation and were shipped to Egypt by Evergreen Marine Corporation.

To meet the KD export demand of SAIC Motor's Ningde production base in Fujian Province, Xiamen COSCO Shipping Lines, Ningde Transportation Investment Logistics Group, and SAIC Motor jointly launched the "SAIC Motor KD Parts" sea-rail intermodal block train.

In October 2021, the first train departed from Ningde's Zhangwan Station to Xiamen's Gaoqi Station and then shipped via Xiamen Port to Laem Chabang Port in Thailand.

Shanghai serves as the export port for Great Wall Motor's KD parts pre-assembly factory in Chongqing's Yongchuan Comprehensive Bonded Zone, which are transported to Ecuador.

In July 2023, a series of complete knocked-down parts for Great Wall Motor's "Tank 300" and "Great Wall Pickup" models were cleared for shipment from the Yongchuan Comprehensive Bonded Zone in Chongqing. Among them, 60 sets of "Great Wall Pickup" parts were transported via river-sea intermodal transportation to the Port of Shanghai for shipment to Guayaquil Port in Ecuador.

Subsequently, in October, the first vehicle rolled off the production line at Great Wall Motor's CKD project for its Great Wall Pickup at the CIAUTO factory in Ecuador, marking the local production of the Great Wall Pickup in Ecuador.

2

In recent years, giants such as Great Wall Motor, Geely, BYD, and SAIC Motor have all intensified their layout in KD exports, including Chery.

Apart from the Qingdao KD factory project, Chery has established a KD export base in Kaifeng Comprehensive Bonded Zone in Henan Province. Phases I and II of the project were commissioned in July 2022 and July 2023, respectively, with an annual export capacity of 50,000 vehicles.

In Anqing, Chery's hometown in Anhui Province, a KD parts export industrial park is under construction with an investment of RMB 16 billion. It is expected to be completed and put into operation by the end of this year, with an annual production capacity of 400,000 sets of automotive KD parts.

Overseas, Chery has established an extensive network of KD factories in ten regions, including Malaysia, Mexico, and Brazil.

Another example is BYD, whose new factory in Uzbekistan was commissioned on June 27. The factory adopts a CKD production model, with most parts sourced domestically. The initial annual production capacity is 50,000 vehicles, with plans to increase it to 500,000.

Great Wall Motor has also made big moves in promoting KD exports, recently establishing KD factories in Senegal and Vietnam—

In the presence of the President of Senegal, Great Wall Motor and a Senegalese dealer jointly signed a memorandum of understanding (MOU) on the construction of a KD factory in Senegal. An MOU was also signed with Vietnam's Thanh Cong Group for CKD assembly cooperation, with plans to manufacture Great Wall vehicles in Vietnam by the end of 2025.

According to Great Wall Motor's response on an investor interaction platform in August this year, the company already has multiple KD factories in Ecuador and Pakistan.

Among them, Great Wall Motor's KD factory in Pakistan was commissioned on September 1, 2022, with the first locally assembled third-generation Haval H6 making its debut on the same day.

3

Compared to complete vehicle exports, KD exports place higher demands on factory intelligence, informatization levels, and logistics support services.

This is easily understandable,

KD parts encompass over a thousand types, with diverse packaging options. All aspects, including production, management, and logistics, require a high degree of intelligence to enhance efficiency and achieve lean and error-free production.

Therefore, domestic KD factories prioritize intelligence.

For instance, Chery's Qingdao KD factory aims to create a "lighthouse factory" for automotive parts.

Previously, by introducing Haixun Cloud, an industrial internet platform jointly developed by Chery and Haier COSMOPlat, Chery's Qingdao Super Factory has met the standards of a benchmark lighthouse factory:

The stamping workshop boasts the fastest deep interactive customization globally, featuring a 6,600T fully automatic high-speed synchronous production line and a digital management platform, achieving 100% automation. The welding workshop possesses the world's most powerful AI quality control system, with 350 AI robots on the production line, enabling intelligent linkage and high-density flexible assembly, allowing for rapid switching between different vehicle models.

SAIC Motor's Ningde base has established an intelligent automotive manufacturing system integrating smart equipment, intelligent supply chain, and big data intelligence, making it a highly automated and interconnected smart factory. It was previously selected as a benchmark smart factory in China in 2020.

In 2023, the base achieved an annual production output (including KD) of over 330,000 vehicles, with over 250,000 vehicles exported (including KD).

Geely's subsidiary, Geely Logistics, explores hardware and software solutions to integrate smart factory operations with smart logistics services.

Geely Logistics' self-developed KDMS system serves as the brain of KD factories, managing production progress throughout the order lifecycle, execution quality during the production process, and unified scheduling of intelligent/automated equipment. It actively promotes the application of smart devices such as vision gates, robotic arm automatic palletizing, and AMR (Autonomous Mobile Robot) pallets in KD smart factories.

In 2022, Geely introduced forklift-type AMR equipment into the existing automatic packaging line at its Ningbo Chunxiao KD factory. Through PLC signal integration, it achieved unmanned connection of the bundling and wrapping line, resulting in a 30% increase in productivity.

Apart from logistics and transportation, automakers face challenges in expanding local markets under the KD export model.

This is because KD exports involve Chinese automakers exporting technology and process equipment, while foreign partners are responsible for assembly and operational management. Automakers seldom participate in local sales channels, leading to uncertainty in brand recognition in local markets.

Chery, an early entrant into overseas markets, serves as a model for brand expansion abroad.

It is understood that Chery's overseas expansion revolves around localization, with product planning and adjustments based on the characteristics and trends of different markets, enabling flexible responses to market changes.

In the Middle East, due to abundant oil resources and low demand for electric vehicles, Chery focuses on fuel-efficient vehicles, promoting brands such as Tiggo, Arrizo, and EXEED, which offer high performance, quality, and intelligence.

In European markets, where environmental protection requirements are stringent and demand for new energy vehicles is high, Chery prioritizes new energy vehicles, showcasing brands like JETOUR and Tiggo, which emphasize efficiency, safety, and comfort.

4

Whether to break through the bottleneck in the development of new energy vehicles or to seek greater breakthroughs in foreign trade imports and exports, Qingdao's focus on automotive KD exports is highly necessary at present.

In this process, it is crucial to leverage Qingdao's port advantages, using the port as a driving force to provide comprehensive services for enterprises expanding overseas in areas such as logistics services and overseas market expansion, optimizing and improving the ecosystem for automakers' KD exports.

Especially in terms of logistics services, Qingdao needs to intensify the recruitment of leading enterprises in the logistics supply chain industry.

It is understood that Qingdao-based COSCO Shipping Lines has already carried BYD's first KD parts export to Uzbekistan.

Fully considering the high requirements for KD parts in shipping and packing, Qingdao Shipping Lines provided BYD with "customized" block train services based on the bill of materials (BOM) and part packaging methods, ensuring punctual and efficient services, significantly shortening the delivery cycle.

The rapid development of Xiamen's automotive KD exports is closely related to its robust supply chain industry.

It is reported that Xiamen is leveraging its excellent port resources and the advantages of state-owned supply chain enterprises to encourage and support the exports of Kinglong and Jinlong passenger vehicles, expand CKD project construction, provide deeply customized products based on market demand, actively attract foreign trade-oriented new energy vehicle enterprises, and lay out new directions for automotive exports.

Furthermore, in terms of market expansion, Qingdao needs to establish international cooperation platforms to help automakers connect with overseas automakers, accelerate their "going out" strategy, and secure overseas orders.

Apart from automotive KD exports, Qingdao's new energy vehicle exports also have significant room for development.

In May 2023, the Qingdao Port Commodity Vehicle Terminal was inaugurated, offering customized "one-stop" container export services for new energy automakers. Through the Yellow River Land-Sea Corridor, new energy vehicles from central and western China are being exported worldwide via Qingdao Port through sea-rail intermodal transportation.

For example, "Made in Xi'an" BYD vehicles are first transported via domestic railway in 2-3 days to Qingdao Port and then shipped to Rotterdam, the Netherlands, via Evergreen's star route in 30 days, completing the entire journey in just 30-35 days.

Zhengzhou, another city along the Yellow River Basin, also has robust demand for automotive exports.

In 2023, Zhengzhou's automotive exports exceeded RMB 20 billion, a year-on-year increase of over 90%. Among them, passenger vehicle exports amounted to approximately RMB 12 billion, a year-on-year doubling; commercial vehicle exports exceeded RMB 9 billion, a year-on-year increase of nearly 80%.

As SAIC Motor's largest export base nationwide, the SAIC Motor Zhengzhou base produced and exported over 310,000 vehicles in 2023, a significant increase from 120,000 in 2021, accounting for 70% of the base's total production. The base primarily manufactures MG models, which are exported to European countries such as the United Kingdom, Spain, and Belgium, as well as some countries and regions in South America and the Middle East.

Currently, Qingdao Port has established in-depth cooperation with over 20 automakers, including Chery and FAW. Chongqing Seres exports its vehicles via Qingdao Port through sea-rail intermodal transportation, while Hyundai vehicles destined for Jeddah Port in Saudi Arabia are transshipped through Qingdao Port.

According to the Qingdao Action Plan for High-Quality Development of the New Energy Vehicle Industry (2024-2025), released in May this year, Qingdao aims to export approximately 180,000 new energy vehicles by 2025, with overseas operating revenue exceeding RMB 36 billion for automakers.