Contemporary young people still want to 'take over' the real estate market

![]() 11/14 2024

11/14 2024

![]() 709

709

In October, data from the Ministry of Housing and Urban-Rural Development showed that both month-on-month and year-on-year sales of commercial housing increased this month, with total sales of new and second-hand homes increasing by 3.9% and 5.8% respectively. The operating amount of the top 100 real estate enterprises surged by 73% month-on-month in October compared to September; it also increased slightly by 7.1% compared to the same period last year.

Looking at the real estate market across the country, there has generally been a minor surge:

In Shenzhen, 2,047 customers competed for 192 units, which were sold out in just 1.5 hours; in Shanghai, nearly 600 second-hand homes were sold in a single day; 64 units priced between 6 million and 9 million yuan attracted 1,300 groups of visitors and over 5,000 people to inquire at sales offices...

Unlike previous real estate consumption recoveries, the group enthusiastic about buying homes in recent years has gradually shifted from middle-aged people to younger generations. Data shows that from January 2022 to the third quarter of 2024, post-90s buyers accounted for nearly 50% of transactions, while post-00s customers increased from 3% to 7%.

This is not unfounded. Previous research institutions have concluded that the average age of domestic consumers purchasing their first home is currently between 27 and 30 years old. As early as 2021, an age trend chart of real estate subscriptions in the Shanghai area showed that home buyers choosing Qingpu, Songjiang, and Jiading were mainly concentrated between the ages of 20 and 40, accounting for over 68%.

Among them, almost all home buyers in Baoshan are between the ages of 20 and 30.

In the consumer market, various industries once pinned their hopes for revival on young people, but unfortunately, their performance was mediocre. Now, it's the real estate market's turn to wait for a young army.

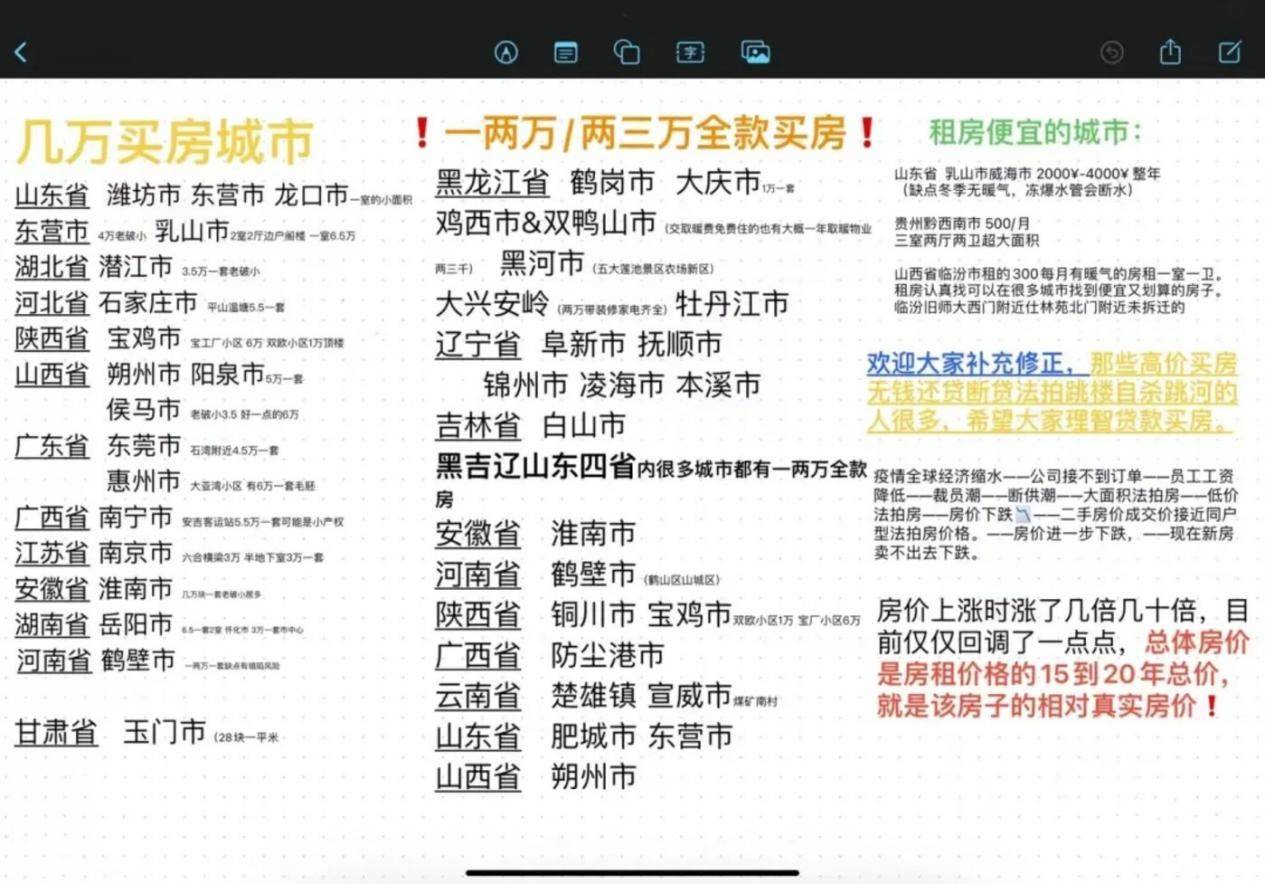

The 'Hegang' housing hunt continues

In some perceptions, contemporary young people are not as obsessed with owning a home as the previous generation. However, this is not the case.

A survey by NetEase showed that up to 85% of young people still believe it is necessary to buy a home. Meanwhile, DT Business Insight revealed that over 40% of respondents still consider buying a home as their primary life goal, with this proportion exceeding 50% in lower-tier cities with cheaper housing prices.

However, when young people's status declines in the consumer market, buying a home, which often costs millions, remains beyond the reach of many. Data shows that only 4.5% of young people currently preparing to buy a home have the ability to pay in full.

The vast majority can only afford a 30% down payment, and among this group, only 34.7% save the money themselves. The remaining 37.5% need to share the burden with their partner, while 26.2% require parental support. More than 10% of young people cannot even afford the 30% down payment.

When buying a home conflicts with spending power, the drama of young people frantically searching for 'Hegang' has resurfaced. In 2019, news of a netizen buying a home in Hegang went viral on social media platforms, catapulting Hegang's housing prices into the spotlight. For a long time, 'buying a home in Hegang' became a trend among young people.

Although subsequent Hegang home purchases lost some of their allure due to the local environment, data from the Hegang Housing and Urban-Rural Construction Bureau shows that young people have never stopped looking forward to affordable housing. It is reported that since 2021, over 2,000 homes have been purchased by out-of-towners in Hegang each year. In the first half of 2023, 1,776 second-hand homes were purchased by out-of-towners, an increase of 105% compared to the same period last year, with 41 newly built commercial homes purchased.

To this day, the 'Hegang housing phenomenon' has even spread nationwide among young people. According to media statistics, as of the end of June this year, at least 24 cities in 10 provinces across the country have experienced the 'Hegang housing' phenomenon, including Fuxin in Liaoning, Datong in Shanxi, Rushan in Shandong, Qianjiang in Hubei, Huainan in Anhui, Gejiu in Yunnan...

Interestingly, rather than saying that Hegang is a 'utopia' that young people seek in real life, it is more accurate to say that Hegang is a traffic symbol that contemporary young people manipulate on the internet. After all, most young people who buy homes in Hegang embark on their journey to become internet celebrities.

Hegang has gradually evolved from a city with a loss of labor force to an e-commerce city. According to statistics from the Hegang Municipal Bureau of Commerce, there are currently 8 e-commerce bases in Hegang City, 7 of which are in operation and 1 awaiting operation. As of the end of last September, a total of 95 merchants had settled in the city's e-commerce bases, and even the growth rate of social retail sales exceeded the overall growth rate of Heilongjiang Province.

In contrast to Hegang is Xiahuayuan, Zhangjiakou, which carries the aspirations of the Beijing drifter community for housing.

In the past two years, Xiahuayuan District, Zhangjiakou, located just over 100 kilometers from Beijing Haidian, has seen many old homes priced at less than 100,000 yuan. The Daily Economic News reported that in Xiahuayuan District, Zhangjiakou, a 60-square-meter two-bedroom apartment can be purchased for 60,000 yuan, and a 78-square-meter two-bedroom, two-bathroom apartment for 80,000 yuan. Shell looking for a house also shows that there are dozens of homes priced around 100,000 yuan in total in Zhangjiakou.

This instantly ignited the enthusiasm of Beijing workers to buy homes. "As soon as the news came out the other day, many Beijing people came that day and bought up all the homes priced below 1,000 yuan on the market," said a local in a in-depth report on Zhangjiakou on Douban. However, when seeing the desolate and quiet surroundings, one might wonder if this is another 'Hegang'.

However, while young people in Hegang are starting live streams, high-speed trains are departing from Xiahuayuan to Beijing.

One hundred and eight 'hurdles' faced after buying a home

Unlike other consumption, real estate, as a major immovable property, is destined to be a long-term consumption behavior. For most contemporary young people, buying a home carries multiple meanings: mortgage, renovation, preservation and appreciation, and even a direct impact on their daily lives under immense pressure.

In the first half of this year, Zhou Qi, who works in Wenzhou, bought a second-hand home. Unlike most young people who buy homes to get married and have children, Zhou Qi bought a home for her six cats. She has been working in Wenzhou for over five years, always renting with her pets. However, as the number of cats increased, the rental house began to struggle under the weight.

According to a 2024 Meituan survey, over 70% of post-90s pet owners currently have pets, and the pet economy has indeed begun to penetrate the real estate sector. For example, Sunac has incorporated the 'Pet Gathering' into one of the eight community modules, and Vanke projects recommend configuring at least 100 square meters of pet activity space...

The diversity of real estate consumption behavior becomes apparent: among young people, some wander to Hegang, while others decide to buy homes for their pets.

However, before buying a home, Zhou Qi experienced endless trivia. First, there was the issue of home depreciation. Due to instability in the real estate market and regulatory policies over the past two years, housing prices have occasionally declined across regions, causing consumers who bought homes at high prices earlier to complain endlessly. Zhou Qi's boyfriend's wedding home has lost over 1 million yuan to date.

Since Zhou Qi bought a second-hand home, they were concerned that the 'tragedy' would recur, especially as the current situation for second-hand homes is particularly awkward.

Real estate data platform monitoring shows that in the first five months of this year, the volume of second-hand homes listed for sale increased by 30% year-on-year, with nearly half of homeowners adjusting their asking prices downward by 10%-20% compared to the same period last year. In July 2024, the average price of second-hand residential homes in 100 cities fell by 0.74% month-on-month, marking the 27th consecutive month of month-on-month decline and a year-on-year decline of 6.58%.

Preservation of value has always been a top concern for home buyers. DT surveys show that up to 60.8% of people hope that their property will at least maintain its value, while only 34% of people can ignore depreciation under the premise of self-occupation. About 5% of people are pursuing significant growth in property value.

Zhou Qi's boyfriend did not want her to buy another home to bear the risk of future depreciation, as their wedding home was already furnished. However, considering future circumstances, Zhou Qi still bought this second-hand home, which is only a ten-minute drive from her company. "With housing provident fund contributions, I don't actually feel like buying a home is a burden," said Zhou Qi.

This is both Zhou Qi's main confidence in independently buying a home before marriage and an advantage that most contemporary young people envy.

Mortgages have a profound impact on current young people. DT Business Insight shows that over 40% of people take out loans for 30% to 70% of the home price, 84.5% of people sacrifice their quality of life to buy a home, 52.9% delay other significant expenditures like car purchases, 46.3% reduce experiential consumption like travel, and 37% lower their daily consumption levels.

Although Zhou Qi does not have this concern for the time being, renovation has become her biggest headache after buying a home.

It is reported that Zhou Qi's initial renovation budget was 150,000 yuan, but due to the demolition work required for renovating a second-hand home, plus later furniture and appliances, and the personalized design brought by her six cats, this cost soared to 240,000 yuan. During the renovation process, she encountered many pitfalls and even a renovation company that 'ran away'.

Data shows that more than 800,000 renovation-related enterprises have been registered every year since 2020. Nearly 80% of renovation companies in the industry have been established for less than five years, with 19.93% established within one year and 59.19% established between one and five years. Only 1.84% of companies have been established for over 15 years.

This means that over 98% of companies in the renovation industry do not survive for more than 15 years.

Dopamine-style bathroom (image source: respondent's WeChat Moments)

A few days ago, Zhou Qi wanted to decorate her bathroom in a dopamine style, which led to another fight with her boyfriend. Even the designer could not understand, and she ultimately had to return to a conventional design. She still can't say for sure if she will regret buying the home in the future, but at least she feels it was worth it for now.

Big cities remain the preferred choice for 'taking over'

Although the 'Hegang phenomenon' continues, recent data analysis shows that the main driving force behind the temporary recovery of the national real estate market still comes from first- and second-tier cities.

Data from the Ministry of Housing and Urban-Rural Development shows that in October, online signings of newly built commercial housing in first-tier cities increased by 14.1% year-on-year, and online signings of second-hand homes increased by 47.3% year-on-year. Among second- and third-tier cities, cities like Nanjing, Ningbo, Dalian, and Dongguan saw year-on-year increases in new home sales of over 30%.

However, on a national scale, in October this year, the year-on-year growth rate of online signings of newly built commercial housing nationwide was only 0.9%, far from the 14.1% of first-tier cities. The year-on-year growth rate of online signings of second-hand homes nationwide was 8.9%, also significantly lower than the 47.3% of first-tier cities.

While young people shout about escaping from Beijing, Shanghai, and Guangzhou, showing off their homes purchased for tens of thousands of yuan in Hegang on camera, the allure of big cities remains as strong as in their heyday. Third- and fourth-tier cities with moderately priced homes and development that largely meets the needs of young people's lives are still far less attractive than first- and second-tier cities.

Data from the E-House China R&D Institute shows that as of February this year, the inventory-to-sales ratio of newly built commercial residential buildings in first-, second-, third-, and fourth-tier cities among the 100 cities was 18.0, 21.4, and 32.8 months, respectively, with the highest inventory pressure in third- and fourth-tier cities. How did first- and second-tier real estate, which can easily deplete the wallets of six people, suddenly regain its popularity?

First, it is certain that the revitalization of real estate consumption in first- and second-tier cities is inseparable from the return of young people. In the past two years, 'escaping from Beijing, Shanghai, and Guangzhou' was almost the most popular slogan among young people. It was also during these years that Hegang became an internet sensation. However, in the past two years, young people who once fled from first- and second-tier cities have gradually chosen to return.

Zhaopin data shows that 39.2% of people who 'escaped' from Beijing, Shanghai, Guangzhou, and Shenzhen will re-submit their resumes to first-tier cities, with an average interval of only 20 months. There is no other choice; after all, most young people return home only to find that there is no place for them in the local talent market.

On the contrary, first- and second-tier cities offer greater employment opportunities. Currently, many companies are also relocating to big cities.

Taking Nanjing as an example, data shows that since 2020, a total of 2,138 high-tech enterprises have relocated across provinces, with the largest number settling in Nanjing among all cities in Jiangsu Province. The China Urban Science and Technology Entrepreneurship Evaluation Report 2024 shows that Nanjing ranked third nationwide in terms of scientific and technological entrepreneurship capabilities in 2023, after Beijing and Shenzhen.

Convenience for commuting has always been a significant factor influencing contemporary young people's decision to buy homes, and its proportion is increasing. The restless souls that first- and second-tier cities cannot accommodate eventually succumb to reality after wandering away for a while. Of course, the current home purchase policies in first- and second-tier cities have also stimulated a large number of home buyers.

Some cities have even started 'giving hukou (household registration) with home purchase.' According to incomplete statistics, nearly 20 cities, including Nanjing, Suzhou, Hefei, Shenyang, and Wuhan, use hukou to attract young people. To this day, young people have to admit that their hearts longing for Hegang were just a fleeting fantasy. When they wake up from the dream, life must continue.

In addition, home buyers nationwide are concerned about the preservation of property value and subsequent investment returns. Compared to third- and fourth-tier cities, these concerns are slightly alleviated in first- and second-tier cities. An article on Huxiu directly points out the difficulties faced by young people who buy homes in their hometowns in county towns, as they even struggle to rent them out.

This is not a concern in first- and second-tier cities.

Data shows that as of the first half of 2023, the average occupancy rates of long-term rental apartment projects in the three core first-tier cities of Shanghai, Beijing, and Shenzhen were 89%, 93%, and 96%, respectively. Especially in Shanghai, from 2018 to the second quarter of 2023, the volume of bulk transactions of long-term rental apartment projects in Shanghai fluctuated and increased. As of mid-2023, the transaction volume of long-term rental apartments in Shanghai had reached 6.48 billion yuan.

Perhaps young people are not trying to save any particular market but are on a journey of self-redemption.

Dao Zong Youli, formerly known as Waidaodao, is a new media outlet in the internet and technology circles. This article is original and any form of reproduction without retaining the author's relevant information is prohibited.