Beijing's Unicorn Map: Haidian's Dominance and Yizhuang's Rise

![]() 05/12 2025

05/12 2025

![]() 1081

1081

Author: I Song Xi | Location: 960

This article is 2,753 words long and will take approximately 3 minutes to read.

Unlisted companies that swiftly achieve a valuation of $1 billion within a decade, leveraging "disruptive technology + capital acceleration," are known as "unicorns." The concentration of these unicorn enterprises serves as a vital indicator for gauging the innovation prowess of a nation or region.

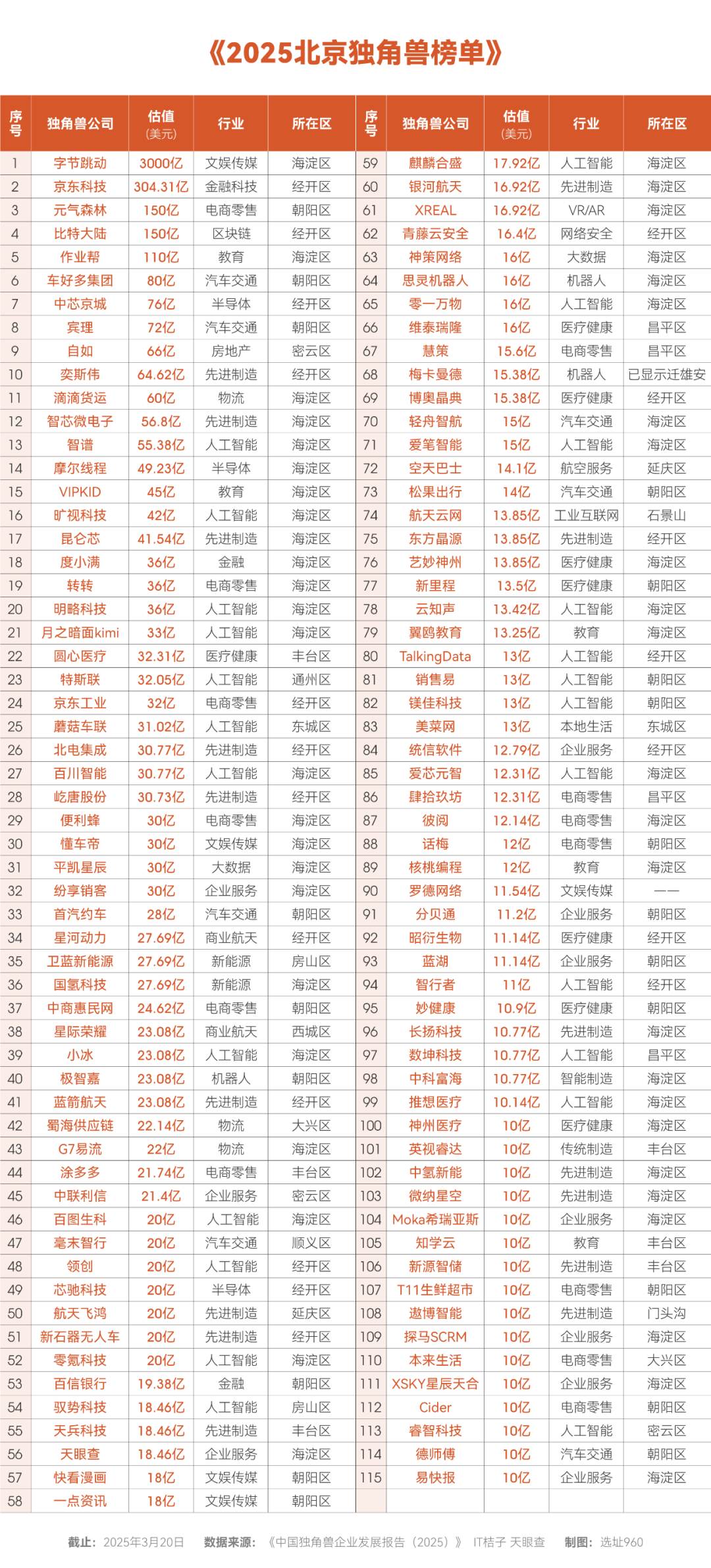

Recently, several lists, including the "National Unicorn Enterprise Development Report 2025" and the "List of Beijing Unicorn Enterprises," have been released consecutively. The data reveals that China boasts a total of 409 unicorn enterprises, accounting for one-third of the global total, with a combined valuation of $1.5 trillion.

Among these, Beijing tops the list with 115 enterprises.

Beijing: The Dominant City, AI Firmly Holding the Central Stage

Cities trailing Beijing in the rankings are: Shanghai (84), Shenzhen (42), Hangzhou (23), Guangzhou (15), Suzhou (13), Hefei (10), Nanjing (10), Chengdu (9), Tianjin (8), among others.

As the consistently leading city, Beijing's 115 unicorn enterprises collectively possess a valuation exceeding $600 billion, marking a 28% increase from approximately $480 billion last year.

Among them, ByteDance, founded in 2012 but still maintaining an annual growth rate of over 20% and undeterred by its size, continues to feature prominently as a super unicorn. ByteDance's latest valuation stands at $300 billion, equivalent to approximately RMB 1.9 trillion, accounting for 49% of Beijing's total valuation and over 70% of the top 10's combined valuation, simultaneously surpassing SpaceX to rank first globally.

Furthermore, JD Technology (9 years), Bitmain (6 years), Genki Forest (5 years), Zuoyebang (7 years), Chehaoduo (9 years), and Ziroom (7 years) on this list are all familiar names.

Among the newcomers, Zhipu AI stands out prominently. Zhipu AI, or Beijing Zhipu Huazhang Technology Co., Ltd., was listed in September 2023 with a valuation of $5.538 billion, equivalent to approximately RMB 36 billion.

Public information indicates that Zhipu AI was founded in 2019, focusing on the research and development of cognitive intelligence large models, with technological advancements stemming from the Knowledge Engineering Laboratory of the Department of Computer Science at Tsinghua University. Past investors include Sequoia China, Tencent, Alibaba, Shunwei Capital, Legend Star, Xiaomi Group, Kingsoft Software, Meituan, Ant Group, China Merchants Investment, Hangzhou City Investment, Alibaba Cloud, Zhongguancun Science City, among others. It is currently the unicorn with the highest valuation and largest scale among Beijing's large model unicorns.

Equally notable are those that have listed before and after, such as Dark Side of the Moon kimi and Baichuan Intelligence.

Dark Side of the Moon kimi was founded in April 2023 and listed in February 2024 with a latest valuation of $3.3 billion, equivalent to approximately RMB 21.45 billion.

Baichuan Intelligence was founded in March 2023, listed in October, and has a latest valuation of $3.077 billion, equivalent to approximately RMB 20 billion.

Data reveals that among the 115 unicorns, there are 29 AI enterprises, accounting for a quarter of the total, with a combined valuation of approximately $360 billion, constituting nearly 60%, firmly securing the central position in Beijing's unicorn subdivision landscape.

From the perspective of subdivision tracks, besides AI, the semiconductor field also shines brightly, with a total of 9 enterprises on the list. These include Beidian Integration, ESWIN Design, SMIC Beijing, Eastern Acorn, Kunlunxin, Zhixin Microelectronics, among others, essentially covering the entire chip design, manufacturing, and testing industry chain. Among them, SMIC Beijing leads with a valuation of $7.6 billion, equivalent to approximately RMB 49.4 billion.

However, chip leader Jichuang North exited the unicorn ranking this year. Jichuang North, founded in 2008, has been operational for 17 years.

Also absent from the list are those that successfully went public in 2024, including Horizon Robotics, Pony.ai, Diandian Zhishu, Shansong, and Baiwang Co., Ltd.

Correspondingly, the new unicorns in 2025 are Dark Side of the Moon kimi, Beidian Integration, Autohome, Tongxin Software, Neolithic Autonomous Vehicles, Zhongqing New Energy, and Weina Aerospace.

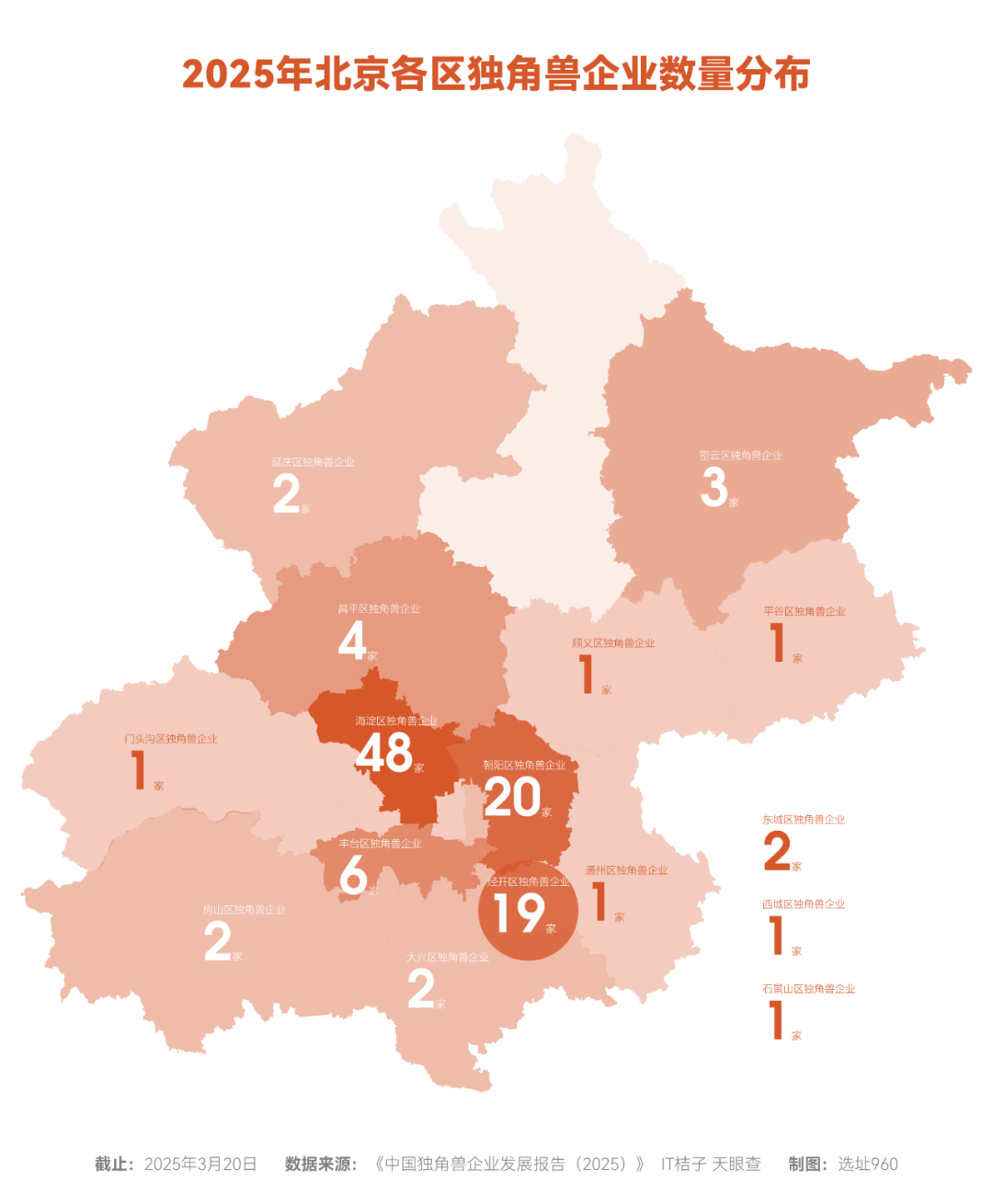

So, how are these 115 unicorns distributed across Beijing's vast 16,400 square kilometers?

Haidian Strengthens Scientific Innovation, Chaoyang Focuses on Consumption, BDA Specializes in High-end Manufacturing

Statistics show that among the 115 unicorns, Haidian District boasts 48, with AI exhibiting the most impressive performance.

The aforementioned Zhipu AI, Dark Side of the Moon kimi, and Baichuan Intelligence are all clustered in Haidian. According to the "High-quality Development Report of Unicorn Enterprises in Zhongguancun Science City," Haidian District hosts approximately 15 AI enterprises, accounting for 30% of Haidian's unicorn enterprises, nearly 30% of the national AI unicorn enterprises, and over 70% of Beijing's AI unicorns.

Software and information services come in second, with 9 unicorn enterprises, comprising 18% of the total number of unicorn enterprises in Haidian District. Representative enterprises include Pingkai Xingchen in the big data field and Minglue Technology in the AI enterprise service field.

Additionally, ByteDance, with a market value of $300 billion and RMB 1.9 trillion; Luckin Coffee, Zhuanzhuan, and 58.com in the new consumption field; and newly listed Weina Aerospace are all situated in Haidian.

The "2024 China's Most Venture Capital-worthy District List" reveals that Beijing's Haidian District, with its closed-loop ecosystem of "talent-technology-capital-scenario," surpasses Shanghai Pudong and Shenzhen Nanshan to rank first.

If hard technology is concentrated in Haidian, consumer unicorns are clustered in Chaoyang District, Beijing, which has the highest density of high-net-worth individuals.

Statistics indicate that Chaoyang District has a total of 20 unicorn enterprises.

Among them, there are 13 new consumption and retail enterprises represented by Genki Forest, Taihe Music, and cross-border e-commerce platform Cider, accounting for over 50%; in addition, there are Kuaikan Comics and Yidian Zixun in the field of cultural technology.

Public information shows that as the main bearing area of Beijing's international consumption center city, Chaoyang District's retail sales of consumer goods account for nearly a quarter of the city's total. The region boasts fashionable business districts such as Sanlitun, Solana, SKP, and Parkview Green, more than half of the city's "Night Beijing" landmarks and business districts, and hundreds of cultural and creative industrial parks.

Recently, the country's largest and Beijing's first JD MALL began trial operations. The selected location is Guangqu Road, which can connect and cover consumer groups in the CBD and Huamao areas.

BDA, with only one fewer unicorn than Chaoyang District, has formed a high-tech barrier high-end manufacturing cluster under the guidance of industrial policies in recent years, focusing on advanced manufacturing (8 enterprises), semiconductors (3 enterprises), and commercial aerospace (2 enterprises). Representative enterprises include SMIC Beijing, Xinghe Power, ESWIN, and LandSpace.

Moreover, JD Technology, incubated by JD.com, has the highest valuation in the region at $30.4 billion, forming the rudiments of a JD unicorn circle in conjunction with JD Industry.

Fengtai District ranks fourth. Relying on its industrial foundation and potential in the fields of rail transit, smart manufacturing, and digital economy, Fengtai District has six unicorn enterprises, including aerospace enterprise Tianbing Technology, atmospheric environmental monitoring producer Insight Data, and Circle Health, among others.

Changping District, leveraging its development in the fields of life sciences and energy technology, has nurtured four enterprises, including innovative pharmaceutical enterprise Vitruilon, Wisdom Strategy, and Numkun Technology.

Miyun, Daxing, Fangshan, and Yanqing, as relatively weaker regions in Beijing's industrial base, have successfully recorded 3 and 2 enterprises, respectively. Besides Ziroom in Miyun, Zhonglian Credit, currently listed, has been renamed Zhonglian Cloud Port. The company possesses strong capabilities in CDN and data services but was established in 2014 and does not actually meet the unicorn criteria. The two recorded in Fangshan are relatively high in value, including Weilan New Energy, which is incubated by the Institute of Physics of the Chinese Academy of Sciences and focuses on solid-state battery research and production with a valuation of ten billion yuan, and UISEE, which possesses L4 autonomous driving technology.

Dongcheng District and Xicheng District, as the core functional areas of the capital, have recorded a total of 3 enterprises due to limited space resources. These include autonomous driving and intelligent transportation unicorn Momenta, fresh produce e-commerce platform Meicai, and Star Era Aerospace, which is registered in Xicheng but has a significant portion of its R&D and office operations in Yizhuang.

From Haidian's AI cluster to Chaoyang's new consumer forces, from Yizhuang's high-end manufacturing to Changping's biopharmaceuticals, the development landscape of Beijing's unicorn enterprises also outlines the differentiated development paths of Beijing's various districts under industrial upgrading.

Behind the glamorous listing, there is also a group of developmentally imbalanced unicorns that are quietly exiting the stage due to mergers and acquisitions, bankruptcies, valuation declines, etc. For instance, Hedo Technology has disbanded most of its core departments due to capital chain ruptures and failed restructuring plans. Dingding Car Rental, Chexiao Technology, Cloudcube, etc., have seen their valuations drop below $1 billion due to lack of financing or prolonged operation.

Additionally, there is a group of companies that have quietly left Beijing for various reasons. For example, the latest business registration address of Mech-Mind Robotics is already shown as Xiong'an New Area; autonomous driving company Momenta has moved its headquarters to Suzhou; and new energy heavy truck company DeepWay has changed its name to Anhui Shenxiang Technology Co., Ltd. and relocated its headquarters to Hefei.

With the rise of newcomers, the listing or withdrawal of old brands, and the premature demise of those with imbalanced development, the updating and iteration of Beijing's unicorns also depict the explicit or implicit evolution of Beijing's technology business year after year amidst the brutal competition in the market.

Note: The "List of Beijing Unicorn Enterprises" is jointly released by the Zhongguancun Unicorn Enterprise Development Alliance, Beijing Great Wall Enterprise Strategy Institute, and ITjuzi, primarily measured by valuation and financing. Some enterprises are not strictly calculated based on their establishment time. Please be aware of this.

Additionally, the regions where unicorn enterprises are located are based on the business registration addresses provided by Tianyancha. Some information may have discrepancies and is for reference only.