Performance Share Price Pain, Guanglianda Climbing Upward

![]() 05/09 2024

05/09 2024

![]() 831

831

The Scenery on the Upslope Is Unique

Editor: Cola

Style: Yiran

Source: Shoucai - Shoucai Financial Research Institute

The warmth is fleeting. From real estate to construction, the market recovery signals are clear, and the dawn is just around the corner, but the final bottoming-out shuffle still causes practitioners pain.

On the evening of April 24, Guanglianda released its 2024 first-quarter report: revenue of 1.3 billion yuan, a year-on-year decrease of 0.93%; net profit attributable to shareholders of 6.0781 million yuan, a year-on-year decrease of 94.92%; non-deductible net profit of -1.3873 million yuan, a year-on-year decline of 101.48%.

Regarding the three declines, Guanglianda explained that new costs and new contracts signed in the first quarter had declined, construction business had declined, and construction delivery implementation costs had remained high.

That said, it should be noted that in 2023, the company had already experienced a double decline in profits, with net profits falling by more than 88% to only 116 million yuan, the lowest in the past eight years, and an operating net profit margin of only 1.82%.

With year-on-year declines in both annual and quarterly profits, such a performance sheet is hardly pleasing to the capital market. As of the closing price on May 8, it was 11.51 yuan per share, down 78.19% from the 2023 high of 55.64 yuan per share, with a market value of only 19.16 billion yuan.

Once upon a time, Guanglianda was a high-performing stock with unlimited prospects in the A-share market. In 2021, revenue reached 5.62 billion yuan, an increase of 40.3% year-on-year; net profit was 660 million yuan, doubling from 2020. At that time, the annual investor conference attracted 327 institutions, including top PEs such as Deshuiquan and Sequoia Capital, as well as large public funds such as E Fund and Tianhong Fund. In January of that year, the company's share price reached a high of 91.56 yuan, with a corresponding market value exceeding 100 billion yuan.

Between peaks and valleys, what has Guanglianda gone through and how should it get out of the困境?

1

Accounts receivable exceed 900 million yuan

Beware of cash flow pressure

In 2023, Guanglianda's revenue experienced its first negative growth in nearly eight years, with net profits down 88.02% year-on-year; combined with the double decline in the first quarter of 2024, the downward trend seems to have intensified. Stretching the timeline, the last double decline dates back to 2015: revenue of 1.539 billion yuan, growth rate of -12.53%; net profit of 242 million yuan, year-on-year growth rate of -59.41%.

Even so, there are still voices of scrutiny from the outside. For example, the significant difference between non-deductible net profit and net profit. In 2023, net profit was 116 million yuan, while non-deductible net profit was only 54.4287 million yuan; in the first quarter of 2024, the former was 6.0781 million yuan, while the latter lost 1.3873 million yuan.

Tracing the reasons for the difference, government subsidies are a consideration. According to the 2024 first-quarter report, the company's government subsidies included in current profits and losses were 6.1512 million yuan, exceeding the absolute value of net profit for that quarter. In 2023, it was even higher at 660.5 million yuan. According to the annual report, these subsidies are mainly for government research and development subsidies, government rewards, and other income.

Industry analyst Sun Yewen said that subsidies help companies enrich their sources of profit and enhance their anti-risk capabilities, but if they rely too heavily on them for a long time, it may weaken the company's market competitiveness and self-adjustment capabilities. Only by continuously improving sustainable profit models and core business capabilities is the long-term solution to improve performance.

Deep into the business aspect, in 2023, Guanglianda's digital cost business revenue was 5.17 billion yuan, an increase of 8.33% year-on-year. During the reporting period, 3.564 billion yuan in cloud contracts were signed, a year-on-year decrease of 9.08%; digital construction business revenue was 862 million yuan, a year-on-year decrease of 35.00%; digital design business revenue was 87 million yuan, a year-on-year decrease of 27.53%. Overseas business accounted for 3%, and domestic business accounted for 97%.

Overall, Guanglianda's business mainly targets participants in the industrial chain such as construction parties and suppliers; revenue is greatly affected by the market sentiment of the construction industry. In a 2023 institutional survey, the company once admitted that although infrastructure investment continues to grow, investment and construction starts in housing projects are still declining, the construction industry is in a shuffle stage, short-term customers lack confidence, and business investment is relatively cautious, thus affecting business development.

In the first quarter of 2024, Guanglianda's accounts receivable were 954 million yuan. From 2021 to 2023, they were 495 million yuan, 1.04 billion yuan, and 842 million yuan, respectively. The high accounts receivable, in addition to alerting to the risk of bad debt impairment and cash flow pressure, also reflects to a certain extent that market discourse power and product competitiveness need to be improved.

In 2023, Guanglianda's net cash flow from operating activities was 637 million yuan, down 61.34% year-on-year, and -750 million yuan in the first quarter of 2024. At the same time, credit impairment losses increased by 196.29% year-on-year, mainly due to the year-on-year increase in accounts receivable balances and the corresponding increase in impairment provisions.

2

Three costs rise, net profit margin below 2%

Detailed interrogation

Guanglianda has long been known as the "leader in engineering cost software." As a service provider of well-known digital construction platforms in China, it has three major business segments: digital cost, digital construction, and digital design, as well as several innovative business units such as digital construction parties, digital cities, digital procurement, digital education, and digital finance.

Based on this, its performance rises and falls are closely related to the real estate industry, with strong cyclical fluctuations.

According to data from the National Bureau of Statistics, over the past decade, the newly started construction area of domestic housing has increased from 550 million square meters in 2005 to 1.29 billion square meters in 2010, and has remained above 1 billion square meters since then, reaching a peak of 1.67 billion square meters in 2019.

Starting in 2021, the newly started construction area began to decline significantly, falling by 39% in 2022 to only 880 million square meters. In 2023, it fell another 21% to 690 million square meters, and Guanglianda was naturally caught up in it, knowing its own bittersweet.

Coupled with the slow recovery of the external economic environment, which has affected the expansion of some businesses; although customers have strong digital transformation needs, due to general considerations to control costs and expenses, related investments have become cautious, and the business transaction cycle has become longer.

Interestingly, in the first quarter of 2024, Guanglianda's management expenses increased by 135 million yuan year-on-year, an increase of 47.62%. Tracing the reason, the company adjusted some businesses at the beginning of 2024 and optimized the corresponding positions. The related expenses brought about by personnel optimization were included in the current management expenses in one lump sum, resulting in a significant increase in expenses, which in turn affected the net profit attributable to shareholders.

Previously, annual fundraising investment projects were amortized after being transferred to intangible assets at the beginning of the year, such as the Xi'an R&D base being put into use at the beginning of the year and transferred to fixed assets for depreciation, with depreciation and amortization increasing by about 200 million yuan; due to the failure of some business segments to meet expected growth rates, the company's asset impairment in 2023 increased by about 100 million yuan compared to 2022, which further affected profitability.

In addition to management fees, sales expenses in 2023 were 2.008 billion yuan, an increase of 18.79% year-on-year, accounting for 30.76% of revenue. This was mainly due to increases in human costs, travel and transportation expenses, office rental depreciation, and business promotion expenses caused by the growth in sales personnel.

Specifically, human costs remain high. Employee compensation accounted for 72% of the total, an increase of about 275 million yuan, a year-on-year increase of 23.6%. However, the number of sales personnel decreased from 4,664 to 4,127. Although the financial report did not provide too many explanations for this increase and decrease, combined with the double decline in profits, there is still room for improvement in cost management and refined operations.

In 2023, the company's gross profit margin was 82.52%, but the net profit margin was low and declined significantly: 7.35%, 9.66%, 12.92%, 15.45%, and 1.83% from 2019 to 2023, respectively;

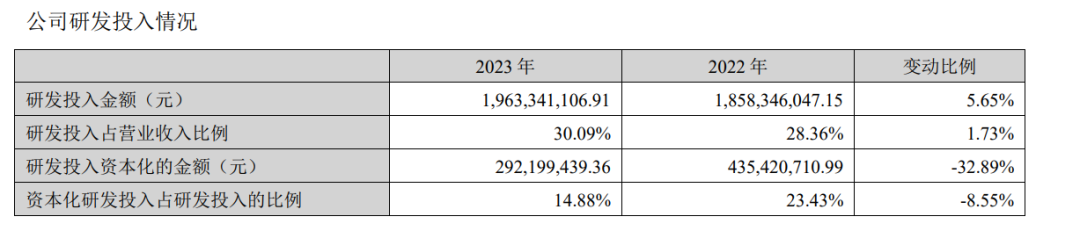

In 2023, R&D expenses increased by 5.65% year-on-year, accounting for 30.09% of revenue, up from 28.36%; the capitalization ratio of R&D expenses was 14.88%, a significant decrease from the previous year, but the proportion is still not low.

With the increase in three costs, it can be seen that the company still has confidence in the market, but ultimately, revenue did not increase but decreased, and net profits plummeted, inevitably causing more scrutiny from the outside world. Are there any reflections on the accuracy and refinement level of investment?

3

Repurchase, Reduction, Pledge

Questioning the spirit of contract

On January 5, 2024, a Maimai user revealed that "Guanglianda's employee performance has been zeroed out," and nearly a hundred netizens replied with "in line with the facts," "I feel the same," etc., causing the company to trend on social media. According to the cover news, Guanglianda's corporate rating on Maimai once fell to 3.7 points.

Facing public pressure, Guanglianda's President's Office issued an open letter to all employees stating that the 2023 operating results failed to meet expectations and decided to adjust its performance bonus policy to adapt to the current operating conditions.

Extending the dimension, similar controversies are not the first time they have appeared. According to the cover news, in 2022, Guanglianda allegedly "broke the performance bonus to scrape together a profit of 950 million yuan." In the evaluation area of Guanglianda's corporate account, many employees gave the company one-star or even 0.5-star ratings, questioning the lack of contract spirit.

Interestingly, while performance was tightened, the company engaged in share repurchases. According to the 2023 semi-annual report, a share repurchase plan was announced, proposing to spend between 300 million yuan and 500 million yuan to repurchase the company's shares at a price not exceeding 45 yuan per share. The repurchased shares will be used for equity incentives or employee stock ownership plans.

As of the end of March 2024, the company had accumulated 15,705,867 shares through concentrated bidding transactions through a dedicated securities account for repurchases, accounting for 0.9434% of the company's total shares. The highest transaction price was 24.50 yuan per share, and the lowest was 15.00 yuan per share, with a total transaction amount of 312,775,001.30 yuan (excluding transaction fees).

On the other hand, on April 15, 2023, Guanglianda disclosed a pre-disclosure announcement of share reductions by directors and senior executives. Directors Yuan Zhenggang, Liu Qian, Wang Aihua, He Ping, and senior management members Li Shujian, Yun Langsheng, and Wang Shaoshan plan to reduce their holdings by no more than 1.67 million shares through concentrated bidding or block trading in the secondary market from May 11, 2023, to November 10, 2023.

Repurchasing and reducing shares at the same time made people scratch their heads for a while.

At the same time as the reduction, share pledges were also made. According to Global Tiger Finance, even though the company has 2.662 billion yuan on its books, its actual controller, Diao Zhizhong, is still pledging shares. Guanglianda successively disclosed three announcements on "partial share pledges by controlling shareholders." Among them, the number of pledged shares with a pledge start date of January 4, 2024, was 5.3 million shares and 2.6 million shares; the number of pledged shares with a pledge start date of January 11 was 2 million shares; the number of pledged shares with pledge start dates of January 22 and January 23 were 7.2 million shares and 4.4 million shares, respectively. All of the above pledged shares are supplementary pledges.

According to Tonghuashun data, as of January 24, 2024, among the 266 million shares held by Diao Zhizhong, 84.4 million shares have been pledged, accounting for 31.72% of the shares held and 5.07% of the company's total shares. The latest decompression date is March 19, 2024.

With a series of capital maneuvers, what the outside world cares most about is the company's subsequent direction. Looking back to the beginning of 2023, Guanglianda's management announced a target of a 30% increase in both revenue and net profit for 2023 at the performance briefing. Chairman Diao Zhizhong even said that revenue in 2025 would double compared to 2022. However, judging from the actual performance sheet mentioned above, there is a long way to go.

According to the China Times, at an investor exchange meeting for the 2023 semi-annual report, when asked if the target of doubling revenue in 2025 could still be valid. Guanglianda staff only said, "I don't think we're talking about the same concept. We did mention at the beginning of the year that revenue and profits would increase by 30% year-on-year, but that was just a performance guidance."

4

Long Industry Slope, Thick Snow of Technology

The Scenery on the Upslope Is Unique

Having confidence in market growth is always good, but to avoid being questioned as empty promises, one needs to be down-to-earth, neither underestimating difficulties nor overestimating expectations.

In the long run, industry opportunities