36 Years of Wanda: Wang Jianlin's Worries and Sorrows

![]() 05/10 2024

05/10 2024

![]() 715

715

Author | Lu Shiming

Editor | Dafeng

Introducing 60 billion yuan of new strategic investment, while allowing Wang Jianlin to lose control of Wanda Commercial Management, has greatly resolved Wanda's gambling crisis.

However, people still underestimated Wang Jianlin's determination in implementing the "asset-light" strategy.

In the past one or two months, Wang Jianlin has continued to accelerate cash flow recovery for Wanda, selling shares of Wanda Films and the Beijing Wanda Plaza, where the Wanda Group headquarters is located.

Image: Beijing Wanda Headquarters Building

Perhaps 36 years ago, Wang Jianlin never imagined that he would build a commercial empire from scratch and also witness its decline. Nowadays, in his twilight years, Wang Jianlin still doesn't know if under his efforts, Wanda will collapse completely or rise again.

Regardless of Wanda's outcome, as the leader, Wang Jianlin has not cashed out and fled, nor has he transferred assets. His quality and responsibility of not evading and not giving up in the ups and downs of business is rare nowadays.

From Dalian to the World

In 1988, Wang Jianlin gave up his "iron rice bowl" as the director of the Xigang District People's Government Office in Dalian and chose to go into business, founding Wanda in Dalian.

The following year, by taking over the old urban area redevelopment project in Beijing Street, Dalian, Wang Jianlin earned his first pot of gold, 10 million yuan, which enabled Wanda to embark on a high-speed track.

In the subsequent years, one after another old city redevelopment projects not only rapidly expanded Wanda Group to obtain billions of assets but also made Wang Jianlin a celebrity in the domestic real estate industry.

However, Wang Jianlin was not satisfied. He wanted to turn Wanda into a giant cruise ship, not just a residential developer. After careful consideration, Wang Jianlin finally turned his attention to commercial real estate.

In Wang Jianlin's view, residential development has unstable cash flow and profits, making one feel uneasy even when making money. But if you do commercial real estate and collect rent from the world's top 500 companies, that is a long-term and stable solution.

Therefore, in 2000, Wanda Group officially entered the commercial real estate industry and developed the Changchun Chongqing Road Wanda Plaza. From 2001 to 2003, Wanda improved and launched the second-generation Wanda Plaza, which consisted of multiple individual stores, including various formats such as department stores, supermarkets, cinemas, with retail as the main format, known as a combination store...

Image: Early Wanda Plaza

Since the first Wanda Plaza in Changchun, Wanda's development model of building high-end urban commercial complexes and urban core landmarks has gradually won the favor of governments at all levels, who have thrown olive branches, hoping that Wanda would develop in their cities, and Wanda has also obtained preferential land prices.

Since then, Wanda has embarked on a model of wild growth, starting to acquire land nationwide, and one after another Wanda Plaza has emerged in major cities across the country. At that time, many out-of-towners would use Wanda's location to find the CBD of the city when visiting a new city.

Accompanying the huge influence is Wanda's scale.

On the business side, since 2005, Wanda has successively established Wanda Cinemas, Wanda Department Stores, Wanda Cultural Tourism, Wanda Studios, Wanda Sports, and other companies involved in many fields, embarking on diversified development.

On the asset side, as of December 31, 2013, Wanda Group's total assets had reached 380 billion yuan. In this year, Wang Jianlin also topped the Forbes China Rich List with a net worth of 86 billion yuan.

However, Wanda's offensive story has not ended. In the next three or four years, Wang Jianlin, full of energy, led Wanda into an era of massive debt and疯狂expansion.

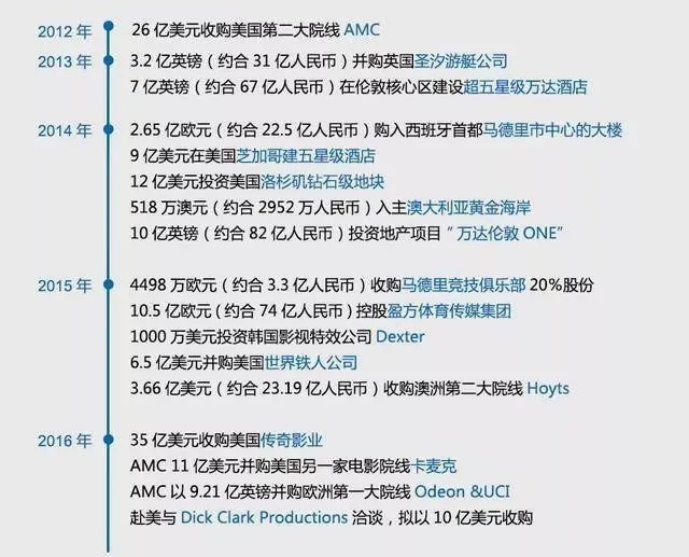

In 2014, Wanda Commercial was successfully listed in Hong Kong; in 2015, Wanda went global and successively acquired multiple overseas high-quality assets. In 2016, Wang Jianlin said in an interview with Lu Yu: "First, set a small goal, for example, I'll earn a billion first..."

Wealth and fame can enhance a person's confidence and courage, but they can also drag a person into the abyss. While shouting the slogan of "exporting Chinese culture to the world," Wang Jianlin was also "buying, buying, buying" globally with money borrowed from domestic banks.

Borrowing chickens from China to lay eggs abroad. This approach planted a huge bomb for Wang Jianlin and Wanda's future.

Misfortunes never come singly

In 2017, against the backdrop of large-scale foreign exchange outflows and tightened capital controls, the then Minister of Commerce Gao Hucheng publicly stated that there are significant risks in blindly investing overseas in real estate, hotels, sports clubs, and other fields, and relevant departments have taken decisive measures to actively guide.

Soon after, the National Development and Reform Commission, the Ministry of Commerce, the People's Bank of China, and the Ministry of Foreign Affairs jointly issued the "Guiding Opinions on Further Guiding and Regulating the Direction of Overseas Investment," clearly stating restrictions on overseas investment in real estate, hotels, cinemas, entertainment, sports clubs, and other areas.

Real estate, hotels, cinemas, sports clubs... Every word does not mention Wanda, but every word is about Wanda.

Soon after, Wanda entered the list of being "seriously dealt with," and multiple overseas project assets acquired by it were required by domestic banks to repay loans early, triggering Wanda's capital chain problem.

Image: Wanda Overseas Investment and Merger Cases

It should be noted that the real estate industry has always been a high-debt industry, and after years of rapid domestic and overseas expansion, Wanda's debt at that time reached more than 420 billion yuan.

From the richest man to the "most indebted," Wang Jianlin began to disappear from the public eye and quietly embarked on a "survival by amputation" model.

In 2017, Wanda sold off a series of heavy assets, including selling 13 cultural tourism projects to Sun Hongbin of Sunac and selling 77 hotels at a "bargain price" to R&F Properties. From 2017 to early 2018, in addition to domestic assets, Wang Jianlin almost liquidated all overseas assets.

By 2018, Wang Jianlin sold Wanda Studios shares, with Alibaba and Wencai Holding acquiring 12.77% of Wanda Films held by Wanda Group at a price of 51.96 yuan per share, becoming the second and third largest shareholders of Wanda Films, respectively.

By 2019, Wang Jianlin sold Wanda's insurance company, Centurion Life Insurance, to Greentown China, and sold all 37 department store locations under Wanda Department Stores to Suning...

However, even after selling off quite a few assets in succession, Wang Jianlin still failed to plug the biggest hole.

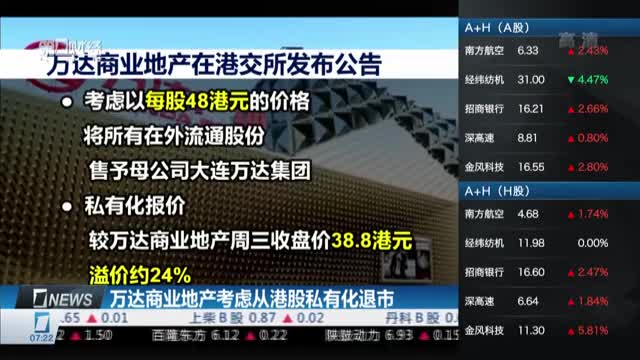

Flashback to 2016, due to Wanda's undervaluation in Hong Kong stocks, Wang Jianlin introduced a group of investors to complete Wanda Commercial's privatization and withdraw from Hong Kong stocks, signing a gambling agreement with the condition of "listing on the mainland's main board market two years after delisting or by August 31, 2018."

But who would have thought that just one year later, Wanda would be in deep trouble, and this sudden change led to Wanda's gambling failure, owing a debt of over 30 billion yuan in principal and interest.

To repay this debt, Wang Jianlin "visited" everywhere, and ultimately, Tencent, Suning, JD.com, Sunac, and other companies acquired about 14% of the shares held by investors introduced during Wanda Commercial's Hong Kong H-share delisting as investors.

However, Wang Jianlin also signed a gambling agreement with the second batch of investors, requiring the transformed "Wanda Commercial Management Group" to be listed by 2023.

Unfortunately, since withdrawing its A-share IPO application in March 2021, Wanda Commercial Management has failed to successfully list on the Hong Kong stock market three times.

According to the gambling agreement, if Wanda Commercial Management fails to go public as scheduled, only in 2021, there is a strategic investment of 44 billion yuan in principal and interest that needs to be repaid. Where will this money come from? Wang Jianlin's answer is still: continue to sell assets and seek new investors.

Only debt-free can one be at ease

Seeing that Wanda Commercial Management's listing was hopeless, to raise the upcoming huge debt funds, Wang Jianlin had no choice but to sell Wanda's best and core assets.

In April 2023, the sale of Wanda's headquarters was widely reported by the media. Tianyancha showed that Beijing Wanda Plaza Industrial Co., Ltd. underwent industrial and commercial changes, with the original wholly-owned shareholder Dalian Wanda Commercial Management exiting, and the new buyer being a fund company under New China Life Insurance.

In the three months of May, June, and July, under the accelerated recovery of the film market, Wang Jianlin still sold Wanda Films shares in multiple transactions through centralized bidding and block trading, cashing out over 5 billion yuan.

Obviously, this money can only hold out for a while and is far from enough to repay hundreds of billions of debt. Under such circumstances, Wang Jianlin once again chose to find new investors.

On December 12, 2023, Wang Jianlin and Wanda welcomed hope: Investment Group PAG and Dalian Wanda Commercial Management Group jointly announced the signing of an investment framework agreement for equity restructuring of Zhuhai Wanda Commercial Management. According to the agreement, Dalian Wanda Commercial Management holds 40% of the shares, while PAG and other investors hold 60%.

It is worth noting that this new investment agreement does not come with a gambling agreement.

Of course, hundreds of billions of debt cannot be fully resolved by PAG alone, but with Wang Jianlin's further efforts, Wanda has ushered in a new phase.

At the end of March this year, Dalian Wanda Commercial Management Group announced the signing of an investment agreement with PAG Investment Group, Abu Dhabi Investment Authority of Middle East Capital, Mubadala Investment Company, CITIC Capital, and ARES. According to the agreement, the above five institutions will jointly inject approximately 60 billion yuan into Dalian Xindameng Commercial Management Co., Ltd., holding a total of 60% of the shares, while Dalian Wanda Commercial Management holds 40%.

It is reported that this investment is the largest single transaction in China's private equity market in the past five years.

In theory, after obtaining 60 billion yuan, both Wang Jianlin and Wanda could breathe a sigh of relief, but surprisingly, Wanda's "sell, sell, sell" pace continues.

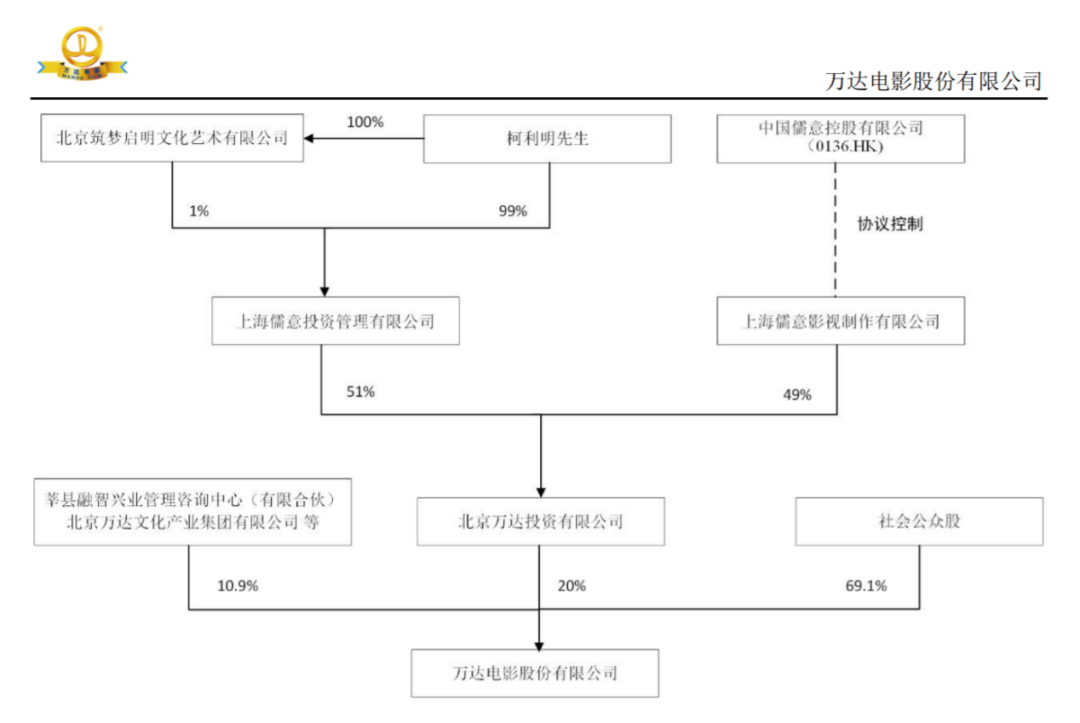

On April 16, Wanda Films announced that Beijing Wanda Cultural Industry Group Co., Ltd. and Wang Jianlin transferred 20% and 1.2% of their respective shares in Beijing Wanda Investment Co., Ltd., and have completed the industrial and commercial registration change procedures. The transferee of the above shares is Shanghai Ruyi Investment Management Co., Ltd. Together with previously transferred shares, "Ruyi Group" holds 100% of Wanda Investment's shares.

Since Wanda Investment is the controlling shareholder of Wanda Films, "Ruyi Group" indirectly controls Wanda Films through this method. Ke Liming, the actual controller of "Ruyi Group," replaced Wang Jianlin as the actual controller of Wanda Films through the above method.

Source: Wanda Films official announcement

Behind the continuous sale of core assets and cash flow recovery, it actually better demonstrates Wang Jianlin's determination to ensure Wanda Commercial's listing.

Currently, the stock market is relatively sluggish, and Wanda Commercial's listing undoubtedly still needs some time. How can we seize the initiative of listing? Undoubtedly, maintaining sufficient cash flow is the most crucial.

By selling high-quality assets, Wang Jianlin keeps the money in his hands, only to use it in more critical areas. Only in this way will Wanda's future have more possibilities; otherwise, it will only face one obstacle after another.

Over the past three decades of ups and downs, Wanda's appearance has been changing, but Wang Jianlin's "decisive" heart seems to have never changed in the past three decades.