Big Tech Firms "Crazily Investing" in Robots: A Consensus Behind the Frenzy

![]() 07/18 2025

07/18 2025

![]() 477

477

The surge in funding within the embodied AI sector underscores big tech firms' eagerness to compete in the robot race. Behind this flurry of activity lies a shared belief among industry leaders: technology, talent, and the future all point to a deterministic path. These firms are keen to catch up, overtake, and future-proof their operations through embodied AI.

Original Tech News, Frontier Tech Team

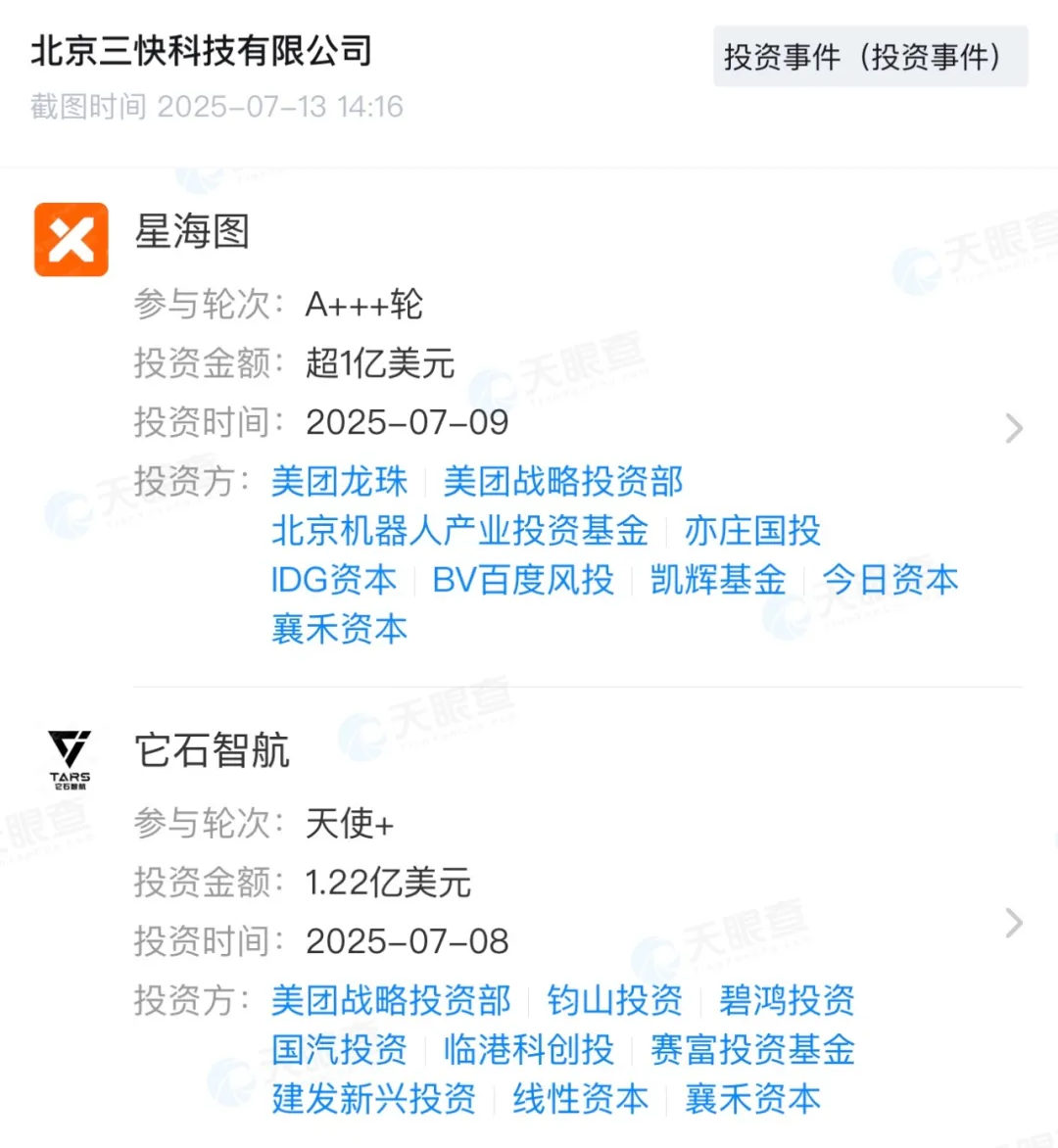

In 2025, the embodied AI sector, which previously saw the most diverse opinions, has recently become exceptionally hot. The pace of funding in this area has been accelerating. On July 8 alone, Tashi Zhihang, led by Meituan, secured $122 million in financing. Furthermore, from July 7 to 9, four companies—Xinghaitu, Xingdong Jiyuan, Cloud Robotics, and Tashi Zhihang—raised a cumulative total of over RMB 2.5 billion in funding. Expanding the time frame to June, companies like Yinhe Tongyong (receiving RMB 1.1 billion in funding led by CATL on June 23) and Unitree Robotics (completing Series C funding on June 19 with a valuation exceeding RMB 10 billion) also performed impressively. According to IT Juzi data, in the first five months of 2025, there were 114 investment events in the embodied AI field, with a total funding amount of RMB 23.2 billion, both exceeding the total for the entire year of 2024.

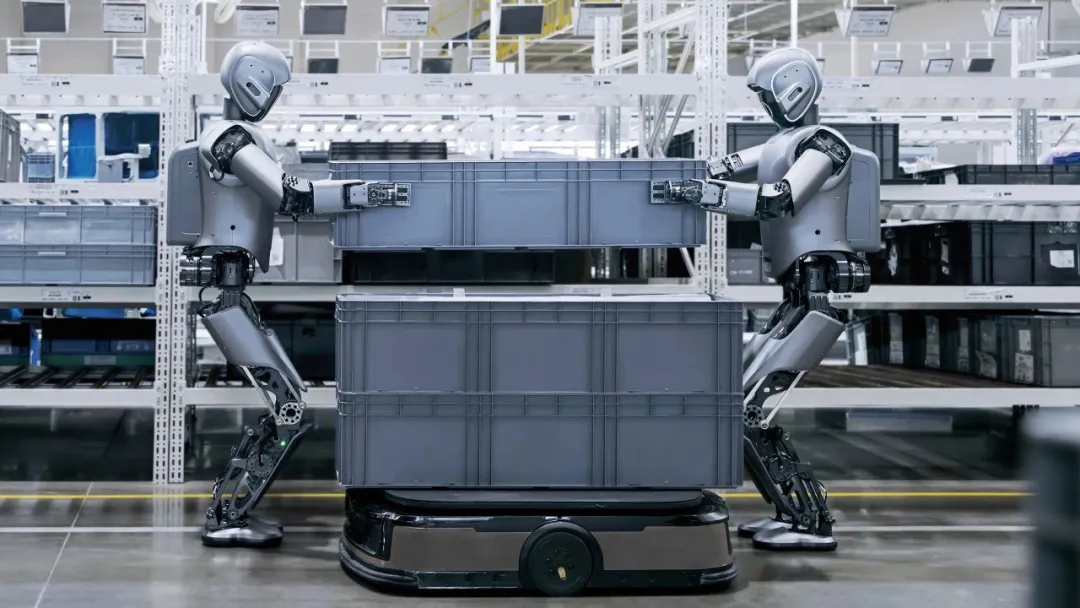

Photo/Yinhe Tongyong

In terms of investors, big tech firms and industrial capital have emerged as the primary forces. Tech giants such as Meituan, CATL, Tencent, and Alibaba have become core drivers. Within the past month, Meituan has invested heavily in Tashi Zhihang and Xinghaitu and participated in projects like Unitree Robotics and Yinhe Tongyong, making six investments in the embodied AI field since 2025. Its investment strategy revolves around "computable scheduling in the physical world," covering the entire chain of robot bodies, large AI models, and scenario applications. By leading the RMB 1.1 billion funding of Yinhe Tongyong, CATL combines embodied AI technology with new energy scenarios to explore the application of humanoid robots in areas such as smart pharmacies and logistics warehousing. Tencent, Alibaba, and Ant Group have invested in companies such as Unitree Robotics and Taihu Robotics to deploy humanoid robot hardware and core components like dexterous hands. From a technical perspective, the current enthusiasm for robot funding doesn't seem to have made significant strides compared to when Unitree Robotics was hot. So why are big tech firms still so eager to place bets after going through disagreements? And what is the allure of this seemingly short-term unredeemable ticket?

01

Embodied AI Offers Certainty

Why have capital investors suddenly shown a stronger interest in embodied AI than before? Perhaps we can gain insight from the example of Tashi Zhihang. According to a report by LatePost, in 2024, when Tashi Zhihang was just established and began fundraising, an insider revealed that the company's direction had not yet been fully determined, and the current team members were mainly doctoral students from Tsinghua University and Fudan University. Fast forward to March 2025, Tashi Zhihang had not officially unveiled its products but had already completed $120 million in funding, setting a record for the largest angel round funding in China's embodied AI industry. Starting fundraising without a clear direction and securing massive funding without unveiling products directly highlights capital's emphasis on the background and long-term potential of the technical team. For example, the founding team of Tashi Zhihang includes Chen Yilun, former CTO of Huawei's Autonomous Driving Department, and Li Zhenyu, former head of Baidu's Intelligent Driving Group. This "star team + technical barrier" model has become a core element attracting investment. However, from another perspective, big tech firms and investors may value the certainty that has already emerged. Gao Yang, Chief Scientist of Qianxun Intelligence and Assistant Professor at Tsinghua University's Institute for Interdisciplinary Information Sciences, revealed in an interview that there is now a certain consensus on embodied AI academically because some paths have been proven false and impossible to achieve; the converging part is to excel in engineering. Although it's not to say that current academic topics have completely converged into one, they may have narrowed from 500 to 100, meaning every topic may have been explored by someone. Fewer questions and increased consensus directly lead to a clearer development path for embodied AI. "Since 2023, I've had this feeling: embodied AI has not completely converged, but it is in the process of convergence. From a social and engineering perspective, convergence is beneficial because we can truly start enjoying the benefits brought by technology," said Gao Yang, expressing optimism about the prospects after technological convergence. The industry has defined the following path: L0 represents industrial robots with no intelligence; L1 represents intelligence in a single task; L2 represents the ability to complete a few tasks in an office scenario, such as pouring a cup of coffee; L3 represents the ability to do 70% to 80% of human tasks in a physical scenario; L4 represents the ability to do everything humans can do within a single scenario, like Waymo, which can go anywhere within the San Francisco area; L5 represents the ability to do anything in any scenario without being limited to a single one. Currently, the industry has reached a level close to L2.

Photo/Yinhe Tongyong

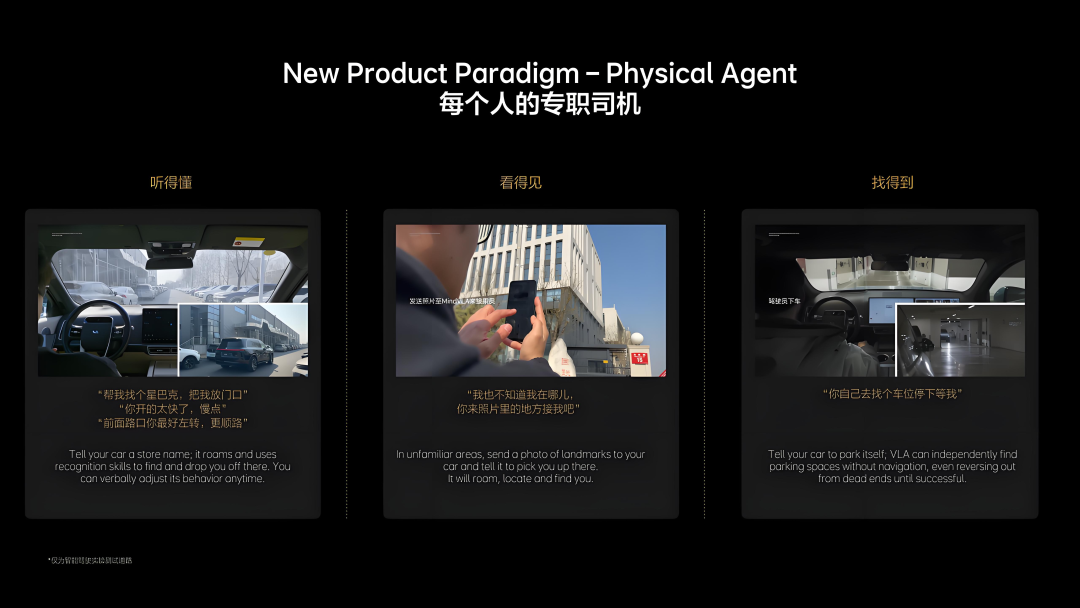

Galbot G1 working autonomously in a smart pharmacy. According to Gao Yang's estimates, the completion of L2 and the arrival of L3 can be seen within five years. More interestingly, in terms of methodology, the emergence of VLA (Vision, Language, and Action) has gradually become a path for embodied AI to achieve breakthroughs, and this point has not only gained consensus among entrepreneurial scientists in the robot race but has also gained a certain degree of consensus in the automotive field. Li Xiang, the founder of Li Auto, mentioned in an interview that Li Auto's VLA model is a vivid practice of this trend. By integrating visual, language, and action intelligence, it turns the car into an intelligent agent that can drive autonomously and interact naturally with users, perfectly illustrating the core concept of "embodied AI."

Liu Fang, former head of Xiaomi's Intelligent Driving, also mentioned that if VLA works, autonomous driving will become a sub-problem of embodied AI. It's not difficult to understand why a large number of talents in the autonomous driving field have joined the embodied AI race. Chen Yilun, founder and CEO of Tashi Zhihang, was formerly the CTO of Huawei's Autonomous Driving Department; Li Zhenyu, chairman of the company, was formerly the senior vice president of Baidu Group and head of Baidu's Intelligent Driving Group (IDG); and Ding Wenchao, chief scientist, led the research and development of Huawei's ADS end-to-end decision-making network. From another dimension, when deterministic technology and deterministic practical routes gradually converge, talent becomes a must-win battleground. Gao Yang from Qianxun Intelligence, Wu Yi, founder of Biansai Intelligence, Chen Jianyu from Xingdong Jiyuan, and Xu Huazhe, chief scientist of Xinghaitu, are known as the "Four Berkeley Returnees," and each of them has secured funding. In other words, big tech firms' competition for embodied AI undoubtedly focuses on the certainty: a definite timeline, a definite technology path, and definite talent. On the other hand, embodied AI seems capable of bringing different levels of improvement to big tech firms from L1 to L5. In other words, current investments are empowerments that can be leveraged at any time.

02

Big Tech Firms Catch Up and Overtake Through Investment

From the current perspective, industrial capital and big tech firms are the most optimistic about the embodied AI sector. Among internet giants, Meituan and ByteDance are undoubtedly typical representatives. "AI will greatly promote the development of robotics technology. Meituan will pay attention to and invest in startups in this field, hoping to deepen business cooperation and technical exchanges with these young companies and more tightly integrate robot technology with AI," Wang Xing said during Meituan's fourth-quarter earnings call in 2024. He emphasized that Meituan's strategic positioning in the AI field is offensive rather than defensive, playing the role of a technological "bridge" connecting the offline and online worlds. It's evident that Meituan, whose main business is retail services, is more focused on the application of AI in offline scenarios. In practice, Meituan's investment in embodied AI is also accelerating. On July 8, Meituan made a strategic investment, leading a new round of $122 million in funding for embodied AI startup Tashi Zhihang. On July 9, Meituan invested again, leading the A4 and A5 rounds of strategic funding for Xinghaitu, with a total funding amount of over $100 million.

Photo/Tianyancha

In the past year, Meituan has also invested in Unitree Robotics, Yinhe Tongyong, and Zibianliang Robotics and has become the largest external shareholder of Unitree Robotics and Yinhe Tongyong. According to statistics, Meituan has invested in 30 robotics and related enterprises in the past three years. Apart from being optimistic about the future, Meituan also applies embodied AI in its current business. A typical case is the integration of Meituan's investment in Yinhe Tongyong with Meituan Pharmacy, which improves efficiency and allows the business to adapt to more scenarios. Furthermore, according to TMTPost's viewpoint, compared to similar internet companies such as Alibaba, Tencent, and Baidu, Meituan's progress in AI and large models is not obvious. To date, Meituan has neither launched online AI applications like ERNIE Bot or Tongyi Qianwen nor a general large model similar to GPT. Embodied AI may be another point for overtaking. This may explain from another angle why, after Meituan's large-scale investment, JD.com and ByteDance quickly followed suit. According to a report by New Intellect, ByteDance's Seed team is recruiting "number one" talents in robot-related directions on a large scale, including product heads, engineering technology heads, and large model heads for embodied AI. According to a report by LatePost, ByteDance has mass-produced over a thousand robots. Currently, the robot form mass-produced by ByteDance is a wheeled logistics robot, or Autonomous Mobile Robot (AMR), without a mechanical arm for sorting. Its main use is to transport packages and parts in warehouses and production lines, with the ability to learn autonomously, plan routes, and move to destinations. Other companies that are also optimistic about this sector include JD.com and Alibaba. Of course, unlike the logic of internet giants eager to overtake, manufacturing giants' increased investment in embodied AI is more like making up for lost time. Last year, Geely's Zeekr 5G Smart Factory introduced the UBTech industrial humanoid robot Walker SLite, which, after 21 days of practical training, mainly performed tasks such as bin handling. Earlier this year, the Lingke Automobile Chengdu Plant also began introducing UBTech humanoid robots Walker S1. UBTech, the world's first listed bipedal robot company, has entered the production lines of multiple automakers such as BYD, and the company optimistically predicts that humanoid robot deliveries will reach several thousand units by 2026. To some extent, Geely is more of a follower.

Photo/UBTech

The relevant person in charge of Yinhe Tongyong, which received investment from CATL, said, "The lead investor, CATL, will continue to deepen industrial synergy with the company and provide key support for the technological landing and large-scale application of the company's embodied AI large model in the industrial field." Whether it's overtaking or making up for lost time, internet giants and manufacturing giants seem to see the parts of embodied AI that they can utilize. From a broader perspective, perhaps both sides are also expecting a more imaginative blueprint.

03

The Future Blueprint is Comparable to Tesla

At the tail end of June, a Tesla Model Y embarked on an autonomous journey from the Tesla factory in Texas, traversing highways, urban landscapes, and diverse scenarios, culminating in an autonomous delivery to the user. Tesla's Full Self-Driving (FSD) technology boasts 1.7 million vehicles in North America, with an impressive two-month accident-free record, sparking widespread interest. Elon Musk has progressively steered the automaker into various realms, including robotaxis and robotics, a strategy underpinned by a compelling logic that has also caught the attention of China's tech titans. Both manufacturing giants like CATL and Geely, and internet behemoths such as JD.com and Meituan, appear poised to embrace a novel growth paradigm and envision new possibilities. This paradigm fundamentally entails the reconfiguration of ecosystems—as embodied AI transcends Level 2 and advances towards Level 3, robots evolve from mere scenario-specific tools to "participants" capable of comprehending the physical world and collaborating with digital systems akin to humans. Behind this lies an aspiration far greater than Tesla's domain-specific breakthroughs: not merely transforming individual industries, but interconnecting every node in the physical and digital realms to forge a "super intelligent network" encompassing production, circulation, and services. For Meituan, this network's inception lies in instant retail scenarios, yet its horizon extends far beyond. When embodied AI robots can autonomously navigate crowded markets, adjust delivery temperatures based on user preferences, and even replace riders in executing complex tasks like "pick-up + after-sales communication," Meituan's service scope expands from "connecting people with goods" to "connecting people with all-scenario needs." This transformation from a "trading platform" to an "intelligent service hub" positions Meituan to tap into a vastly larger new market, transcending its current business boundaries.

Photo/AI created

CATL's strategic layout points towards a symbiotic system of "energy-intelligence." Efficiently handling batteries in logistics and warehousing hinges on a profound understanding of lithium-ion battery characteristics. When embodied intelligence is deeply integrated with new energy scenarios, it not only amplifies the efficiency of individual scenarios but also spawns innovative business models such as "intelligent energy storage stations + robotic operation and maintenance" and "photovoltaic power stations + autonomous inspection robots." The crux of these models lies in establishing a closed loop between energy production, storage, and usage, and the actions and decisions of intelligent agents—robots that are no longer passive command executors, but "collaborators" capable of autonomously adjusting their operational modes in response to energy fluctuations. Tencent and Alibaba's ambitions center on the "integration interface between digital and physical worlds." The humanoid robot hardware of Unitree Robotics and the dexterous hands of Tita Robotics serve not only as executors in the physical world but also as "physical carriers" of digital content. This closed loop of "digital twin-physical interaction" is more aligned with users' genuine needs than traditional APP interfaces and has the potential to redefine the gateway to internet traffic—future "super APPs" may not be icons on smartphones, but rather robots capable of listening, seeing, and acting.

While Tesla has leveraged FSD to demonstrate the disruptive impact of intelligent technology on a single industry, the embodied intelligence pursued by China's tech giants aims to position intelligent technology as the fulcrum that pivots the entire social operating model. It promises not only to expedite food delivery, enhance factory efficiency, and intelligentize energy management but also to redefine the very essence of "efficiency"—when robots can comprehend human emotional needs (like slowing down when handing a cup of warm water to an elderly person living alone) and make ethical decisions in unforeseen scenarios (like prioritizing avoiding children), embodied intelligence transforms from a "tool" to a "social participant." This participation will reshape human work methodologies (spawning more creative jobs), life rhythms (delegating mundane tasks), and even urban forms (adapting community planning to robot-human collaboration).

Thus, what the tech giants are vying for is not a "short-term ticket" but rather an "admission ticket" that can dictate the industrial landscape over the next 30 years. As embodied intelligence surpasses Level 3 and edges closer to Level 4, enabling robots to navigate freely within office buildings, factories, and communities like humans, it not only propels technological iteration but also fundamentally restructures production relations, business logic, and the social division of labor. In this restructuring, those who pioneer the establishment of intelligent agents in localized scenarios will wield the power to shape the rules governing the transition from the "Internet era" to the "intelligent entity era." The urgency felt by tech giants stems from their desire to avoid being left behind in this transformative shift, one with the potential to rewrite the course of human civilization.

References: LatePost, "In 2.5 Years, ByteDance Built 1,000 Robots, with Long-term Goals of Embodied Intelligence"; TMTPost, "Beyond the Battle of Food Delivery Subsidies, Meituan Quietly 'Bought' Half of the Robot Race"; LatePost, "Embodied Intelligence Startup Itstone Zhihang Completes US$122 Million Angel+ Round of Funding"; Mobility China, "Embodied Intelligence Breakthrough in End-to-End VLA, with Funding from Geely, CATL, and Bosch"; LatePost, "Dialogue with Qianxun Gaoyang: End-to-End is the Future of Embodied Intelligence, and Hierarchical Models are Just a Short-term Transition"