Honor Faces Formidable Hurdles Prior to Public Listing

![]() 07/18 2025

07/18 2025

![]() 703

703

Written by Dou Wenxue

Edited by Ziye

Over the past six months, Honor has embarked on an accelerated trajectory.

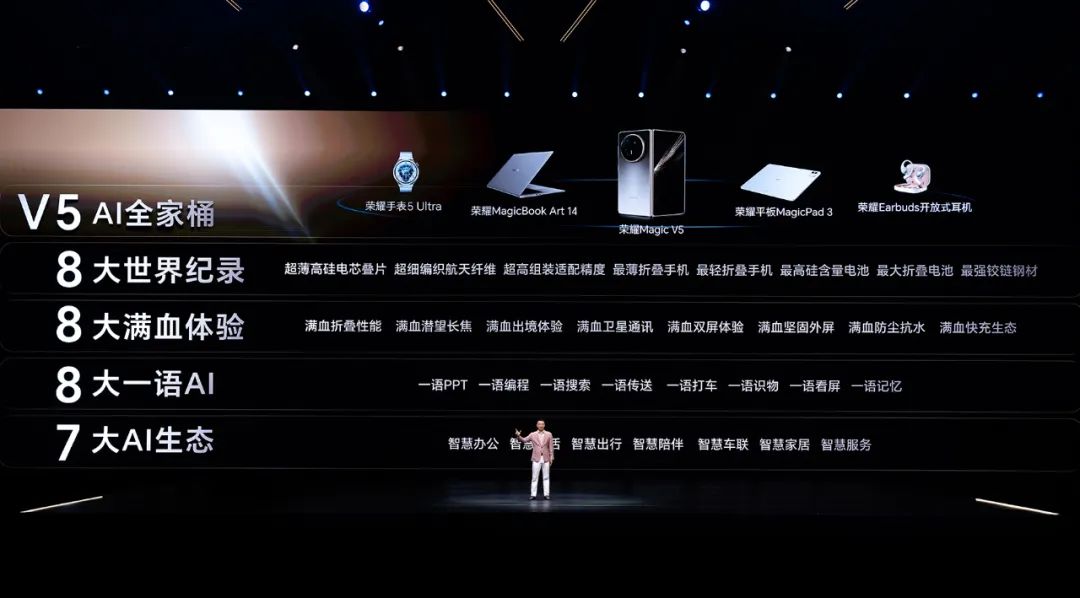

In June, it unveiled the mid-range Honor 400 series, with several senior executives present at the launch to address inquiries. Then, on July 4, it launched the latest AI-powered foldable flagship, the Magic V5. Just days later, on July 15, the X70 series made its debut.

Honor Magic V5 launch event, source: Honor official website

The release of three phones in less than two months underscores Honor's eagerness to showcase its latest R&D achievements and regain the market share it lost in the first half of the year.

Additionally, Honor's listing plan, which has garnered significant external attention, has made new strides.

On June 26, the China Securities Regulatory Commission's online service platform (trial operation) revealed that Honor had initiated listing counseling registration, with CITIC Securities as the counseling institution. The counseling filing report indicates that Honor's listing counseling work will span from June 2025 to March 2026, divided into three stages.

All information disclosed to the public signals that Honor is poised for a fresh start.

To successfully go public and secure a higher valuation, Honor cannot afford to overlook any 'tough nuts' that could help break the deadlock but require substantial effort: AI phone development must continue, premiumization must be pursued, and sales must be maintained.

Despite Honor's vigorous sprint and market news of the Honor 400 series' strong sales, the road ahead remains challenging.

In terms of premiumization and AI phone deployment, Honor is not a latecomer, but with increasing competition, every segment is becoming crowded. Additionally, the technical bottleneck in mobile phone products is becoming increasingly difficult to break. Honor needs to demonstrate differentiated advantages to stay ahead in the current landscape.

Honor's management team has undergone adjustments, and the new team must answer crucial questions: how to restore sales and bolster confidence in the capital market?

1. Honor Remains Committed to AI Phones

'Whether a mobile phone can win users, the market, and the future largely hinges on its ability to swiftly realize the transformation of application technology, particularly 'AI + mobile phones.' In other words, for the mobile phone industry, artificial intelligence represents a leapfrog development opportunity. Seize it, and you lead; miss it, and you risk elimination.'

This is an excerpt from an article by Zhao Ming, the former CEO of Honor, published in People's Daily in 2018. This sentiment may explain why all companies are now accelerating their AI phone deployments.

In the current mobile phone market, many players are emphasizing AI capabilities.

Data from Canalys shows that in 2024, 16% of global smartphone shipments were AI phones, and this proportion is projected to surge to 54% by 2028. Between 2023 and 2028, the AI phone market is expected to grow at a compound annual growth rate (CAGR) of 63%.

Honor is one of the pioneers in AI phone narratives.

As early as 2016, Honor integrated the Magic Live system into the Magic model, which could recognize keywords in information and provide scheduling services.

At that time, the global AI market size was on the cusp of exceeding $10 billion, far from the $294 billion forecast for 2025.

In 2022, when the overall AI market size in China was growing slowly, Honor launched MagicOS 7.0, a full-scenario operating system based on Android. The MagicRing trust ring of this system enables self-discovery, self-networking, and self-connection of different Honor devices under the same account, along with functions like keyboard and mouse sharing, notification and call sharing, and application continuation.

By 2024, this system had evolved to version 9.0.

Source: Honor MagicOS 9.0 video screenshot, source: Honor official website

To this day, AI remains a cornerstone of Honor's strategy, a direction that has remained unchanged despite leadership and organizational changes.

Last year, one of the more memorable events for Honor was when Zhao Ming, then CEO, used the 'YOYO' intelligent agent to order 2,000 cups of coffee at the Magic 7 series launch event.

During his first public appearance after taking office, the new chairman, Li Jian, unveiled Honor's ambitious AI plan – the Alpha strategy. He announced that $10 billion would be invested over the next five years to build an AI device ecosystem and showcased the new AI assistant, 'YOYO Intelligent Agent.'

Honor unveils Alpha strategy, source: Honor official website

From a broader perspective, Honor's progress in AI phone deployment is not lagging.

The development of AI phones has undergone three main stages: the AI APP stage, the AI functionalization stage, and the AI native stage.

These stages are defined by how AI functions are realized. The first stage relies on independent AI apps; the second stage integrates AI with existing mobile phone applications like cameras and voice assistants; the third stage involves deeply integrating AI technology into the phone's native service ecosystem, allowing users to interact with the phone through voice, text, etc., to access AI services.

Honor has effectively entered the third stage.

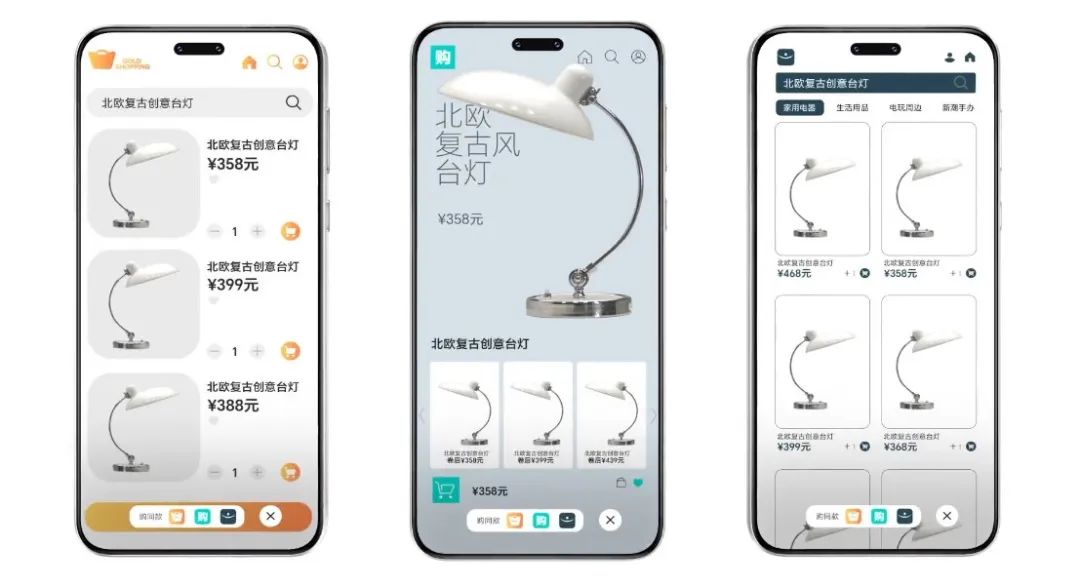

For instance, its newly released Honor Magic V5 is equipped with the MagicOS 9.0.1 system and full MagicLM capabilities, enabling one-word AI applications such as 'one-word PPT, one-word programming, one-word search, one-word transfer, one-word taxi hailing, one-word object recognition, one-word screen viewing, and one-word memory.' It has also collaborated with Alibaba, BYD, Midea, and other enterprises in intelligent agent services, smart car connectivity, smart home, and other areas.

If Honor's launch event promises materialize, it can be considered a front-runner in AI phone development. Currently, no other mobile phone brand can create a PPT with a single sentence, and only leading brands like Huawei, Xiaomi, and vivo have developed AI operating systems.

However, while the Magic V5 has office attributes, consumers are not yet fully accustomed to using mobile phones for office tasks. For AI-powered PPT creation or programming, more users might still prefer platforms like DeepSeek and Doubao.

Therefore, these advanced features still need time for users and the market to adapt in mobile phone usage scenarios.

The evolution of the times has increasingly validated Honor's initial assertion. As the view that 'smartphones are one of the best terminals for AI technology implementation' gains recognition, Honor, needing sales recovery and unable to afford setbacks in premiumization, will undoubtedly persist with AI phones.

2. Pushing for Premiumization and Foldables, Honor Must Scale New Heights

Apart from AI phones, another unfulfilled ambition for Honor is premiumization.

As a brand created to compete with Xiaomi, Honor gained popularity with mid-range products but was also labeled as such.

Although after its independence, Honor swiftly improved its supply chain and expanded sales channels, even briefly topping annual domestic mobile phone shipments, its sales relied on 'cost-effectiveness.' Honor still aspired to add imagination by launching a standout high-end model.

Over the past year, Honor has continuously introduced multiple high-end models, such as the Magic7 RSR Porsche Design, Honor Magic7 Pro, Honor Magic 6 Ultimate Edition, etc.

Its foldable products are also part of its premiumization strategy, especially the Magic V series, priced mostly above 6,000 yuan.

This year, following a leadership change, Honor released the mid-range Honor 400 and immediately followed up with the 'AI lightweight flagship foldable' phone – the Honor Magic V5, priced from 8,999 yuan, surpassing Huawei's previously launched Pura X.

Honor Magic V5, source: Honor official WeChat public account

This move partly reflects Honor's attempt to maintain last year's release cadence, as the previous model in the Magic V series, the Magic V3, was released in mid-July. It also showcases the company's progress in foldable flagship products and high-end offerings, further fueling anticipation about its listing.

However, despite Honor's annual phone launches, the journey to premiumization is still a long way off.

According to Canalys data, in Q3 2024, Honor ranked fifth globally among vendors in the price segment above $600 with its flagship Magic7 Pro, capturing a 2% market share. It was one of only two Chinese companies in the top five, alongside Huawei.

In the domestic market, Honor squeezed into the top three in high-end market share, but Apple and Huawei led with 52% and 33% market shares, respectively. Other players have a long way to catch up.

Source: Canalys official WeChat public account

IDC data shows that in Q1 2025, Huawei held a 76.6% share of the foldable phone market, while Honor's share was only 9.1%.

Ranking second in foldable phone market share is a commendable achievement, but foldable phones are niche products, so this is insufficient for Honor.

IDC data reveals that in Q1 2025, total foldable phone shipments in China were 2.84 million units, a 53.1% year-on-year increase. However, smartphone shipments in the same quarter were 71.6 million units, with foldables accounting for just 0.397%.

The era of cost-effective phones is long gone, and the smartphone market has transitioned from a price war to a value war.

According to Counterpoint's 'Smartphone Model Sales Tracking Report,' China's high-end smartphone market share (priced at $600 or 4,350 yuan and above) climbed to 28% of the overall market in 2024, a significant increase from 11% in 2018.

Therefore, if Honor aims to support its long-term valuation, it must continue scaling new heights.

3. While Crafting Stories, Honor's New Team Must Stabilize Core Operations

To this day, the immediate challenge Honor urgently needs to address is its current situation.

Whether diving deep into technology to create exceptional AI phones or aiming high for premiumization and flagship foldable products, it must be grounded in the stability of the company's overall situation.

However, Honor experienced a sudden leadership change and management adjustments at the beginning of 2025. The new chairman had to undertake a series of significant internal organizational adjustments to stabilize the team and start anew.

Source: Honor official website

In 2024, Honor's mobile phone shipments ranked fifth.

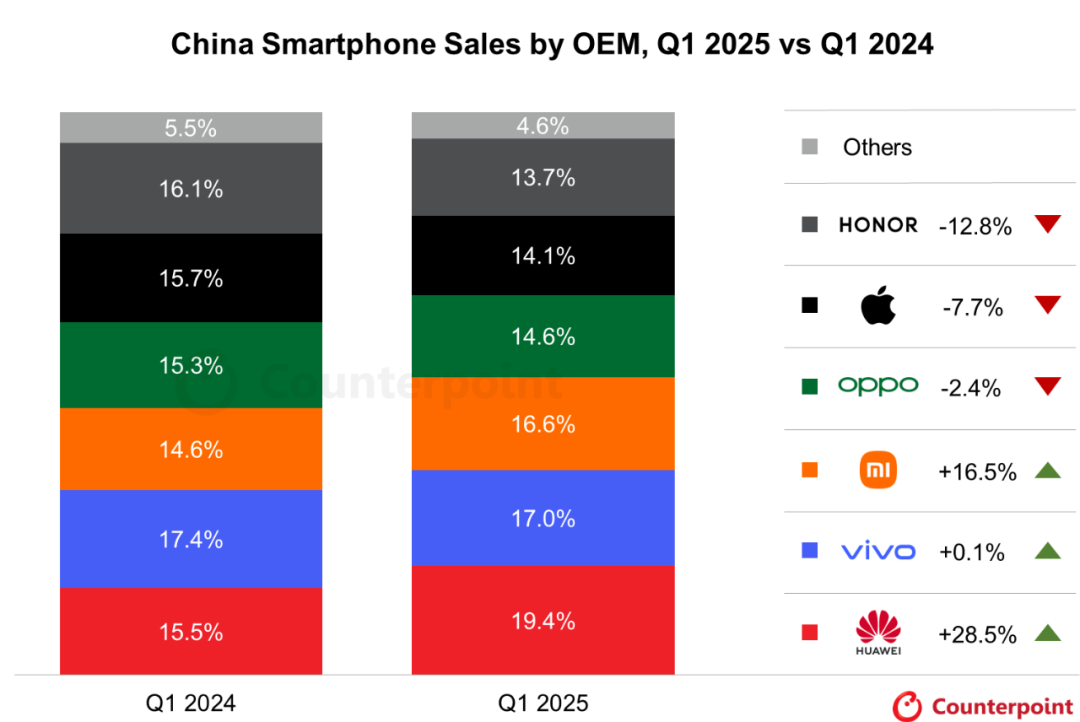

According to Counterpoint Research data, in Q1 2025, Honor's shipments in the Chinese smartphone market were about 9 million units, with a 13.7% market share, ranking sixth. Sales decreased by 12.8% year-on-year.

After adjustments in Q4 2024 and Q1 2025, Honor is striving to regain its footing. Honor executives have stated in interviews that the company aims to return to the top three in China by year-end.

In Q2 2025, market news spread that the Honor 400 sales were highly successful. Previous media reports indicated that the global cumulative activations of the Honor 400 series had surpassed 1 million units, breaking the sales record on the first day and achieving the fastest 1 million activations for Honor phones in the past three years. These figures represent increases of 195% and 138% compared to the Honor 300 series and 200 series, respectively.

This model might be a promising start for Honor's rebound, but whether it can truly turn the tide remains to be seen.

In today's ever-changing mobile phone market, the market share gap between brands often seems less than 1%, but securing that 1% requires executing many things flawlessly.

According to Counterpoint data for two quarters, in Q4 2024, the domestic smartphone vendor market share rankings were Huawei, Xiaomi, Apple, vivo, Honor, and OPPO, with market shares of 18.1%, 17.2%, 17.1%, 16.3%, 13.6%, and 12.5%, respectively.

In Q1 2025, this ranking shifted to Huawei, vivo, Xiaomi, OPPO, Apple, and Honor, with market shares of 19.4%, 17.0%, 16.6%, 14.6%, 14.1%, and 13.7%, respectively. If we only consider share data, Huawei, vivo, and OPPO gained more shares.

Source: Counterpoint official WeChat public account

These three brands have seen an increase in market share due to their introduction of competitive products. Huawei leveraged the popularity of the nova 13 series and the flagship Pura 70 series, OPPO excelled with its A series, and the Reno 13 series bolstered its mid-range market presence. Meanwhile, vivo relied heavily on its top-selling Y series mid-range models to drive sales.

Therefore, Honor must continue to rely on its product offerings to catch up with its rivals.

In an interview with the media, Li Jian revealed that during the fourth quarter of 2024 and the first quarter of 2025, while competitors released numerous new models, Honor was undergoing organizational changes and only launched two new models, making it challenging to maintain its market share.

Starting from the second quarter of 2025, Honor regained momentum and has since released four new smartphones, encompassing a diverse price range: one model priced between 2500 and 4000, one above 8000, and two within the 1000 to 2000 bracket. The newly launched Honor X70, emphasizing long battery life, robust protection, and high cost-effectiveness, serves as a key sales driver.

Honor's accelerated product launches aim not only to stabilize and recover lost sales but also to gradually regain its overall development pace.

However, for Honor to return to its former glory or achieve its aspirational position, these efforts alone are insufficient. The brand must consistently produce compelling products to truly mount a successful counterattack.

(The lead image of this article is sourced from the official Honor website.)