Luxury Car Market Undergoes Overnight Shift: Consumption Tax Threshold Raised to 900,000 Yuan, Triggering Mixed Reactions

![]() 07/18 2025

07/18 2025

![]() 501

501

Whose World Is Collapsing?

Author | Wang Lei

Editor | Qin Zhangyong

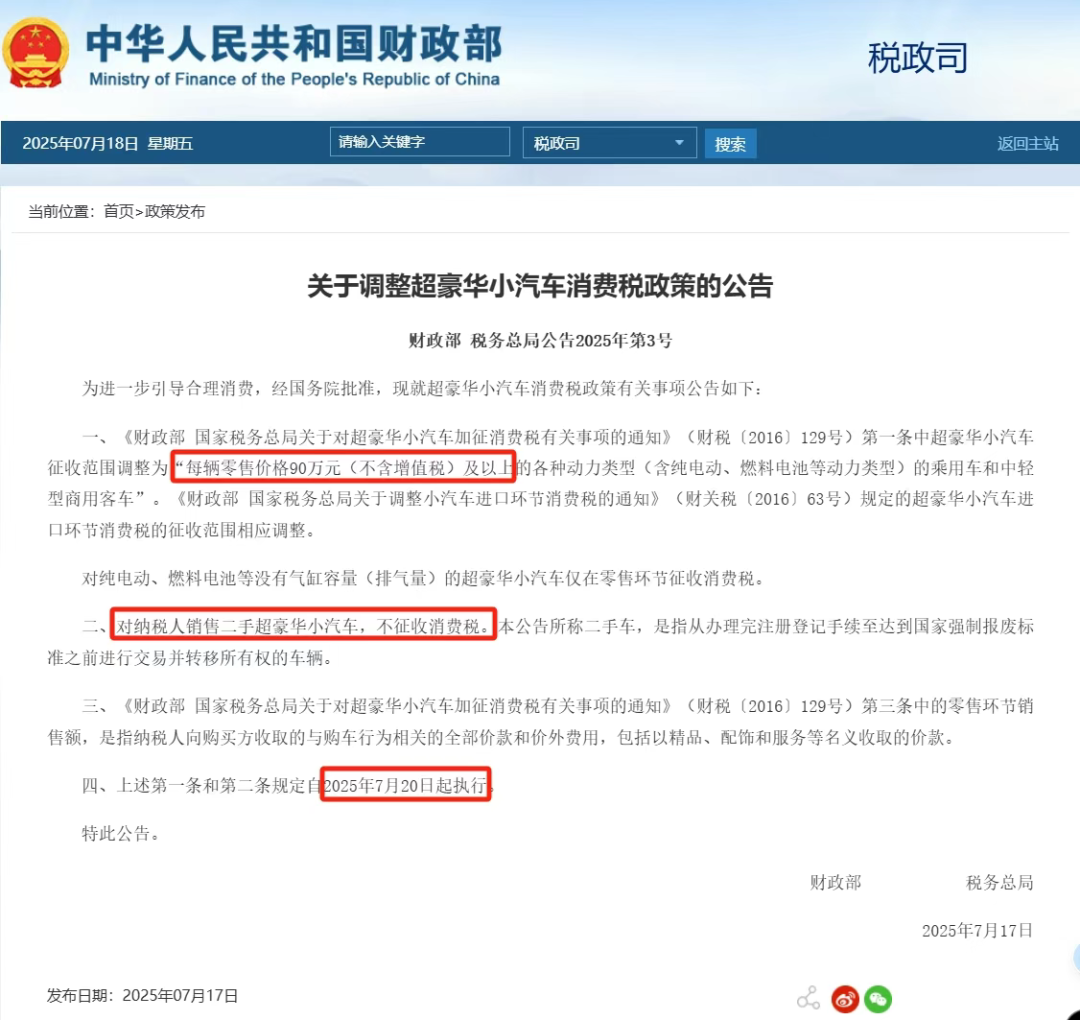

On July 17, the Ministry of Finance and the State Taxation Administration jointly issued a notice adjusting the consumption tax policy for super luxury cars, lowering the threshold for imposing additional consumption tax on models with a "retail price of 1.3 million yuan (excluding VAT) and above" to 900,000 yuan.

This signifies that henceforth, purchases of luxury cars exceeding 900,000 yuan will incur an additional "luxury car tax" at a rate of 10% of the total price.

Remarkably, there is virtually no grace period following the policy's announcement, with the new regulations set to take effect from July 20, 2025. Prospective luxury car buyers are urged to expedite their purchases within the next few days.

Who will be most impacted by this luxury car tax? Contrary to expectation, it is not the top luxury brands like Rolls-Royce and Bentley, but rather traditional super luxury brands like Porsche, which are already facing challenges.

01 One Adjustment, Two Changes

In addition to the crucial reduction in the tax threshold, the new policy also makes significant adjustments to the scope of levy, used car transactions, and refinement of the tax base, compared to the original 2016 policy.

Let's delve into the two core changes in this adjustment:

Firstly, the tax threshold has been lowered from the original 1.3 million yuan to 900,000 yuan, excluding VAT. Notably, this adjustment is based on a reverse calculation using the existing VAT rate of 13%. In practical terms, the luxury car tax threshold has been reduced from an original invoice price of 1.469 million yuan to 1.017 million yuan. Put simply, if the price of your car exceeds 1.01 million yuan in the future (approximately equivalent to 900,000 yuan excluding tax), an additional 10% consumption tax will be imposed, amounting to an extra 100,000 yuan.

On the day of the announcement, salespeople from luxury brands had already begun disseminating the news.

Secondly, the new policy defines the scope of super luxury cars more clearly and imposes stricter requirements. The announcement explicitly includes passenger cars of various power types (such as pure electric and fuel cell) as well as medium and light commercial passenger vehicles within the scope of levy.

In essence, whether it's a fuel vehicle, pure electric, hybrid, or hydrogen energy vehicle, if it surpasses the threshold, it will be subject to an additional consumption tax as a "super luxury" car.

As domestic independent automakers surge ahead in new energy and brands collectively "move up", many domestic models have already fallen under the ambit of the "luxury car tax".

For instance, the Yangwang U8 and U9 models. Taking the Yangwang U8 Deluxe version as an example, with a guide price of 1.098 million yuan, the price excluding VAT for the new car is 971,700 yuan. This implies that from July 20, an additional tax of 97,000 yuan will be required for purchasing a new Yangwang U8.

Furthermore, the top-of-the-line model of the Zunjie S800 and certain "Guo" series models from Hongqi are also included in the taxation scope.

It's worth mentioning that only the Zunjie S800 Xingyao Executive version, with a guide price of 1.018 million yuan, is affected. At a tax rate of 10%, purchasing the top-of-the-line version will incur an extra cost of 100,000 yuan. However, the good news is that Zunjie responded swiftly. Some bloggers reported receiving official notification that users who place an order (without needing to lock it) before 23:59:59 on July 19 will not be subject to the luxury car tax.

It seems that there will be another surge in orders for the Zunjie S800 in the next two days.

For super luxury cars without a specified cylinder capacity (displacement), such as pure electric and fuel cell vehicles, only a 10% consumption tax is imposed at the retail level. Traditional fuel vehicles, however, continue to face double taxation at the production/import level (tax rate of 1%~40%) and retail level (additional 10%).

Moreover, the new policy supplements the definition of vehicle price. The standard of 900,000 yuan and above encompasses not only the bare car price but also all related costs and fees, including accessories, decorations, and service charges.

This is clearly aimed at addressing the gray operations of some luxury automakers in the past, who split the total car price to avoid the "luxury car tax", such as separating it into "bare car + mandatory decoration + optional equipment + licensing/financial service fees". This new policy effectively closes this loophole.

In essence, as long as the overall cost incurred around the car exceeds the threshold, the "luxury car tax" will definitely apply.

Unexpectedly, the introduction of this new policy has breathed new life into the used super luxury car market – the new regulations explicitly exempt used car transactions from consumption tax.

It's important to note that even in used car transactions, previous buyers of super luxury cars had to pay the "luxury car tax". However, post-July 20, used super luxury car transactions are exempt from consumption tax, avoiding double taxation. For instance, on a luxury car priced at 1.2 million yuan, 120,000 yuan in taxes can be saved.

Given the short two-day window and favorable policies for used super luxury cars, there's a high likelihood of a surge in "0-kilometer used super luxury cars" that have only been registered during this period.

The reasons behind this phenomenon warrant careful consideration.

02 Opportunities for Domestic Luxury Cars on the Horizon

Historically, the targets of the "luxury car tax" have primarily been imported cars. While the new policy has impacted a few domestically produced models, most within this price range are still traditional luxury brands. For most Chinese brands focusing on high-end luxury, this new policy is indeed good news.

A quick review of the primary battleground for domestic independent luxury brands reveals that prices are generally concentrated between 400,000 and 800,000 yuan, which is also within the affordable range for most consumers.

The reduction in the "luxury car tax" threshold will, to a certain extent, push some potential million-yuan consumers towards choosing models with a lower price point. This price range happens to be the comfort zone for domestically produced luxury brands.

Models priced between 900,000 and 1.3 million yuan, or automakers within this price range, will be most affected by this new policy.

It's no surprise that Porsche, emblematic of overseas super luxury brands, tops the list.

Especially Porsche, which has always relied on optional equipment as a profit center. The tax threshold definition in this new policy may even cause more Porsche models, initially not in this range, to fall under the tax category due to optional equipment.

For instance, the entry-level Porsche Macan's top-of-the-line model starts at 850,000 yuan. With optional equipment easily costing tens of thousands of yuan, it can easily reach the threshold for the "luxury car tax".

Moreover, the price range of 900,000 to 1.3 million yuan precisely covers Porsche's main popular models. China's best-selling Cayenne and Panamera, as well as the electric Porsche Taycan, fall within this price bracket. For example, the starting guide price of the Cayenne is 910,000 yuan, which, with optional equipment, easily crosses the consumption tax threshold.

In 2024, Porsche delivered nearly 56,900 vehicles in China, marking a year-on-year decrease of 28%, particularly with low sales of the pure electric Taycan. However, the brand's "best-selling" products happen to fall within the 900,000 to 1.2 million yuan range.

Entering 2025, the downtrend persists. On July 8, data released by Porsche showed that in the first half of this year, Porsche sold 146,000 vehicles globally, a year-on-year decrease of 6%, with sales in the Chinese market declining by 28% year-on-year.

Although Porsche currently offers significant discounts, the overall increase in landing prices due to the new policy cannot be overlooked.

It's not just Porsche but also models like the Mercedes-Benz S-Class and GLS, BMW 7 Series and X7, Audi A8, and Land Rover Defender, that have been affected. Additionally, many imported new energy vehicle models, such as the BMW iX and Mercedes-Benz EQS, are also included.

Practically all imported luxury cars priced between 900,000 and 1.2 million yuan now face a new challenge: how to convince consumers to buy when sales are already sluggish?

On the flip side, opportunities for domestically produced luxury cars are undeniably on the horizon.