The myth of creating wealth has burst, and AI companies are queuing up for sale

![]() 06/06 2024

06/06 2024

![]() 803

803

Author | Sun Pengyue

Editor | Da Feng

Not only does AI's big model have a myth of creating wealth, but it also has bankruptcies, closures, and acquisitions.

Before the second quarter of 2024 has even ended, American AI companies have begun a wave of closures. Stability AI, a star startup that once had a valuation of $1 billion, 180 employees, and created the Stable Diffusion series of models, has reported a broken capital chain and is seeking merger news.

According to The Information, AI company Adept, founded by former OpenAI and Google AI developers, is in negotiations with AI giants regarding the possibility of a sale or strategic partnership.

Large language model startup Reka AI has been exposed as potentially being acquired by data storage and analytics company Snowflake for $1 billion.

In a short time, more and more generative AI companies are considering joining the ranks of those for sale.

This also confirms that AI seems like a myth of creating wealth, but in reality, it is a "capital game" that only internet giants can afford to play.

AI world starts a major reshuffle

The first quarter of 2024 is destined to be a key node in the AI world, and it can even be seen as the "reshuffle period for AI companies".

Affecting 90% of AI companies, they are either already acquired or on the path to seeking high-priced acquisitions. Even AI companies with sufficient funds to support them have begun layoffs and cost reduction and efficiency enhancement.

Among the AI companies seeking acquisitions, most are not small or shell companies in the industry, and some are unicorn companies.

For example, Stability AI completed at least $101 million in financing in 2022, entering the unicorn ranks, and at the end of 2023, reached a $50 million investment agreement with Intel. After two consecutive rounds of financing, Stability AI's valuation soared from $100 million to $1 billion.

Adept's financing achievements are even more brilliant. Because the founders come from the OpenAI and Google AI teams, they received investments from industry leaders and well-known VCs right after their establishment. In 2023, Adept raised two rounds of funding totaling $415 million, with investors including NVIDIA and Microsoft, and quickly became a unicorn.

If you say that these acquired AI companies are all big model companies with inflated market values and will collapse once their capital chains are broken. Then, apart from big model companies, AI hardware companies are also not doing well.

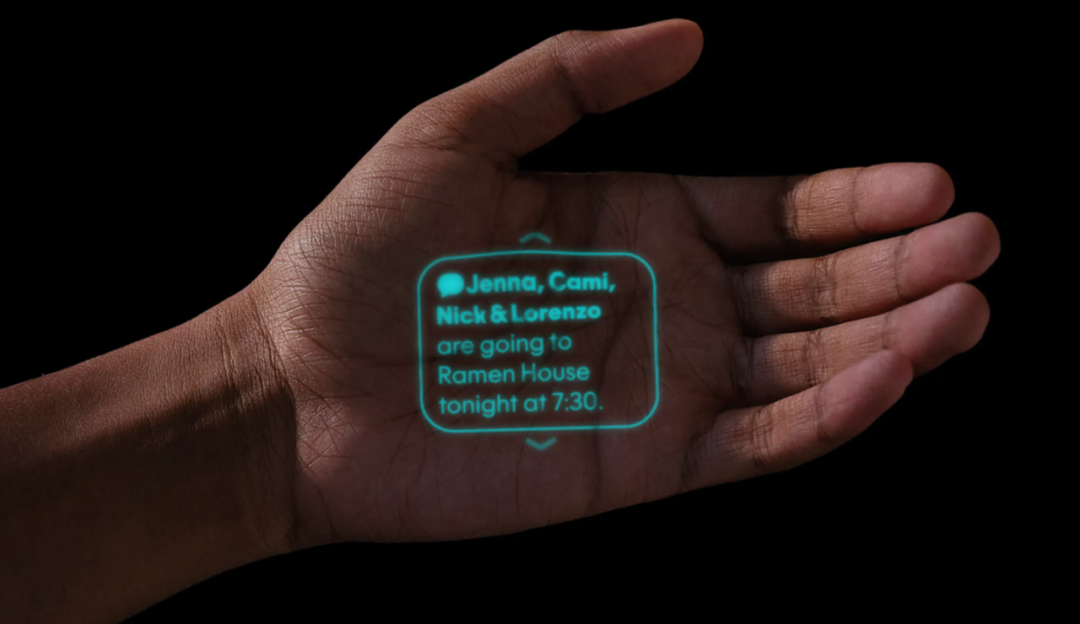

Last year, wearable AI device AI Pin became popular worldwide, and its parent company Humane, also a unicorn, received a $100 million Series C round of financing from Microsoft and OpenAI.

However, just one month after AI Pin's official launch, Humane was exposed by the media as hiring a financial advisor, and the founder couple, Imran Chaudhri and Bethany Bongiorno, hope to find an acquisition price of $750 million to $1 billion.

AI Pin

Not only are AI companies selling themselves, but they have also started layoffs.

AI programming company Replit announced that the company has laid off 30 employees, accounting for about 20% of its total workforce;

AI unicorn Jasper AI has fired a significant number of employees, the exact number is unknown;

AI speech recognition and transcription startup Deepgram announced that it has laid off about 20%, or about 20 employees, including data scientists, researchers, and engineers;

Generative AI company Tome rebuilt its team, laying off 20% of its 59 employees, including the consumer market team and product developers who focus more on users who use Tome products for free.

Selling off + layoffs have become the collective choice of AI companies. Against this backdrop, internet giants have also begun buying up companies.

According to the latest report from market research firm Stocklytics, as of 2023, Apple has acquired a total of 32 AI companies, the most among technology companies; Google's parent company Alphabet acquired 21, Meta acquired 18, and Microsoft acquired 17.

By 2024, the acquisition spree of the big companies has not stopped, and Apple once again acquired Canadian AI startup DarwinAI, which is Apple's 33rd known AI acquisition.

AI chatbot startup Inflection AI reached an agreement with Microsoft, where Microsoft hired most of Inflection AI's employees and paid the startup $650 million, effectively "acquiring" Inflection AI in an alternative way.

For a while, the AI world presented a very primitive industry ecology: big fish eating small fish, and small fish eating financing.

Profitability difficulties under the AI boom

Whether it's being acquired or laying off employees, AI companies have exposed a cruel industry reality: profitability difficulties.

What is the best business model for generative AI applications?

All practitioners can talk at length about three to five points, but once it comes to actual operation, even OpenAI has yet to solve the high operating costs of ChatGPT.

Currently, most big models are "crossing the river by feeling the stones of OpenAI," adopting ChatGPT's subscription model and enterprise version model as the industry's unified standard.

ChatGPT Plus subscriptions are targeted at individual users, who can subscribe to ChatGPT Plus for $20 per month to gain more usage rights, including priority access, shorter queue times, higher concurrent usage, and more.

ChatGPT Enterprise has been comprehensively upgraded to enhance service security and privacy, with unlimited access to faster GPT-4, handling longer inputs, having longer context windows, advanced data analysis capabilities, and customization options.

ChatGPT Enterprise's basic version costs $500 per month and supports a team of 30 people; the advanced version costs $1,500 per month and supports a team of 100 people.

ChatGPT

Although it seems beautiful on paper, getting used to free users to pay for services in the internet world is undoubtedly a very difficult task.

According to a disclosure from Mistral, an open-source AI developer abroad, the vast majority of customers are using smaller free models, with less than 10% using the largest paid models.

Not only are startups struggling to make a profit, but even the big companies are struggling with AI profitability.

According to Stifel Investment Bank, Microsoft's AI services sales in cloud computing were about $1 billion in the most recent quarter, up from almost zero a year ago.

Meta has increased its AI construction budget by about $10 billion, but Zuckerberg remains pessimistic about AI profitability, saying that the company is investing to maintain technological leadership and will not achieve profitability through its AI products in the next few years.

If it's difficult to make a profit, then what does the company rely on to survive? Of course, it can only rely on financing.

According to PitchBook, an industry research firm, AI startups received about $330 billion in investments from 2021 to 2023, an increase of two-thirds year-on-year, but many AI startups still don't have enough money, and high AI construction costs and labor costs have dragged down many AI companies.

For example, Stability AI mentioned above, even after receiving two rounds of $151 million in financing, its valuation soared to $1 billion. However, Stability AI spends $8 million per month on employee salaries, AI hardware equipment, hiring high-paid engineers, and spending a significant amount of money on business development.

So can Stability AI earn $8 million a month?

The Information reported that Stability AI's revenue in the first quarter of this year was less than $5 million, with losses exceeding $30 million, and it even owes nearly $100 million to cloud computing providers and other companies.

Only big companies can afford to play the "money-burning game"

Stability AI is undoubtedly a microcosm of all AI startups:

In Silicon Valley, it's not difficult to hire a team of engineers, buy a bunch of NVIDIA chips, and design a big model. The difficulty lies in relying solely on financing for all funds and barely making any money.

If the financing runs out, the company is left with only one option: selling itself.

That's why AI is a "money-burning game" that only big companies can afford to play, as they have more funds and can support it through reasonable use of capital means.

With the best business model unclear at the moment, most AI players are taking market penetration as a breakthrough, which is to attract more users by providing products for free.

Once users get used to using it for free, it becomes difficult to charge for it.

Unless subsequent AI companies can provide attractive additional features, such as GPT-4's creativity, most users are willing to pay for the product.

To make money using AI in the AI era, one must consider product implementation.

For example, FancyTech, a Chinese AIGC video advertising company (Times Emerging), is focusing on the direction of "realistic outfit change functionality".

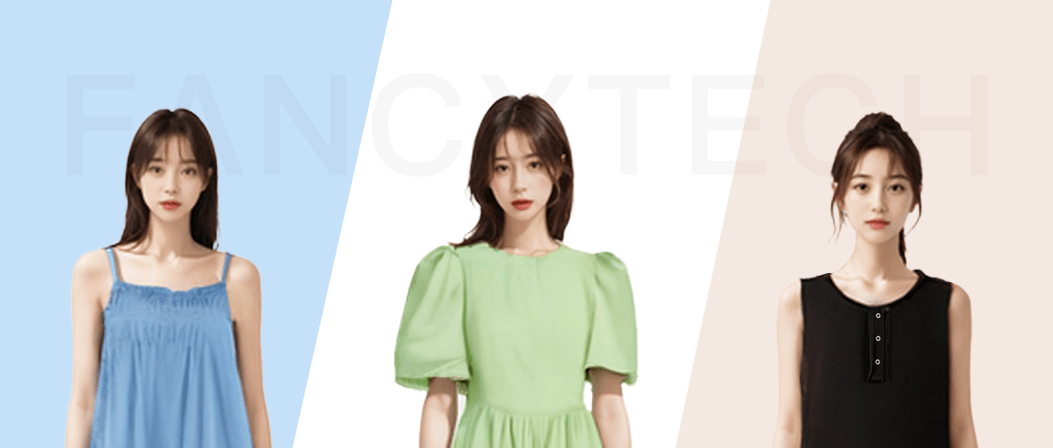

FancyTech

Simply put, based on a product image, it can generate a model wearing the item, with customizable poses, backgrounds, and faces. It can completely replace e-commerce product posters and promotional images.

Last year, FancyTech collaborated with over 500 domestic and international brands, generating over 100,000 videos daily. According to media exposure data, FancyTech's revenue last year reached over 50 million, an increase of five to six times compared to 2022.

FancyTech is a small company, but it has also brought new business avenues to many well-known domestic and international AI companies.

Product implementation and business models are more important than competing in the ecosystem, big models, and market penetration.

After all, no matter how strong the product is, one must also consider survival issues.