NVIDIA is equivalent to 10 Moutai, and it is definitely overvalued, while Apple is undervalued.

![]() 06/11 2024

06/11 2024

![]() 711

711

Not surprisingly, NVIDIA has surpassed Apple to become the second-largest company in the world in terms of market capitalization, once exceeding $3 trillion, and is also one of the only three companies in the world with a market capitalization of $3 trillion.

How impressive is NVIDIA's $3 trillion? Just compare it with Moutai. $3 trillion is equivalent to 21.7 trillion yuan, while Moutai, which is so profitable, is only worth 2.03 trillion yuan.

One NVIDIA is equivalent to more than 10 Moutais.

Even more interestingly, the current three largest U.S. stocks, Microsoft, NVIDIA, and Apple, have a combined market capitalization of over $9 trillion, equivalent to more than 65 trillion yuan. These three American companies are already comparable to the total market capitalization of China's A-shares, as there are over 4,000 listed companies in China, and their total market capitalization is only about that much.

Many people believe that NVIDIA is definitely overvalued. To be honest, from the perspective of revenue, profit, and future development potential, NVIDIA is indeed overvalued.

Let's compare it with Moutai. Moutai's revenue in 2023 was 150.5 billion yuan, an increase of 18% year-on-year, with a profit of 74.7 billion yuan, an increase of 19%.

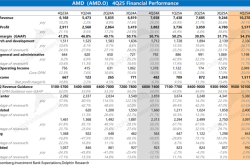

On the other hand, NVIDIA's revenue in 2023 was $60.9 billion (about 441 billion yuan), an increase of 126% year-on-year, with a profit of $29.8 billion (about 215 billion yuan), an increase of 581% year-on-year.

NVIDIA's revenue is about three times that of Moutai, and its profit is also about three times. However, its market capitalization is 10 times that of Moutai. Is that reasonable? Do you think NVIDIA's prospects as a tech stock are limitless, while Moutai's prospects in China are still questionable?

Now let's compare it with Apple. Apple's revenue in 2023 was $383.3 billion (about 2.78 trillion yuan), with a profit of $97 billion (about 700 billion yuan).

Calculating it this way, Apple's revenue is more than six times that of NVIDIA, and its profit is more than three times that of NVIDIA. However, Apple's market capitalization is still lower than NVIDIA's. From this perspective, is NVIDIA overvalued, and is Apple undervalued?

Everyone knows how powerful Apple is, with its phones, tablets, Mac computers, M chips, the Appstore giant, the IOS system, and various digital peripherals.

Many people may say that Apple is already old, and NVIDIA is the AI霸主 (AI leader).

However, the question is, is the AI market as large as the mobile phone market, tablet market, digital peripheral product market, and other markets that Apple is present in? With Apple's size, strength, and technological capabilities, even if it doesn't grow for a long time, it is unlikely to decline.

And once Apple makes a breakthrough, its future possibilities are much stronger than NVIDIA's.

Although NVIDIA is the dominant player in AI chips and currently has no competitors, it doesn't mean that it won't have competitors in the future. Companies like Intel, AMD, and even ARM are all keeping a close eye on the market. Currently, NVIDIA is not doing well in the Chinese market, with Huawei, Haiguang, and others competing for its market share.

In addition, the AI chip market is not as large as people imagine. Currently, due to the fierce competition among various models, there is a significant demand for AI chips. However, once the market stabilizes and only a few companies remain, the demand for AI chips will greatly decrease, and NVIDIA's growth will not be sustainable.

Nevertheless, some people also argue that NVIDIA is currently driving the U.S. stock market crazy. Once NVIDIA's bubble bursts, it will also drag down the U.S. stock market, and a market crash is not impossible at that time.