AI Cultivates the Fertile Soil of "Social + Gaming"

![]() 08/08 2025

08/08 2025

![]() 598

598

Amidst fierce competition in content creation, China's pan-entertainment industry is embarking on a fresh growth trajectory.

Recently, Chztown Technology issued a profit forecast, anticipating that its social business revenue for the first half of 2025 will range from 2.8 to 2.86 billion yuan, marking a year-on-year increase of 35.4% to 38.3%. Notably, AI is pinpointed as the primary driver of this growth.

Simultaneously, XD.com, leveraging its proprietary games and the TapTap platform, witnessed a staggering 215% surge in net profit year-on-year. Furthermore, the company invested $14 million in MiAO, a startup specializing in "gaming + social." In the "social + gaming" sector, Yalla Group has dominated the Middle Eastern pan-entertainment market with its localized strategy.

Favorably influenced by these developments, XD.com's market value soared by over 35% within a week, Chztown Technology's by over 10%, and Yalla's by nearly 20%.

Various indicators suggest that Chinese pan-entertainment enterprises are merging social and gaming elements to lay the groundwork for the next generation of overseas products. AI is revolutionizing the digital life scenarios characterized by "high-frequency social interaction × medium and light games," thereby presenting new opportunities for global platforms.

"Social + Gaming" Redefines the Gateway to Digital Life

Amidst the relentless evolution of short videos and social apps, digital entertainment is becoming increasingly fragmented, and the growth engine of China's pan-entertainment industry is subtly shifting. Interim reports indicate that the deep integration of "social + gaming" is emerging as a novel path to tap into overseas markets and build platform-level ecosystems.

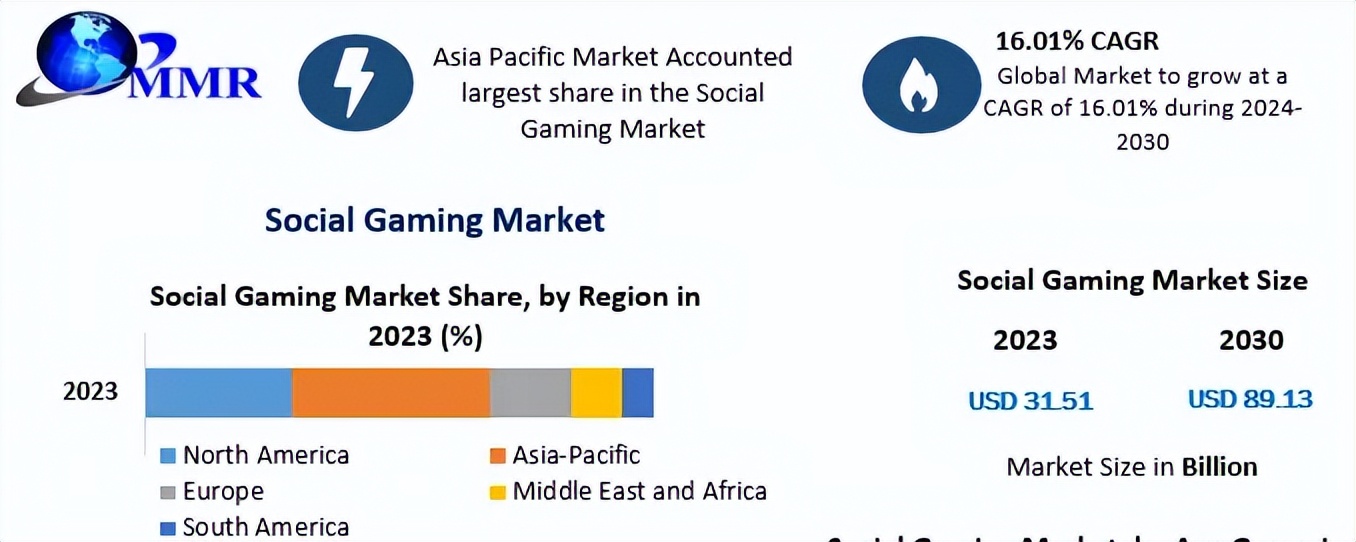

Social platforms bolster user engagement through games, while games enhance interactions via social features, collectively forming a novel digital life scenario. Data projects that the global social gaming market will continue to expand at a rate exceeding 15% annually, from approximately $30 billion in 2023 to 2030.

Recent actions and performance of several representative companies provide compelling evidence.

Chztown Technology's profit forecast predicts social business revenue of 2.8 to 2.86 billion yuan for the first half of 2025, a 35.4% to 38.3% year-on-year increase. The company explicitly lists AI technology as one of the core drivers of this growth. Its business model is expanding beyond pure social to encompass innovative areas such as boutique games, casual games, and social e-commerce, driving robust double-digit growth in overall revenue and net profit.

XD.com has also experienced significant growth. Leveraging the synergy between its proprietary games and the TapTap community platform, XD.com achieved a remarkable 215% year-on-year surge in net profit. Its self-developed game "Departure, Muffin" (Japanese name: "GOGOマフィン × MALTESE") successfully entered the Japanese market, capturing attention with its unique "idle + social" gameplay, underscoring the pivotal role of social design in the globalization process. Notably, XD.com recently invested $14 million in MiAO, a startup focused on "gaming + social," further solidifying its presence in this sector.

Moreover, Yalla Group, with a strong foothold in the Middle Eastern market, has achieved a paid rate exceeding 40% for some of its products through its "social + gaming" product mix, attributed to its nuanced understanding of the local Majlis culture (emphasizing pure chat gatherings). This showcases its robust localization capabilities and commercial potential.

Image source: Diandian Data

From an industrial perspective, leading pan-entertainment enterprises venturing overseas are exploring a development path with greater platformization potential: casual social games are rapidly evolving into an entry point for reconstructing social ecosystems. Conversely, social relationship networks naturally foster propagation and retention for games.

Interim reports from multiple companies attest that compared to the traditional model reliant on single traffic monetization, "social + gaming" inherently possesses the capability to construct a closed-loop business model encompassing "traffic-interaction-payment," significantly enhancing user engagement and conversion efficiency, thereby laying a solid foundation for platformization.

Notably, cutting-edge technologies, epitomized by AI, are playing a pivotal role as catalysts behind this integration wave.

Whether it's Chztown leveraging AI to optimize user matching and real-time translation to bridge cultural divides, or XD.com investing in MiAO to explore AI's potential in game content generation, technological empowerment has become a critical factor in bolstering the efficacy of this integration model.

This also signals that the next evolution of "social + gaming" will be inextricably linked to AI.

AI Catalyzes the Fusion of "Social + Gaming"

As the integration of "social + gaming" emerges as a major trend for the pan-entertainment industry's overseas expansion, artificial intelligence serves as the core engine for enhancing platform efficiency and expanding boundaries.

AI transcends being merely a tool to aid product development and user operations; it is gradually becoming deeply embedded in product logic, serving as a key catalyst for driving user experience upgrades, operational efficiency leaps, and content ecosystem flourishing.

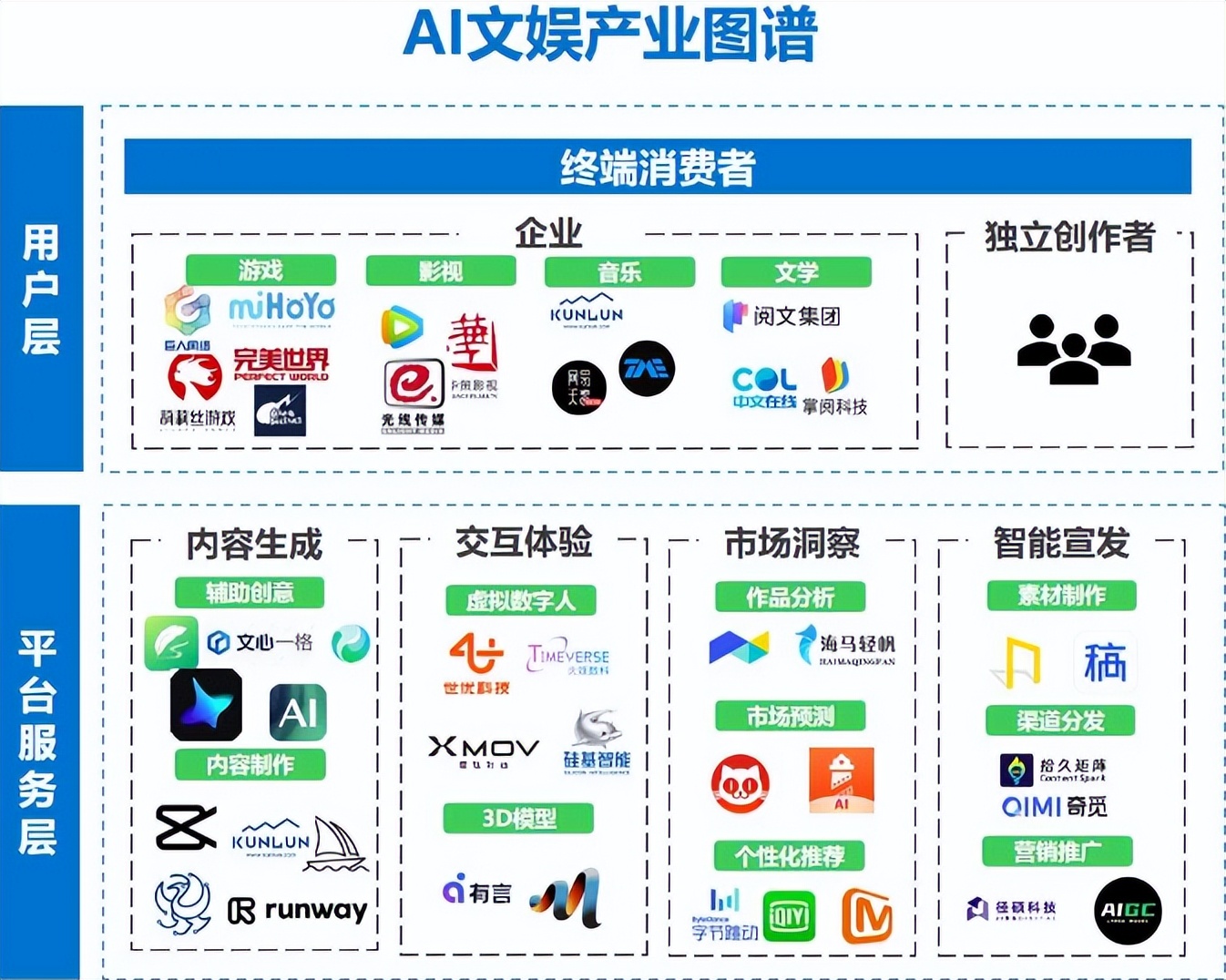

Image source: 36Kr Research Institute

Firstly, from an operational standpoint, the dual enhancement of efficiency and experience represents the most tangible value release of AI.

Chztown Technology deeply integrates AI into user persona modeling, real-time matching optimization, intelligent content recommendation, and cross-language real-time translation. Essentially, AI optimizes the cost of constructing and maintaining social relationship networks, fortifying the user base of the integrated ecosystem.

Secondly, on the gaming front, AI's reach is extending into the core domains of development and operations. According to CNG Data's "China Game Industry AIGC Development Prospects Report," over 60% of domestic leading game companies have deployed AIGC (Artificial Intelligence Generated Content).

AI can substantially reduce the marginal cost of game content production and iteration. For instance, MiAO, the startup invested in by XD.com, is focused on developing a multiplayer open-world social game. Its founder, Wu Meng, once expressed his long-term vision for AI - "one sentence to generate a Genshin Impact." This underscores the potential for AI to exponentially enhance the richness, update frequency, and personalization of future "social + gaming" products.

An even more disruptive impact lies in AI's reimagining of the interactive experience itself.

Traditional social gaming interactions primarily occur between users (PvP) or between users and preset programs (PvE). The maturation of AI technology is giving rise to highly anthropomorphic "intelligent agents" (AI NPCs/companions) capable of emotional feedback.

Users will no longer interact solely with "real people" or "rigid codes" but will be able to establish more natural and profound emotional bonds with virtual characters that understand context, generate empathy, and continually learn. This vastly expands the scope of "social + gaming," extending from human-to-human connections to human-to-intelligent agent symbiosis, making the social experience in the virtual world more fulfilling and immersive. This upgraded experience is the cornerstone for attracting and retaining users, particularly Generation Z users who prioritize novelty and emotional satisfaction.

In summary, AI has leaped from being a backend technical support to a "system-level" variable that reshapes the product form and user experience of "social + gaming." It not only significantly boosts the operational efficiency of the integration model in the present but also fundamentally opens up new interaction dimensions and content ecosystems for the future.

The deep integration of AI is rapidly transforming "social + gaming" from a mere product mix into an "intelligent pan-entertainment ecosystem" with self-updating and continuous evolution capabilities. This undoubtedly creates a broader realm of imagination for the globalization of the pan-entertainment industry.

In the era of overseas expansion 2.0, reassess the platform-level opportunities of "AI + Pan-entertainment"

This earnings season, the "social + gaming" integration model has demonstrated certainty and high growth, heralding a new wave of strategic opportunities for Chinese pan-entertainment enterprises on their overseas expansion journey.

This week, the share prices of iconic pan-entertainment overseas enterprises such as XD.com, Chztown Technology, and Yalla surged. Behind the capital market's enthusiastic response lies the fact that Chinese enterprises are not only expanding their share in the global pan-entertainment market but also transitioning towards a new model characterized by higher adaptability, stronger user engagement, and superior business efficiency, thereby unlocking platform value globally.

Compared to traditional models, the integrated ecosystem of "social + gaming + AI" can penetrate cultural barriers and precisely cater to the diverse digital life needs of the global market.

Contrary to high-investment, long-cycle, and high-technical-threshold overseas expansion paths exemplified by large 3A games like "Black Myth: Wukong," the combination of "social + gaming + AI" does not rely on extreme graphical performance or complex gameplay design. Instead, it focuses on lightweight content, intense social interaction, and AI-driven personalized experiences as its core strengths.

This model can more swiftly respond to local user preferences and flexibly adjust product forms, such as Yalla's adaptation to the Middle Eastern Majlis culture, efficiently constructing high-frequency "daily digital scenarios." Data indicates that in 2024, China's overseas revenue from self-developed games amounted to approximately $15 billion, accounting for nearly 30% of global game revenue, with medium and light games featuring social attributes contributing significantly and growing at a remarkable rate.

At a deeper level, this advantage aligns with the wave of demographic and technological shifts.

On one hand, Generation Z, as digital natives, is gradually becoming the mainstay of consumption. For Generation Z, games are evolving into a new social language.

For them, the life cycle of a product is no longer solely determined by gameplay innovation but increasingly depends on the establishment of social relationship networks and the maintenance of emotional connections. This is precisely the core competency of the "social + gaming + AI" model - optimizing connections through AI, creating novel interactive experiences, and continually activating community vitality, enabling the product itself to possess platformization extension potential.

On the other hand, AI is transitioning from the "tool layer" to the "system layer," gradually becoming a pivotal engine for unleashing the creative potential of China's pan-entertainment industry.

Over the past two decades, China has amassed talent, toolchains, and production experience in the gaming and content industries. These assets are now being rapidly mobilized and amplified with the support of AI technology, constituting the most enduringly valuable competitiveness for overseas enterprises.

From content creation to distribution mechanisms, AI is accelerating the release of productivity within the creator ecosystem, propelling a series of high-threshold content forms down the path of scalable growth. The creative bottlenecks that have historically plagued film and television works, light interactive games, and other fields are gradually being overcome by AI's efficient generation and distribution capabilities.

Looking ahead, as AI becomes the core infrastructure of the industry, the pan-entertainment landscape is shaping into a new paradigm of "large companies building roads, small and medium-sized companies making cars."

Technology giants represented by Tencent and ByteDance are increasingly focusing on providing robust "technical foundations," including large model capabilities, development toolchains, and cloud computing resources, lowering the thresholds and costs for the entire industry to embrace AI, and becoming providers of "utilities" for industrial innovation. For instance, Tencent Hunyuan recently released and open-sourced the 3D World Model 1.0, significantly enhancing the work efficiency of professional modeling teams and ushering in new possibilities for game development and digital content creation.

Image source: Tencent Hunyuan

Meanwhile, pan-entertainment overseas enterprises exemplified by Chztown Technology and XD.com are actively embracing technological dividends, combining their profound insights into the needs of specific market users, social mechanisms, and game design, to focus on creating the next generation of "AI-native" social gaming products.

Looking ahead, the continuous advancement of large model capabilities will further elevate the immersion of "social + gaming + AI," giving birth to novel product forms with greater platform potential. Chinese pan-entertainment enterprises are poised to usher in a new era of overseas expansion marked by multi-domain integration and intelligent product reimagining.

Source: HK Stocks Research Community