Unveiling the ROI of AI Investment by Tech Titans: The "Driving Force" of Advertising in Q2 Reports

![]() 08/08 2025

08/08 2025

![]() 621

621

The AI variable is reshaping the landscape of the global digital advertising market.

In early August, China's State Administration for Market Regulation released statistics indicating that in the first half of 2025, leading enterprises and institutions in the national advertising industry saw their advertising revenue rise by 11.3% year-on-year, with internet advertising revenue increasing by 19.0% year-on-year, accounting for 81.1% of total advertising revenue.

Behind this trend of "the strong getting stronger" lies a structural shift in advertising technology pathways and delivery logic.

As AI technology increasingly permeates the advertising industry, from search advertising to short video recommendations, and from graphic and text creativity to AIGC-generated content, AI is deeply embedded in the entire advertising chain. Search giants like Google and Baidu, as well as streaming media platforms such as Netflix, Douyin, and Kuaishou, are all redefining advertising formats and reconstructing ecological structures, aiming to gain a competitive edge in the new era.

Digital advertising, the most mature business model on the internet, is also entering its deepest adjustment period in a decade.

Elephant Turns: AI Powers a Leap in Advertising Efficiency

The U.S. market has always been a bellwether for global digital advertising trends. According to eMarketer data, in the first half of 2025, the growth rate of digital advertising in the United States fell below 10%, marking the lowest since 2009.

This decline is not due to digital advertising losing favor but rather reflects the entire industry entering a period of reconstruction.

Google's conversational search "AI Mode," launched in 2025, is a product of this reconstruction. Unlike before, advertising displays in this mode do not rely on keywords input by users but instead automatically understand user needs through conversation context and insert relevant brand information. This signifies that AI is no longer merely a tool but plays a pivotal role in partial decision-making and content generation in advertising businesses.

In addition to Google, Microsoft is also accelerating the integration of search and news advertising into the Copilot ecosystem, directly incorporating them into its office scenarios and enterprise service systems. This integration has yielded significant benefits. According to the latest financial report, Microsoft's search and news advertising revenue increased by 21% year-on-year, far surpassing the industry average growth rate.

The U.S. stock earnings season conveys a consensus: AI significantly enhances advertising conversion rates.

Despite the overall slowdown in advertising market growth, quarterly advertising revenue for platforms like Google, Microsoft, and Meta still maintained double-digit growth.

Despite the overall pressure on its search business, Google's advertising revenue remained robust, reaching $65.2 billion, a year-on-year increase of 10%. Its core breakthrough lies in the launch of "AI Overviews," a type of conversational search advertising format that enables advertising displays to transcend keyword matching, integrating user intent and context to improve conversion rates. CFO Ruth Porat also noted that generative AI has markedly increased user engagement with advertising products, paving the way for future multimodal exploration of advertising products.

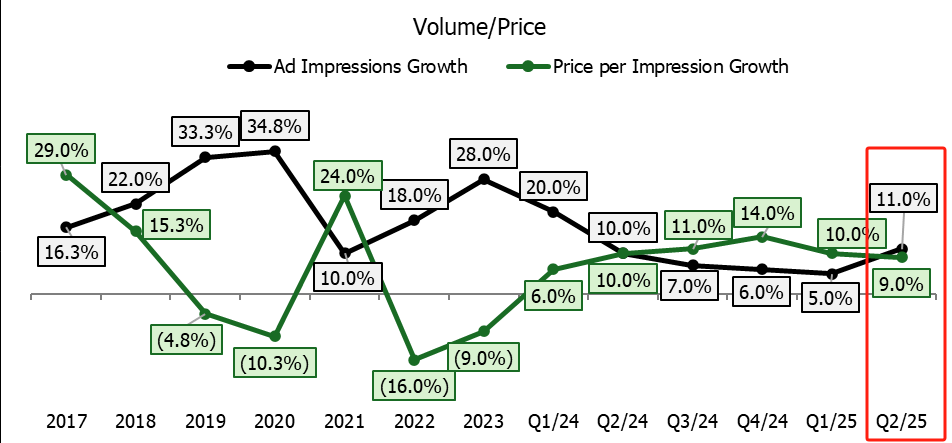

Furthermore, Meta's Q2 2025 financial report clearly reflects the overall improvement in advertising business efficiency driven by AI. Meta's advertising revenue increased by 16% year-on-year to $36.2 billion, becoming one of the main growth drivers this quarter. During the earnings call, Zuckerberg highlighted that the support of AI tools for advertising recommendations and creative generation significantly enhanced delivery effectiveness, with the number of ad impressions increasing by 11% and average prices rising by 9%, indicating that the platform is not only improving traffic monetization efficiency but also gradually establishing a high-value content ecosystem. In this regard, Zuckerberg stated that the advertising business has already generated "significant" revenue from new generative AI functions.

These changes point to a common trend: with the slowdown in platform traffic growth, improving the efficiency of monetizing each unit of traffic has become the core objective, and AI is the key driver to achieve this goal.

Facing this trend, Chinese technology companies are also accelerating their efforts.

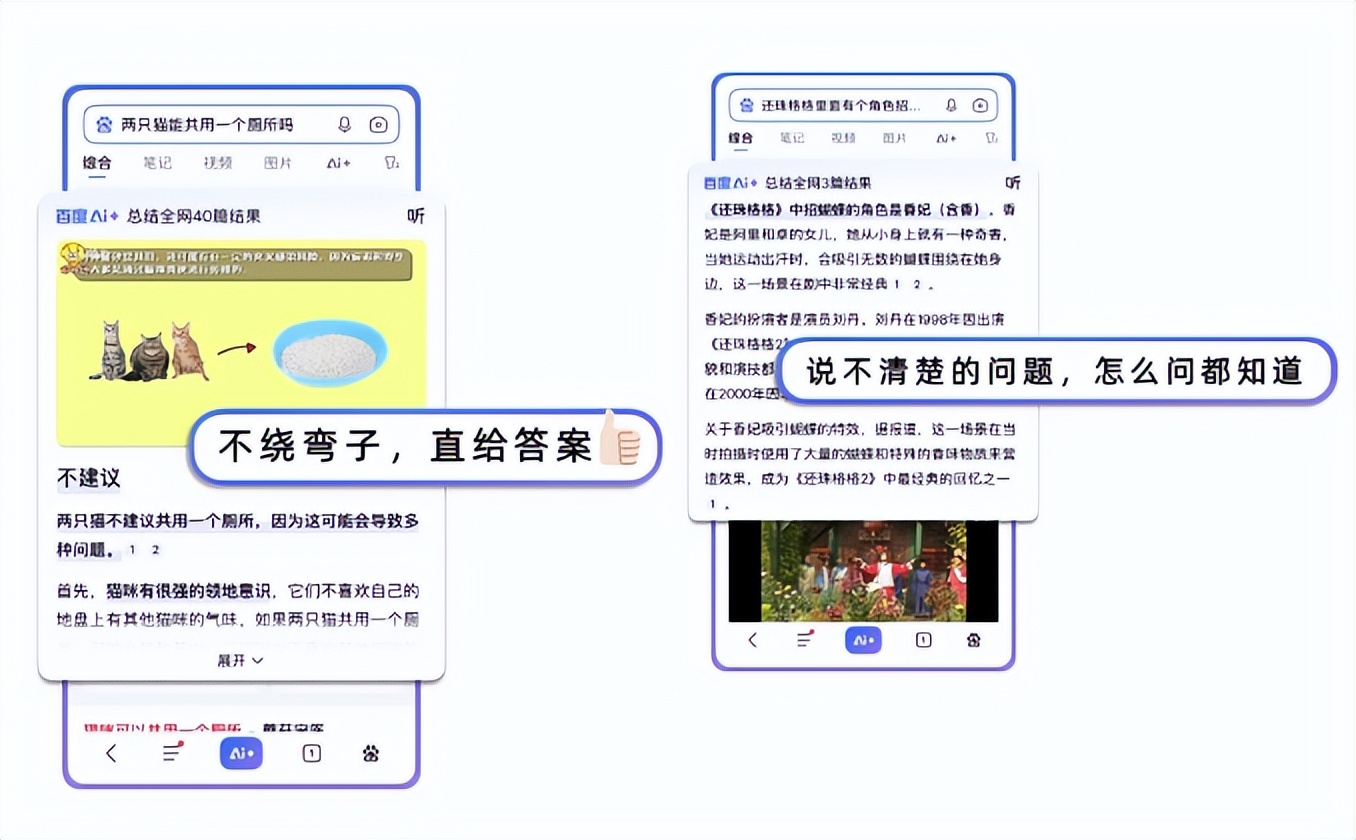

For instance, Baidu integrated ERNIE Bot into the main search entry, attempting to guide users to migrate their search behavior to an AI question-and-answer framework; Tencent integrated the capabilities of its large AI model to enhance user matching and content generation in advertising placements; Douyin and Kuaishou were more direct, embedding AI tools into the short video creation chain to help merchants rapidly generate creative scripts, materials, and copywriting, shortening the cycle from demand proposal to content launch.

The strategic adjustments of Chinese and American technology platforms are essentially addressing a market issue: the shift in the underlying logic of advertising is reshaping budget allocation rules, and how can platforms compete for more shares?

Reevaluating the Content Ecosystem: Shifting Focus from Traffic Scale to Both Quality and Efficiency

While AI improves advertising efficiency, platforms' understanding of "traffic" is also being reconstructed.

In the past, as long as a platform had sufficient user attention, it could occupy a dominant position in budget allocation. However, as content, conversion, and trust gradually form a new value loop, the evaluation logic of traffic has also quietly shifted.

In the content era driven by AI, the key to measuring traffic has shifted from "how many people can be reached" to "how many can be converted".

This is precisely why Netflix, which once emphasized user experience and rejected advertising interference, further increased its advertising business in 2025, officially transitioning its profit model from subscription-driven to a "hybrid" of advertising and subscription.

The rationale behind Netflix's decision lies in the fact that as AI drives advertising content to more naturally integrate into storylines or usage scenarios, brands no longer shy away from "advertising interference" but are willing to actively seek high-quality content environments for customized placements. In this regard, Chief Financial Officer Spencer Neumann stated that the growth in advertising sales has exceeded expectations for the same period this year and is expected to double by the end of 2025.

This trend is even more pronounced on short video platforms. Advertising service revenue accounts for more than 55% of Kuaishou's total revenue, and as the core of Kuaishou's AI strategy, Kuaishou's self-developed AIGC tool series, Keling AI, assists merchants and creators in generating scripts, visuals, and even virtual anchors, with monthly revenue exceeding 100 million yuan. In its first-quarter report, Kuaishou stated that AIGC content production, delivery agents, large marketing recommendation models, and large bid inference models are comprehensively reshaping business operations on Kuaishou.

Whether it's Netflix or Kuaishou, they are telling the same story: in the era of stock, technology companies are shifting from pursuing quantity and scale to value, and AI has altered the value logic of advertising, with "AI+advertising" becoming a new weapon for platforms to transition from the "incremental era" to "stock intensive farming".

The logic is simple: the advertising industry has long relied on standardized formats such as information streams and patches, and enterprises often have to simply combine existing materials due to budget constraints. If sales conversion is overly emphasized, it may lead to audience fatigue or resistance, thereby weakening user stickiness.

Generative AI technology has changed this dilemma. On the one hand, large video generation models such as Keling AI allow advertisers to generate a vast amount of native creative content at low cost. According to internal estimates by Kuaishou, AI large models are expected to reduce the production cost of clients' short video marketing materials by 60% to 70% or even higher. On the other hand, AI replaces manual mass bidding models, leveraging data advantages to achieve precise delivery and full traffic management, enhancing ROI returns.

Image source: Kuaishou Magnet Engine Business Insights

The simultaneous upgrade of the supply and demand sides has given advertising platforms new growth momentum, and the focus of competition among platforms has shifted from traffic competition to in-depth confrontation between efficiency and ecology.

The digital advertising market, where tech giants are "all participating," is welcoming a new round of technology and ecological competition.

Giants Compete: The "Hidden War" of AI Advertising in the New Ecosystem

Changes in the advertising markets of China and the United States in 2025 prove that tech giants are actively dismantling their original moats, and the focus of competition among platforms has shifted from simple traffic competition to efficiency and ecological competition.

Entering the mid-year report season, global tech giants have unveiled their AI transformation scorecards. Magnificent7 took the lead in announcing positive results, and the share prices of Google, Microsoft, and Meta rose accordingly after their financial reports were released.

Now, as the Hong Kong stock market welcomes the intensive disclosure period for mid-year performance previews, the market is also paying attention to how adjustments and breakthroughs will come to the advertising business of Chinese technology platforms. Judging from existing signals, three trends are worth noting.

First, AI capabilities are shifting from "tooling" to "productization," becoming an inherent capability. Baidu's integration of the ERNIE Bot large model in search advertising has comprehensively reconstructed the traditional advertising ecosystem. At the same time, Kuaishou is also accelerating the integration of AI and digital humans into all aspects of "content + e-commerce + local life," and further improvements in advertising business efficiency driven by AI may be seen in the latest quarterly report.

Image source: Baidu

Second, the integration of content, e-commerce, and advertising will further deepen. Advertising is no longer just a single-point delivery tool but a link driving the transaction closed loop. For example, Alibaba's digital marketing platform "Alimama" has launched a series of AI-based marketing tools and solutions, proving that advertising platforms are gradually packaging AI capabilities into user-friendly tools and services, lowering the usage threshold for small and medium-sized businesses.

Image source: Alimama Digital Marketing

With the standardization of AI services, platforms are expected to open up new growth points in the mid-tier customer market. This trend of connecting advertising with transaction links may be reflected in more Chinese stocks listed in the United States in the second half of the year.

Finally, the advertising pricing mechanism may be adjusted. Meta optimized placements through AI, resulting in an 11% increase in the number of ad impressions and a 9% increase in average prices, indicating that advertisers are paying more attention to ROI rather than price sensitivity. As AI improves delivery efficiency, advertisers are no longer solely concerned with click-through rates or impressions but place more emphasis on GMV or retention value after conversion. This will force platforms to reassess their ROI models and promote a pricing system that prioritizes "effectiveness" over "bidding".

It is foreseeable that with AI fully involved in the advertising business, Chinese tech giants will no longer purely pursue the expansion of advertising scale but will shift to building a closed-loop ecosystem integrating "content + technology + transactions".

Beyond financial reports, this structural evolution will have a more profound impact on platform valuation logic and growth space.

Although essentially, AI has not altered the core value of advertising as "connecting supply and demand," it has rewritten the way and cost structure of that connection. Not only are advertisers shifting from competing on budget scale to pursuing long-term ROI, but platforms are also shifting from traffic operations to deepening ecological closed loops, thereby creating AI-native advertising products.

From the "sudden drop in growth rate" in the U.S. market to the "structural upgrade" in the Chinese market, the dramatic changes in digital advertising are prompting a profound reassessment of platform value.

This earnings season can focus on the following content, including Tencent's reliance on the WeChat ecosystem and AI technology to drive advertising efficiency improvements, with attention paid to the driving effect of its public and private domain linkage on advertising revenue; Alibaba launched a series of AI-based marketing tools and solutions during the 618 shopping festival, and it is necessary to observe the conversion rate of its e-commerce advertising; Baidu refactored the search advertising link, and it is essential to evaluate its AI-generated content for advertisers' ROI improvement effect.

When AI shifts from the "storytelling" stage to the "doing real things" stage, those who can balance user experience and advertising efficiency are likely to lead a new round of growth in this advertising reconstruction.

Source: Hong Kong Stock Research Society