In the Sino-US AI Race, Chinese Internet Giants Are Being Marginalized

![]() 08/08 2025

08/08 2025

![]() 704

704

This article is based on public information and intended solely for information exchange, not as investment advice.

Perhaps only in hindsight will we fully understand what motivated Meta founder Mark Zuckerberg to invest heavily in the AI race today.

In the past 12 months alone, Meta's spending spree in the AI race has been a daily media headline:

It spent $14.3 billion to acquire a 49% stake in data annotation company Scale AI and hired its CEO, Alexandr Wang, as Meta's Chief AI Officer.

It offered compensation packages ranging from $100 million to $300 million to 10-20 top AI talents, potentially totaling between $1 billion and $6 billion (based on multi-year contracts, partly in equity). These astronomical contracts even overshadowed those of sports stars accustomed to big contracts.

According to Meta CFO Susan Li, Meta's total expenditure in 2025 is expected to be between $114 billion and $118 billion, with the majority allocated to AI infrastructure construction.

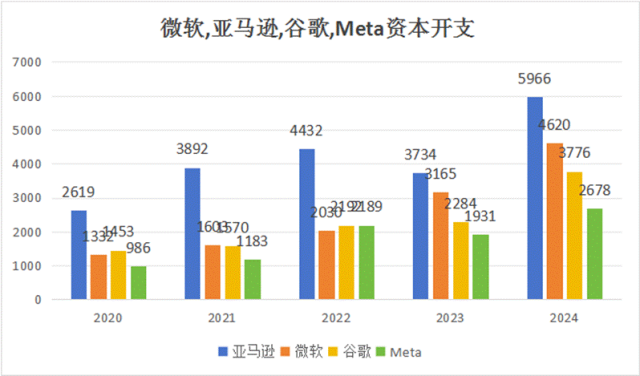

Incredibly, Meta is not even the US tech giant with the highest capital expenditure over the past five years:

In terms of actual capital expenditure, the four major internet technology companies have at least doubled their spending over the past four years, with a total expenditure in 2024 equivalent to RMB 1.7 trillion, close to Alibaba's current market value.

In 2025, based on guidance from several tech giants, the total capital expenditure of these four companies is expected to exceed $344 billion, exceeding RMB 2.5 trillion.

Ninety percent of this expenditure goes towards the AI computing power centers that the US is vigorously building. AI Capex (capital expenditure) has become a significant driver of the US economy:

In the third quarter of 2024, AI capital expenditure accounted for 16%-20% of real GDP growth in the US, masking weaknesses in other economic sectors.

In 2025, AI-related capital expenditure will account for 21% of the total capital expenditure of the S&P 500, contributing more to GDP than consumer expenditures combined.

Not only chips, nuclear power, and even liquid cooling, connectors, and transformers, but share prices have soared in this new railway construction investment.

01 This is Not a Bubble

The demand for AI data centers is not a bubble.

The power usage effectiveness of data centers has multiplied annually, growing from 4GW in 2024 to an estimated 10-15GW in 2025, and is expected to reach 123GW by 2035, marking a growth of over 30 times. US utility company Capex has also increased by 15-20% to meet the power demand of data centers alone.

Small modular nuclear power plants have also multiplied within a year.

Whether it's Google, Microsoft, or even Meta, the phrase "strong demand for cloud and AI" has been a recurring theme in conference calls, with advertising, e-commerce, and collaborative office work all benefiting from the growth in AI demand.

On the supply side, the AI adoption rate of US companies has reached 78%, and 85% in large enterprises, an increase of 42% from 55% in 2023.

In other words, the surge in Capex of US tech giants is not just out of fear of missing out (FOMO), but due to seeing the acceleration of AI demand.

In a speech at Allin Podcast, Trump couldn't hide his smile:

"In the competition for artificial intelligence, we have achieved a substantial lead over China."

02 Silent Chinese Internet Stocks

Trump is not exaggerating. The technological level of the US industry relative to China has shown long-term stagnation at various levels over the past 30 years, but in the AI race, a significant reversal is occurring.

The data is stark:

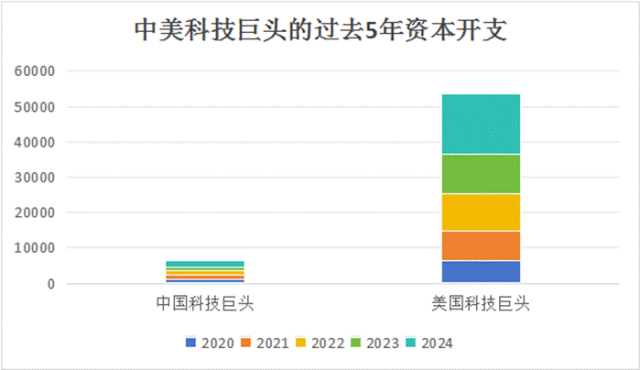

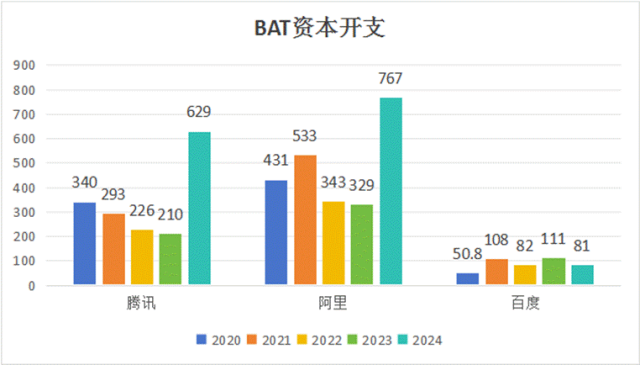

The combined capital expenditure of the four US tech giants over the past five years has reached RMB 5.36 trillion, while the combined capital expenditure of China's seven leading internet companies - Tencent, Alibaba, Baidu, JD.com, Kuaishou, Meituan, and NetEase - is only RMB 630 billion.

In 2020, this capital expenditure ratio was 1:6, and in 2024, it reached 1:10.

It should be noted that this already wide gap is based on the fact that companies like Tencent and Alibaba caught up after the emergence of Deepseek in the fourth quarter of 2024.

From a trend perspective, the gap will continue to widen in the coming years:

Microsoft, Meta, Amazon, and Google will have AI capital expenditure of nearly RMB 2.5 trillion this year.

Even considering unlisted companies like ByteDance, plus the AI capital expenditure of operators undertaking basic tasks, estimates by CICC suggest the overall amount in 2025 will not exceed RMB 500 billion.

It should be noted that this also includes plans for overseas expansion of AI, and the AI Capex actually invested in the Chinese market has significantly lagged behind US competitors.

03 "AI Deflation" Syndrome of Chinese Internet Giants

There are many reasons for the "AI deflation" in China's internet industry, and Chinese giants can find various excuses.

The most obvious is the chip-level restrictions, which many Chinese internet companies cite as an excuse for their delay in action:

Due to policy restrictions, it's impossible to purchase NVIDIA's cutting-edge performance graphics cards, and procurement volumes are also difficult to guarantee, rendering capital expenditure futile. At least for the five years before Deepseek emerged, this narrative held some weight.

Fairly speaking, US export controls have become increasingly stringent and complex over the past five years:

For example, the ban on advanced semiconductors in 2022 was expanded to cloud access and AI model weights in 2025, leaving China lacking cutting-edge AI chips and forcing developers to turn to local alternatives, but the performance gap of domestic chips remains significant.

But the situation is more complex than that.

Judging from the proportion of capital expenditure to operating net cash flow of leading overseas and domestic internet companies, the capital expenditure of leading US internet companies has reached 30% in recent years and is expected to reach 40% in the future. In contrast, leading Chinese internet companies have been at 15% in recent years and will be around 25% in the future.

In other words, due to the weaker profitability of Chinese tech companies, the proportion of investment in AI is also lower.

Where does the money of Chinese internet companies go?

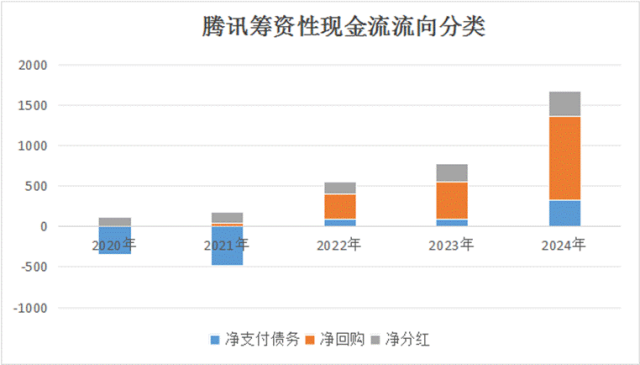

Let's take Tencent as an example:

In the past five years, Tencent's funds have been actively rewarding shareholders, with the amount of repurchases + dividends + debt repayment increasing yearly. In 2024, the total net amount of Tencent's repurchases, dividends, and debt repayment reached RMB 168.1 billion, more than twice the capital expenditure for the year.

The same is true for Alibaba:

According to the cash flow statement, in 2024, Alibaba invested a total of $16 billion in share repurchases, equivalent to RMB 116.8 billion, and distributed dividends of RMB 28.9 billion, totaling RMB 145.7 billion, which is also more than twice the AI capital expenditure for the year.

The situation of other internet companies is well-known.

Today, China's AI Capex only accounts for 0.1-0.2% of GDP, far lower than that of the US.

In other words, in the five years since the start of the AI race, Chinese internet companies have lagged behind US internet companies in terms of capital expenditure and AI infrastructure building, forming a significant "technical debt".

Most funds are used for dividends and repurchases, with market value management conducted through financial engineering.

"Technical Debt" is a concept first proposed by Ward Cunningham in 1992, analogous to the interest mechanism of financial debt. It refers to potential problems accumulated in software development due to adopting non-optimal solutions for short-term efficiency, which require additional costs to fix in the future.

I often recall Peter Thiel's classic pessimistic tone during the golden decade of the US stock market:

"Enterprises don't know where to invest their profits and can only use them to repurchase stocks, while investors who sell stocks also don't know where to invest their money and can only continue to buy back stocks. Amidst a blind and optimistic atmosphere in the stock market, the US has gone through another decade of technological stagnation."

At this moment, when Chinese internet pioneers, once representing the spirit of the times, don't know where to go in the future, Chinese tech companies have gone through five years of AI stagnation through repurchases and dividends.

In these five years, the competitive landscape of Sino-US AI has quietly reversed:

More capital of Chinese tech companies has been allocated to means of stabilizing market value such as repurchases, dividends, and debt repayment, while US tech companies have ambitiously invested more capital to embrace the overall improvement in organizational efficiency brought by AI.

Export restrictions from the US are only a small part of the factors contributing to the "AI deflation" of Chinese tech companies, and the emergence of Deepseek is proof of this;

Cynicism towards technological growth and using public opinion warfare to cover up their inaction in AI are the inner demons that Chinese tech companies find hard to overcome.

04 AI Capex: The Next Gray Rhino in the Sino-US National Power Competition

For today's AI Capex in the US, accounting for 25% of growth is not an impressive number. During the peak period of railway construction in US history, railway capital expenditure accounted for 6% of the country's GDP, and the railway fever across the nation reached its peak. Warren Buffett's grandfather made a fortune by studying railway bonds.

For AI data centers, the power of network effects will not be less than that of search engines in the internet era and operating systems in the PC era. The more people use AI, the harder it will be for competitors to catch up. Today's Chinese software companies going overseas basically have no low-hanging fruit, with every sector crowded, leaving no big fish in shallow pools.

Today, China's AI capital expenditure only accounts for 0.2% of the country's economy. This brand-new theme of the AI era has been infinitely marginalized in simplified Chinese mainstream narratives, with the inaction of Chinese tech giants being the core problem.

Today, AI Capex is not just about the Sino-US technology competition; it has become the core theme of economic competition and a key indicator of whether tech giants can still have influence in the next decade.

From Zuckerberg's perspective, this is an important reason why he's willing to bet heavily to stay in the game: For this 1.5-tier tech giant, which derives 99% of its revenue from advertising and has used open source from the beginning to try to slow down the progress of closed-source models, today's accelerated investment in AI is not too late.

Because there are even more Chinese 1.5-tier tech giants that haven't even obtained a ticket to the table yet.

05 In This AI Competition, Chinese Internet Giants Are Rapidly Being Marginalized

Let's compare another set of data to see the current situation of Sino-US competition in AI.

The weekly active users (WAU) of the diverse large models in the US, deduplicated across various metrics, have reached the level of 1 billion.

Today, the WAU of large models in China, after deduplication, is around 70 million.

The AI adoption rate of US companies (at least one department using one AI function) has reached 85%, and 90% for large companies.

However, the AI adoption rate of Chinese companies will not exceed 15%.

This also constitutes an important factor in the "AI deflation" of Chinese tech companies.

It should be noted that the high AI usage rate of US users is against the backdrop of:

In a market where the white-collar service industry accounts for more than 60% of the US economy, the extremely high costs of healthcare and education have become the next targets of the AI revolution:

Outpatient fees in the US start at $100 per visit, and AI large models can directly replace doctors' consultations with almost no need for promotion in the US; the high tuition fees of US universities have also become a market that large models can directly occupy.

The number of employees in China's advanced service industry is small, and the per capita GDP is lower, so the effective market that large models can serve is much smaller than that of the US.

It is understandable that the AI adoption rate of Chinese companies is much lower than that of the US: Even if Deepseek is completely free, the number of truly active weekly users of AI in China is still very limited, forming a ratio of 1:10 with the US.

It is not difficult to conclude:

With a relatively small effective market and lower substitution costs, the network effect of AI in China will be more limited, and the technological barriers faced by Chinese tech companies participating in global technological competition will rapidly increase.

To accelerate the usage rate of AI large models, Chinese tech companies not only need to quickly catch up in capital expenditure but, more importantly, they need to adopt the spirit of takeout and ride-hailing services, using more subsidies to bridge the gap in AI usage rates between China and the US, rapidly expanding the AI user base, and increasing the AI adoption rate of enterprises.

This poses the question of which came first, the chicken or the egg:

Disregarding the matter of chip performance, a lower AI usage rate directly correlates with a diminished return on AI capital expenditure. Consequently, the greater this disparity in return, the further China will trail behind the US in the AI race.

The clock is ticking for China's internet giants.