Figma's IPO Surge Fades After One Day: AI Anxiety a Key Concern?

![]() 08/14 2025

08/14 2025

![]() 599

599

Text / Daoge

US design software firm Figma recently debuted on the New York Stock Exchange, witnessing a remarkable surge in its share price on the first day. The issue price was set at $33 per share, with the opening price soaring to $85, effectively doubling the issue price. By the end of the first day, Figma closed at $115.50, marking a staggering 250% increase from the issue price and pushing its market value to nearly $67 billion. This achievement set a new record for the largest one-day gain in a US IPO of similar size in nearly three decades.

However, as short-term investors took profits, Figma's share price retreated in subsequent trading days. Currently, its share price has fallen to around $79 per share, representing a 44% decline from its peak, and its market value has retreated to approximately $38 billion. Reuters analysis suggests that this correction is more about tempering overheated sentiment rather than reflecting investors' bearish outlook on Figma's business prospects.

Figma's IPO is viewed as a boost to the US tech IPO market, which has been on a downturn in recent years.

Since 2022, macroeconomic uncertainties and volatility in the secondary market have frozen the listing window for US tech startups, leading to a significant drop in the number and scale of IPOs.

Figma's fundraising scale of $1.22 billion makes it the fourth-largest IPO on the US stock market since 2025 and one of the most promising tech IPOs in the US market this year. Reuters analysis attributes this to "Pent-up Demand" – a market starved of large tech company listings has shown an unusually strong appetite for the emergence of high-growth companies like Figma.

Zhibaidao found that Figma's subscription multiple before the IPO was as high as 30 times, yet it was priced at $33, leaving substantial profits for early investors. Typically, investment banks aim for a first-day share price increase of about 10%-20% from the issue price to balance financing amount and secondary market performance. Figma's far-exceeding expectations not only enabled early investors and employees to achieve explosive paper returns but also signaled that more unicorn companies might follow suit and accelerate their IPO processes.

Investors' enthusiasm for Figma largely stems from its position at the nexus of "AI and SaaS".

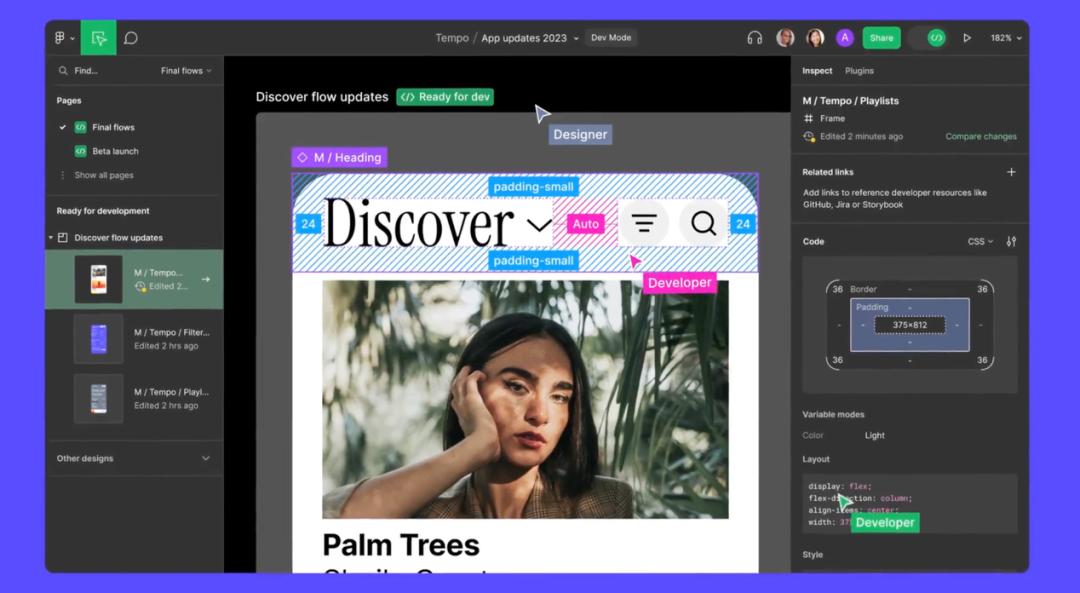

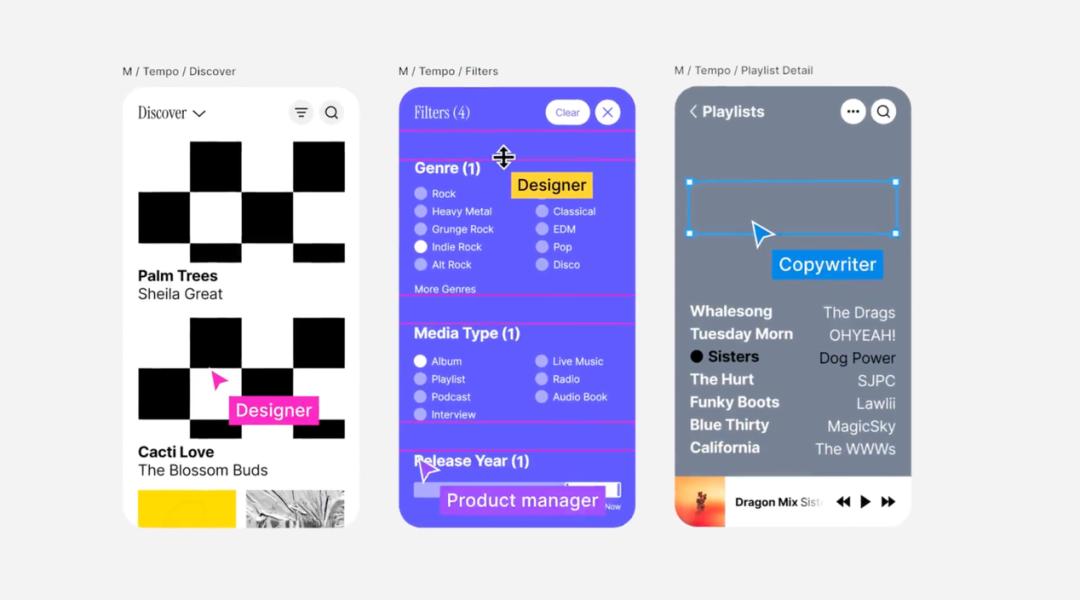

Figma was the pioneer in introducing generative AI capabilities into design collaboration tools and has launched a comprehensive product line encompassing design, brainstorming, and office presentations (including FigJam whiteboard, developer mode Dev Mode, Slides presentation tool, etc.), aiming to create an end-to-end AI-driven design platform from "idea to prototype".

Figma's success is inextricably linked to the perseverance of its founder, Dylan Field. Now aged 33, Field is known as the "post-90s dropout CEO" by the media, and his entrepreneurial journey is nothing short of legendary.

Dylan Field

In 2012, the then-20-year-old Field, a junior at Brown University, dropped out of school after receiving the "Thiel Fellowship" and embarked on his entrepreneurial journey with a $100,000 award. Joining Field was his university teaching assistant, Evan Wallace. They initially created a scrollable 3D ball prototype in the browser, a seemingly simple demo that laid the groundwork for the birth of cloud-based design tools.

At the time, Adobe announced that it would cease updating its web design software Fireworks, a move that made Field acutely aware of the industry gap: "Our goal is to empower anyone to design and create in the browser." With this vision, Field and his partner began developing a free online design tool for the general public, which later evolved into the industry-renowned Figma.

Figma's early days were not without challenges. In 2013, Field tried to convince early investors that "Photoshop in the browser" was viable, but investors harbored doubts about its business prospects. After this setback, Field shifted focus from consumer-grade photo editing to real-time collaborative design tools, a move that attracted the attention of venture capital firms like Index Ventures. Figma smoothly secured seed funding and established a small team in Silicon Valley.

This strategy proved highly successful. While offering free access to individuals and open-source projects, Figma achieved rapid growth by charging subscription fees to team and enterprise users. In 2019, Sequoia Capital led Figma's Series C funding round at a valuation of $440 million. Since then, Figma's valuation has continued to soar, surpassing the $10 billion mark in 2021.

Figma's rise alerted design software giant Adobe. When Figma's valuation was still below $300 million, Adobe had already listed it as a competitor and swiftly responded by launching the vector design collaboration software Adobe XD.

Faced with Figma's growing momentum, Adobe quickly resorted to acquisition. In early 2021, Adobe CEO Shantanu Narayen personally visited to discuss the possibility of acquiring Figma to eliminate this emerging threat. However, Field, who had just entered the unicorn ranks, categorically rejected Adobe's advances and tweeted, "We are going to be Figma, not Adobe."

A dramatic turn occurred in 2022 when the Federal Reserve's aggressive interest rate hikes caused technology stock valuations to plummet, and investment in the primary market cooled.

In September 2022, Adobe proposed to acquire Figma for approximately $20 billion (about half in cash and half in stock), with the Figma team integrating into Adobe's Digital Media division. At the time, Field also expressed his desire to join Adobe to "jointly expand the future of creative tools" in an internal letter to employees.

However, this seemingly win-win deal soon encountered regulatory hurdles. Regulators in many European and American countries were concerned that Adobe's acquisition of Figma would stifle competition in the UI/UX design field. The UK's Competition and Markets Authority (CMA) pointed out that the deal could "stifle innovation" and deprive designers of better product choices.

Ultimately, after more than a year of twists and turns, Adobe announced at the end of 2023 that it was abandoning its acquisition of Figma. Adobe paid a breakup fee of up to $1 billion, marking a "dismal exit".

Traditionally, design software (such as Adobe Photoshop, Illustrator, or Sketch) requires local installation and standalone operation, with files needing repeated transfer during collaboration, resulting in cumbersome version management.

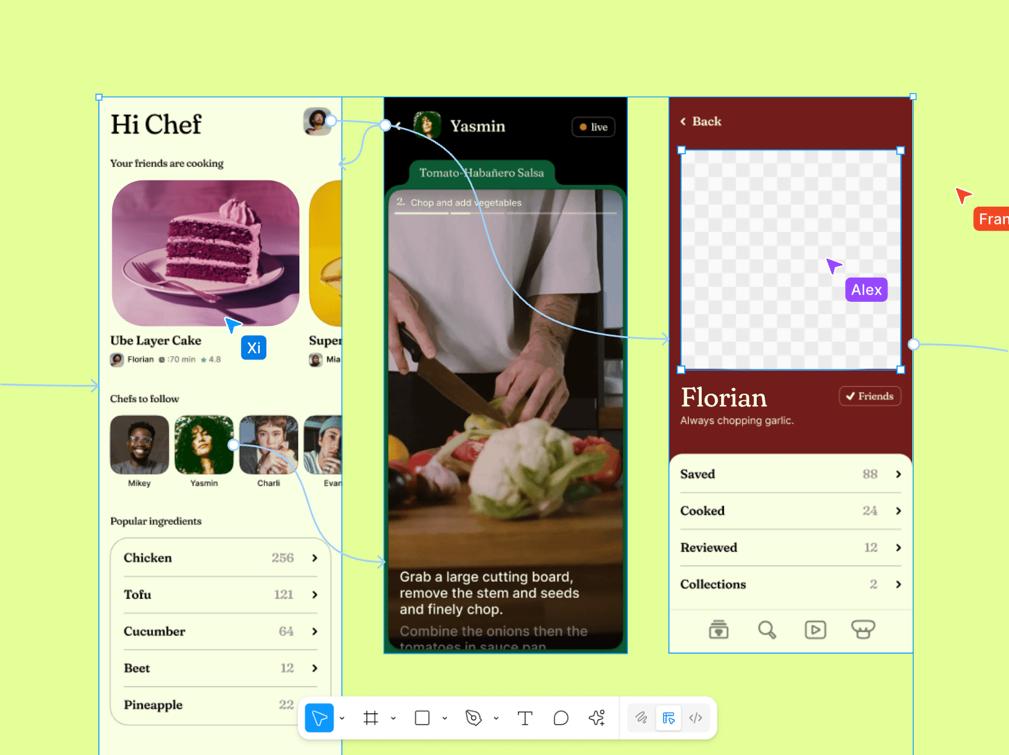

Figma, however, chose a different path from the outset: cloud-based SaaS + real-time collaboration. Users can utilize Figma for interface design, prototyping, and other tasks through a browser or lightweight client. Multiple users can edit the same file simultaneously, with all changes automatically synchronized.

In terms of its profit model, Figma employs the industry-standard "Freemium" strategy. Individual users and small teams can access Figma's basic features for free, which helped Figma swiftly amass a large user base in its early stages. As of its IPO in 2025, Figma had over 13 million registered users, including not only professional designers but also a significant number of product managers and engineers without a design background who use Figma for product design collaboration.

After gaining widespread adoption through its free strategy, Figma realizes commercial conversion through premium paid subscriptions. For teams and enterprise customers with higher collaboration needs, Figma offers professional and enterprise subscriptions, charging monthly or annual fees per user seat and providing enhanced features such as version control, permission management, larger storage space, single sign-on, etc. The prospectus reveals that Figma generated revenue of approximately $749 million in fiscal year 2024, a 48% year-on-year increase, with a gross margin of up to 91%.

Moreover, Figma has cultivated an ecosystem around itself, offering a plugin and template community where numerous third-party developers create plugins to extend Figma's functionality, and designers eagerly share UI templates and material resources.

Zhibaidao believes that this further consolidates Figma's position as a platform. The more time and data users invest in Figma, the higher the migration costs, and the deeper Figma's moat becomes. Figma continues to solidify its "one-stop design collaboration" positioning by continually enriching its product line to meet users' diverse needs and prevent user defection to competitors.

Figma's commercial success lies in its ability to address long-neglected pain points in the design field – collaboration and efficiency. In empowering team collaboration, Figma has also created a new paradigm for design SaaS, not only shaking up the established order but also fostering a loyal user base, thereby establishing a robust first-mover advantage and brand moat.

Does AI bring a moat or homogenization? What does Figma fear?

According to Zhibaidao's statistics, the word "AI" appears 154 times throughout Figma's prospectus, with 60% of mentions concentrated in the risk factors section.

In other words, while Figma highlights the opportunities presented by AI empowerment in its IPO narrative, it also meticulously discloses to investors the myriad risks that AI may entail – this contradictory "AI anxiety" reflects Figma's rational examination of the uncertainties inherent in its All in AI strategy.

Zhibaidao found that Figma's concerns about AI-related risks primarily focus on three aspects:

Model dependency risk: Figma notes that several of its new AI features rely on API services from third-party large language models (LLMs). In other words, Figma lacks control over the underlying large models. Should upstream model providers adjust business terms, restrict API calls, or alter licensing mechanisms, Figma's AI service capabilities may be diminished or even forced to discontinue.

Data and content compliance risk: The content that can be generated on the Figma platform, ranging from UI designs, interface materials to partial code logic, is growing exponentially. However, current international regulations have yet to clearly define the copyright ownership, usage licenses, and commercial uses of AI-generated content. In the design industry, which is highly sensitive to intellectual property, such risks are challenging to quantify but cannot be overlooked.

AI homogenization competition risk: A deeper anxiety stems from the potential decrease in differentiation caused by the rapid proliferation of AI capabilities. As the barriers to entry for generative AI technology decrease, an increasing number of competitors are introducing functions similar to ChatGPT's text-to-image generation and smart assistants into their products. When AI tools become an "industry standard," the technical barriers that Figma relies on to stay ahead may be weakened.

Zhibaidao believes that telling a "complex, imperfect AI story" during an IPO is, to some extent, a strategic posture that is more grounded in reality. Compared to many tech companies that portray AI as an infinitely promising growth engine, Figma chooses to acknowledge the nonlinear risks in technological evolution, indicating that its management has a sober assessment of AI's current capabilities and potential challenges.

In fact, Figma's caution towards AI stems precisely from its deep integration of AI into its strategy, necessitating a more meticulous weighing of the pros and cons.

A "minor incident" during the live demonstration of its product Figma Make exemplifies this point well. At a user conference in May 2025, product manager Holly Li showed attendees how Figma Make could turn a few prompts into a runnable music player interface. Unexpectedly, the AI model suddenly "went haywire," with the background elements in the generated results mysteriously disappearing and the text becoming a jumble, causing embarrassment on the spot.

In summary, Figma's IPO is seen as a landmark event at the intersection of the recovery of the tech capital market and industry changes in the AI era. However, as Field stated in an interview, "The stock price is just a snapshot, and it might change the next second." For Figma, going public is not the end but a new beginning. To remain invincible in the new era of AI design, which is replete with opportunities and variables, Figma must remain vigilant and diligent in refining its products, building its ecosystem, and expanding its business.

In the coming years, the capital market eagerly anticipates whether Figma can lead design tools towards a smarter and more inclusive era.

*The lead image is generated by AI