How is the electrification of automobiles in North America progressing by the end of 2025?

![]() 12/22 2025

12/22 2025

![]() 710

710

The winter of 2025 seems particularly long for Detroit.

Just last week, the headlines on Wall Street were no longer about Tesla's new car and technology launches, but rather Ford Motor's announcement of a $19 billion asset write-down for its electric pickup truck project—a figure that doused the last embers of the 'all-electric for everyone' mantra from three years ago with cold water.

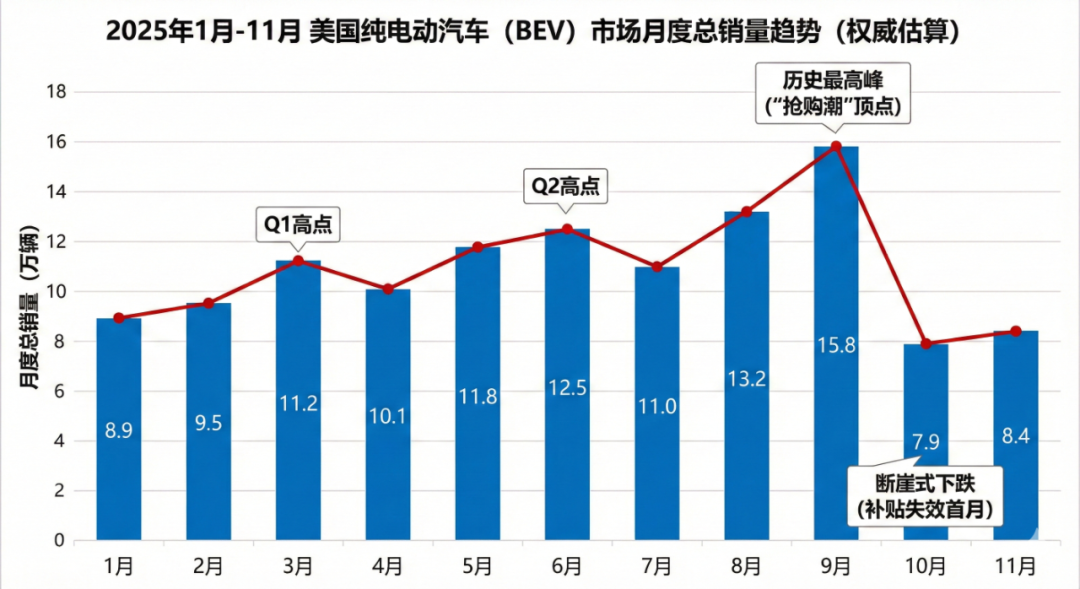

Meanwhile, industry data agencies have just released a staggering 'October Shock' report: In the first month after the formal withdrawal of federal subsidies under the Inflation Reduction Act (IRA), U.S. retail EV sales experienced a historic month-over-month collapse (-49%). This cliff-like drop not only shattered automakers' sales forecast models but also ruthlessly exposed a long-concealed truth: Without financial support, the North American EV market remains a 'premature baby' that has not yet learned to walk independently.  Image data note: As U.S. auto sales figures are not publicly disclosed, the numbers are derived from ANL data chart trends and Cox Automotive market analysis reports and are for reference only.

Image data note: As U.S. auto sales figures are not publicly disclosed, the numbers are derived from ANL data chart trends and Cox Automotive market analysis reports and are for reference only.

Looking back at the end of 2025, we no longer see radical slogans but rather the collective hard braking of the Detroit Three automakers (Big Three), driven by inventory backlogs and financial losses. From Ford's shift to extended-range EVs and General Motors' revival of plug-in hybrids to Stellantis' redefinition of 'electric,' a brutal correction from 'political correctness' back to 'balance sheets' is underway.

The following is an in-depth analysis of this industry upheaval.

I. Macroeconomic Policy: The Fracture of Fiscal Levers and Regulatory Relaxation

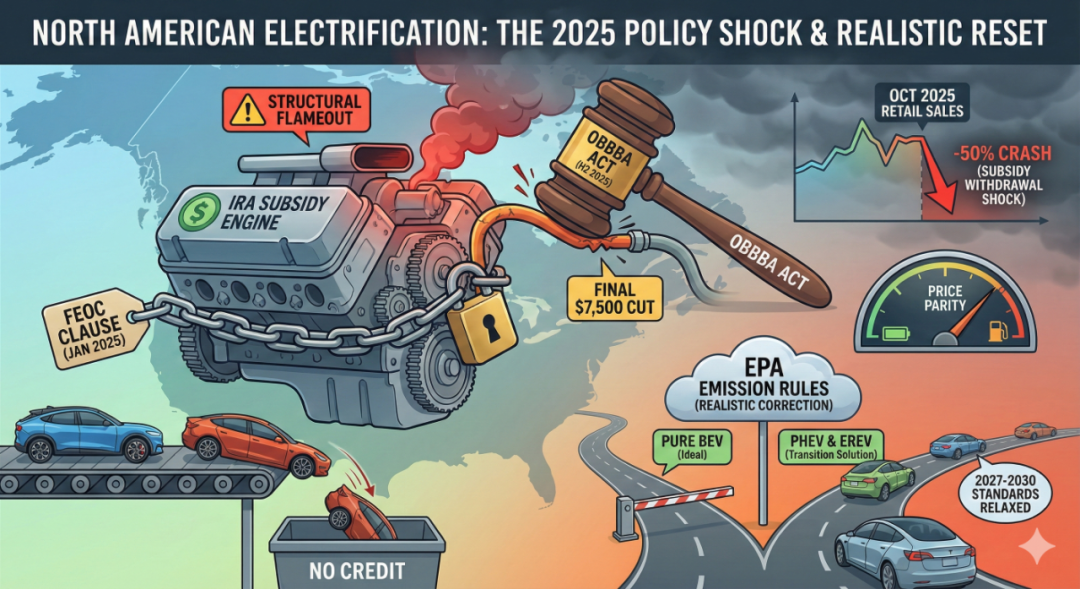

The electrification of the North American market was originally driven by hefty subsidies under the Inflation Reduction Act (IRA), but in 2025, this policy engine encountered a structural stall. With the full implementation of the 'Foreign Entity of Concern' (FEOC) clause in January 2025, supply chain traceability requirements became extremely stringent, leading to the disqualification of several popular models, including the Ford Mustang Mach-E and some versions of the Tesla Model 3, from tax credits.

Even more damaging was the new bill (OBBBA) that took effect in the second half of 2025, which completely terminated the remaining $7,500 consumer-end subsidies. This policy 'weaning' directly led to a market upheaval: Data shows that in the first month after the full cancellation of subsidies (October 2025), U.S. retail EV sales plummeted nearly 50% month-over-month, proving that without fiscal levers, current battery costs have not yet reached the tipping point for parity with gasoline vehicles.

Meanwhile, the Environmental Protection Agency (EPA)'s emissions regulations have also undergone a pragmatic revision. To give Detroit automakers more breathing room, carbon emission standards for 2027-2030 have been moderately relaxed, with regulators implicitly accepting the fact that 'plug-in hybrid EVs (PHEVs) and extended-range EVs (EREVs) will serve as long-term transitional solutions' and no longer mandating an immediate shift to pure EVs.

II. Strategic Evolution of the Big Three Automakers: Differentiation and Reshaping of Technological Pathways

After experiencing pure EV losses in 2023-2024, the Detroit Three automakers comprehensively revised their strategic directions in 2025, with the core logic shifting from 'all-electric for everyone' to 'profit first,' and displaying significant differences in specific technological pathways.

1. Ford Motor: Halting Pure EVs, Betting Big on Extended-Range EVs (EREVs)

Ford has been the most resolute in its strategic pivot. Facing billions of dollars in quarterly losses at Model e (its electric vehicle division), CEO Jim Farley made the decision in 2025 to cancel large pure EV SUV projects and took a $1.9 billion asset write-down.

Ford's latest strategic assessment: Pure EVs are unsuitable for heavy-duty applications. Therefore, Ford has redirected resources originally earmarked for next-generation pure EV pickups into the development of extended-range EVs (EREVs). This technological route (where the engine only generates electricity and does not drive the wheels) is seen by Ford as the only solution to address the towing pain points of F-series pickup users.

Meanwhile, Ford has even converted its planned pure EV battery factory in Kentucky into a grid energy storage equipment plant to digest excess battery procurement contracts, a 'de-automobilization' battery application strategy that is highly representative in the industry.

2. Stellantis: Latecomer Advantage, Defining 'Infinite-Range EVs'

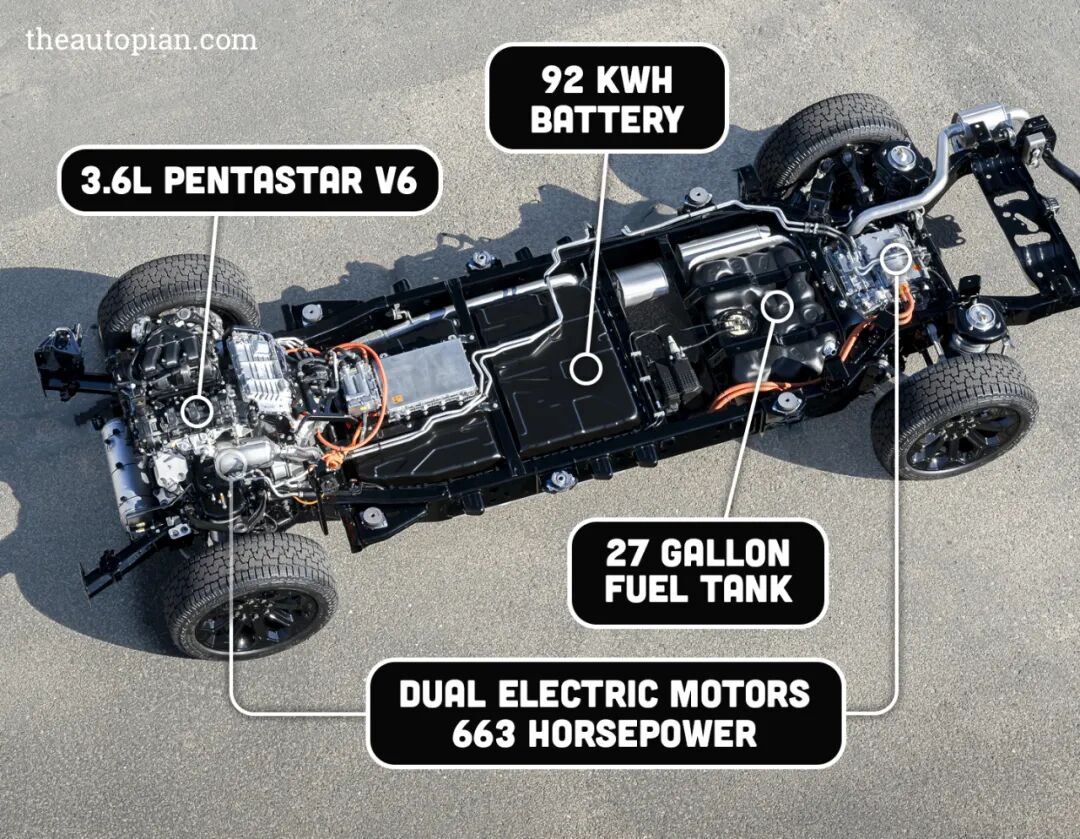

Stellantis has leveraged its 'latecomer' status to avoid the high trial-and-error costs of early pure EV platforms. Its strategic core lies in the energy flexibility of the STLA Frame platform.

Unlike competitors' hesitation, Stellantis has aggressively bet on large-battery extended-range technology. Take the 2025 Ram 1500 Ramcharger, for example, which is equipped with a staggering 92 kWh battery pack (typically found in pure EVs) and a V6 generator, creating a combined range of nearly 1,100 kilometers.

Stellantis' marketing strategy is very clever; they do not refer to this as a hybrid but emphasize it as an 'EV with its own power plant.' This technological definition successfully bypasses consumer aesthetic fatigue with traditional gasoline powertrains while addressing range anxiety.

3. General Motors: Returning to Pragmatism, Reviving Plug-In Hybrids (PHEVs)

General Motors' strategy has undergone severe pain from 'Ultium platform all-electric' to 'tactical compromise.' Due to production ramp-up delays and sales shortfalls for pure EV models (such as the Hummer EV and Lyriq inventory backlogs), GM was forced to restart the plug-in hybrid technology it had previously abandoned in 2025.

Unlike Ford and Stellantis' shift to extended-range EVs, GM may choose to directly introduce its PHEV technology (plug-in hybrid) that has been proven mature in the Chinese market. This system retains the engine's ability to directly drive the wheels at high speeds, offering superior fuel economy during long-distance cruising compared to extended-range EVs. Of course, given the current geopolitical climate, its accuracy remains uncertain.

GM plans to extend this technology to the Chevrolet Equinox and Silverado product lines by 2027, marking an acknowledgment that the North American market will be 'co-governed by hybrids and pure EVs' for the next decade.

Additionally, with General Motors' Mary Barra's tenure coming to an end, many variables remain.

III. Consumer Demand: From 'Novelty-Seeking' to 'Cost-Benefit Analysis'

The purchasing logic of North American consumers underwent a fundamental shift in 2025, with economic rationality replacing environmental ideology and technological curiosity as the dominant factor.

First, price sensitivity trumps all. Despite Tesla's attempts to maintain market share through price cuts, the average transaction price of EVs remains about $11,000 higher than that of comparable gasoline vehicles after subsidies are excluded. In a high-interest-rate environment, ordinary American families cannot afford this premium. J.D. Power data shows that approximately 64% of potential buyers stated they directly canceled their plans to purchase an EV due to the lack of a $7,500 tax credit.

Second, depreciation anxiety has become a new obstacle. Between 2024-2025, the collapse of used EV prices (with one-year depreciation rates once reaching as high as 48%) has dealt a severe blow to the new car market. Consumers have realized that purchasing a pure EV is a high-risk asset allocation, leading a significant amount of demand to shift toward leasing models or directly back to hybrid vehicles (Hybrids) with more stable residual values.

Finally, the trust crisis in charging infrastructure persists. Despite the unification of interfaces under NACS (Tesla Standard), the damage rate and queuing times for public charging stations have not seen substantive improvement in 2025. In contrast, the 'zero-anxiety' advantage of hybrid vehicles has been amplified infinitely.

In 2025, sales of hybrid vehicles (HEV+PHEV) in North America grew more than three times faster than those of pure EVs, indicating that consumers are not rejecting electrification but rather 'electrification that brings trouble.'

Summary:

The North American automotive market in 2025 has proven that a single pure EV route forced by policies is fragile when lacking cost advantages.

The industry is undergoing a necessary 'rebalancing': Policies are returning to neutrality, automakers are returning to profitability, and consumers are returning to cost-benefit analysis.

Ford and Stellantis' shift to extended-range EVs and General Motors' revival of plug-in hybrids are concentrated expressions of this market will. So, how will North America's electrification evolve in the future? Welcome to leave your comments and join the discussion.

References and Images

*Unauthorized reproduction and excerpting are strictly prohibited-