AI Advertising Ushers in a New Era: Mobvista Rises Amid AppLovin's Profit Surge

![]() 08/14 2025

08/14 2025

![]() 481

481

"Generative AI is propelling the advertising network from an era of 'traffic competition' to one of 'algorithmic flywheel' efficiency."

Recently, advertising industry stocks in the U.S. have reported robust growth, with the commercial potential of AI-powered advertising becoming a key discussion point. Six months later, market sentiment for AI+applications has surged again, receiving positive feedback from investors in the secondary markets of U.S. and Hong Kong stocks.

Among these, Mobvista has shown the strongest momentum. As of August 14, its share price surged 11% on the day, setting a new all-time high. Institutions explain that the integration of AI+advertising is accelerating revenue growth, and leading platforms are expected to maintain their dominant positions.

From a business logic perspective, why is Mobvista considered a "potential stock" among Chinese companies that benchmark AppLovin?

AI Redefines Advertising Growth Cycles, U.S. Digital Advertising Sees Winners Take All

As 'AI Redefining Advertising' transitions from concept to reality, leading enterprises' financial reports serve as the most direct verification tools. In the second quarter of 2025, U.S. digital advertising companies used hard data to prove the commercial viability of 'AI+advertising', but only AppLovin and META have truly gained market recognition. In comparison, companies like SNAP, Pinterest, Roku, and The Trade Desk all underperformed.

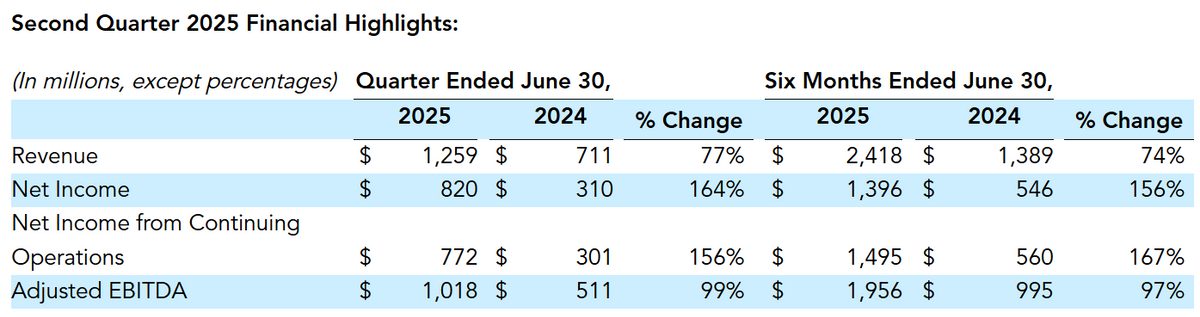

AppLovin, a digital advertising and marketing company originally rooted in game agency and now focusing on APP marketing software, exemplifies this trend with its second-quarter financial report: revenue increased by 17% year-on-year to $1.259 billion; net profit surged by 164% to $820 million, and adjusted EBITDA increased by 99% year-on-year. All three core financial indicators significantly exceeded expectations.

Behind this growth, its self-developed AI advertising engine AXON 2.0 successfully covered high-growth areas such as e-commerce and fintech through dynamic budget allocation and real-time bidding optimization, driving a 77% year-on-year increase in advertising sales (excluding games). AppLovin's quarterly report further reinforces and validates the investment logic of the 'AI-driven advertising efficiency revolution'.

More importantly, based on these impressive achievements, AppLovin appears to be on a roll, taking strategic measures of 'breaking away' – divesting the remaining gaming business and fully committing to the closed-loop construction of 'AI+advertising'. It is highly confident in the future, with a median revenue guidance of $1.33 billion for the third quarter, continuing to exceed market expectations.

In an industry in the early stages of large-scale verification and implementation of new technology commercialization, the number of players that can validate investment logic typically evolves from 'absolutely scarce' to 'relatively scarce' to 'ubiquitous'.

Meanwhile, social media giant Meta Platforms also delivered an 'AI-enhanced' report card.

As the world's largest social platform, Meta's AI+advertising capabilities have long been proven, and Q2 still exceeded expectations: the AI recommendation model increased Instagram's conversion rate by 5%, and Reels advertising revenue increased by 21% year-on-year (accounting for 98% of total revenue), driving total revenue and net profit to increase by 22% and 36%, respectively, on a large base.

Unlike AppLovin's 'closed loop' and Meta's 'social barriers', the smaller TTD lagged behind after choosing 'open ecosystem + AI efficiency'. With the accelerated penetration of AI advertising, it has become an industry consensus that the global advertising market is entering a period of 'intelligent' reconstruction.

After AppLovin's financial report was released, multiple institutions such as Oppenheimer and Bank of America raised their ratings. The secondary market also voted with its feet, with the share price rising by nearly 16% on the first day after the results announcement and ultimately closing up by over 11%; in contrast, Meta's share price performance after the results announcement saw a sustained slight adjustment.

Placing this in the context of the industry as a whole, it reflects differences in industry tiers: Meta and Google, the two giants, still dominate the digital advertising sector with deep moats and steady performance growth; however, AI serves more as an endogenous driving force for them, with limited share growth space and short-term profit elasticity.

What excites investors is that players like AppLovin have found a breakthrough point amidst the impact of AI technology and are regarded as targets with high growth elasticity and high certainty in reshaping the AI advertising landscape – they may achieve a leap in performance and also boost their market position.

Therefore, for investors, AppLovin offers better investment 'value for money' in terms of comprehensive dimensions such as growth elasticity and the profitability of reshaping the landscape.

Chinese Stock Benchmarking: Mobvista Leads with a 1.6x Increase

Corporate and industry benchmarking are often clever speculative strategies used in the secondary capital market. Especially in China, with its vast commercial resources, highly mature e-commerce system, and high technology acceptance across various industries, the market predicts that leading enterprises may overtake in the 'AI+advertising' sector through 'scenario data + AI capabilities'.

Among them, Chinese stock Mobvista is a popular benchmarking option. Since bottoming out in September 2024, its Hong Kong stock price has increased by over 8.7 times cumulatively within 11 months, with fluctuations in between but excellent valuation resilience; it has achieved a phased increase of 1.6 times since April.

Undoubtedly, investors' actual bets with real money in the secondary market are the most practical.

In fact, when discussing the implementation of AI+advertising at home and abroad, the market often compares Mobvista and AppLovin together.

There are indeed some similarities in their past paths; both have cultivated vertical gaming scenarios and may be pioneers and growth potential stocks in the AI+advertising sector; however, there are still differences in the paths they will take in the future. The latter has chosen to fully focus on 'AI advertising' by leveraging the advantages of new technology; while the former still adheres to a dual-wheel drive strategy of gaming and non-gaming.

As for which of these two paths is better, it is not an either-or question, nor can the outcome be determined in a few words. The key is to suit oneself.

At least for now, Mobvista, which has chosen to 'walk on two legs', has built a synergistic barrier of 'advertising technology + marketing technology': its GameAnalytics platform has accumulated data on over 119,000 game behaviors (covering over 97,500 active games and 194 million monthly active users), which feeds back into the advertising model to improve conversion rates; at the same time, its 'user segmentation + dynamic creative generation' technology for e-commerce clients significantly improves material production efficiency.

This 'data-algorithm-scenario' closed-loop capability transforms it from a 'traffic intermediary' to a 'technology enabler'.

From a valuation pricing perspective, in the short term, the market will focus on whether Mobvista's Q2 performance meets expectations; in the medium to long term, it depends on whether it can complete its transformation from a 'traffic intermediary' to an 'algorithm service provider', which will be the key to its ability to rank among the world's top tier of AI advertising.

But the question is, why has Mobvista become one of the preferred benchmarking targets among Chinese stocks in the 'AI+advertising' sector?

The direct reason in form may be that in the Chinese market, Mobvista and AppLovin occupy similar positions in the industry tier.

The answer on the operational side may lie in the fact that it not only possesses technological barriers to compete with international giants but also captures the dual dividends of Chinese overseas enterprises and emerging markets.

Mobvista's core platform Mintegral has established global competitiveness in the programmatic advertising field and has ranked third in the global all-category volume ranking on the Android side for three consecutive years (second only to Google and Meta), with its strength ranking simultaneously jumping to third; it ranks sixth in the iOS all-category strength ranking and second in the gaming category volume ranking.

Behind this is the support of the 'AI+machine learning' intelligent bidding system – since the launch of intelligent bidding products such as Target ROAS in 2023, such products have contributed over 80% of the revenue and become the core engine of Mintegral's growth. In 25Q1, its Mintegral revenue increased by 48.4% to $420.8 million.

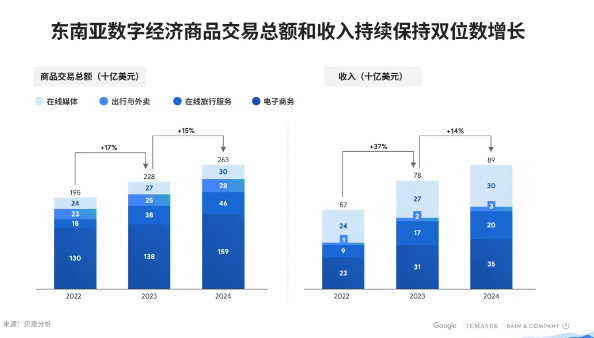

At the same time, its revenue structure is naturally compatible with the global advertising trend of 'regional differentiation'. Nearly half of its revenue comes from the Asia-Pacific region, with emerging markets such as Southeast Asia and the Middle East serving as key growth engines. According to Statista's forecast, the scale of e-commerce advertising in Southeast Asia will reach four times that of gaming advertising by 2025, and Mobvista, with its leading market share in the region and in-depth cooperation with top e-commerce platforms such as Shopee and Lazada, will directly benefit from the increase in local internet penetration and consumption upgrades.

More importantly, Mobvista, in its role as a 'seller of advertising technology water', is deeply tied to the wave of Chinese companies going overseas. Currently, it serves over 10,000 global advertisers and over 110,000 top applications, covering fields such as gaming, e-commerce, and social networking.

It is reported that in Q1 2025, the budget of Chinese cross-border sellers on its platform increased sixfold year-on-year, behind which is the industrial upgrade of 'cross-border e-commerce + AI' – more and more Chinese enterprises optimize product selection and marketing through AI, and Mobvista is a key technological partner for their 'overseas customer acquisition'. This tie-up will bring long-term growth momentum.

The financial report shows that its e-commerce advertising revenue in Southeast Asia increased by 82% year-on-year in the first quarter, significantly higher than the overall growth rate. In contrast, although overseas forces such as AppLovin have an advantage in the European and American markets, they are weaker in serving Chinese overseas enterprises and have limited ability to share the dividends of this round of industrial transfer.

The 'Golden Age' of AI Advertising: A Window of Opportunity Just Opening

From an industry future perspective, the performance explosion of leading enterprises is not an isolated event but an inevitable result of the global advertising market's transformation from 'incremental to stock, from extensive to refined'. 'Intelligence' is merely a tool that catalyzes this outcome.

First, the peaking of traffic forces advertisers to 'reduce costs and increase efficiency', making AI a 'must-have'. Global internet traffic growth has nearly stagnated, and the effectiveness of the traditional 'buying traffic' model is diminishing. At this point, the demand of advertisers shifts from 'reaching more users' to 'reaching more precise users'.

WPP Media's 'This Year, Next Year' report states that the global advertising market will grow by 6.0% in 2025, with digital advertising accounting for 73.2% (including traditional media's digital derivative channels reaching 81.6%); and over half of the advertising revenue from user-generated content (UGC) comes from platforms like TikTok and YouTube, with advertising revenue for content creators expected to double to $376.6 billion by 2030.

This means that advertisers need smarter tools to accurately match target users from massive UGC content, and AI is the core solution to this problem.

Second, as privacy policies in various countries and regions tighten, the data monopoly of traditional traffic giants such as Google and Meta is weakened, and advertisers begin to seek 'decentralized' delivery channels, bringing 'decentralized' opportunities for advertising technology companies.

TTD's open ecosystem and Mobvista's 'multi-cloud scheduling' strategy target this trend – by integrating multi-platform data to provide advertisers with more flexible and compliant delivery solutions.

Third, the fragmentation of media and the dispersion of user attention force advertising technology to undergo 'intelligent upgrades'.

The 'aggregation platformization' of media (such as super apps) and the 'fragmentation' of content have made advertising delivery significantly more difficult: how to balance the scale of breadth (covering users) with the depth of interaction (user participation)? The answer is 'AI-driven intelligent ad delivery'.

In summary, the global advertising market is undergoing a triple transformation from 'traffic to algorithms, from centralized to decentralized, from extensive to refined', and AI+advertising is the core driving force behind this transformation.

In this transformation, the story of 'Mobvistas' has only just begun, and it is uncertain who will be the biggest beneficiary of industry changes or even become a rule reshaper.

Source: Hong Kong Stock Research Society