Palantir's High-Stakes Game

![]() 08/14 2025

08/14 2025

![]() 613

613

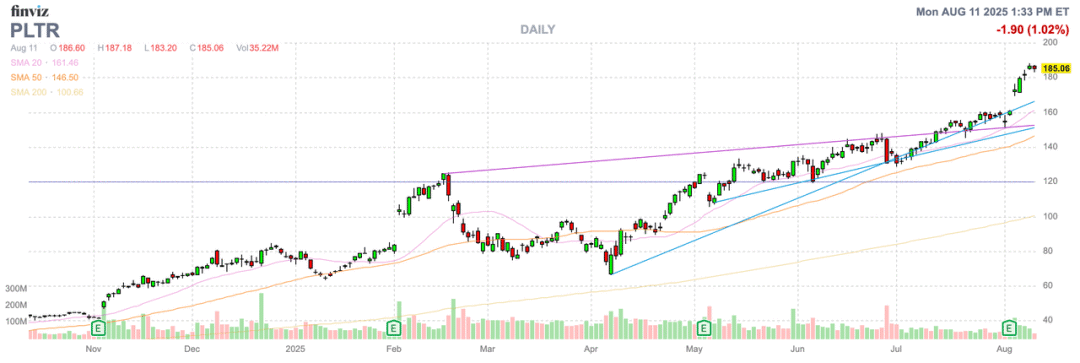

Palantir Technologies (NASDAQ: PLTR) continues to shine as American businesses invest in AI software to enhance operational efficiency, benefiting the company significantly. However, despite the potential growth of this enterprise AI software company in the next decade, its current massive stock valuation is unsustainable, reminiscent of the post-internet bubble stocks in 2000. Analysts are deeply skeptical, warning investors that they are playing a high-stakes game.

Palantir stands as a leading player in the enterprise AI software market. The company reports a surge in US commercial accounts, with a 64% increase last year, reaching 485.

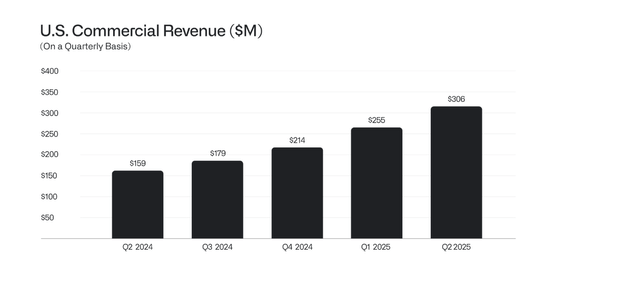

In the second quarter of 2025, revenue soared 48%, surpassing $1 billion for the first time. Notably, US commercial revenue grew by an astonishing 93%, although sales for the June quarter only reached $306 million.

Palantir's rapid growth is largely attributed to its nascent stage in the AI business. However, as revenue scales to $5-10 billion, growth is expected to slow down in the coming years.

In a shareholder letter, CEO Alex Karp inadvertently reminded investors that after more than 20 years of development, the company's business seems to have just emerged from a "virtual startup phase," with skepticism gradually fading. Despite years of investment and ridicule, the company's growth has significantly accelerated, and skeptics have been worn down.

This upward trajectory reflects the remarkable convergence of language models, the chips required to power them, and Palantir's software infrastructure, enabling organizations to connect the power of AI with real-world objects and relationships.

Snowflake's total revenue is similar to last year, but its sales growth rate has fallen below 30%, leading to a sharp drop in its stock price. In 2020, the company's stock price was near $400, but it fell to $100 last year. However, in the third fiscal quarter of 2022, Snowflake's sales once grew by 110%, surpassing Palantir's commercial growth rate.

Undoubtedly, Palantir will expand faster than Snowflake, but this example underscores the risks when popular narratives falter. While demand for Palantir remains substantial, the company's ability to keep up is questionable, and this confluence of events will eventually dissipate.

This quarter, Palantir's total contract value reached $2.3 billion, with an annual contract value of $684 million and an average contract duration of 3 years. Demand is undoubtedly set to remain strong in the coming years.

Palantir's valuation is exceedingly high, with the appreciation from equity incentives far outstripping what its financial performance can support. Over the past year, the number of shares of this enterprise AI software company has increased by 148 million, bringing the diluted total share count to 2.56 billion.

Equity dilution alone has added nearly $28 billion to the company's market capitalization, while the company expects revenue to reach only $4.15 billion. The market capitalization contributed by such a large-scale equity incentive is seven times the revenue target and exceeds the price-to-sales ratio of large enterprise software companies like Salesforce. This is just the value brought by stock options and restricted stock units (RSUs) granted to executives and core talent.

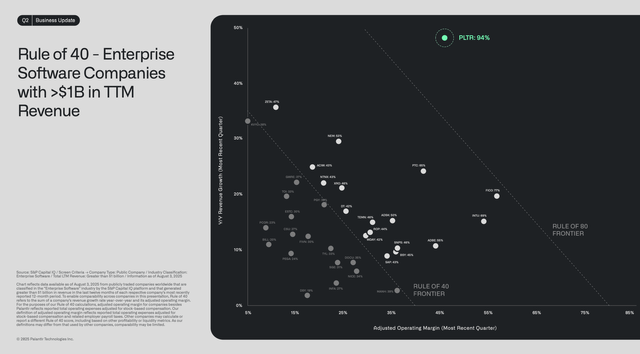

Even the calculation of the "Rule of 40" is highly exaggerated. Palantir's "Rule of 40" figure is 94%, consisting of 48% growth and 46% adjusted operating margin.

A large tech company with normal levels of equity incentives would not report such a high operating margin. Palantir's ability to do so is partly due to a 19-percentage-point difference between its GAAP (Generally Accepted Accounting Principles) operating margin and its adjusted margin.

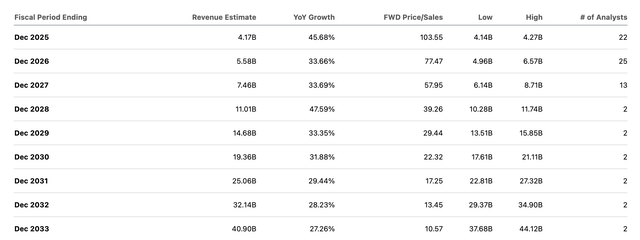

While the magnitude of equity dilution is not significant (a 6% increase year-over-year from 2.41 billion shares in the second quarter of last year), it is crucial for a stock with a price-to-sales ratio exceeding 100x. Palantir's current diluted market capitalization is $474 billion, while analysts expect revenue to exceed $40 billion by 2033.

The stock's price is 12 times the revenue target for eight years from now (the chart does not include the diluted market capitalization). Even considering profits (given the company's high profit margins), Palantir's stock price is equivalent to 30 times the expected earnings per share of $6.10 in 2033.

Additionally, it's worth noting that Palantir has only reported $3.6 million in income taxes. With a tax rate of 22% for Salesforce, Palantir will eventually apply a similar tax rate, significantly reducing its reported net profit.

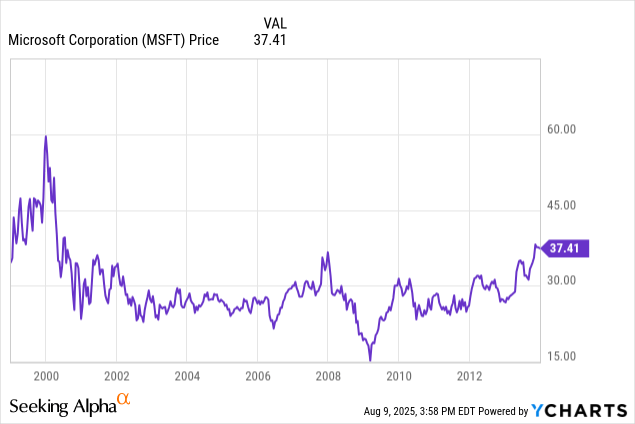

Microsoft investors who bought at the high of $60 in 2000 and held until the end of 2013 saw their investment shrink by 50% over 14 years. Worse still, during the market lows of the 2008/09 financial crisis, the decline was around 75%.

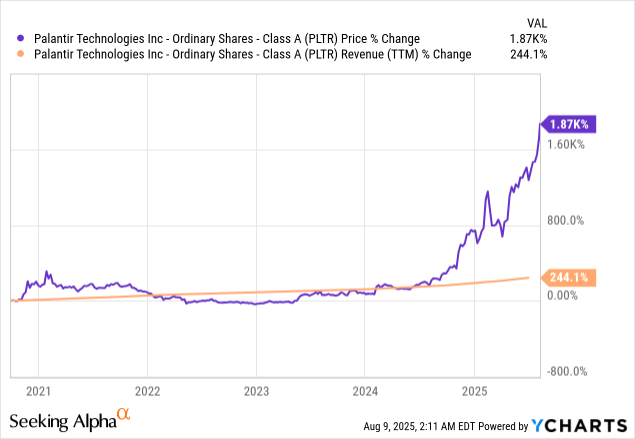

If the above data isn't enough to highlight the market's misplaced priorities, the chart below should clarify the investment logic. Over the past five years, the company's stock price has risen by 1870%, while its business revenue has only increased by 244%.

Currently, the market is failing to properly reflect risks, with the stock price reaching 100x the sales target, reducing the value of future SBC awards. Employees receiving stock options lack reasonable future appreciation opportunities, limiting Palantir's attractiveness and potentially causing current employees to lose interest in staying on.

Reports suggest that 50% of NVIDIA's (NVDA) employees are now worth more than $25 million, and over 80% have a net worth of over $1 million, thanks to stock option appreciation. Palantir's employees face a similar situation, and over time, the company may encounter a "semi-retirement" scenario where employees lose motivation due to stock appreciation.

However, the stock price could still surge. After a potential double-top formation a few months ago, Palantir has already risen by more than 50%, making it unrealistic to short the stock before a momentum reversal.

For investors, it's crucial to understand that Palantir's shareholders are playing a high-stakes game. Any minor setback in the business could send the stock price plummeting by more than 75%, and even at a market capitalization of over $100 billion, questions about Palantir's worth persist—much like Microsoft's "lost decade."

Despite the high risks, the stock price could still reach $200, or even a market capitalization of over $1 trillion. Palantir may continue to report accelerated growth for some time, and the market tends to remain bullish in such situations. However, from now on, the higher the stock price rises, the greater the downside risks will be.