Tencent AI Garners Early Success: Another 'WeChat-Level' Game Changer?

![]() 08/14 2025

08/14 2025

![]() 635

635

The strategic significance of AI surpasses that of Tencent's 'hope of the entire company', Video Number, potentially rivaling WeChat in its value as a catalyst for a new cycle.

By Wan Tiannan

Edited by Chen Jiying

Tencent has once again emerged victorious in the second quarter.

Both revenue and net profit exceeded expectations. Previously, securities firms generally predicted Tencent's Q2 revenue to be around 180 billion yuan, with Guohai Securities estimating 179.6 billion yuan and Everbright Securities anticipating 179.9 billion yuan. However, Tencent's actual revenue reached 184.5 billion yuan.

Particularly noteworthy is the advertising business. According to QuestMobile, China's Internet advertising market grew by only 6.8% year-on-year in Q2 2025, whereas Tencent's Q2 advertising revenue surged 20%, significantly outperforming the market.

What fueled this surge in advertising? James Mitchell, Tencent's Chief Strategy Officer, revealed that it was driven by AI and an ecological closed loop. "Our deployment of AI in the advertising field is a crucial variable."

He also clarified, with a touch of sarcasm, that e-commerce and food delivery platforms invested more in subsidizing users this quarter, thereby reducing their advertising expenditures. However, this did not impede Tencent's advertising revenue from soaring. Furthermore, the current ad load rate of Tencent's short video platform (Video Number) is only 3-6%, significantly lower than that of its peer (Douyin) at 13-16%. Hence, this quarter's growth did not rely on an increase in the ad load rate. In other words, Tencent still has significant potential in advertising – if the ad load rate is maximized, Video Number's advertising revenue could double.

Although Tencent was not the first to embark on AI deployment, it has swiftly become a new ace card for the company. From native AI application Yuanbao to plugin AI applications on WeChat, AI has emerged as Tencent's new trump card, supporting its advertising, gaming, and e-commerce businesses.

However, while Tencent's financial report acknowledges the value of its AI efforts, it does not explicitly quantify the driving impact of AI on performance.

Can Tencent's AI deployment strike a balance between pragmatism and long-term vision?

"AI has become the gene of new businesses," this is Tencent's official stance.

The value-added services business, primarily focused on gaming, grew 16% year-on-year, thanks to AI. Both "Honor of Kings" and "Game for Peace" have incorporated AI applications. A loyal fan of "Honor of Kings" often encounters novice players when teaming up, which frustrates him. This annoyance can be mitigated by AI – the AI voice assistant "Lingbao" can accompany players during matches and provide tactical guidance to beginners.

The advertising business, which has experienced double-digit growth for 11 consecutive quarters, surged 20% this quarter, also thanks to AI. By upgrading the advertising foundation model, AI has been integrated into the entire advertising chain, encompassing creation, delivery, recommendation, and effect analysis. For instance, Tencent's advertising delivery platform has launched an intelligent delivery function where advertisers only need to set marketing goals, budgets, and simple creatives, and AI will automatically create and deliver ads. With improved ROI, advertisers are naturally more inclined to place orders.

The financial technology and enterprise services business grew 6% year-on-year, also due to AI. With the upgrade of the Hunyuan foundation model, AI has been integrated into productivity tools, such as the meeting summary function in Tencent Meeting and the assisted writing function in Tencent Docs, which were specifically mentioned by Tencent President Martin Lau.

Tencent has deployments in multiple AI application forms, including plugins, apps, and webpages.

Martin Lau revealed that Tencent currently focuses on four indicators in AI: first, the impact of AI on existing businesses; second, the performance and quality of the Hunyuan large model; third, the user growth of AI-related applications; and fourth, the progress of other AI-related innovative products within the entire ecosystem.

As a native AI application, Yuanbao entered the market relatively late but has ambitious goals, targeting not only high-end users but also the mass market. The promotional content of Yuanbao Video Number is so down-to-earth that it borders on magical, covering scenarios such as renting, photo editing, exam preparation, feeding cats, gardening, opening stores, shopping, and grocery shopping. It aims to be a partner both in the workplace and in life.

According to Martin Lau, Tencent vigorously promoted Yuanbao in the first quarter, with the focus in the second quarter being on improving the product. After optimizing the product, Tencent will continue to vigorously promote it.

The promotion has been quite effective, with Tencent Yuanbao's daily active users surging more than 20 times from February to March. Additionally, according to QuestMobile data, 67.4% of native apps experienced negative growth in the first half of this year. However, Tencent Yuanbao bucked the trend, ranking second in the top list of AI native app user scale growth in the first half of the year with a year-on-year growth rate of 55.2%, trailing only Deepseek but still lagging significantly behind ByteDance's Doubao in terms of user volume.

AI is crucial, but Tencent is not "throwing money around." Martin Lau revealed, "We are managing costs in a relatively refined manner. If we can use a smaller model, we will choose it, as its cost will be much lower than using a flagship model. If we continuously improve inference efficiency through software upgrades, costs can also be controlled."

What does AI mean for Tencent? Our assessment is that its strategic importance surpasses that of Video Number, the 'hope of the entire company', with its strategic value potentially comparable to WeChat, serving as a springboard for a new cycle.

The rationale is as follows: first, AI is expected to disrupt the experience of end-side devices and the entire app ecosystem, with Tencent's core businesses – gaming and advertising – being restructured by AI; second, for Tencent, both AI and WeChat can be considered infrastructure, while Video Number is not, but rather a killer app dependent on the WeChat ecosystem; third, both WeChat and AI are expected to help Tencent usher in a new era – WeChat helped Tencent secure a ticket for the Internet era, and the next ticket will be "AI".

Although AI has taken center stage at Tencent, it still faces challenges.

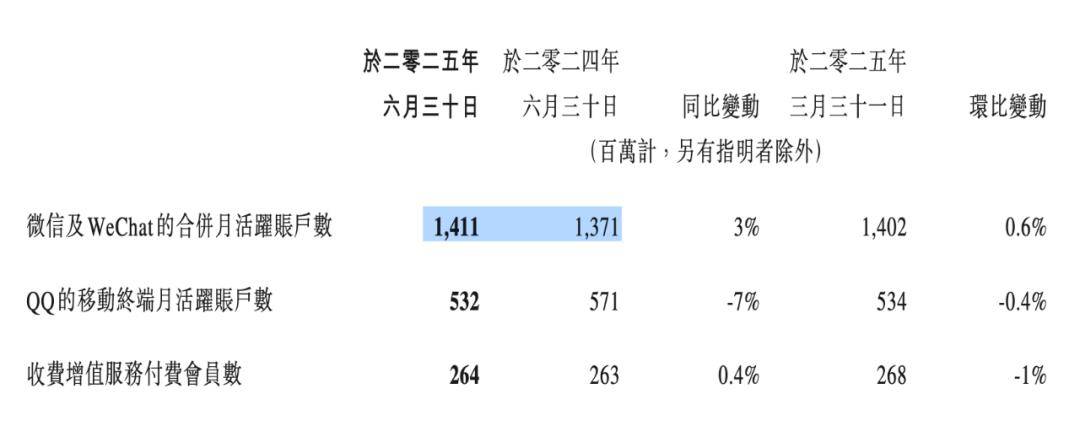

First, it is difficult to directly convert WeChat's 1.4 billion active users into AI paying users.

OpenAI's revenue has surged, driven by both user subscriptions and enterprise payments. According to DemandSage statistics, OpenAI's weekly active users reached 800 million in April 2025 and fell back to 700 million in July, still doubling from the beginning of the year. Among them, paid users accounted for about 5-6%, contributing 75% of revenue.

In contrast, Chinese users are accustomed to "free" services and have a weaker willingness to pay. Therefore, Tencent's current AI monetization still relies on B-end customers, "subsidizing users' AI usage costs through the growth of other businesses."

Second, although Tencent has strengths in user scale and scenario integration, it still needs to catch up in terms of large model capability and iteration speed.

Tencent's previous strategy was quite clever, accessing DeepSeek and forming a dual-model team. However, external assistance, no matter how strong, is ultimately not enough. The self-developed Hunyuan is both a face-saver and a core competence. Tencent still needs to step up its efforts as the Hunyuan model is still rarely seen at the top of global authoritative AI rankings.

Why was Tencent the first to reap the rewards of AI?

Early this year, DeepSeek emerged as a dark horse, showing potential to rival OpenAI, and its user base still ranks first, leaving a trail of large factory AI applications behind.

Although App user volume cannot match DeepSeek, what is the winning edge for large factory AI?

In fact, although DeepSeek is "far ahead," it is quite laid-back in application deployment. Liang Wenfeng, the founder of DeepSeek, has a different view on the cycle of large AI models compared to large factories eager to monetize through deployment. "The current stage is a period of technological innovation, not an application explosion" – large factories are more pragmatic, while DeepSeek is more visionary.

This laid-back approach has led to a decline in traffic. According to Semianalysis's report, DeepSeek's user utilization rate has significantly declined from a peak of 7.5% at the beginning of the year, with official website traffic falling to 3% during the same period. Additionally, according to QuestMobile data, as of June, DeepSeek's monthly active users on mobile terminals numbered 163 million, a decrease of over 30 million compared to the 194 million in March, although its user base still far exceeds that of large factory AI apps.

This laid-back approach by DeepSeek has given large factories an opportunity to intercept users. Tencent, Baidu, Alibaba, and other large factories have successively accessed DeepSeek.

In May this year, among the lost users of the DeepSeek App, 56.0% used Baidu, 42.1% used QQ Browser, and 39.4% used Doubao.

However, while this move may seem to divert DeepSeek's users, it is actually a win-win situation.

Liang Wenfeng aims for AGI (Artificial General Intelligence). "In the long run, we hope to establish an ecosystem that allows the industry to directly use our technology and achievements."

For Tencent and other large factories, accessing DeepSeek has several benefits: first, it can quickly complement AI capabilities; second, it can prevent potential DeepSeek users from leaving their own apps, improving user retention; third, it can also leverage DeepSeek to advertise their own native AI applications. For example, Yuanbao supports both the self-developed Hunyuan and DeepSeek models.

In addition to "taking shortcuts to intercept users," Tencent's confidence in achieving an early lead in AI despite not being the first to start lies in its user scale, scenario layout, ecological closed loop, resources, and funds.

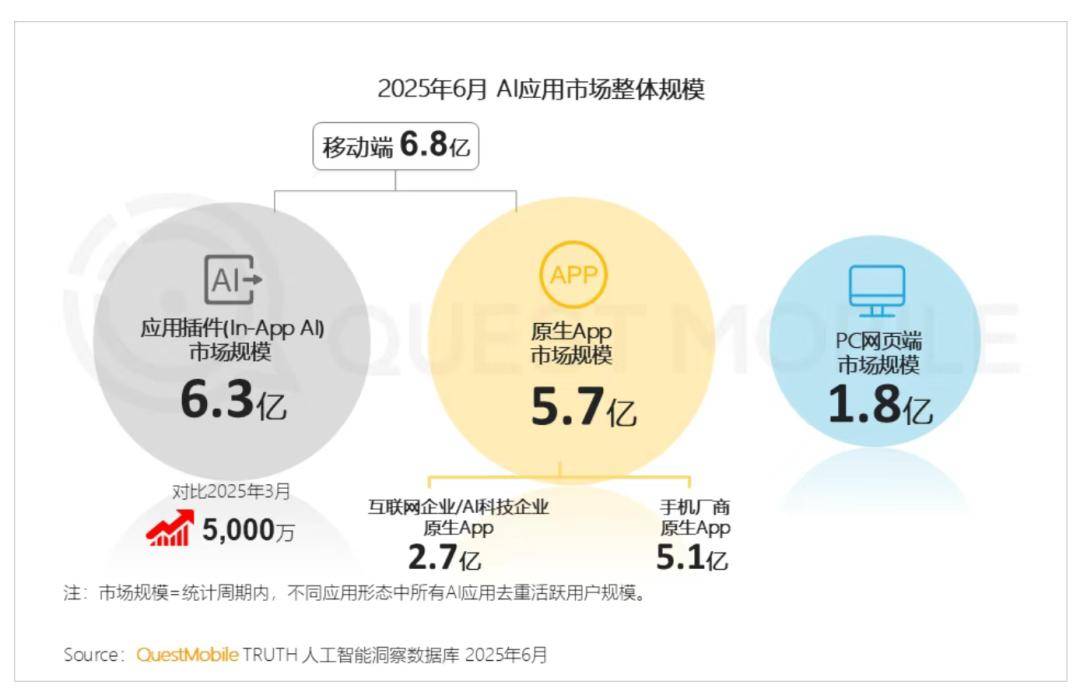

According to the QuestMobile report, as of June 2025, the user base of "mobile-end application plugins (In-App AI)" was 630 million, that of "mobile-end native apps" was 570 million, and that of "PC web applications" was 180 million, with increases of 50 million, decreases of 20 million, and decreases of 30 million, respectively, compared to March. Among them, 67.4% of native apps experienced negative growth in the first half of this year.

Among the three modes, only the In-App AI plugin mode has been on the rise. In the first half of this year, 74.5% of plugin-form applications maintained positive growth, with an average of 2.1 AI applications per app (with AI implementation). The structural change in the AI application group validates that the plugin form is currently the shortest path for AI implementation, and AI is beginning to "compete" in system-level integration capabilities.

Under this trend, "all-rounder" large factories with comprehensive advantages in "large model capabilities + platform leverage + scenario integration + ecosystem construction" have a much higher chance of winning than "one-sided" startups.

Looking at domestic large factories, there are currently only two companies with super apps: one is Tencent, which had a combined monthly active user base of WeChat and WeChat International exceeding 1.411 billion at the end of the second quarter; the other is ByteDance.

In other words, the main battlefield of current AI competition has returned to Tencent's strongest field – Tencent's AI stands on the shoulders of WeChat.

Yuanbao also benefits from WeChat's strong user base. In mid-April this year, Yuanbao officially opened an entry point on WeChat and has gradually been integrated into core scenarios such as Tencent News and Tencent Docs.

Regarding this, Martin Lau made it clear, "The promotion of Yuanbao will not solely rely on spending money in the market to acquire users. We have many existing platforms to leverage. I believe that integrating Yuanbao with our existing platforms is one of our important advantages. In the coming months, in addition to starting to increase promotion of this product, we will also do more work on integration."

Looking at the scale of investment, large AI models have become a "game for the rich."

The reason OpenAI and DeepSeek are far ahead is largely because they "don't lack money." DeepSeek is funded by its parent company QuantInsights, with investments in funds, resources, and manpower comparable to those of large factories, something other large AI model companies cannot match. In contrast, AI startups with financial constraints have begun collective layoffs.

Large factories naturally do not lack money or talent. With high-intensity R&D investment, they have every opportunity to catch up and surpass in the AI race.

In the second quarter of this year, Tencent's R&D investment reached 20.25 billion yuan, a year-on-year increase of 17%, amounting to an annual R&D investment of up to 100 billion yuan. Alibaba is also doing the same, planning to invest 380 billion yuan over the next three years to deploy AI.

Therefore, it is no coincidence that Tencent has achieved an early lead in AI deployment. Whether AI can truly become Tencent's next "WeChat-level" springboard for a new cycle remains to be seen over time.