Is Oracle's Explosive Growth the Beginning of the AI Boom?

![]() 09/17 2025

09/17 2025

![]() 611

611

Oracle's stock price soars.

Investors Network Lead | Xie Yingjie

On September 10 (Eastern Time), just 30 minutes after the opening bell at the New York Stock Exchange, Oracle (Oracle) experienced two temporary trading halts due to hitting 'volatility thresholds.' After resuming trading, the stock price continued to surge, closing at $328.62, up 36% from the previous day. This marked the largest single-day gain since its 1992 listing, with the market value soaring by over $244 billion overnight—equivalent to adding a Nike or two Goldmans Sachs in value. Such a massive fluctuation was not driven by overall market trends—the S&P 500 rose just 0.3% that day, while the Nasdaq gained less than 0.6%.

What truly ignited investor enthusiasm was a blockbuster deal dated '2027': Oracle signed a five-year computing power procurement agreement with OpenAI, valued at $300 billion, averaging $60 billion annually. This ranks as the largest single contract in cloud computing history and exceeds twice the total cloud infrastructure revenue Oracle generated in the past four fiscal quarters.

Oracle's market value surges by $190 billion

Database software and cloud company Oracle disclosed in its latest earnings report that it added $317 billion in cloud contract revenue for the quarter ending August 31, 2025. This not only drove a 36% single-day stock price surge but also fueled market enthusiasm for AI investments.

Earnings far exceeded market expectations, with Oracle's stock price achieving its largest single-day gain since 1992. The company's market value grew by $244 billion to $922 billion.

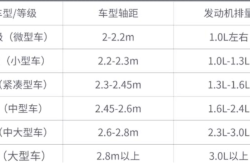

On September 9, Oracle released its Q1 FY2026 earnings, reporting a 12% revenue increase to $14.9 billion. Cloud computing revenue rose 28% to $7.2 billion, with cloud applications (SaaS) contributing $3.8 billion (up 11%), while software revenue declined 1% to $5.7 billion. Under non-GAAP metrics, net profit increased 8% to $4.3 billion.

The earnings forecast projects Oracle's cloud infrastructure revenue will grow 77% to $18 billion in FY2026.

Oracle CEO Safra Catz stated during the earnings call that cloud infrastructure revenue will rise to $32 billion, $73 billion, $114 billion, and $144 billion over the next four fiscal years, respectively.

For Q1 FY2026 ending August 31, Oracle's total remaining performance obligations (RPOs—signed revenue not yet recognized) surged 359% year-over-year to $455 billion.

As Oracle's stock price climbed, co-founder and Chairman Larry Ellison's wealth surged by $70 billion. According to the Bloomberg Billionaires Index, his total wealth reached $364 billion, nearing Elon Musk's world-leading $384 billion.

Over the past decade, Oracle lagged behind AWS and Microsoft Azure in cloud infrastructure (IaaS), with market share hovering in the single digits. However, the rise of generative AI has renewed interest in 'vertically integrated' vendors capable of autonomous chip design, database software, and hardware integration.

Under the agreement, Oracle will build at least 10 'GPU supercomputing clusters' in Texas, Utah, and other locations, with a total power demand of 4.5 gigawatts—equivalent to two Hoover Dams—to provide OpenAI with end-to-end computing power for training and inference. As an added term, OpenAI's new inference models will prioritize Oracle Cloud for deployment, with both companies sharing incremental revenue.

Multiple investment banks swiftly updated their target prices for the tech giant. Wolfe Research raised Oracle's target from $300 to $400 per share, implying over 20% upside from the latest close and a $1.12 trillion market cap. Bank of America increased its target from $295 to $368 per share. Jefferies lifted its target from $270 to $360 per share, while Piper Sandler raised it from $270 to $330 per share.

Strong cloud business outlook ignites demand for AI infrastructure

For A-shares and Asian tech supply chains, Oracle's meteoric rise has spillover effects. On September 11, data center and optical module concept stocks like Kingsignal, Ehualu, and Huafu Fashion hit daily limits en masse. In Hong Kong, GDS Holdings and 21Vianet surged up to 14%. The market logic: if Oracle's model is replicated by AWS or Google Cloud, orders for upstream GPU servers, liquid cooling equipment, and high-speed connectors could explode geometrically.

A new global AI wave continues to surge, with computing shortages driving server demand. The global AI server market is growing rapidly.

According to IDC, the global AI server market is projected to reach $125.1 billion in 2024, $158.7 billion in 2025, and $222.7 billion by 2028, with a CAGR of 15.5% from 2024–2028. Generative AI servers will account for 29.6% of the market in 2025, rising to 37.7% by 2028.

In August, a report by China Telecom Research Institute projected that AI will contribute over RMB 11 trillion to China's GDP by 2035, accounting for 4–5% of GDP, potentially driving 10x to 100x growth in computing demand.

Regarding AI capital expenditures by Chinese hyperscalers, Alibaba's (09988.HK) announcement in February 2025 of a RMB 380 billion ($53 billion) three-year plan for cloud and AI hardware investments drew significant attention. On September 11, 2025, Alibaba announced a $3.2 billion zero-coupon senior note issuance, with 80% earmarked for cloud infrastructure upgrades. This sizable financing plan is seen as Alibaba stockpiling ammunition for the future AI race.

However, risks are accumulating.

Analysts at CLSA and Bank of America remain bullish on AI's long-term investment value, but warnings about overheating AI investments are emerging as capital floods the sector. By August 2025, the 'Magnificent Seven' U.S. tech giants reached a combined market cap of $19.7 trillion, accounting for 34.1% of the S&P 500. Alibaba co-founder Joe Tsai previously cautioned that AI investment scales have become excessive, risking resource misallocation and potential dangers to financial markets and the real economy.

Take Oracle as an example: Overreliance on OpenAI for revenue poses risks. If OpenAI's funding or model commercialization underperforms, Oracle's heavy capital expenditures could turn into idle capacity. JPMorgan estimates that fulfilling the $300 billion contract requires Oracle to invest ~$100 billion in data centers and GPUs by 2027. With free cash flow at -$2.2 billion over the past 12 months, Oracle would need to rely on debt or equity financing, potentially raising its leverage ratio from 1.8x to over 3x.

Looking back at the past two years, the AI rally has shifted from hardware (NVIDIA) to models (OpenAI) and applications (Microsoft, Adobe), now reaching the 'cloud infrastructure' quadrant. Oracle's $300 billion contract signals to the market: as large-scale model competitions enter the '10,000-GPU cluster' era, computing power equals influence, and traditional vendors with land, power, databases, and engineering integration capabilities can also share in this capital feast. (Produced by Thinker Finance) ■

Source: Investors Network