Are Bigger Cars Taking Over? Do Chinese Consumers Have a Penchant for Large Vehicles?

![]() 12/23 2025

12/23 2025

![]() 496

496

Introduction

Strictly speaking, A-class cars haven't vanished from the market; rather, their definition has evolved.

"These cars are nearly identical in size, so why is there such a significant price disparity?"

Last week, after accompanying my friend Xiao Jin to several 4S stores in search of a car, he posed this question at the outset of our discussion. I explained, "Some are A-class cars, while others are B-class. Take the Qin PLUS and Camry, for instance. The Qin PLUS is categorized as an A-class car but has reached B-class dimensions. The Camry, in contrast, is a quintessential B-class car, hence the price difference."

However, my explanation left him perplexed. In his view, A-class cars should be distinct from B-class cars, with clear boundaries in terms of size, displacement, and other factors. He questioned why the sizes of A-class and B-class cars were becoming increasingly similar.

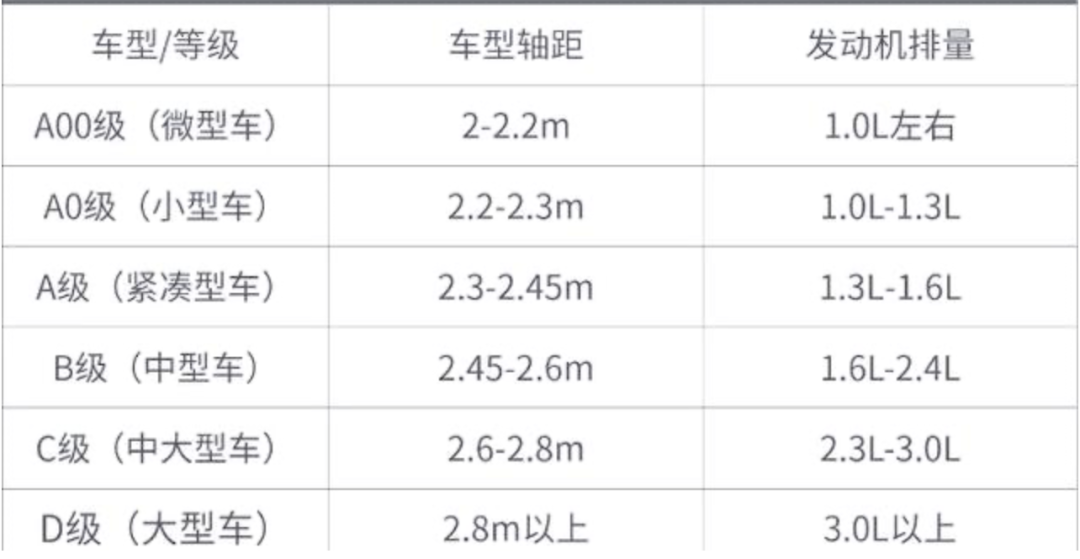

For example, A-class cars (compact cars) typically have a wheelbase strictly between 2.5 meters and 2.7 meters, while B-class cars (mid-sized cars) range from 2.7 meters to 2.9 meters, creating a distinct price and positioning divide. Consumers also understand these boundaries: A-class cars cater to basic transportation needs, whereas B-class cars offer a comprehensive upgrade in space, comfort, and prestige.

However, unknown to many, the boundaries between A-class and B-class cars in the Chinese automotive market are becoming increasingly blurred. As a result, numerous consumers like Xiao Jin are confused by the ambiguous positioning of car classes.

Moreover, with intensifying competition in the automotive market, the distinctions between A-class and B-class cars, as well as higher-level models like C-class and D-class cars, are fading. In particular, mainstream domestic brands' A-class cars often boast the wheelbase, length, and even the comfort and luxury traditionally associated with B-class cars. Leveraging these advantages and priced significantly lower than traditional B-class cars, they have carved out a niche for domestic brands' growth.

01 Eroding Boundaries

There was a time when classification standards in the Chinese automotive market were as clear-cut as a textbook.

Different vehicle classes had stringent definitions. In addition to body size, standards also encompassed engine displacement. For instance, A-class cars typically featured engine displacements ranging from 1.6 liters to 2.0 liters. This segment was once dominated by joint-venture brands, with models like the Lavida, Sylphy, and Corolla leading sales charts and forming the first-car memories for Chinese families.

In contrast, B-class cars like the Accord, Camry, and Passat, with wheelbases ranging from 2.7 meters to 2.9 meters, body lengths around 4.8 meters, and larger-displacement engines, had clear boundaries with A-class cars.

However, this seemingly solid dividing line has been constantly eroding in the Chinese market. A closer examination reveals that this erosion can be traced back to the cross-level competition strategy adopted by domestic brands to compete with joint-venture brands.

During the era when joint-venture brands nearly monopolized the mid-to-high-end market, domestic brands, faced with the technological prowess and brand premium of joint-venture brands in the traditional A-class car market, opted for a "dimensional reduction strike" approach. They offered B-class car sizes at A-class car prices, creating an asymmetric competitive advantage. For example, the 2008 BYD F6 featured B-class car space and luxurious configurations but was priced at 89,800 yuan, the same as a Fit at the time, posing a threat to the B-class car market.

The rationale behind this strategy was that while domestic brands required time to catch up with joint-venture brands in traditional areas like engines, they could more easily surpass them in terms of body size, interior design, and technological configurations. When consumers sat in a domestic brand model with a 2.8-meter wheelbase, they couldn't help but compare it to joint-venture B-class cars of similar size but significantly higher prices.

Especially with the marketing slogan of "buying B-class car size at A-class car prices," which resonates with the unique value judgment of Chinese consumers. In a market environment where car ownership per capita is still relatively low, many families adhere to the principle of "getting it right the first time" when purchasing a car. A vehicle is not just a means of transportation but also an extension of family space and an important carrier for social image display. When domestic brands keenly captured this demand, size expansion became the most direct competitive advantage.

Having tasted success, many domestic brand models also underwent lengthening during their facelifts and generational changes. The Changan Eado PLUS grew from 4.62 meters in its first generation to 4.73 meters in its current version; the BYD Qin PLUS reached 4.765 meters; and the Qiyuan A05 even approached the 4.8-meter mark. These figures would have fully met B-class car standards in the past.

Meanwhile, with the advent of electrification, electrification and platformization technologies have once again provided a physical basis for size expansion. For example, pure electric platforms eliminate the complex transmission layouts of traditional fuel vehicles, allowing for maximum internal space within the same external dimensions. Modular platforms enable automakers to develop models of different sizes at relatively low costs and quickly adjust body parameters to meet market demands.

Platforms like BYD's e-Platform 3.0 and Geely's SEA Architecture boast extremely high space utilization rates. When electric vehicles no longer require large engine compartments, the wheels can be pushed as far as possible to the corners, significantly increasing "usable space." This technological dividend allows A-class and A+-class electric vehicles to directly challenge traditional fuel-powered B-class cars in terms of space.

02 Not 'Killed' but Redefined

When an automaker achieves market success with an "enlarged" A-class car, competitors are compelled to follow suit.

This competitive pressure of "either grow or be eliminated" has fueled size expansion across the entire segment. Even joint-venture brand models that once adhered to standard sizes have had to introduce elongated or special editions to meet the challenge. Strategies like the Lavida Plus and the co-sale of classic and new-generation Sylphy models are all passive adjustments under this trend.

Especially after facing strong offensives from domestic brands in the "enlarged A-class car" market, the market share of traditional A-class cars from joint-venture brands has been continuously squeezed. Giants like Volkswagen, Toyota, and Honda have had to re-evaluate their product strategies. On the one hand, they are accelerating their electrification transformation, introducing more localized electric models. On the other hand, in the fuel vehicle sector, they are adopting a "defend the high end, release the low end" strategy, allocating more resources to the B-class and above markets where brand premium still exists.

For example, the Toyota Corolla and Levin have had their wheelbases lengthened from 2,700mm to 2,750mm; the Volkswagen Sagitar has reached a length of 4,812mm and increased rear legroom through optimized layouts.

Moreover, some joint-venture brands have chosen to "play big against small," introducing entry-level B-class car models with lower prices to erode the A+-class market. This pincer attack has further narrowed the survival space of traditional A-class cars while giving rise to larger-sized, higher-configured A-class and A+-class cars under the new era's definition.

Clearly, in the fierce market competition, "increasing size" has become one of the key strategies for joint-venture A-class cars to defend their market share and maintain product appeal. This "size competition" is essentially an adaptive adjustment by joint-venture brands to the new market landscape.

With the breaking of old boundaries and the drawing of new ones, strictly speaking, A-class cars haven't been "killed" but rather redefined. Traditional size-based classification standards are giving way to new standards centered on functionality and usage scenarios.

Not just now, but the future market may witness even more possible differentiations. For instance, some A-class cars may continue to "grow" and become the sole vehicle choice for families; others may return to their "compact" essence, focusing on niche scenarios like urban commuting and personalized travel. The latter may be represented by boutique small cars that no longer pursue maximum size but optimize the experience within limited dimensions.

Additionally, with the development of intelligence, when driving assistance and smart cockpits become core selling points, consumers' focus is shifting from "physical space size" to "digital space experience." A vehicle with slightly smaller dimensions but excellent autonomous driving capabilities, smooth in-car interactions, and a rich entertainment ecosystem may have a perceived value far exceeding that of a "large but mediocre" model.

This value shift provides A-class cars with a new competitive dimension, allowing them to establish differentiated advantages through intelligence and personalization rather than competing fiercely in the red ocean of size. Because when size expansion reaches its physical limits (constrained by factors like parking convenience and energy consumption), the focus of competition will inevitably shift to dimensions such as energy efficiency, safety performance, intelligence, services, and brand culture.

In conclusion, B-class cars haven't truly "killed" A-class cars; instead, they have jointly orchestrated a market evolution. What has disappeared is not a particular class of vehicles but rigid classification boundaries; what has changed is not consumers' demand for space but the ways to meet this demand.

The ultimate outcome of this size competition will not be all cars becoming 5-meter-long giants but rather a new balance formed under diverse demands: some people need maximized space for family travel, some need agile urban companions, and some need stylish options to express their individuality.

The value competition in the automotive industry is not just about physical dimensions. As consumers, we might ask ourselves: Do we really need a car that "looks like it costs 200,000 yuan," or do we need a car that is "worth 200,000 yuan"? The answer to this question will also determine the direction of future automotive evolution.

Editor-in-Chief: Li Sijia Editor: He Zengrong

THE END