15-Fold Valuation Increase Within a Year, Reaching $39 Billion: Is Figure a Genuine Success or Just a Bubble?

![]() 09/19 2025

09/19 2025

![]() 614

614

Whether Figure, buoyed by its founder's reputation and investor confidence, can maintain its lofty valuation remains to be seen over the long term.

On September 16th, Figure, an emerging American humanoid robot company, announced the completion of a Series C funding round exceeding $1 billion, with a post-money valuation soaring to $39 billion.

Just a year prior, its valuation stood at $2.6 billion. In a single year, it has skyrocketed 15-fold. This valuation not only far outpaces that of industry pioneer Boston Dynamics but even surpasses century-old manufacturing giants like General Electric.

How did Figure achieve such remarkable growth? Is the $39 billion valuation truly justified?

01 The Rise of Figure

Figure's ascent owes much to its founder, Brett Adcock.

Image source: New Atlas

Born in 1986, Adcock grew up on a farm outside the small town of Moravia, Illinois, displaying entrepreneurial flair from a young age. After graduating from the University of Florida, rather than joining traditional financial institutions or tech firms, he opted to launch his own ventures, founding two content platforms: Street Of Walls.com and Working App. The former focused on workplace training content in the financial sector, while the latter emphasized professional networking and skill matching. Although neither achieved blockbuster success, they provided him with invaluable experience.

At 26, Adcock achieved his first major entrepreneurial milestone. He founded AI headhunting company Vettery and secured $12 million in funding from various venture capital firms. Five years later, he sold it to Adecco Group for $110 million. In 2018, Adcock founded Archer Aviation, which produces fully electric vertical takeoff and landing aircraft for urban air mobility. Within three years, he propelled the company's market value from zero to $2.7 billion, successfully listing it on the New York Stock Exchange through a SPAC merger.

In May 2022, Adcock stepped down as CEO of Archer Aviation, turning his attention to the humanoid robot sector and founding Figure. His previous entrepreneurial triumphs naturally led investors to believe in this "mini-Musk," expecting Figure to replicate his past successes and laying a solid foundation for Figure's initial financing and development.

Capital injections provided Figure with ample funds for technological R&D, enabling it to achieve rapid technological iterations.

In March 2023, the first prototype, Figure 01, was unveiled, capable of only simple bipedal walking and grasping actions, with relatively basic functionality. By October of the same year, the optimized first-generation Figure 01 was officially released, featuring significantly improved performance, more stable and fluid walking, and autonomous learning capabilities.

2024 was a pivotal year for Figure. In January, Figure announced a strategic partnership with BMW. Subsequently, Figure 01 secured its "first job" at BMW's manufacturing plant, marking the beginning of Figure's commercialization exploration. In August, Figure 02 was introduced, achieving a qualitative leap in performance, capable of navigating stairs and handling loads up to 25 kilograms, with a maximum battery life of 5 hours, substantially increasing work intensity and duration.

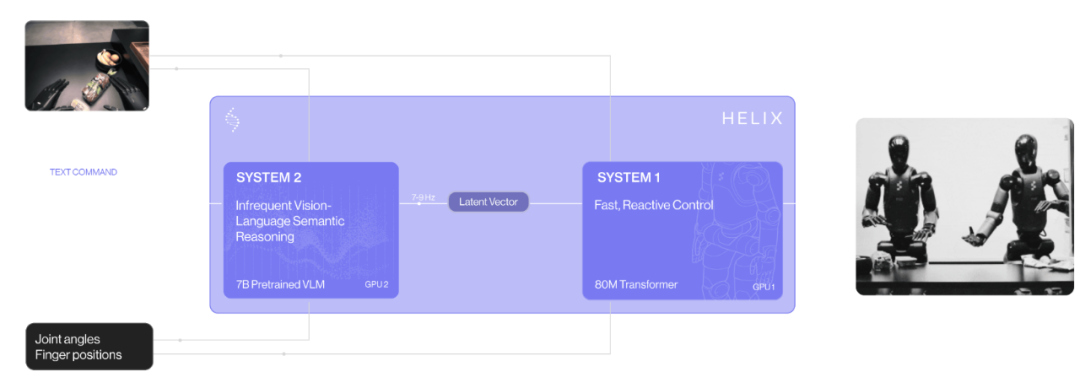

In February 2025, Figure unveiled the revolutionary "Helix system," capable of translating abstract instructions into specific physical actions, elevating the intelligence level of humanoid robots to a new height.

Image source: Figure

Continuous technological breakthroughs further attracted support from industry giants, injecting new momentum into Figure's development. The list of investors in Figure's Series C funding round is impressive, led by Parkway Venture Capital, with participation from tech giants such as NVIDIA, Intel Capital, LG, Qualcomm Ventures, and top asset management firms like Brookfield Asset Management.

The capital frenzy stems not only from long-term optimism about the humanoid robot sector but also from the potential value of capital and resource alignment. NVIDIA can provide AI chip and algorithm support, enhancing the robot's "cognitive" abilities; Intel can collaborate in sensor technology and chip manufacturing, optimizing the robot's perception and execution; LG can leverage its mature electronic manufacturing experience to help Figure overcome challenges in large-scale production. This deeply integrated model offers multidimensional potential support for Figure's development, propelling it onto the fast track from its inception.

02 Concerns Behind the Aura

Figure's rapid rise and high valuation have made it a new star in the humanoid robot sector, but beyond the aura of capital and technological demonstrations, its path to commercialization remains fraught with challenges.

Whether Adcock's past successes can be replicated remains uncertain. His previous ventures differ fundamentally from his current business. Throughout his entrepreneurial journey, Vettery succeeded through algorithmic efficiency and channel expansion, without delving into the challenges of hardware R&D; Archer Aviation, while focused on hardware, relied heavily on policy incentives (U.S. government subsidies for the eVTOL industry) and continuous capital infusion, remaining a capital-driven product. In contrast, humanoid robots demand mechanical structural stability, motion control precision, and cost control capabilities, far exceeding the complexity of headhunting platforms and unrealized aircraft.

The market's overemphasis on Adcock's personal aura essentially uses his past successes in asset-light ventures to obscure the inherent complexity and uncertainty of the humanoid robot business.

More critically, Figure's technological advantages remain confined to laboratory demonstrations, untested in real-world scenarios. In controlled laboratory environments with predefined conditions and processes, its robots can perform various actions smoothly. However, once deployed in complex and dynamic real-world settings like factory floors and households, their stability becomes questionable. According to a research report by China Creation Ventures, Figure's robots have a 3% fall rate in complex terrains, compared to 0.1% in laboratory environments; the Helix system exhibits a 15% error rate in executing instructions in unstructured environments (e.g., cluttered household scenes).

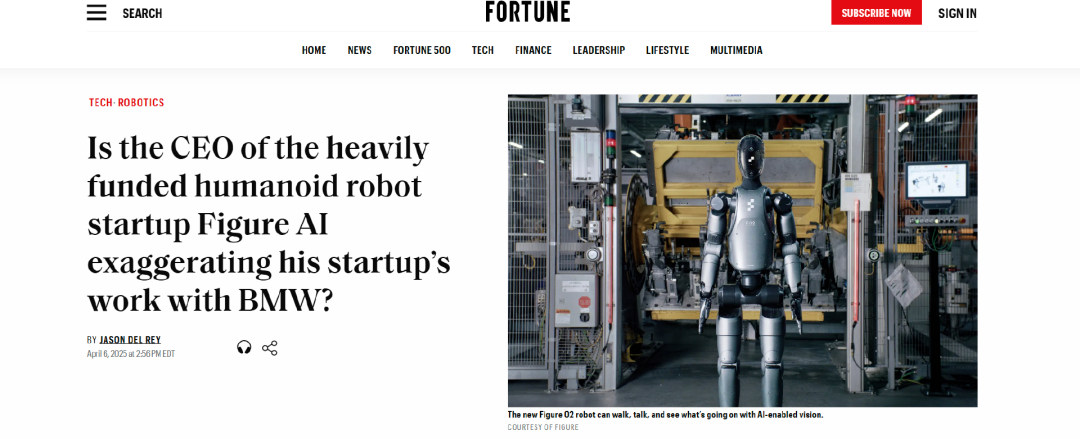

A trust crisis has already emerged. In April 2025, Figure was accused by Fortune magazine of "exaggerating its partnership achievements with BMW factory," with claims of "large-scale deployment" and "end-to-end production operations" refuted by BMW as merely "initial testing involving a single robot handling parts."

For a company yet to turn a profit, the transparency of its technological progress and the authenticity of its partnership implementations are crucial for investors to assess its value. Figure's approach essentially erodes credibility. More dangerously, the trust crisis may reflect the reality of its technological "difficulty in implementation." If it could truly achieve "end-to-end production operations," why rely on packaging to maintain hype? Once the market doubts its technological capabilities, subsequent financing, supply chain collaborations, and customer trust will all be impacted, posing the most fatal obstacle to Figure's commercialization.

Image source: Fortune

Production capacity implementation represents the ultimate test of its fate. According to plans, Figure's Bot Q factory will commence production of its first-generation production line in 2026, with an annual capacity of 12,000 units, aiming to increase it to 100,000 units within four years. However, given its current production capacity, this goal seems like a distant ideal.

Currently, Figure's monthly production capacity stands at only 50 units, while Tesla Optimus plans to reach 1,000 units per month, highlighting a significant gap. Additionally, the core reducers used in Figure's robots are highly dependent on Japanese company Harmonic Drive, accounting for 25% of costs. Although Figure has formulated plans to address this by 2026 through domestic substitution, supply chain constraints will continue to affect its production ramp-up and cost control in the short term.

In March 2025, Figure founder Adcock revealed that "Figure 03 has been designed and will enter mass production this year," but as of September, no substantial progress has been made. If production capacity targets remain unmet, Figure's technological leadership will remain confined to niche prototypes, unable to translate into market share and revenue, rendering its $39 billion valuation a castle in the air.

03 Other Figures We've Seen

Throughout tech history, stories of high valuations sustained by concepts but stalling during implementation are not uncommon. Figure is not an isolated case. Some collapse before implementation, while others break through amid skepticism.

Medical technology company Theranos once reached a valuation of $9 billion with its concept of "testing hundreds of diseases from a single drop of blood," claiming to rapidly complete over 200 tests with just a fingertip prick, at a cost far lower than traditional methods, attracting significant capital and dubbing its founder Holmes the "female Steve Jobs." However, it was ultimately exposed for technological fraud, with partners terminating agreements and investors collectively seeking legal recourse. Theranos' valuation instantly collapsed, leading to bankruptcy and the founder facing imprisonment.

Image source: Internet

In stark contrast, Tesla's rise from "production hell" to "global benchmark" exemplifies resilience. In 2017, during the initial mass production of the Model 3, Musk's ambitious "fully automated factory" plan suffered severe setbacks, with frequent production line shutdowns and only 220 Model 3s delivered in the third quarter, causing stock prices to plummet and drawing ridicule as "PPT car manufacturing." However, Tesla transformed investor trust into engineering capabilities to solve specific problems, overcoming production challenges. Today, Tesla's Shanghai factory boasts an automation rate exceeding 95%, achieving the miracle of producing a car every 40 seconds, successfully entering the top tier of the global new energy vehicle industry.

History repeatedly proves that a tech company's value lies not in how compelling its story is but in whether its concepts can be implemented and translated into tangible results. Figure stands at a historical crossroads, facing the choice of becoming the next Theranos, falling from grace, or replicating Tesla's comeback, depending on its ability to convert investor enthusiasm into engineering capabilities to address mechanical stability, production ramp-up, and other practical issues.

04 Conclusion

Figure's $39 billion valuation ultimately reflects investor optimism about the "general-purpose humanoid robot" sector rather than recognition of its current capabilities. Humanoid robots are indeed seen as a crucial direction for the next technological revolution, capable of addressing labor shortages in manufacturing, hazardous scenario operations, and other real-world problems, with immense market potential, which is why companies like Tesla and UBTECH are vying to enter the field.

However, potential does not equate to reality, and sector value does not equate to individual enterprise value. Capital market enthusiasm may sustain for a while, but ultimately, it must return to commercial fundamentals, translating into tangible revenue and profits.

If Figure can seize the critical window of production capacity implementation in 2026, overcome technological implementation bottlenecks, achieve large-scale production, and generate stable revenue, its $39 billion valuation will withstand scrutiny as "real gold." Conversely, if Figure fails to achieve commercialization before 2026, investor patience will gradually wane, and the bubble's burst will become inevitable.

* Image sourced from the internet. Please contact us for removal if infringement occurs.