Can DJI's 'Technology Repurposing' Strategy Triumph in the Robot Vacuum Market?

![]() 09/21 2025

09/21 2025

![]() 606

606

From the Skies to the Floor!

Investor Network | Gravity | Zhang Jingyi

In August 2025, DJI, a frontrunner in the drone industry, officially made its foray into the home appliance sector with the unveiling of its inaugural robot vacuum, the ROMO series. This move instantly sparked market enthusiasm. Prior to its launch, pre-orders on JD.com's flagship store soared past 20,000, and the initial batch of products swiftly sold out across multiple platforms.

However, as the initial excitement waned, user reviews became increasingly polarized. On one side, its 'drone-grade obstacle avoidance system' was hailed as the 'epitome of obstacle avoidance.' Conversely, issues such as the nearly four-hour deep cleaning time for a 63-square-meter house, base station leakage, and inconsistent return policy implementations triggered numerous complaints. As a tech company with a global market share exceeding 70% in the drone sector, is DJI's cross-industry venture a technological leap or a blind expansion by a 'home appliance newcomer?'

How Does DJI's 'Drone DNA' Enhance Robot Vacuums?

Established in 2006, DJI Innovation has risen to global prominence in the consumer drone market through its technological advancements. Data indicates that DJI has consistently maintained a market share exceeding 70% in the global consumer drone market. In 2025, this tech giant, traditionally rooted in the skies, extended its reach to the ground, officially entering the seemingly disparate field of robot vacuums.

From a market standpoint, TF Securities projects that by 2025, the household penetration rate of robot vacuums in China will remain below 5%, while the U.S. household penetration rate will surpass 15%, signaling significant growth potential. Nevertheless, industry growth has decelerated from 21.5% in 2023 to 14.2% in 2024, with a competitive landscape that is becoming increasingly consolidated.

A deeper dive into consumer needs reveals potential breakthroughs in the robot vacuum market. Survey data indicates that when selecting a robot vacuum, consumers' top three concerns are obstacle avoidance capability (68.3%), cleaning effectiveness (62.1%), and intelligence level (57.4%). DJI's core technologies, honed in the drone sector, align precisely with users' primary pain point: obstacle avoidance capability.

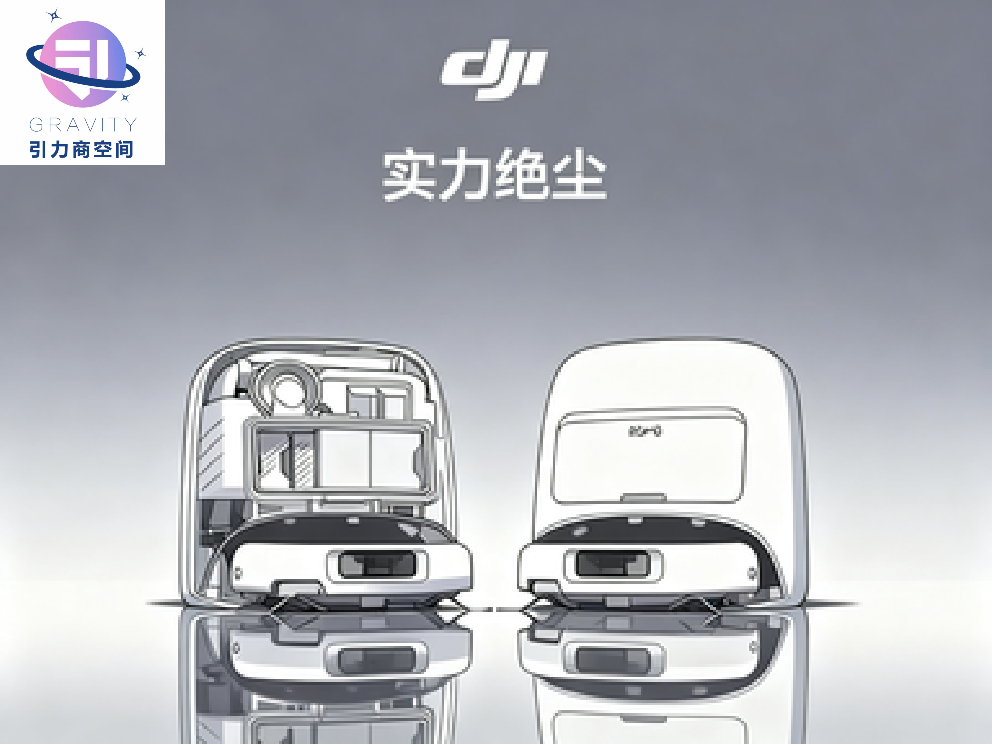

Specifically, the core selling point of DJI's ROMO series lies in its systematic transfer of core drone technologies to robot vacuums. The series is equipped with a 'Ge Wu Obstacle Avoidance System' that combines 'binocular fisheye visual sensors + triple lidar,' theoretically enabling precise identification of 2mm wires and obstacles over 15mm. This technology stems from DJI's expertise in SLAM (Simultaneous Localization and Mapping), visual recognition, and multi-sensor fusion technologies in the drone sector.

In terms of product performance, the ROMO series showcases distinct differentiated characteristics: its 25,000Pa suction power far surpasses the 5,000Pa of Ecovacs' flagship X1 series, with a standard mode battery life of approximately 3 hours, covering a cleaning area of 178 square meters. Industrially, its fully transparent body, base station, and dynamic robotic arm design have been lauded by users as 'functionalist aesthetics,' earning high aesthetic evaluations.

However, the technology transfer has not been flawless. Multiple users have reported significant shortcomings in actual use: deep cleaning of a 63-square-meter house takes nearly four hours, daily cleaning requires one hour, and mapping has omissions. The mopping module's circular design lacks cleaning power for stubborn stains, leading to 'secondary contamination during simultaneous sweeping and mopping.' Its obstacle-crossing capability is only 25mm, below the industry average. More dissatisfying for consumers are after-sales issues, including inconsistent return policy implementations online and offline, frequent hardware problems like base station leakage and unresponsive voice control, severely impacting the user experience.

Can DJI Break Through in the Robot Vacuum Market Dominated by Industry Leaders?

The robot vacuum market is no longer a 'blue ocean.' Data shows that in the first half of 2025, the top five global brands accounted for 64.8% of the market share (Roborock 20.7%, Ecovacs 13.9%, Dreame 12.3%, Xiaomi 10.1%), with increasing industry concentration. While growth potential remains, new entrants face a highly concentrated oligopoly.

Priced between 4,699 and 7,399 yuan, DJI's ROMO series directly competes with iRobot's premium models, overlapping with price ranges of Ecovacs X9, Roborock P20 Ultra, and others. Notably, the robot vacuum market has formed clear price tiers: the premium segment (over 3,000 yuan) accounts for 39%, becoming the most attention-grabbing price range. As a new entrant, DJI's direct entry into the premium market reflects its confidence in its technological capabilities.

However, due to its lack of significant advantages in core metrics like mopping capability and obstacle-crossing, some consumers criticize it as 'overpriced and underpowered.' This gap between positioning and actual experience poses DJI's primary challenge.

In response to DJI's challenge, existing leading companies have acted swiftly. Ecovacs has adopted a 'defensive innovation' strategy, leveraging its premium product lines (X9, T80 series) and differentiated layout with Tineco floor washers to capture premium pricing. Roborock, meanwhile, has expanded its market share through a 'technology democratization' strategy, shipping 982,000 units in Q1 2025 to maintain its top market position. Brands like Xiaomi and Dreame have introduced features like AI triple-camera panoramic recognition and automatic water refill/drainage, as the industry shifts from 'hardware stacking' to 'technology empowerment,' comprehensively upgrading competitive dimensions.

Is Cross-Industry Expansion an Active Choice or a Passive Breakthrough?

From a technological synergy perspective, DJI's entry into the robot vacuum market represents a planned technology transfer and cost reuse. Applying mature drone technologies to new product categories not only reduces R&D costs for new technologies but also enhances technological utilization efficiency. Strategically, robot vacuums serve as a natural extension of drone environmental perception technologies into household scenarios, with collected household environmental data potentially optimizing drone obstacle avoidance algorithms in complex indoor environments.

Is DJI's cross-industry move driven by a perceived ceiling in the drone sector's growth? Data shows that global consumer drone growth has slowed from over 30% in early stages to 14.89% in recent years, though long-term potential remains. With its high market share and strong cash flow, DJI's move appears more as an active conversion of technological redundancy and channel advantages. Industry analysts note that DJI's global channel capabilities may accelerate the global penetration of robot vacuums.

In the short term, DJI is unlikely to disrupt the existing market landscape. However, its success will hinge on three key factors: product iteration speed, channel development capability, and ecosystem construction ability. Long-term, DJI's technological investment may drive the industry toward increased intelligence and premiumization, shifting competition from single cleaning functions to ecosystem battles centered on AI algorithms, multi-robot collaboration, and whole-house intelligence.

DJI's 'blockbuster' entry into the home appliance sector brings significant technological disruption and market impact. Senior home appliance industry analysts state, 'DJI's brand influence and fan base can drive substantial traffic and attention to the robot vacuum category.' However, as a 'home appliance newcomer,' whether DJI can translate its drone technological advantages into user value in household scenarios remains to be seen over time.

In the highly concentrated robot vacuum market, technological prowess is merely an entry ticket; the real competition has just begun. From product refinement to channel development, from user experience to ecosystem construction, each step tests this tech giant's cross-industry wisdom. For consumers, this technological upgrade and price competition driven by DJI may prove to be the greatest benefit. (Produced by Sixth Tone) ■

Source: Investor Network