NVIDIA's Dual-Track Strategy in Robotaxi: Cultivating Innovation and Investing for Growth

![]() 09/24 2025

09/24 2025

![]() 525

525

Produced by Zhineng Technology

Amidst the fierce AI competition this year, the automotive industry has unexpectedly shifted its focus to Robotaxi—a strategic move embraced by both Elon Musk and NVIDIA.

As a pivotal force in artificial intelligence computing, NVIDIA is venturing into this burgeoning market through two complementary avenues:

◎ Utilizing internal incubation to propel Robotaxi projects that seamlessly integrate end-to-end neural networks with world models, thereby showcasing its engineering prowess in 'Physical AI';

◎ Bolstering support for pioneering autonomous driving firms like Wayve through strategic capital and ecosystem investments, thus solidifying its presence in the autonomous driving landscape.

With incubation and investment serving as twin pillars, NVIDIA is making significant strides in the Robotaxi sector, aiming to shape the future of Physical AI.

01 Cultivating Robotaxi Projects: Vertical Integration from Chips to 'Physical AI'

According to media reports, NVIDIA officially initiated an internal Robotaxi incubation project during its company-wide conference, spearheaded by Senior Director Ruchi Bhargava. Positioned as a 'technology enabler' for automakers and mobility providers, NVIDIA aims to construct its own Robotaxi demonstration fleet to rigorously test its full-stack autonomous driving capabilities.

Technical Blueprint: End-to-End Neural Networks and the Cosmos World Model

The project adopts a technical framework akin to Tesla's FSD and the UK-based startup Wayve, emphasizing end-to-end neural network training and deployment.

Contrary to traditional rule-based, multi-module autonomous driving systems, end-to-end models directly translate camera and sensor inputs into driving commands, fostering highly adaptive intelligent agents.

The technical hurdle lies in achieving generalization across intricate road scenarios and ensuring robust safety redundancy validation—key challenges NVIDIA is determined to surmount.

To mitigate the scarcity of real-world data for extreme scenarios, NVIDIA unveiled the Cosmos World Foundation Model in early 2024.

This platform generates physically plausible synthetic videos by amalgamating text, image, video, and sensor data, boasting 20 million hours of pre-training.

Cosmos augments end-to-end network training through virtual world scalability, enhancing system performance in long-tail scenarios.

Chinese automakers such as NIO and XPeng are also exploring world models, indicating a burgeoning industry consensus on this technical path.

Strategic Rationale: Skill Enhancement and Defining 'Physical AI' Benchmarks

NVIDIA is not hastily pursuing ride-hailing revenue from Robotaxi in the near term but views it as a 'proving ground.'

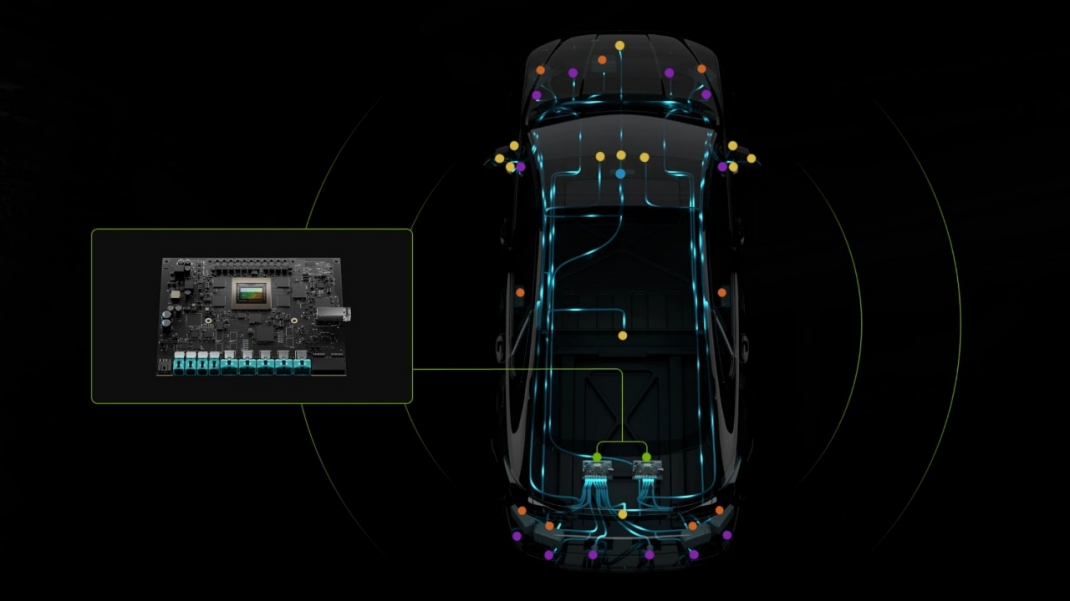

Through incubation, NVIDIA can validate the synergy of its GPUs, DRIVE Thor chips, AI toolchains, and Cosmos models in real urban operating environments, amassing experience and benchmarks for next-gen 'Physical AI.'

Initial investment is estimated at $3 billion, with project rollout prioritizing U.S. cities. Although smaller than Waymo's multi-year cumulative expenditure, this budget supports a validation fleet of several hundred vehicles.

Compared to Waymo's 700 operational vehicles and Tesla's dozens, NVIDIA enters the market later but wields the capital and technical acumen for potential catch-up.

NVIDIA's Robotaxi incubation transcends a mere commercial experiment—it validates its full-stack 'chip + large model + toolchain' capabilities while probing the boundaries of Physical AI in mobility through real-world fleet operations. Nevertheless, software and experience gaps remain formidable obstacles.

02 Investing in the Robotaxi Ecosystem: Capitalizing on End-to-End Innovation

Beyond internal incubation, NVIDIA has been actively engaging in capital markets, particularly in autonomous driving ecosystem investments.

Recently, Jensen Huang announced a £2 billion investment in the UK, with approximately one-fifth allocated to autonomous driving firm Wayve, including a $500 million follow-on investment in its next funding round.

Synergy Between Wayve's End-to-End Approach and NVIDIA's Strategy

Founded in 2017, Wayve's core technology (AV2.0) mirrors Tesla's, eschewing high-definition maps or complex sensors. Instead, it leverages end-to-end deep learning and embodied AI to empower vehicles to learn driving patterns directly from camera data, akin to human learning.

To enhance 'black box' transparency, Wayve developed the LINGO-2 visual language model, which elucidates driving decisions in natural language while executing maneuvers.

Its GAIA-2 world model simulates extreme driving scenarios for reinforcement training, aligning closely with NVIDIA's Cosmos rationale.

Ecosystem-wise, Wayve's platform has undergone testing in the UK, Germany, and Japan, with plans to launch Nissan's ProPILOT next-gen system (powered by Wayve software) in FY2027. Uber is also exploring L4 fleet pilots with Wayve in the UK. These deployments, coupled with NVIDIA's hardware and toolchains, create vertical integration opportunities.

NVIDIA's Strategic Vision: Technological Wagering and Market Positioning

Investing in Wayve is not NVIDIA's inaugural move. It participated in Wayve's $1.05 billion Series C funding in 2024.

The renewed mega-investment reflects Huang's endorsement of end-to-end technology and NVIDIA's aspiration to secure a stake in potential 'next trillion-dollar companies' through strategic capital positioning.

Compared to solo incubation, investing in external partners like Wayve enables NVIDIA to swiftly access real-world testing data and global scenario diversity, offsetting its engineering experience gaps.

Huang's public acclaim after test-driving Wayve's London vehicles underscores its strategic significance.

In Q2 2025, NVIDIA reported $26.4 billion in net profit, providing far greater capital firepower than industry averages. Waymo invested approximately $12 billion to reach its current 700-vehicle operational scale, while NVIDIA's single-quarter profit surpasses that decade-long cumulative expenditure.

This financial strength empowers NVIDIA to pursue both self-research and investment paths concurrently, mitigating risks from single-route uncertainty.

By investing in Wayve and others, NVIDIA not only aligns with potential winners in end-to-end technology but also complements its Cosmos and DRIVE Thor offerings, forming a closed loop encompassing chips, models, platforms, and ecosystems.

Conclusion

Robotaxi has officially emerged as the primary battleground for Physical AI. While Waymo and Tesla have taken early strides toward deployment, NVIDIA is entering through a dual strategy of cultivation and investment.

Cultivation enables NVIDIA to hands-on develop full-stack capabilities from chips to world models, exploring the application boundaries of Physical AI. Investment leverages external innovation to accelerate scenario coverage and ecosystem integration. This 'skill enhancement + wagering' model presents a captivating strategic approach.