Is This the Acceleration Phase of AI Development in China and the US, or the Onset of a Bubble?

![]() 09/25 2025

09/25 2025

![]() 626

626

This week has been abuzz with significant market developments. On one front, NVDA is reported to invest $100 billion in OpenAI, with both entities signing a 10GW order. Given that 1GW roughly translates to $50 billion, the 10GW deal equates to a staggering $500 billion. This contract is projected to generate $350 billion in revenue for NVDA in the future, propelling its stock to an all-time high.

On the other hand, Alibaba, a leading Chinese internet AI company, has witnessed a surge in its valuation over the past two weeks. This boost initially stemmed from its self-developed chips and was further fueled by today's announcement of an additional capital expenditure (capex) of 380 billion yuan. By 2032, Alibaba Cloud's global data center energy consumption is anticipated to increase tenfold, with an estimated average annual investment of approximately 150 billion yuan. This aligns with market rumors of a 1 trillion yuan capex and is reflected in Alibaba's stock price, which reached a new yearly high with a 9% surge today.

It is now abundantly clear that AI is the focal point across A-shares, Hong Kong stocks, and US stocks. Especially after multiple tech giants, including NVDA, Broadcom, Oracle, Microsoft, and Google, highlighted AI demand in their Q2 reports, it appears we have entered the second acceleration phase of the AI theme.

Why do we say that? Initially, when major tech companies began investing in AI, the market's primary concern was the inability to recoup costs. However, the performance of Cloud Service Providers (CSPs) in the first half of this year has demonstrated that AI can indeed be profitable, with a much faster return on investment than cloud service construction. For instance, Google's AI Overview has debunked narratives of being overwhelmed by AI search, and its recent Nano Banana image generation model has further bolstered Google's market share. Consequently, Google's stock price has also soared to an all-time high.

In essence, following the Q2 reports, we have witnessed the AI flywheel starting to close the loop. If one remains uncertain about whether capex investments can yield profits, then there is little point in continuing to follow AI.

Secondly, the market currently doubts the future AI outlook presented by tech giants like OpenAI, NVDA, Broadcom, and Oracle. Common arguments include the inability to profit from AI investments, the inability to monetize AI large models, or claims that tech companies lack sufficient funds, with OpenAI allegedly unable to invest $300 billion in Oracle.

If one holds such views, they might also consider the opposite perspective. If only one CEO were making grand claims about the future Total Addressable Market (TAM), it would be easy to see through. However, if multiple leading tech companies are saying the same thing, shouldn't one consider the authenticity of their claims? Simply put, would these tech giants, with trillions of dollars in market capitalization, fabricate fake orders to entice you to buy their stocks?

For example, let's examine statements from several tech company leaders:

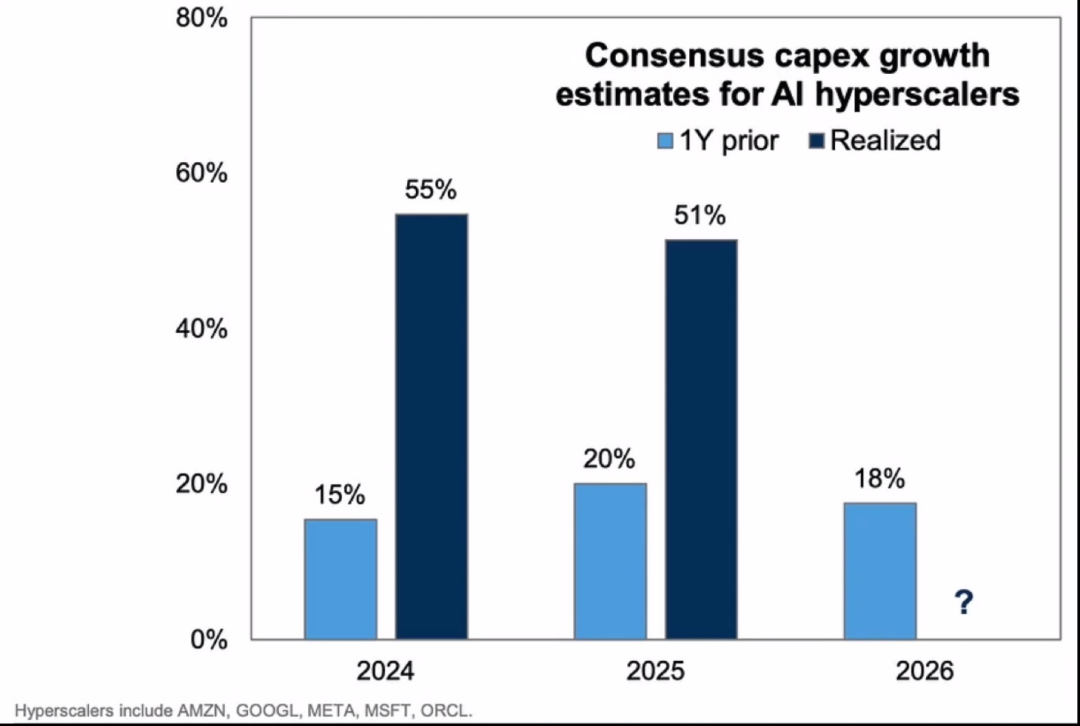

NVDA's Jensen Huang stated that the annual market size growth rate would be 50% in the coming years. For instance, the AI capex growth rate in 2026 is projected to be 50%, implying a total market size of $3-4 trillion by 2030.

Previously, the market expected a capex growth rate of only 18% next year. The actual capex expenditures in 2024 and 2025 have far exceeded market expectations, indicating a significant discrepancy between market investors' and tech companies' expectations. AI's actual development has far surpassed everyone's predictions.

Jensen Huang attributed the annual market size growth of 50% to two factors: First, large CSP customers' reasonable forecasts for the future; second, open-source models are prompting large enterprises, SaaS companies, industrial firms, and robotics companies to join the AI revolution.

When Jensen Huang mentioned a market size of $3-4 trillion by 2030, foreign banks were skeptical, thinking they had misheard. Consequently, the market remained cautious, seeking cross-validation from more CEOs of major companies.

Until then, Broadcom and Oracle's future guidance nearly cross-validated Jensen Huang's claims. Broadcom stated that its AI revenue would reach $120 billion by 2030, while Oracle projected its revenue to hit $144 billion by the same year.

However, these figures are still insufficient to fill the $3-4 trillion gap. According to Jensen Huang, more industries will join AI investments in the future, such as robotics, which is easy to understand, along with increased sovereign AI investments from countries worldwide.

Thus, there is a significant expectation gap here. Either multiple CEOs are colluding to deceive the market and inflate the bubble, or there is indeed a vast demand that we cannot comprehend. These tech leaders have a vision of the future market size and business potential that the market has yet to see, presenting an investment opportunity.

This ultimately boils down to believing early or late. Over the past three years, early believers have made money, and late believers have also profited, but skeptics have missed out on AI investment gains. As for these astronomical figures, whether to believe or not depends on each individual's understanding of AI.

Commonly, people wonder where the funds for these multi-billion-dollar investments come from.

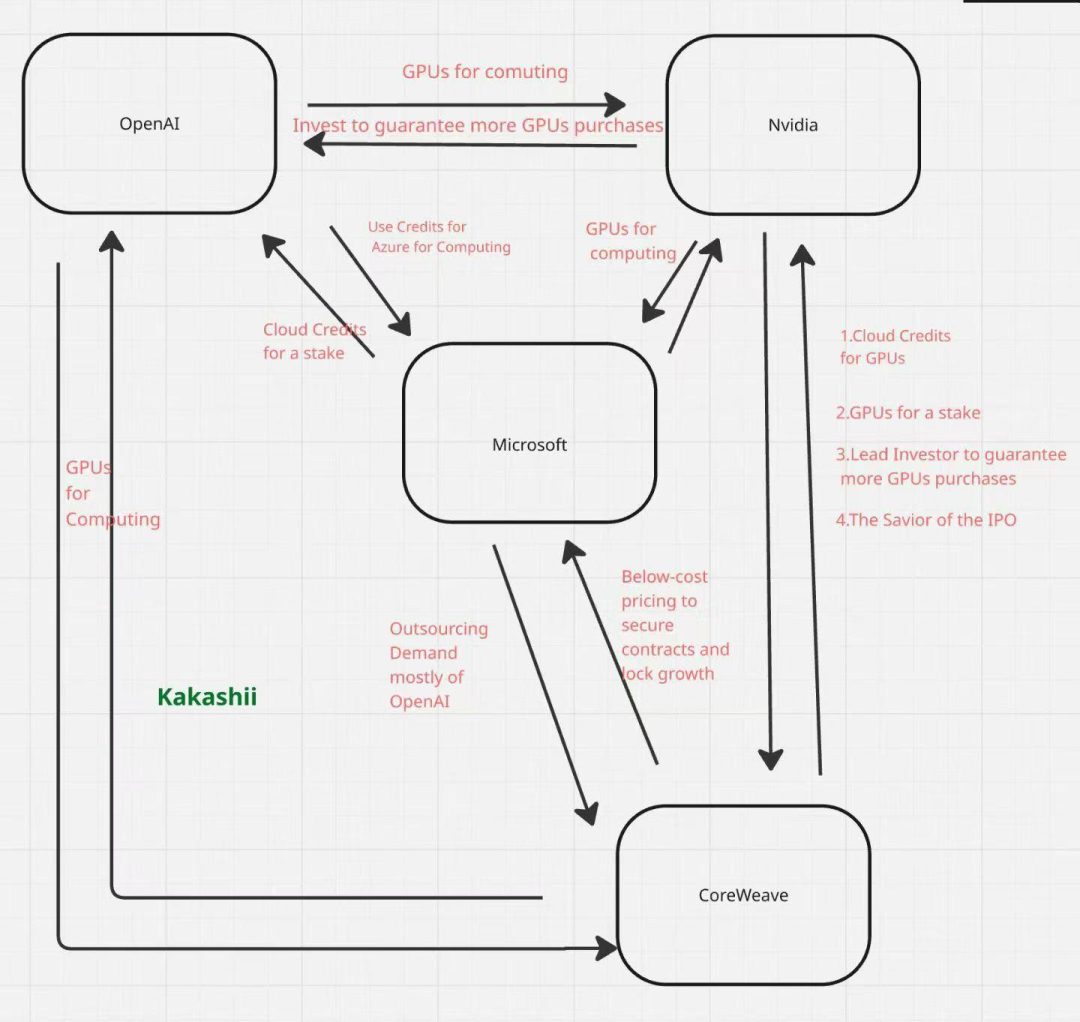

Currently, there are three primary avenues: First, tech companies reinvest their earnings into AI construction to generate more profits; second, external consortia lead investments, such as the US government-promoted Stargate initiative; third, as seen this week with NVIDIA investing in its major client OpenAI, the logic becomes smoother, eliminating concerns about future funding.

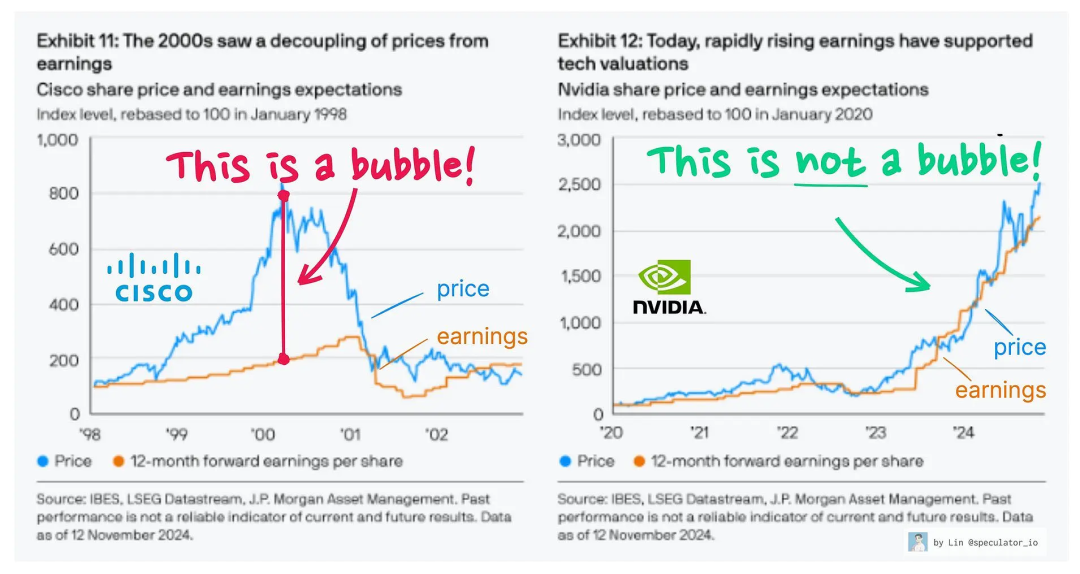

People often compare the current situation to the 2000 Internet bubble. However, this is a cliché. Stock prices, Earnings Per Share (EPS), and capital expenditures are all aligned, with none deviating significantly. For instance, there is no scenario where investments do not yield profits, and earnings have not improved, at least not yet. Even now, NVDA's consensus EPS forecast for next year is around 23x Price-to-Earnings (PE) ratio. Where can one find such a high-certainty, reasonably valued company?

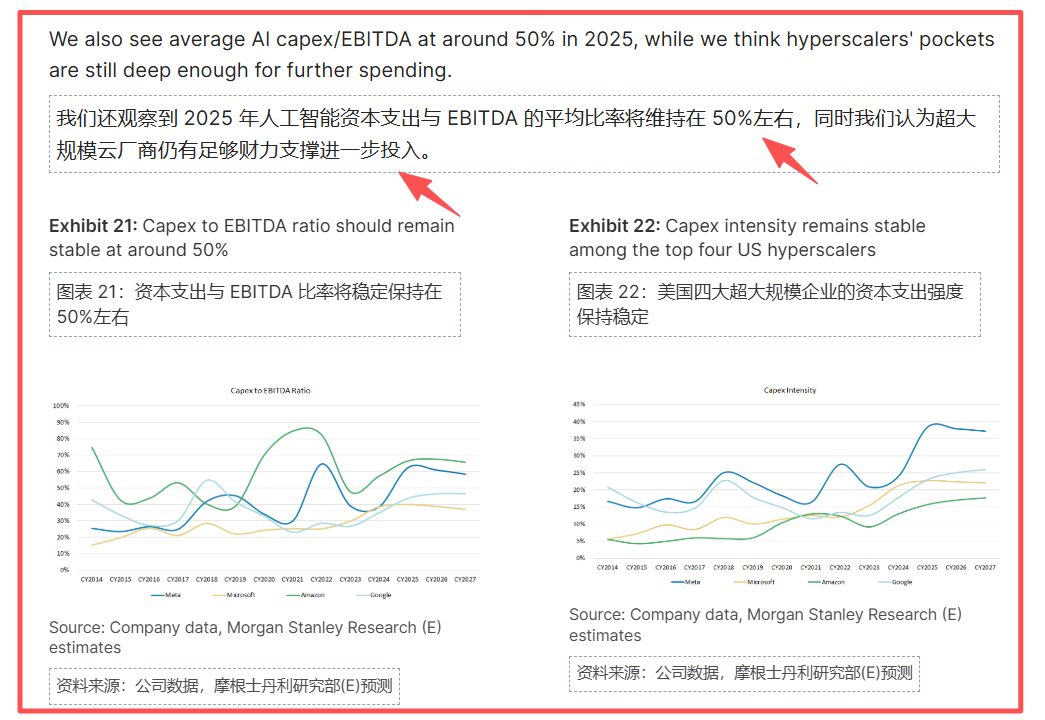

However, concerns about a bubble are not unfounded. Over the past two years, tech companies' capex has only been a portion of their annual profits, without resorting to debt financing for AI hardware investments to gamble on the future. As seen in the chart below, the average AI capex/EBITDA ratio in 2025 remains around 50%, meaning tech companies are only investing half of their annual profits, leaving room for further increases. Additionally, most tech companies have substantial cash reserves, previously used for buybacks, now redirected towards investments for growth, making continued investment increases reasonable.

Oracle's recent move seems to indicate the beginning of leverage, as it lacks sufficient funds to fulfill orders and may resort to borrowing for financing.

This requires continued observation, but the same applies to Alibaba. If it plans to invest 1 trillion yuan in the coming years, it does not currently have that much cash on hand. The expectation is to drive up valuations first, with the market believing in the vision, even though EPS contributions will not be visible in the short term.

Therefore, looking back in six months or a year, will this be the acceleration phase of AI development in China and the US, or the onset of a bubble?