Running on Zero Debt! Accelink Technologies Hits 16.5 Billion Yuan in Revenue with No Borrowing, Outperforms Zhongji Innolight with 47% Gross Margin

![]() 11/13 2025

11/13 2025

![]() 590

590

In today's business landscape, 'borrowing for growth' is nearly ubiquitous among companies. Reasonable borrowing is often considered a 'catalyst' for corporate expansion, with short-term loans providing working capital and long-term loans funding growth initiatives.

International behemoths like Apple and Microsoft, along with domestic counterparts such as Foxconn Industrial Internet (which saw short-term borrowing reach 85.8 billion yuan in Q3 2025), have all leveraged debt to fuel their expansions.

However, one tech 'maverick' has bucked the trend, achieving remarkable growth without any borrowing. This company is Accelink Technologies, a frontrunner in China's optical module sector.

The Zero-Borrowing Miracle: A Financial Anomaly Fueling Explosive Growth

A glance at Accelink Technologies' balance sheet reveals a phenomenon that can be dubbed a 'modern corporate marvel': since 2021, the company has maintained zero short-term and long-term borrowings.

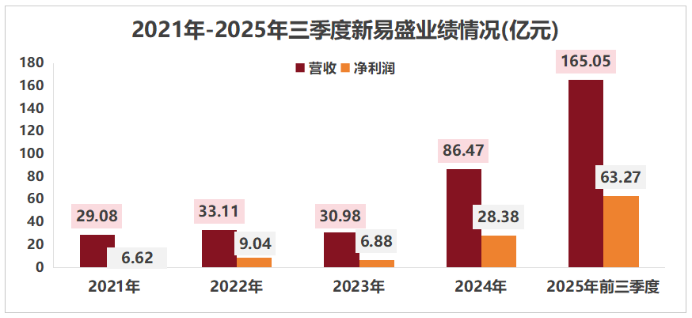

This isn't because the company is small. On the contrary, it marks Accelink Technologies' 'golden age' of performance. Let's delve into some key figures: revenue soared from 2.908 billion yuan in 2021 to 16.505 billion yuan in the first three quarters of 2025, a staggering 5.6-fold increase in just over four years. Net profit surged from 662 million yuan to 6.327 billion yuan, nearly a tenfold jump!

This implies that Accelink Technologies has achieved extraordinary growth solely through its internal profitability. Its only liabilities stem from naturally occurring operational payables (4.773 billion yuan at the end of Q3 2025), while it holds 5.439 billion yuan in cash and 3.995 billion yuan in accounts receivable, signaling a robust financial health.

This completely upends the conventional wisdom that tech companies are inherently 'high-investment, high-debt, high-growth' entities.

So, the question looms: how has Accelink Technologies achieved such rapid development without relying on any borrowing?

Riding the AI Wave: Optical Modules, the Essential 'Gateway' for 'High-Speed Computing'

The answer begins with its precise alignment with the most potent trend of our era—AI computing.

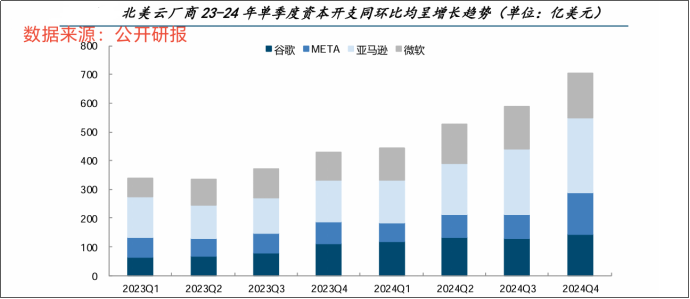

As Microsoft, Oracle, Apple, and Tesla engage in a frenzied arms race for AI large models, these giants are investing heavily in the sector.

Microsoft alone plans to invest approximately 80 billion US dollars in data center construction in fiscal 2025. If AI servers are likened to 'computing power skyscrapers,' then optical modules are the 'high-speed gateways' facilitating data in and out of these edifices. Without high-performance optical modules for data conversion and transmission, even the most powerful AI chips would be confined to server rooms, unable to deliver their computing prowess.

Accelink Technologies is precisely the architect of these 'high-speed gateways.' In 2024, it achieved a remarkable 'double leap,' surpassing Huawei in global optical module shipments for the first time and ranking third worldwide. Compared to Zhongji Innolight, which holds the top spot, 98% of Accelink Technologies' revenue comes from overseas tech giants, enabling it to more directly and fully capitalize on the enormous demand driven by the global AI capital expenditure surge.

Cost Leadership: The Dual Benefits of Technology Strategy and Vertical Integration

However, merely riding the trend doesn't fully account for its formidable profitability. Accelink Technologies' strength lies even more in its exceptional internal capabilities—cost advantages.

This is primarily reflected in two key strategic decisions:

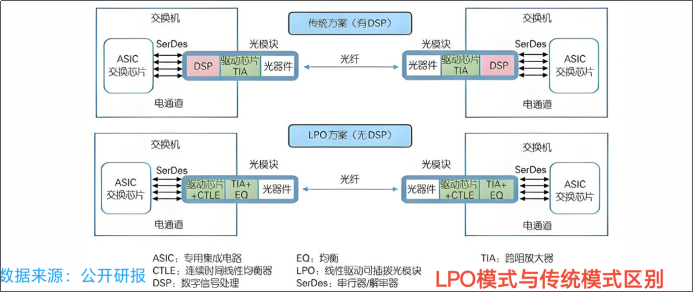

1. Choosing the Right Technology Path: LPO vs. CPO. Zhongji Innolight focuses on CPO (Co-Packaged Optics) technology, which represents a disruptive architectural shift.

Accelink Technologies, in contrast, emphasizes LPO (Linear-Driven Pluggable Optics) technology. Its greatest advantage lies in the elimination of the power-hungry DSP chip, resulting in superior cost and power efficiency, while leveraging the existing technology ecosystem for rapid mass production.

2. Vertical Integration of the Supply Chain: As early as 2017, Accelink Technologies acquired Alpine, a U.S. company specializing in optical module chip design. This strategic move enabled it to gradually achieve self-research and self-supply of core chips, significantly reducing external procurement costs and strengthening supply chain control.

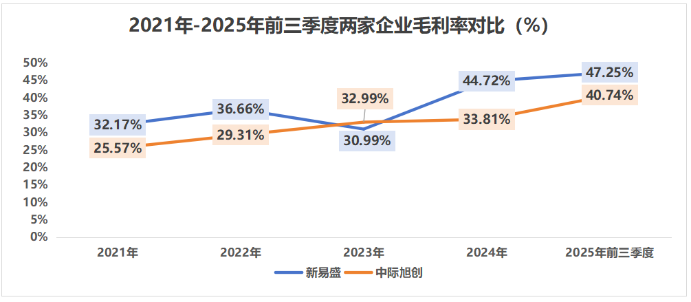

The cost advantages are directly reflected in gross margins: in the first three quarters of 2025, Accelink Technologies' gross margin reached 47.25%, compared to Zhongji Innolight's 40.74%. This means that even though Accelink Technologies' average selling price per optical module (about 990.5 yuan) is significantly lower than Zhongji Innolight's (about 1,635.5 yuan), it is more profitable.

Regarding the company's strategy, Accelink Technologies' management team exhibits a pragmatic and confident demeanor. They have stated, 'We have consistently focused on building core competitiveness through technological innovation and operational excellence, rather than relying on financial leverage. Our strategic choices in technology paths like LPO and our commitment to vertical integration have positioned us favorably in the AI computing wave. We are confident in the future of optical modules and the company's ability to sustain healthy growth.'

Does Yan Xi believe that zero borrowing, high growth, and high profitability render Accelink Technologies seemingly flawless?

Not entirely. Beneath the dazzling aura, several potential risks loom large.

1. Cash Flow 'Crunch': Profits 'Trapped' in Inventory and Receivables.

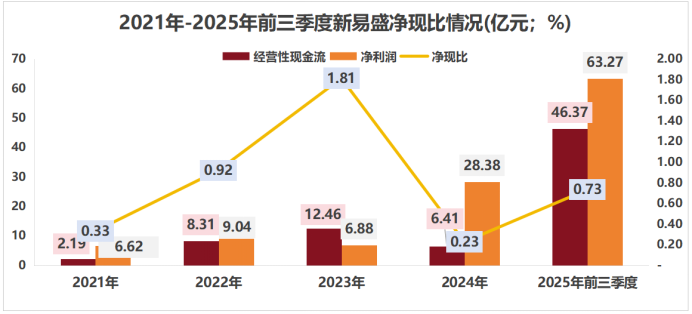

This is Accelink Technologies' most pressing challenge. The company's 'net cash to net profit ratio' (operating cash flow net amount / net profit) has long been volatile, dropping to as low as 0.23 in 2024, meaning that for every 1 yuan of net profit earned, only 0.23 yuan of cash was recovered. Although it improved to 0.73 in the first three quarters of 2025, it still hasn't 'turned positive.'

Where has the money vanished?

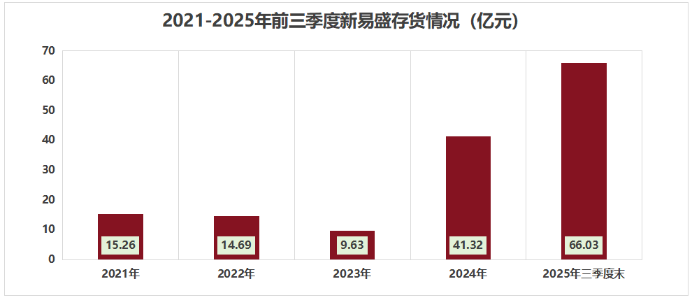

High Inventory Levels: At the end of Q3 2025, inventory reached 6.603 billion yuan, surging 60% from the beginning of the year. This directly resulted in 163 million yuan in inventory write-down losses, beginning to erode profits.

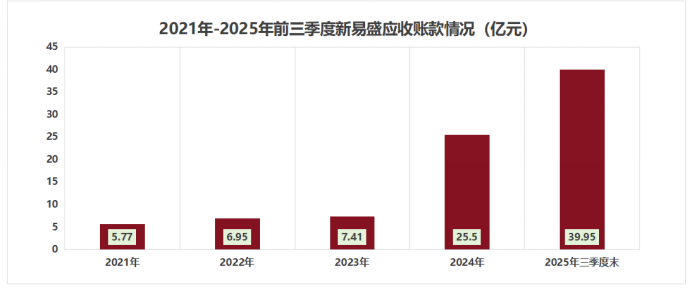

Soaring Accounts Receivable: Accounts receivable increased to 3.995 billion yuan, far outpacing revenue growth, indicating that a significant portion of the company's payments remains uncollected.

This reflects that Accelink Technologies is being 'squeezed' simultaneously by upstream suppliers (inventory occupying funds) and downstream customers (delayed payments) in the supply chain. Although 99.97% of receivables are within one year and the risk is manageable, the substantial capital occupation still hampers the company's operational efficiency and risk resilience.

2. The 'Gamble' on Technology Paths.

The competition between LPO and CPO is far from settled. As a more forward-looking technology, CPO could potentially surpass LPO in the future if it overcomes cost and ecosystem hurdles. Accelink Technologies' research, development, and mass production progress in higher-speed products like 1.6T will be crucial to maintaining its competitiveness.

3. Customer Concentration.

High reliance on a few overseas giants is a double-edged sword. While it brings order certainty, it also deeply ties the company's performance to these giants' capital expenditure plans, introducing significant volatility.

Extreme cost control has met explosive global demand, proving that a Chinese tech company can secure an indispensable position in the global top-tier supply chain solely through organic growth.

As the industry transitions from an explosive growth phase to steady expansion, where competition shifts from 'selling whatever is available' to a 'comprehensive battle of technology, cost, capital, and service,' managing surging working capital, maintaining technological leadership, and balancing customer relationships with healthy cash flow will become critical for Accelink Technologies' transformation from a 'dark horse' to an 'evergreen.'

Accelink Technologies has made a strong start, but the long race continues.

Note: (Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Investors act at their own risk.)

- End - Hope to resonate with you!