Please Give Joint Ventures the Respect They Deserve丨15 Years of Passion and Glory⑥

![]() 11/13 2025

11/13 2025

![]() 576

576

Introduction

True strength lies not in celebrating easy wins during prosperous times but in learning to carry all pressures forward in adversity.

On March 26, 2010, a new car that would reshape China's automotive landscape made its debut.

As Volkswagen's first domestically produced SUV in China and the brand's first urban SUV globally, the Tiguan not only further unleashed the potential of China's SUV market but also solidified the absolute strength of joint venture automakers in China, forming an impenetrable defensive fortress.

For a long time afterward, the Tiguan was in short supply, with price hikes for immediate delivery evoking mixed feelings. Yet, its arrival made Chinese automakers realize that foreign automakers, welcomed under the old notion of "market-for-technology," were still the ones to learn from.

During that golden decade for SUVs, not just the Tiguan but also the Haval H6 and Changan CS75 became highly sought-after models. However, no matter how strong their sales were, the overwhelming brand power gap of joint ventures remained an insurmountable barrier.

For joint venture companies, the vast business opportunities in China's auto market fueled their expansion, with everyone deeply enjoying the resulting market dividends. "Suffering under joint ventures for too long" has long been the sentiment of Chinese automakers, yet the impenetrable wall in reality left them powerless.

Where lies the breakthrough for Chinese automakers? Over the past 15 years, we have been seeking answers. Today, the new energy transition offers domestic brands a chance to shine. For joint venture automakers, stepping out of their comfort zones and re-examining current industry norms has become urgent.

Before this year, with the exits of Suzuki, Renault, Acura, Jeep, Mitsubishi, and other joint ventures, the situation for joint ventures has drastically changed from their peak. Many claim joint ventures have no future, suggesting even giants like Toyota and Volkswagen will succumb to Chinese companies' advances.

However, I argue that the world's rules are not written by a single group. On the surface, joint ventures' struggles reflect foreign automakers' collective setbacks in China. Yet, since 2025, increasing events remind us that underestimating joint ventures' resilience is unwise.

Nissan, Toyota, and General Motors' counterattacks may mark just the first phase of strategic shifts. With much time ahead, who can guarantee joint ventures are truly outdated? Facing uncertainties, it is unwise for any Chinese automaker to develop with a dismissive attitude. Acknowledging cyclical industry changes is far more crucial than complacency.

01 Fortunes Reverse Over Time

Fifteen years ago, Wei Jinqiao, the founder, established "Auto Business" with the belief that the automotive industry held great promise. Participants across the industry shared this vision, especially during China's rapid auto market growth, with no hesitation or concern about encountering significant resistance.

SAIC Volkswagen's move to solidify its industry leadership with the Tiguan was inspiring. At that stage, the Chinese auto market's control unquestionably rested with joint venture companies. It was an era where gold was abundant, and anything foreign-backed would succeed.

Volkswagen was undoubtedly the prime beneficiary of this dividend (dividend/bonus). However, even second-tier joint ventures enjoyed effortless success.

After years of market cultivation, Beijing Hyundai entered the million-sales era in 2013. Data showed annual production and sales surpassing one million units, ranking fifth among domestic automakers with a market share rising to 6.8%. That year, Beijing Hyundai became the third automaker (after Volkswagen and General Motors) to exceed one million units in single-brand sales, setting a record for the shortest time to reach five million cumulative sales domestically.

For the next three years, Beijing Hyundai maintained annual sales above one million units.

Similarly, Dongfeng Peugeot Citroën, representing two major brands, peaked in sales in 2014 and 2015, exceeding 700,000 units annually, with 710,000 in 2015 marking its historical high. In 2016, Changan Ford reached its sales peak of 958,000 units, contributing 90% of Changan Automobile's profits that year.

Unfortunately, the shift from glory to obscurity happened swiftly. Joint ventures often self-proclaimed as "mentors" to Chinese automakers. Over a long market journey, their pride placed them at the pinnacle of China's auto market. Yet, when China designated new energy vehicles as a national priority, a new era dawned.

To be honest, the emergence of numerous Chinese startups, driven by substantial government subsidies, posed no real threat to joint ventures. With patience, these startups would eventually self-destruct.

Indeed, within a few years, as predicted, most new entrants proved to be "paper tigers." Many argued that PPT-based car manufacturing lacked basic respect for the automotive industry, let alone a future.

Given this backdrop, could joint ventures continue to treat China's automotive industry with condescension? Frankly, regardless of their proclaimed "In China, For China" principles, arrogance persisted during those chaotic years.

That is until thunderous blows struck the joint venture ranks.

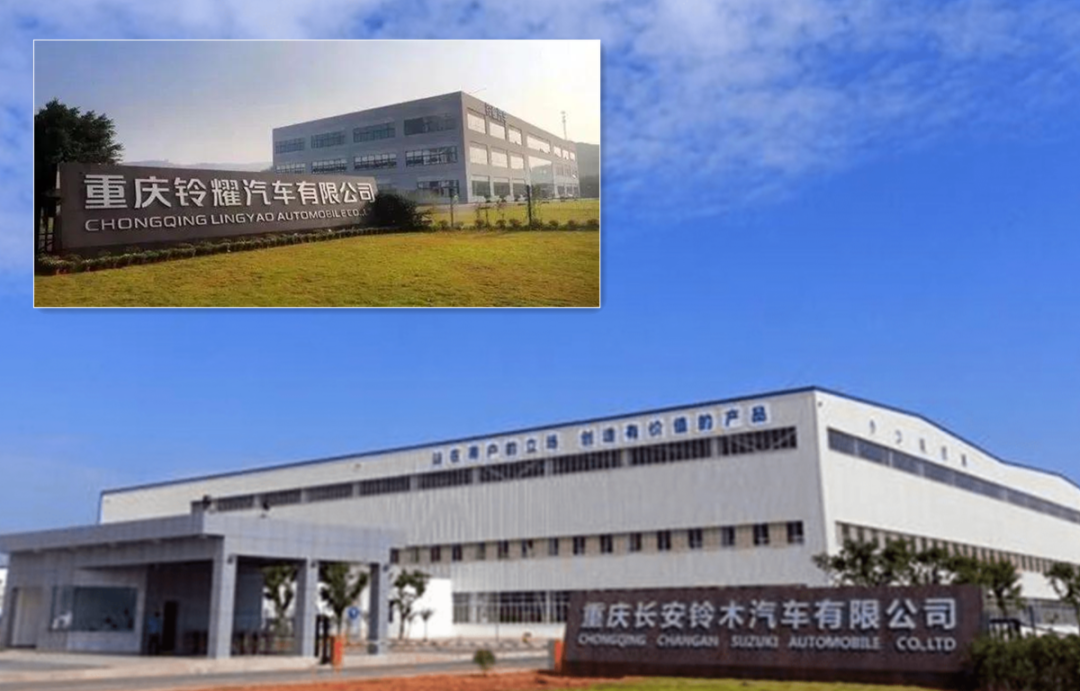

In June 2018, Suzuki withdrew from Changhe Suzuki. In September, Changan Automobile symbolically acquired Suzuki's 50% stake in Changan Suzuki for 1 yuan, making it a wholly-owned subsidiary. By December 2020, with Changan Suzuki renamed Chongqing Lingyao Automobile, Suzuki exited China's auto market entirely.

On April 14, 2020, amidst a pandemic-ravaged market, France's Renault Group announced transferring its shares in Dongfeng Renault to Dongfeng Motor, halting Renault-branded operations and marking its exit from China's passenger vehicle market.

On October 24, 2023, GAC Group announced a restructuring involving GAC Mitsubishi and its sales company, with shareholders injecting funds to clear debts. By March 2024, GAC Mitsubishi renamed itself Hunan Zhixiang Automobile Management Co., Ltd., severing Mitsubishi's ties with China.

In July 2025, a ruling by the Changsha Intermediate People's Court in Hunan Province ended GAC Fiat Chrysler Automobiles Co., Ltd.'s journey in China. On July 8, the administrator reported that with no prospects for restructuring, the court declared bankruptcy following Creditors' Committee (creditor committee) discussions.

These tragic stories spreading across joint ventures signal that for surviving brands to avoid a similar fate, they must humbly lower their heads.

02 From Mentors to Students: A Fresh Start

In the past three years, joint ventures likely never expected to be so passively impacted by China's automotive rise. Yet, witnessing peers like Hyundai and Stellantis struggle amidst Chinese competition, do giants like Volkswagen, Toyota, and General Motors resign themselves to the tide?

Indeed, arrogance is often cited as the original sin behind joint ventures' setbacks against Chinese automakers. With China's companies dictating industry rhythms, many believe joint ventures have lost their chance to recover.

Before 2025, mainstream joint ventures' uncompetitive responses seemed to validate this view. However, for Volkswagen, Toyota, and others, China's market significance leaves no room for hesitation in matching China's pace.

"We can outspend Chinese automakers to extinction!" Joint ventures once dismissively predicted the fate of China's new energy vehicle industry. Today, while electric vehicle development is indeed costly, it proves that following this path, however difficult, is unavoidable.

Entering 2025, in March, GAC Toyota made a bold move with the bZ3X, priced just over 100,000 yuan, challenging all Chinese automakers and declaring Toyota's electrification strategy aligned with Chinese user demands. Soon after, Dongfeng Nissan's N7 emerged in the same price segment, aiming to reclaim attention previously lost by the Leaf and Ariya.

Is this a desperate gamble or a strategic rebirth? In my view, reality is less dramatic; rather, when discerning joint ventures choose to stay in China, it's not too late.

Over decades of joint ventures in China, a fact remains: internal decision-making power has always favored foreign parties. Even minor product modifications faced resistance from Chinese joint venture partners, making significant changes unrealistic.

Today, products like the bZ3X and N7 are not late arrivals but reflections of foreign partners' realization that clinging to outdated approaches in China's transformed auto market is futile, only hastening their exit.

While Mazda preceded Toyota and Nissan by partnering with Changan to launch the China-focused EZ-6, today, all joint ventures need not just breakthrough strategies but a collective resolve to fight. With industry leaders adapting, subsequent models like the Mazda EZ-60 and Buick Ultimate L7 embody a new era.

Meanwhile, even for struggling automakers like Beijing Hyundai, which resorted to selling factories for survival, launching the highly refined all-electric SUV EO Yio signals a last-ditch effort to capitalize on trends. "Never exiting China" is no longer a slogan but a guiding principle for action.

With such expectations, joint ventures must undergo fundamental changes.

Case in point: Hyundai China's recent announcement that Li Fenggang, former executive deputy general manager of FAW-Audi Sales Co., Ltd., joins Beijing Hyundai as general manager.

Notably, since Lu Zaewan's decade-long tenure ended in 2011, the position saw nine successive appointments: Bai Xiaoqin, Choi Sung-ki, Kim Tae-yoon, Lee Byung-ho, Jang Won-shin, Tan Dohong, Yin Mengxuan, Choi Dong-woo, and Oh Ik-joon—all foreign nationals with limited battle experience in China.

From products to leadership, infusing Chinese elements seems revolutionary for joint ventures. Yet, China's automotive industry has inexplicably compelled them to shed their arrogance. Surviving in China requires abandoning past approaches.

Around the same time, Honda's decision to delay the Ye GT (Ye GT) electric sedan's launch, risking supply chain relations, speaks volumes. While I don't fully grasp Honda CEO Toshihiro Mibe's statement at the Japan Mobility Show—"Honda's three core markets for future automotive business are the U.S., India, and Japan"—it's clear Honda cannot afford complacency in China.

Over 15 years, Chinese automakers have been fortunate to learn car-making essentials from joint ventures. Conversely, joint ventures were lucky to profit handsomely while maintaining pride.

However, as times change and peers depart, whether it's Volkswagen, Toyota, General Motors, Hyundai, or Honda, the past is past. Given China's transformed market, embracing new roles is essential. Success has no shortcuts; respect must be earned through unique efforts, not replication.

Of course, if this battle can be weathered successfully, the existence of joint ventures will remain a valuable asset to China's automotive industry. From start to finish, from systematically resolving difficulties to judging market cycles and consumer trends, joint ventures have always been an object worthy of learning for China's automotive sector.

Although the era of a hundred flowers blooming has passed, we should believe that the mutual support and understanding between joint ventures and domestic automakers are the sources of sustained vitality for China's automotive industry.

Editor-in-Charge: Cao Jiadong Editor: He Zengrong

THE END