XPENG Fires the First Salvo in the Robotaxi Battle

![]() 11/18 2025

11/18 2025

![]() 472

472

Introduction: The Robotaxi Race Intensifies: From Tech Arms Race to Real-world Deployment

The Robotaxi sector has been abuzz with activity lately.

Tesla aims to phase out safety drivers by year-end; Waymo is expanding its footprint in Seattle; Pony.ai and WeRide made their Hong Kong Stock Exchange debuts on the same day; Baidu's Apollo Go leads globally in cumulative service orders; Didi's autonomous driving unit has secured over 10 billion yuan in funding; and Enjoy Ride is gearing up for an IPO (preparing for initial public offering). The Robotaxi news keeps pouring in.

But when it comes to who's been making the biggest waves in the Robotaxi arena recently, XPENG Motors might just take the crown.

At XPENG's Tech Day, their "catwalk robot" stole the show, sparking widespread discussions about Robotaxi, flying cars, and other futuristic projects.

Subsequently, XPENG's PR team executed a brilliant marketing campaign, using subsequent "self-validation" of the robot to reignite public interest, drive up stock prices, and keep XPENG in the headlines for days.

On the surface, this buzz seems to be more about the robot than Robotaxi.

However, on one hand, XPENG's CEO He Xiaopeng mentioned that 70% of the technologies in autonomous driving, flying cars, and robots are shared. Zhang Yongwei, Chairman of the China Auto 100 People's Forum, also noted at the Convergence of Intelligent Industry Development Conference that the overlap in supply chains between intelligent vehicles, embodied robots, and flying cars exceeds 60%.

On the other hand, from a public perception standpoint, AI technology is still viewed through a broad lens, with robots, autonomous driving, and practical large models all falling under the same cognitive umbrella—one leading to all.

Capitalizing on this momentum, XPENG also began promoting its Robotaxi project, partnering with Alibaba's Gaode Maps to officially integrate into the Gaode platform, jointly offering users L4 autonomous driving travel services.

Judging by this recent flurry of activity, competition in the Robotaxi field has quietly entered a new phase—from a tech arms race to real-world deployment. Robotaxi has reached a point where it needs to take a few decisive steps forward.

I. Changing Landscape: The Proof Is in the Deployment

Currently, Robotaxi players generally fall into three categories: first, companies like Apollo Go, Waymo, Pony.ai, and WeRide; second, automakers like Tesla and XPENG that combine technology with in-house vehicle production; and third, ride-hailing platforms like Uber, Didi, and Hello.

Previously, we believed these three types of players each had their strengths and weaknesses. However, judging by the recent trend of Robotaxi players breaking into the mainstream, the current Robotaxi industry has reached a point where "the proof is in the deployment."

From this perspective, some Robotaxi players that haven't truly deployed operations are at a disadvantage in terms of publicity.

Previously, public perception of Robotaxi was still in a "trying something new" phase, with a more wait-and-see attitude. But with one deployment and promotion after another, public expectations and awareness of Robotaxi are continuously rising, with boundaries shifting from science fiction to reality. At this point, what's needed is publicity with a bit of practical impact, like that from XPENG Motors.

Even in internal competition, companies that have deployed more vehicles have more confidence.

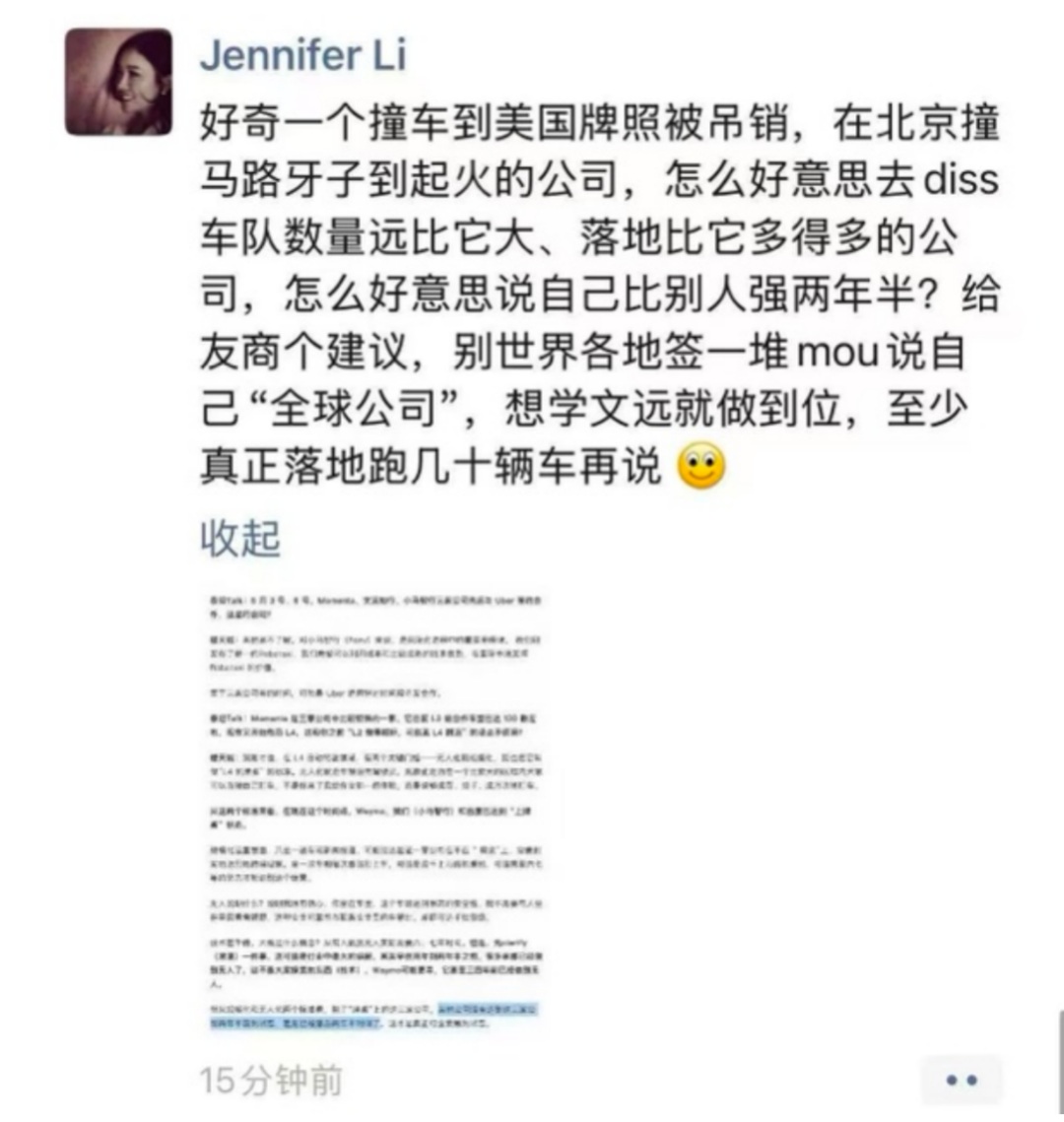

In June of this year, Lou Tiancheng, co-founder and CTO of Pony.ai, mentioned in an exclusive interview with Tencent Auto that L4 autonomous driving has clear thresholds and standards, namely driverless operation and scalability. In his view, globally, only Waymo, Baidu, and Pony.ai are at the forefront, with other companies not yet reaching the state these three were in two and a half years ago.

Later, Li Xuan, CFO of WeRide, quickly countered on WeChat Moments, ending with, "If you want to learn from WeRide, do it properly. At least deploy and run a few dozen vehicles for real."

You see, even in online spats, brands with more operational vehicles and real-world deployments have more confidence.

Even Enjoy Ride, which is preparing for an IPO, includes the deployment of its Robotaxi business as a bargaining chip in its prospectus.

According to Enjoy Ride's prospectus, since launching operations in 2021, its Robotaxi business has completed over 330,000 orders, opened over 48,000 pickup points, and accumulated over 2.5 million kilometers of driving.

For Robotaxi players like Didi and Hello that haven't truly deployed operations, the urgent task is to accelerate the deployment process. At the very least, they can follow XPENG's lead—even if their own products haven't deployed yet, they can start the marketing battle, showcasing various technologies and gimmicks to seize the high ground of public opinion.

The high ground of public opinion—if you don't seize it, someone else will.

In fact, ride-hailing platforms like Didi and Hello have natural advantages in the Robotaxi space. First, in terms of user habits, users of ride-hailing platforms don't need to open a new app. With Didi, for example, users can choose between driverless and manned vehicles with a single tap. User consumption habits will always be an advantage.

Second is the advantage of travel data. Ride-hailing platforms hold data on user travel habits, operations, and more, providing strong data support for subsequent R&D and operational practices in Robotaxi.

For instance, Didi handles nearly 50 million daily orders, covering 400 Chinese cities and 14 overseas countries, forming one of the world's largest and most diverse travel databases. This data can help Didi avoid disconnects between technological routes and market demand in future R&D and operations, giving it an edge.

That's why Didi Autonomous Driving and Hello have repeatedly won capital favor even before deployment, with continuous financing in the Robotaxi field.

However, with a series of players continuously ramping up, the market is now full of anticipation for Robotaxi's prospects. Goldman Sachs reports that by 2030, the global Robotaxi market size is expected to reach $40-45.7 billion, with a compound annual growth rate exceeding 60%.

With increasing capital injections and rising expectations, most current Robotaxi players are well-armed. Didi, Hello, and others should also be more proactive in publicity to build momentum for their future deployments.

II. Only After Deployment Can You Know the Depths

The three major challenges for Robotaxi—safety, cost, and public opinion—can only be truly assessed through operational deployment.

Without delving into safety, both the LiDAR camp represented by Waymo and Baidu's Apollo Go, and the pure vision camp represented by Tesla, have now undergone practical testing in terms of safety. Among Robotaxi players that have already deployed operations, the probability of safety issues is extremely low.

However, for brands that haven't operated in reality, everything remains uncertain, which is detrimental to future competition.

Imagine dozens of Robotaxi brands competing simultaneously in the future, with some being established brands that have operated for years and others being newcomers. When it comes to travel safety, how will consumers choose?

They can only focus on price, experience, and quality, but can't others in other fields catch up in the future? Leading brands like Apollo Go, Tesla, and Waymo aren't exactly short on resources.

The subsidy war between Didi and Uber in the ride-hailing sector is still fresh in our minds, but back then, Didi was leading the industry. Now, it's lagging behind several competitors in terms of deployment, putting pressure on players like Didi and Hello. Moreover, for the Robotaxi field, cost is inherently a bottleneck.

Cost is a major pain point constraining the Robotaxi sector. According to Tianyancha APP data, Pony.ai reported a net loss of $37.38 million in the first quarter of this year, while WeRide reported an adjusted net loss of 295 million yuan in the same period.

Baidu's Apollo Go aimed to achieve break-even in Wuhan last year, with Robin Li stating on Baidu's Q1 2025 earnings call, "We have already seen a clear path to profitability." However, whether it can fully enter the profitability phase by the end of 2025 remains uncertain.

Calculating costs on paper is far less direct than actually operating.

Confident as Tesla is, repeatedly emphasizing "Tesla is indeed a leader in real-world AI," even it had to lower expectations for its Robotaxi business after actual deployment.

At the Q2 earnings call, Musk set an aggressive goal to cover half of the U.S. population with Robotaxi services by the end of the year, but by the Q3 earnings call, his statement changed to expanding the service to 8-10 cities by the end of the year.

So for the Robotaxi field, only through operational deployment can one more effectively understand their cost boundaries.

Besides, deployment also tests whether one can withstand the tide of public opinion. AI projects inevitably involve combining grand narratives with real-life disruptions.

When Apollo Go deployed in Wuhan, there were many online comments from ride-hailing drivers demanding a halt to Apollo Go operations, sparking significant discussion on whether AI should compete with the public for livelihoods.

Such doubts and discussions are long-lasting.

Recently, local ride-hailing drivers in Seattle gathered to protest Waymo's autonomous driving company, opposing the promotion of driverless services in the area.

Peter Kuehl, president of the drivers' union, expressed concerns about Waymo, telling KIRO 7 TV, "The primary issue is job impact." With around 30,000 ride-hailing drivers in Washington State, he and union members fear they won't survive the transition to driverless operations. "We have families to support, and Waymo can't provide livelihoods for those unemployed families."

However, among Robotaxi players that haven't faced such doubts yet, Didi should be the least worried, as it has one more trump card than other Robotaxi players.

Recently, Meituan announced a pension insurance subsidy plan open to riders nationwide. Starting in November, riders can freely choose to pay in their hometown or work location, with both long-term full-time riders and part-time crowd-sourced riders eligible to participate.

As a result, among the "Iron Triangle" of express delivery, food delivery, and ride-hailing, only drivers now lag in social security coverage. If Didi addresses drivers' social security issues when deploying Robotaxi, it will naturally have an edge in public opinion over others, as ride-hailing platforms inherently create employment for drivers.

Moreover, Robotaxi can also generate related positions like safety officers, cleaners, and maintenance personnel, which may prioritize ride-hailing drivers in the future.

Ultimately, the Robotaxi race is not just a technological or commercial competition but a struggle for defining the future of transportation. Deployment is no longer an option for Robotaxi but a strategic focus for all players. Whoever can first establish a viable business model and balance human-machine conflicts will truly hold the key to the second revolution in transportation.

Disclaimer: This article is based on legally disclosed company information and publicly available data, with commentary provided. However, the author does not guarantee the completeness or timeliness of this information.

Additionally: Stock markets involve risk; enter with caution. This article does not constitute investment advice. Whether to invest requires personal discretion.