Without Subsidies, What Can New Energy Still Offer?

![]() 11/18 2025

11/18 2025

![]() 640

640

Lead

Introduction

Whether new energy vehicles are 'swimming naked' will soon be revealed.

On November 21, the Guangzhou Auto Show is set to open.

In 2024, as the theme of 'Auto Magazine's' coverage of the Guangzhou Auto Show, 'Internal combustion engine vehicles are not dead' has been validated this year. Although the penetration rate of new energy passenger vehicles has surpassed 50% since last year, the growth rate is slowing down.

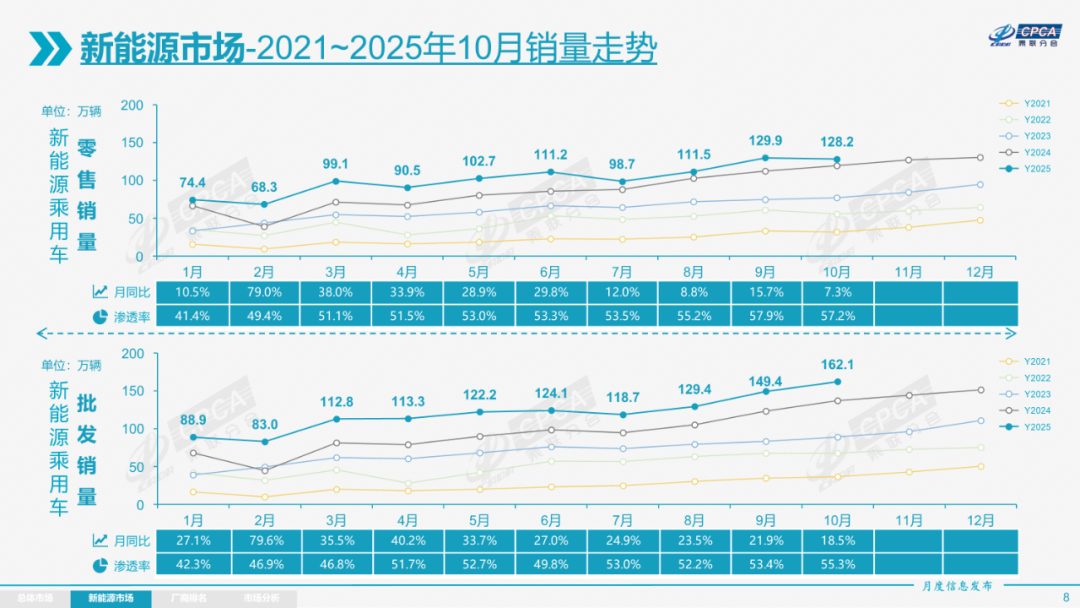

Data from the China Passenger Car Association shows that the retail penetration rate of new energy vehicles in October was 57.2%, a slight month-on-month decrease of 0.7% from September.

Unlike last year's discussions on whether fuel vehicles still had a future, this year, fuel vehicles have made a fierce comeback. From June to September, domestic traditional fuel vehicle sales increased year-on-year for four consecutive months. Although retail sales of fuel vehicles fell below 1 million again in October, the joint venture brands' strong call for 'equal rights for fuel and electric vehicles' is about to take a big leap forward.

'The real battle will begin after equal rights for fuel and electric vehicles are established. The current prosperity of electric vehicles is built on national policy tilt (preferred treatment), substantial subsidies, and support.'

Faced with the rise of new energy vehicles and the declining market share of fuel vehicles, some argue that the 'visible hand' has lifted new energy. Once subsidies are reduced and fuel and electric vehicles return to an equal starting line, fuel vehicles are expected to stir up the market once again.

'Practice is the sole criterion for testing truth.' As the debate between fuel and electric vehicles continues, two key changes are reshaping the competitive landscape.

On one hand, on October 9, multiple departments jointly announced that starting from 2026, the purchase tax for new energy vehicles will be restored to a 50% reduction, with the maximum tax reduction per vehicle shrinking to 15,000 yuan. On the other hand, fuel vehicles are catching up in intelligence, with traditional shortcomings such as assisted driving and smart cockpits being rapidly addressed.

Under the dual impact of policy reductions and technological catch-up, the 'swimming naked' test for new energy vehicles has arrived.

01 Farewell to the Subsidy Cradle

Before the official announcement on October 9, the market still held the last hope for the exemption of purchase tax for new energy vehicles in 2026.

Since September 2014, this policy has been extended four times. Just as some fuel vehicle users believe that the rise of new energy is entirely due to policy support, the tax exemption for electric vehicles is also seen as an unshakable stereotype.

The latter enjoys the benefits, while the former feels disgruntled.

In addition to purchase tax exemptions, new energy vehicles also enjoy explicit benefits such as exemption from fuel surtaxes, green license plates in big cities, and unrestricted travel. For automakers, substantial subsidies have injected crucial momentum into the new energy industry, which initially suffered from weak technology and high costs.

Policy tilt (preferred treatment) has fueled the industry's leapfrog growth. Over 11 years, the market penetration rate of new energy vehicles nationwide has surged from 0.3% to 57.8%, achieving a remarkable overtaking maneuver. However, while crutches have propelled the industry forward, they have inevitably obscured the efforts of outstanding companies and left fuel vehicle owners feeling disillusioned.

Now, the tide is receding. With tightening purchase tax subsidies and weakening trade-in subsidies, the policy dividends that have lasted for years are entering their final stage. The answer to whether new energy vehicles are 'swimming naked' will soon be revealed in market competition.

And some clues can already be seen in the current market response.

After the purchase tax announcement, more than ten automakers under sales pressure have successively (successively) launched 'guarantee' plans, promising to cover purchase tax costs for users. Behind this lies not only corporate responsibility but also the real pressures facing the industry.

'It's extremely, extremely, extremely hard to sell,' said Xiao Meng, a Xiaomi automobile salesperson in Shanghai. On average, each salesperson in his store could only sell one vehicle in October. Among them, the purchase tax became a major obstacle.

'The impact of the purchase tax is huge,' said another salesperson, Xiao Li, from the same store in an October interview. 'Many people have already given up halfway when they hear that this car (Xiaomi YU7) has a one-year wait. Then, when they hear that there will be over 10,000 yuan in purchase tax next year, 90% give up.'

Although automakers' guarantee policies have attracted some hesitant customers, they still cannot fundamentally alleviate sales difficulties.

Xiao Meng said that a user who missed out on the zero-gravity seat giveaway for not snapping up the new car's debut completed the order under the stimulate (stimulus) of the purchase tax. 'His own words were that if it weren't for the purchase tax guarantee policy, he might still not get over the zero-gravity seat hurdle.' However, such cases are still rare.

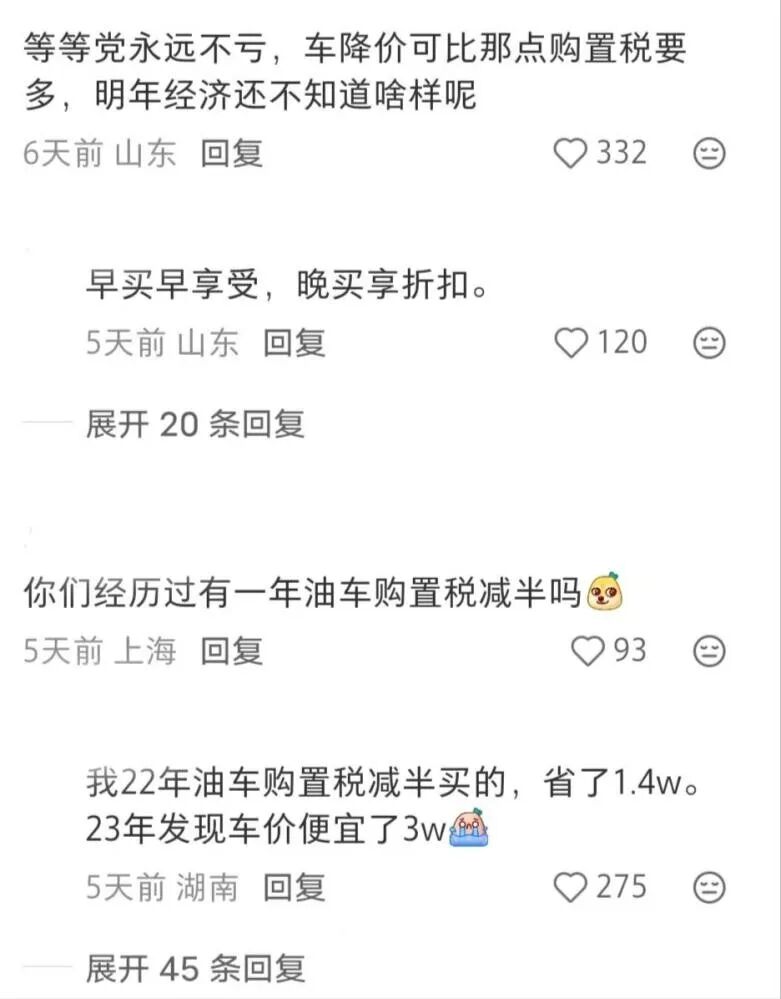

Faced with a volatile market, consumers who fear being stabbed in the back and dislike aggressive sales tactics are unwilling to be swayed by policies.

Product price reductions after subsidy reductions have almost become a consensus. Taking the author's own experience as an example, a few months ago, the author enjoyed a 20% national subsidy and purchased an IKEA lamp and bulb for 119 yuan. Recently, a friend bought the same product for only 114 yuan without any subsidies, making it even cheaper than the subsidized price.

Moreover, recent price fluctuations in the automobile industry have been unstable, and with numerous uncertainties, more consumers prefer to become 'wait-and-see' buyers.

Some consumers shared their experiences, saying that they had previously set their sights on the Epi 007 and hurriedly purchased the vehicle upon hearing that the Sichuan provincial subsidy was about to be canceled. However, since the 007 did not have a top-spec model in stock, they switched to another brand's model. Less than a month later, Epi launched the 007+ model, which not only added features such as lidar, high-computing-power chips, and active suspension but also kept the price unchanged. As a result, he deeply regretted it, saying, 'I would rather have paid the purchase tax and forgone the provincial subsidy. I lost out big time.'

For automakers in the elimination round, guaranteeing purchase tax is almost a must-do choice. Looking back at history, we find that the wheels of history always follow a similar path. In the second half of 2022, fuel vehicles enjoyed a brief period of a 50% reduction in purchase tax. In early 2023, the subsidy policy was canceled, and with the rise of new energy and sales pressure at the beginning of the year, a price war broke out in March and has continued to this day.

More severe (severely) is that even with guarantee policies in place, they may still be affected by their side effects. A salesperson from Hongmeng Zhixing revealed that some customers chose to give up after learning about the policies: 'This clearly means I can't get the car this year.'

02 Back to the Same Starting Line

Just as the 'visible hand' slowly withdraws, the 'invisible hand' of the market is recalibrating the balance of competition.

Charging costs and intelligent experience were once the two biggest shortcomings criticized about fuel vehicles. Now, with rapid technological iteration, the latter is being rapidly addressed, becoming an important driving force for the recovery of the fuel vehicle market.

In the field of assisted driving, taking the newly launched all-new Sagitar L as an example, as a fuel vehicle in the 100,000-150,000 yuan price range, the new car is equipped with 7 cameras, 5 millimeter-wave radars, and 12 ultrasonic radars in terms of hardware. Inside the car, it is configured with a 15-inch 2K floating central control screen, a 10.25-inch full-liquid-crystal instrument, and a W-HUD head-up display system. In terms of software, the new car is equipped with the IQ.Pilot enhanced driving assistance system, covering 95% of urban road conditions and 100% of highway scenarios, enabling highway navigation assistance, precise on-off ramp maneuvers, smooth avoidance, and red light start-stop.

In terms of smart cockpits, Dongfeng Nissan has taken a crucial step forward. By collaborating with Huawei, the Teana Hongmeng cockpit delivers an interactive experience comparable to that of new energy models, setting a new benchmark for the intelligent upgrading of traditional fuel vehicles.

The addressing of intelligent shortcomings has directly driven the recovery of the fuel vehicle market. Data shows that in September, domestic traditional fuel vehicle sales reached 1 million units, a year-on-year increase of 6.4% and a month-on-month increase of 10.9%, marking the fourth consecutive month of year-on-year growth.

With the reduction of new energy purchase tax subsidies in 2026, fuel vehicles will enter the market with more balanced product capabilities. The competition between fuel and electric vehicles will shift from mismatched competition under policy tilt (preferred treatment) to a full-fledged showdown of hard power across all dimensions.

Misfortune may be a blessing in disguise, and vice versa. The reduction of subsidies marks the end but also the beginning of industry maturity.

From an essential perspective, subsidies are a short-term regulatory measure during periods of market instability or economic weakness. The original intention of new energy vehicle purchase subsidies was to bridge the price gap with fuel vehicles and nurture emerging industries. However, subsidies can only solve short-term problems and cannot eliminate the long-term uncertainties of industry development.

Will new cars be subject to price reductions, upgrades, or additional features? Will the residual value of used cars remain stable? In an environment of high information asymmetry, consumers cannot make rational judgments about the long-term situation and can only adopt a wait-and-see attitude, hoping to ultimately pass on cost pressures to automakers.

As the subsidy cushion gradually withdraws, the competitive logic of the industry will inevitably shift from policy dividend-driven to product value-driven. New energy automakers need to shed their reliance on subsidies and demonstrate real capabilities in cost control, technological innovation, and user experience. Fuel vehicles, on the other hand, have regained the confidence to compete on the same stage as new energy vehicles by leveraging their intelligent catch-up and mature industrial chain advantages.

This industrial transformation, which began with policy support, is now returning to its market-driven essence. The true showdown between fuel and electric vehicles is just beginning at this moment.

Editor-in-Chief: Li Sijia Editor: He Zengrong