Which Segment Will Be the Sole Potentially Profitable One Among Large Models?

![]() 11/21 2025

11/21 2025

![]() 629

629

Author: Shi Yu Xing Kong (Poetry and the Starry Sky)

ID: SingingUnderStars

In October 2025, an American internet user employed ChatGPT to scrutinize their brother-in-law's ICU rescue bill. They found irregular charges amounting to $162,000 within a total bill of $195,000. Eventually, the final bill was reduced to $33,000.

Subsequently, OpenAI declared that ChatGPT would cease providing medical, legal, or financial advice.

Some individuals have downplayed the notion that these events are connected, while others perceive it as a problem unique to the United States, stating, "Don't meddle with vested interests."

Fortunately, China's open-source large models are still accessible. In fact, 80% of Silicon Valley's AI startups rely on Chinese models.

Popular examples include Kimi, DeepSeek, and Alibaba's Tongyi Qianwen.

Alibaba not only develops its own large models but also fosters affiliated companies to train their models. For instance, Ant Group launched and open-sourced its Ant Financial Large Model, which gained popularity on Hugging Face. At the recently concluded Wuzhen Internet Conference, Ant unveiled its Ant Medical Large Model.

Winning Health, in which Alibaba holds a stake, also introduced WiNGPT.

However, concerns surfaced when Winning Health announced on November 5 that its wholly-owned subsidiary, Shenzhen Winning Zhongtian, along with its actual controller and chairman, Zhou Wei, received a "Criminal Judgment" issued by the People's Court of Dianbai District, Maoming City, Guangdong Province, on the same day. The first-instance judgment found Shenzhen Winning Zhongtian guilty of unit bribery, imposing a fine of RMB 800,000. Zhou Wei was sentenced to one year and six months in prison for unit bribery and fined RMB 200,000. On November 10, the company announced Chairman Zhou Wei's resignation.

01

Winning Health's Dismal Financial Performance

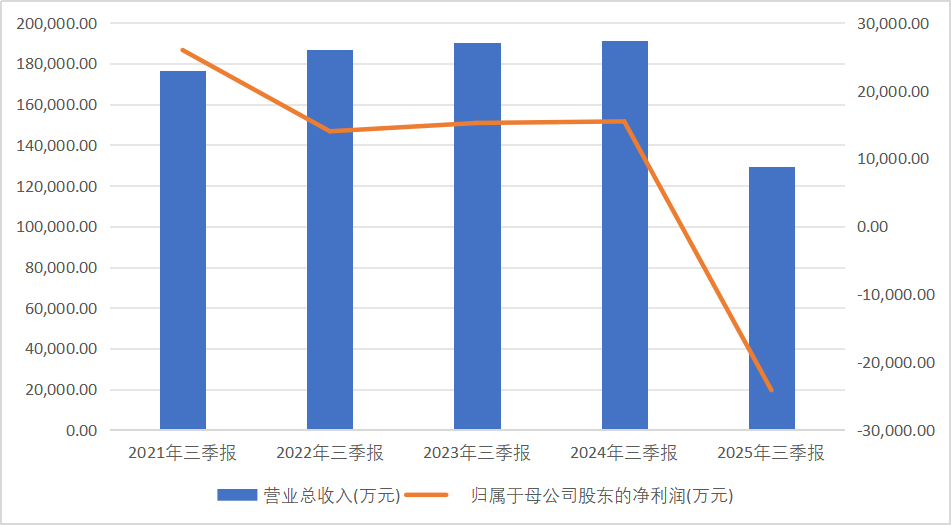

When it rains, it pours. Winning Health's third-quarter report for 2025 revealed an extremely dire financial performance over the first three quarters.

Data Source: iFind

The company generated revenue of RMB 1.296 billion in the first three quarters, marking a year-on-year decrease of 32.27%. It ranked 22nd out of 102 companies in the industry. The net profit attributable to shareholders was -RMB 241 million, representing a year-on-year decrease of 256.10%. This marked the company's first loss in the first three quarters since 2010. Non-GAAP net profit losses widened to -RMB 228 million, a year-on-year decrease of 259.86%, indicating a severe deficiency in the profitability of its core business.

Quarterly breakdown: Revenue in Q1 was RMB 345 million, down 30.24% year-on-year. Revenue in Q2 was RMB 494 million, down 31.43% year-on-year. Revenue in Q3 was RMB 457 million, down 33.78% year-on-year.

Notably, the year-on-year revenue decline in Q3 further expanded to 33.78%, indicating an accelerating downward trend in the company's performance.

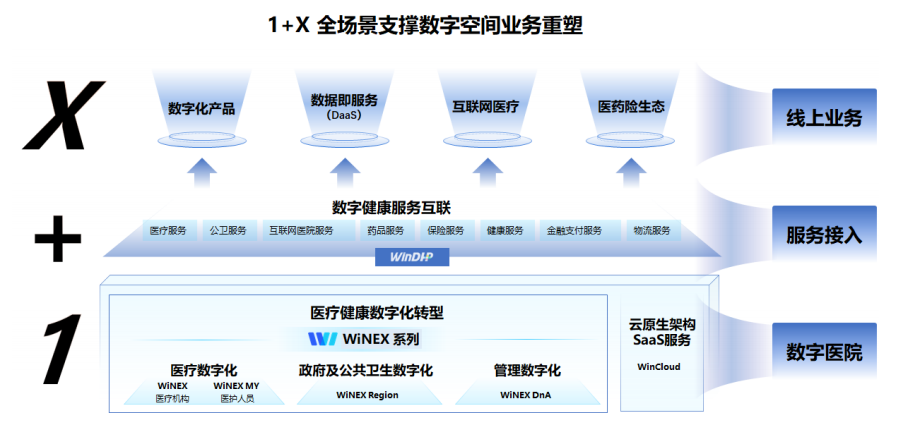

Winning Health, headquartered in Shanghai, operates 10 R&D bases and 20 branches nationwide. It serves over 6,000 healthcare institution users, including more than 400 tertiary hospitals.

In recent years, the company has developed products and solutions for various application scenarios, with its business spanning smart hospitals, regional health, primary health, and health services.

Data Source: iFind

Since 2015, the company has started to make strategic moves in the medical and health services sector, promoting the development of innovative businesses such as medical health cloud services under the Internet+ model.

02

The Root Causes Behind the Sharp Profit Decline

The company's business model entails providing information system solutions to hospitals or health departments through "information engineering project contracts," "software sales contracts," or "purchase service contracts." It builds hardware and software application platforms and collects project contract payments, software sales contract payments, or technical service fees from users to generate revenue and profits.

After delivering information system solutions to customers, the company offers long-term product upgrades, hardware and software maintenance, and other services through technical support service contracts. It generates revenue and profits by collecting technical support and service contract fees from customers.

Customers are mainly domestic public hospitals, health management departments, and other institutions. These institutions generally adhere to strict budget management systems for information product procurement. Investment plans are typically formulated in the first half of the year and involve processes such as budgeting, approval, bidding, and contract signing, resulting in relatively long cycles.

Therefore, customers' annual capital expenditures are mainly concentrated in the second half of the year, especially in the fourth quarter. Project acceptance and payments are also concentrated during this period.

If customer demand is released slowly, bidding schedules are unreasonably arranged, or delivery and acceptance are delayed, it will significantly impact the company's recognition of operating revenue.

Additionally, the company will continue to ramp up R&D investment around its WiNEX product suite and AI applications. However, the new-generation WiNEX product is still in the process of upgrading and replacement and has not yet translated into substantial revenue.

The company has merged technical services and software sales into software technology and services, but it is still evident that the gross profit margin of its core products is declining.

From an industry-wide perspective, Winning Health's gross profit margin falls in the mid-to-lower range. The reduction in revenue scale is just one aspect; more importantly, the profitability of its core products is declining, and innovative products have not yet formed a second growth curve.

Although the company has implemented various measures to control costs and expenses, the significant increases in asset impairment losses and bad debt losses have also dragged down its profitability to a certain extent.

03

Asset Impairment Losses

Winning Health's asset impairment losses primarily stem from two aspects: contract asset impairment and goodwill impairment.

Contract assets refer to prepayments or contractual rights held by an enterprise after signing a contract. Typically, the company needs to assess whether contract assets are impaired at the end of each year based on factors such as increased market risks, deteriorating economic conditions, customer defaults, and contract invalidity.

Over the past three years, the company's contract asset impairment losses have exceeded RMB 100 million. As of the third-quarter report, contract assets still stood at nearly RMB 2 billion, accounting for 25% of total assets. This indicates that the risk of contract asset impairment remains high.

Goodwill refers to the excess of the consolidation cost over the fair value of the identifiable net assets acquired in a business combination not under common control. Goodwill is not amortized but is subject to impairment testing at the end of each future year. If the industry in which the acquired assets operate becomes unfavorable, their business declines, or other factors lead to future operating conditions and profitability falling short of expectations, there is a risk of goodwill impairment.

Winning Health's goodwill mainly comes from Shanxi Winning and Huanyao Winning. The combined goodwill from their acquisitions totals approximately RMB 400 million, accounting for about 70% of the total goodwill.

In the first three quarters of 2025, the company recognized asset impairment provisions for contract assets exceeding RMB 60 million, further dragging down profitability. Although the company did not recognize goodwill impairment provisions, the third-quarter report is unaudited, and whether goodwill impairment provisions will be recognized in the annual report remains uncertain.

04

Extravagant Dividend Payments

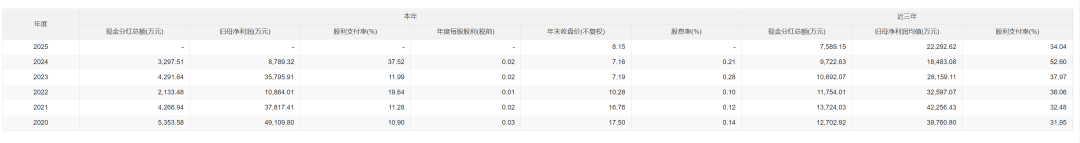

In recent years, despite a significant decline in profitability, the company has substantially increased dividend payments. By the end of 2025, the dividend payout ratio had already reached 34%.

With billions of yuan in outstanding payments still to be collected and the need for continuous investment in the WiNEX product, excessive dividend payments will further exacerbate the pressure on the company's capital chain.

-END-

Disclaimer: This article is based on the public company attributes of listed companies and primarily relies on information disclosed by listed companies in accordance with their legal obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms) as the core basis for analysis and research. Shi Yu Xing Kong strives to ensure the fairness of the content and views presented in the article but does not guarantee its accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice, and Shi Yu Xing Kong assumes no responsibility for any actions taken based on the use of this article.

Copyright Notice: The content of this article is original to Shi Yu Xing Kong and may not be reproduced without authorization.