Shattering the BBA High-End Monopoly: Will Huawei “Rule” the Guangzhou Auto Show and Reshape the Luxury Car Market?

![]() 11/21 2025

11/21 2025

![]() 446

446

In 2025, the automotive landscape finds itself in a state of collective uncertainty, encompassing everyone from automakers and suppliers to the media.

Automakers are confronted with agonizing decisions: Do they persist in price wars at the risk of diluting brand value, or do they prioritize maintaining brand prestige? Should they chase online traffic or channel resources into research and development (R&D)?

Technological advancements are evolving at breakneck speed. Solutions that are highly acclaimed today may become obsolete tomorrow. Can substantial R&D investments guarantee a steady stream of orders?

Amidst this widespread confusion, the 2025 Guangzhou Auto Show—the year’s grand finale—has arrived as planned.

However, amidst this turmoil, a “supplier” that claims not to manufacture cars has carved out a prominent niche in the automotive sector, with various manufacturers vying for collaboration opportunities. What’s even more unsettling for competitors is that during the HIMA Enjoya S9 new product launch, Huawei’s Executive Director and Terminal BG Chairman, Yu Chengdong, revealed that HIMA’s average transaction price in October reached 390,000 yuan, effectively breaking the high-end market monopoly previously held by foreign luxury brands like BMW, Mercedes-Benz, and Audi (collectively known as BBA).

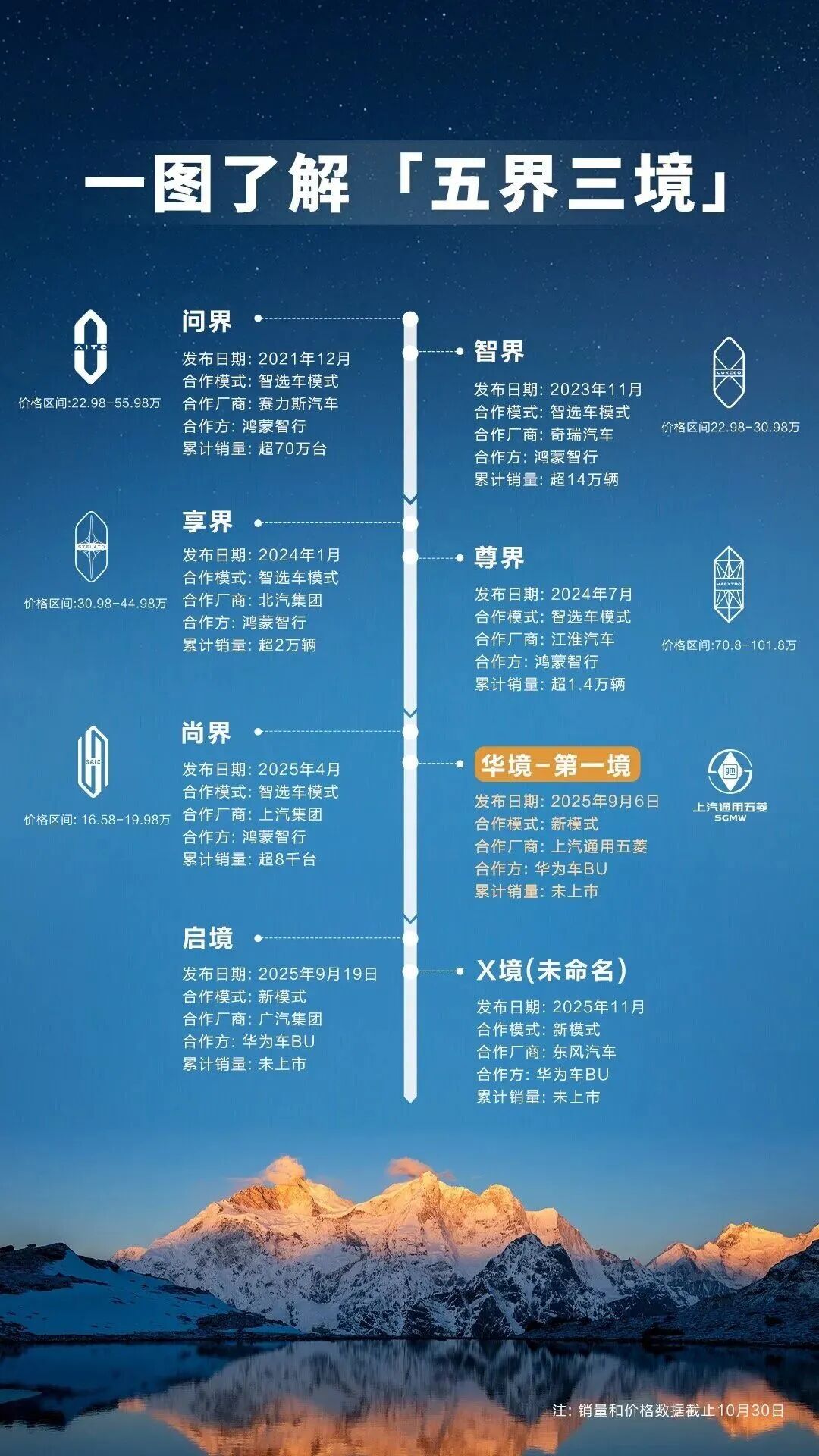

In terms of its product lineup, HIMA has established a comprehensive “Five Realms” strategy: AITO (a collaboration with Seres), Luxeed (a collaboration with Chery), Enjoya (a collaboration with BAIC), Zense (a collaboration with JAC), and Shangjie (a collaboration with SAIC).

Interestingly, beyond these five realms, Huawei has also registered 200 trademarks containing the character “Jie” (realm), such as Qijie, Xianjie, Tianjie, Junjie, and Zhengjie.

It remains to be seen whether these “realms” will eventually make a significant impact on the automotive industry. Beyond the Five Realms, Huawei’s new “Jing” series has also embarked on a new journey. Collaborations such as Qijing with GAC, Huajing with Wuling, and X Jing with Dongfeng will all make their debut at the Guangzhou Auto Show, ready to compete in the market.

Similarly, Huawei has registered multiple trademarks containing the character “Jing,” such as Baojing, Shunjing, Yijing, and Yuanjing.

The “Jing” series will expand its collaborations to include automakers like Changan and FAW, in addition to the already confirmed GAC, Wuling, and Dongfeng. The models will cater to various market segments, with prices ranging from 100,000 to 250,000 yuan.

It is reported that Huawei’s self-developed motor and electronic control systems will be gradually integrated into the “Jing” series models.

The automotive industry is a landscape of contrasts: some revel in success while others lament setbacks; some dine in opulence atop skyscrapers while others wander the streets in search of opportunity...

Thus, this year’s Guangzhou Auto Show serves as a massive cross-section, reflecting the true state of the entire industry after a period of intense turmoil. There are those who are anxious, those who are eager, those who are struggling, and those who are groping their way forward in the mist.

I wonder what everyone thinks about Huawei’s ecosystem dominating the Guangzhou Auto Show. Feel free to leave your comments and discuss your insights...

Defying physical laws is unacceptable! A certain car attempted to climb the 999-step Tianmen Mountain staircase but unfortunately rolled back, crashing through the guardrail. A Xiaomi car in Changzhou exploded and burst into flames by the roadside, leaving only an empty shell after firefighters extinguished the blaze. Are advance reservation figures unreliable? First Financial News revealed that officials are discussing the “False Marketing Identification Method.” Powered by “love”? The Lantu Mount Taishan faced criticism from “digital enthusiasts” before its market debut. Lexus’s car sales drama went viral thanks to a cleaning lady. Mr. Duan joked that Mercedes-Benz isn’t a “generic electric vehicle,” but netizens say it still looks a bit “generic.” Seres’s Hong Kong stock debut plummeted 9.51% on the first day. Why couldn’t a hundredfold subscription prevent the break below the IPO price?

Thank you for reading.