AI Applications: Still Waiting for Breakthroughs

![]() 11/21 2025

11/21 2025

![]() 499

499

"Where Are the Groundbreaking AI Applications?"

Author | Jian An

Editor | Lu Xucheng

AI remains the most captivating narrative of our era. Its immense potential and the revolutionary changes it promises for the future are undeniable. Yet, when juxtaposed with the disruptive innovations brought forth by super apps during the mobile internet boom, we must acknowledge a stark reality: current AI applications have yet to deliver many true surprises.

Old Wine in New Bottles

During Tencent's earnings call on November 13, President Martin Lau announced that WeChat would eventually roll out an AI agent. This agent will empower users to accomplish multiple tasks within the WeChat ecosystem, leveraging AI to understand user needs, intentions, and interests.

On the same day, reports surfaced that Alibaba had quietly launched the 'Qianwen' project, mobilizing hundreds of engineers to work in secrecy. The goal was to compete head-to-head with ChatGPT and secure a spot in the global AI application elite. Internally, Alibaba views this as the 'future battle of the AI era.' On November 17, the 'Qianwen app' officially entered its public beta phase.

The narrative is grand, and the scene is bustling with activity. However, it's not hard to discern that the tech giants are primarily focusing on integrating AI into their existing businesses. This approach resembles an 'involutionary' upgrade within their own realms.

Take 'Qianwen,' for instance, which has garnered significant anticipation. One of its core subsequent tasks is to facilitate overall synergy between AI and various Alibaba businesses.

In an article by 'LatePost,' when questioned about 'Alibaba's specific consumer-end AI strategy,' the Qianwen team highlighted two key aspects: one is native applications, exemplified by Qianwen itself; the other is AI-izing existing businesses. Currently, the Qianwen team has also forged collaborations with teams from Taobao, Gaode, Shangu, Alipay, and other products.

Prior to this, Alibaba had already infused AI capabilities into every business line: Taotian introduced AI shopping guides to offer personalized product recommendations; AI-generated product detail pages to reduce merchant operational costs; intelligent customer service to handle after-sales issues; Gaode Maps incorporated an intelligent voice assistant; Quark integrated AI Q&A, content generation, and learning assistants... AI has now permeated every facet of Alibaba's business operations.

Compared to Alibaba's aggressive AI investments, Tencent appears relatively restrained and conservative. Yet, a closer examination of its AI布局 (layout) reveals that it still adheres to a 'core business-centric' approach.

Tencent's AI strategy centers around its AI assistant 'Yuanbao,' which has now been seamlessly integrated into dozens of Tencent's core applications: Yuanbao + QQ Music for 'search and listen'; Yuanbao + Tencent Video for a one-stop 'search-chat-watch' movie experience; Yuanbao + Xiaodian for intelligent product recommendations, marketing content generation, and intelligent customer service; additionally, Yuanbao frequently makes appearances in the comment sections of WeChat Official Accounts and Video Channels... Yuanbao has effectively covered Tencent's core business areas in social, office, and consumption.

This framework is also evident in JD.com and Baidu's strategies.

At the '2025 JD Global Technology Explorer Conference' held in September, JD.com unveiled its AI panorama for the first time, announcing the deep application of AI in core areas such as retail, logistics, health, and industry. Its strategy is crystal clear and focused: leveraging AI to strengthen its core capabilities in 'supply chain and logistics.'

Baidu was the earliest domestic internet company to bet big on AI, launching Wenxin Yiyan as the first generative AI product released by a major domestic company. It deeply integrated this technology into its core business—search, transforming it into an AI extension of its search DNA. Baidu Wenku also introduced AI writing, AI summarization, AI translation, and other functions to enhance user efficiency in creating and processing documents.

It's evident that in these tech giants' AI narratives, AI is being treated more as a 'value-added' tool rather than a revolutionary force capable of redefining product logic, user habits, and business models. Collectively, they are engaging in a 'business + AI' superposition (overlay), akin to a collective 'old wine in new bottles' celebration.

Making a perhaps not entirely apt analogy: it's like in the era of horse-drawn carriages, everyone was focused on 'how to make carriages run faster' and 'how to make carriages more comfortable,' but no one dared to dream of inventing the automobile.

For the tech giants, integrating AI into existing businesses is undoubtedly the safest, least resistant, and most benefit-maximizing choice. This is understandable, but the crux of the matter lies in: when these tech companies, boasting the most abundant resources, the strongest technology, and the most substantial funding, opt to use AI as an 'enhancer' for existing businesses, how much disruptive innovation can we realistically expect?

Innovations in the Mobile Internet Era

During the mobile internet era, BATJ (Baidu, Alibaba, Tencent, JD.com) also underwent mobile upgrades—Mobile Taobao, Mobile Baidu, Mobile JD.com—all of which were highly successful. However, what truly cemented the current status of Chinese tech giants were innovations like mobile social (WeChat) and mobile payments (WeChat Pay), mobile reading and short videos (Toutiao, Douyin, Kuaishou), new e-commerce (Pinduoduo), cloud computing (Alibaba Cloud), instant retail (Meituan), shared mobility (Didi), and new energy vehicles (CATL, BYD).

ByteDance capitalized on the demand for fragmented reading among mobile users, reconstructing the content distribution model with algorithms to recommend personalized content based on users' reading habits, interests, and locations. With Toutiao and Douyin, it demonstrated that in the mobile era, it's not about people searching for information but information finding people. Leveraging this model, ByteDance emerged as China's most profitable tech company.

We still recall the 'WeChat Red Envelope' battle launched by Tencent during the 2014 Spring Festival, which completely disrupted Alipay's monopoly in the payment sector. This move made mobile payments one of China's new four great inventions and laid a revolutionary foundation for China's subsequent global leadership in mobile e-commerce and the sharing economy.

Before Pinduoduo emerged, Alibaba and JD.com had long dominated the e-commerce market as a 'duopoly.' No one believed that another comprehensive e-commerce platform could gain traction in the domestic market. However, Pinduoduo targeted the 'outside the fifth ring road' population, employing group buying, price cutting, and sharing—new shopping methods tailored for mobile payments and mobile sharing—to challenge Alibaba and JD.com's mature 'search-shelf' model. This opened up a new track for 'social e-commerce.' In 2016, Taobao also pioneered a new era of live-stream e-commerce beyond showcases and game live streams, enabling subsequent followers like Douyin E-commerce and Kuaishou E-commerce to rise to prominence.

Ele.me, founded by a college student entrepreneurial team, became China's first food delivery platform. The advertisement 'Hungry? Don't call mom, call Ele.me' marked the birth of the food delivery industry, transforming Chinese dining habits and the entire catering industry's business model. Meituan started from group buying, survived the fierce 'thousand-group battle' with strong execution and financing capabilities, and swiftly launched a beachhead landing campaign. Utilizing a dislocation competition and low-end disruption strategy, it reached parity with Ele.me in just 10 months and subsequently surpassed it. Meituan's instant retail business model, built on food delivery, continued to stir up the market until 2025, becoming a core driver of user growth for Alibaba and JD.com.

An experience of 'being unable to hail a taxi' led Didi founder Cheng Wei to identify the pain point of 'difficult taxi hailing and low travel efficiency.' He leveraged the sharing economy model to transform idle vehicles into tradable resources, disrupting traditional travel modes and changing people's travel habits.

Innovations like shared bicycles, shared power banks, and new energy vehicles have positioned China as the most convenient country in the world for eating, dressing, using, and traveling.

...

It's evident that these innovations didn't merely transfer PC-end businesses to mobile phones. They weren't about creating 'cheaper Taobao,' 'more convenient dining platforms,' 'smarter news clients,' 'better taxi-hailing software,' or 'shorter video platforms.' Instead, they uncovered new demands, scenarios, and business models, thereby altering the connections between people, people and information, and people and services (e-commerce), and reconstructing the industry's underlying logic.

Their commonality lies in their ability to break free from the PC internet mindset, creating entirely new scenarios based on the 'always-online' characteristic of the mobile internet era, rather than simply overlaying 'existing businesses + new technologies.'

Summary

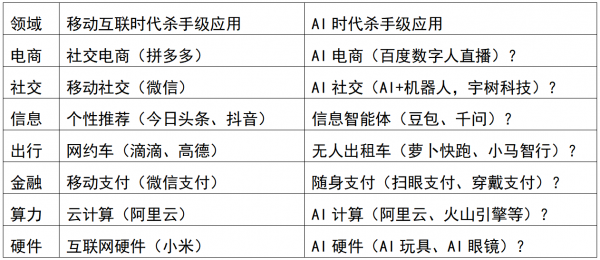

If we compare the innovative products and applications of the mobile internet era, where are the killer apps for information, social, e-commerce, travel, and finance in the AI era being nurtured?

At the 2025 Inclusion Conference on the Bund, Jonah Zhu, a partner at GSR Ventures, expressed his belief that the boundaries of AI's capabilities have already become apparent. 'Applications will definitely explode next year (2026), so the next ByteDance, the next Kuaishou, and the next Xiaohongshu should have already been established this year,' he stated.