Action Camera Sales Soar: How Will DJI and Others Face Up to the Challenge from Smartphone Makers?

![]() 11/21 2025

11/21 2025

![]() 577

577

Can OPPO and Vivo Overturn DJI's Market Dominance?

Written by: Li Jinlin

Edited by: Li Ji

Layout by: Annalee

Data from the Double 11 shopping festival promotion indicates that action cameras have transitioned from being a niche novelty to a must-have gadget among consumers.

According to the 2025 China E-commerce Development Report, the sales turnover of action cameras skyrocketed by 6,191%. Based on the sales rankings released by JD.com's self-operated platform from October 30 to November 11, DJI secured the top five positions in the action camera category with products such as the Osmo Action5 Pro, Osmo Action4, and Osmo Nano, firmly establishing itself as the sales leader.

Just over a month ago, OPPO and Vivo announced their entry into the action camera and panoramic camera markets, with plans to launch new products by 2026.

With the action camera market evolving and expanding rapidly, the entry of smartphone manufacturers is poised to ignite a comprehensive competition. As technological boundaries blur and innovation often emerges at the intersections, this crossover competition among imaging devices may open the door to a new era.

DJI Ousts GoPro, Now Faces OPPO and Vivo

"The DJI Nano makes me look like a star in a Korean variety show! I call it the beauty restoration master!"

"For landscape photography enthusiasts, the Insta360 Ace Pro2 is a top choice. It comes with a built-in Leica filter, allowing you to capture stunning scenery with minimal parameter adjustments—truly a testament to German engineering."

"It's not that digital cameras are unaffordable; it's that action cameras offer better value for the money."

In recent years, with the rise of self-media and the trend of documenting life, owning an action camera or panoramic camera has become commonplace. It can be said that the short video era has provided unprecedented growth momentum for handheld smart imaging products.

Currently, DJI and Insta360 are fiercely competing, while GoPro, which once dominated the global market, has gradually faded into obscurity.

Nowadays, it's rare to see users recommending GoPro on social media.

Six years ago, when DJI first entered the market with the Osmo Action, many believed that GoPro had a near-monopoly after dominating the market for nearly two decades. At that time, people only thought of GoPro when it came to action cameras, and DJI's challenge seemed doomed to fail.

However, DJI now holds a 66% global market share, with products like the Osmo Action 5 Pro and Osmo Nano establishing absolute dominance. In contrast, GoPro's global market share has continuously shrunk, falling to 18% this year.

While it's difficult to pinpoint exactly where GoPro went wrong, one thing is clear: challengers become leaders by seizing the right opportunities at every step.

In the first three quarters of 2025, domestic brands DJI and Insta360 accounted for over 70% of the market share in the action camera sector. However, it's still too early to declare future leaders. The market is constantly reshuffling, with smartphone manufacturers like OPPO, Vivo, and Xiaomi quickly entering the fray.

DJI products are flying off the shelves on JD.com.

Smartphone manufacturers' foray into the action camera market leverages their accumulated expertise in consumer electronics to capitalize on the contrast between the stagnating growth of the smartphone market and the high-profit margins of action cameras.

From an advantage standpoint, smartphone manufacturers and action cameras share a highly overlapping core hardware supply chain. Components like CMOS sensors and optical lenses can be shared, while years of developed imaging algorithms can be directly applied. For example, Vivo's V3 chip with 4K cinematic imaging and heterogeneous computing architecture, and OPPO's floating stabilization solution, eliminate the need to build a technical system from scratch.

In terms of channels and ecosystems, smartphone manufacturers have established global online and offline networks. OPPO and Vivo's over 200,000 offline stores can directly stock and set up experience zones for action cameras. They can also tap into lower-tier markets through home appliance stores. More critically, action cameras can achieve one-click transmission and cross-device editing with smartphones, and even link with smart bracelets to trigger shooting, creating a differentiated ecosystem experience.

In terms of cost control and price tolerance, smartphone manufacturers' massive procurement scales grant them stronger bargaining power, and profits from their main smartphone business can support short-term losses in action cameras. They can price entry-level models at 1,299-1,599 yuan to fill market gaps. Combined with their strong user base and high brand recognition, they can precisely target potential customers through data analysis, significantly reducing market education costs.

However, smartphone manufacturers also have significant shortcomings. Professional action cameras must withstand extreme conditions like underwater waterproofing and ultra-low-temperature operation. The Insta360 X4 uses fluororubber seals and fully invisible diving shells, while the DJI Action 5 employs aerospace-grade materials to meet these demands—areas where smartphone manufacturers still lag.

Meanwhile, in terms of user perception, Insta360 has already bonded with extreme sports groups, and DJI has captured Vlog users, while smartphone manufacturers have long been perceived as "mass consumer goods." Breaking into professional circles will still require a considerable cultivation period.

What Will an Ecosystem-Driven Competition Bring to Action Cameras?

Since official news of Vivo and OPPO's entry into the action camera market emerged this year, both manufacturers have set their product launch predictions for 2026. It's clear that these two giants are targeting this expanding market.

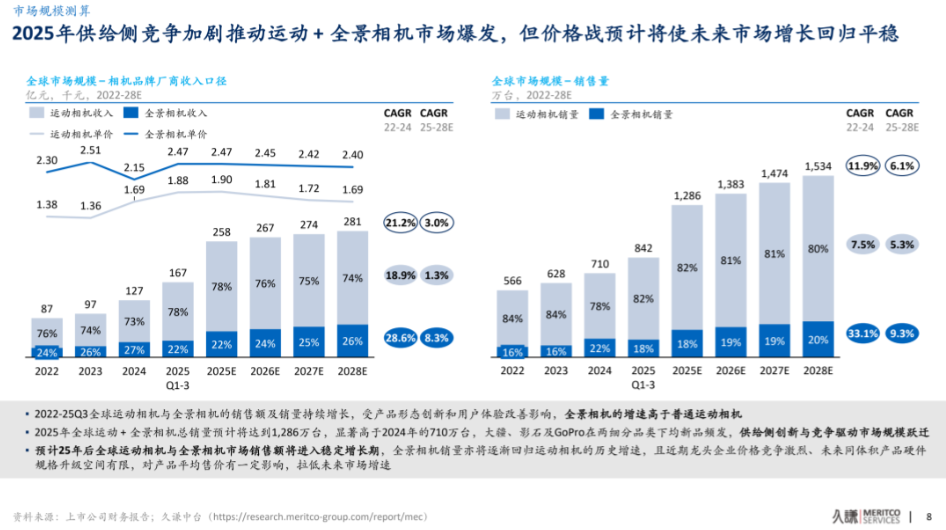

According to data from consulting firm Frost & Sullivan, the market size for handheld smart imaging devices was 36.47 billion yuan in 2023 and is expected to maintain an average annual compound growth rate of about 12.9% from 2023 to 2027, reaching a market size of 59.2 billion yuan by 2027. Among them, the market size for panoramic cameras capable of 360° shooting is 5 billion yuan. Beyond life, sports, and entertainment recording, panoramic technology is expected to further open up market ceilings in new application scenarios like video conferencing and robotics.

Source: Jiuqian Middle Office Consumption

From a near-term competitive perspective, smartphone manufacturers are likely to first break through in the entry-level market, targeting potential users in lower-tier markets with precisely priced entry-level models at 1,299-1,599 yuan and offering "smartphone + action camera" bundles. This will not only directly divert market share but also squeeze potential users from Insta360 and DJI.

In the long term, smartphone manufacturers will also impact the high-end market. Once product capabilities and user perception are established, they can further expand their R&D scale, potentially forcing leading brands to lower prices and compress their high-end product profit margins.

More notably, smartphone manufacturers understand the importance of "competing on applications rather than specifications," which will drive the action camera market to shift from "hardware-driven" to "software and ecosystem-driven." Additionally, by integrating action cameras into ecosystems like "smartphone + tablet + watch," smartphone manufacturers offer a more open ecosystem compared to the relatively closed ones of Insta360 and DJI.

However, the entry of smartphone manufacturers is more likely to accelerate market expansion rather than swallow up specific brands' market shares. In the short term, entering smartphone manufacturers will undoubtedly bring more imagination to the market, stimulate innovators' creativity, and add spice to this incremental competition.

However, as the competitive landscape shifts from a duopoly to a multi-polar hierarchy, a reshuffling is inevitable. Whether it's the moat of technological patents and accessory ecosystems, the advantages of ecosystems and pricing, or sufficiently niche market scenarios, every business capability will become a factor influencing the future market landscape.

During this period, user needs and consumption trends are also undergoing profound changes. As the consumer base grows, action cameras and panoramic cameras will undergo a fundamental identity shift—they will no longer be exclusive equipment for extreme sports and outdoor scenarios but will be labeled as productivity tools in the new consumption era. Therefore, attributes like experience, ease of use, and community-building will become increasingly prominent.

Product lightweighting will become mainstream, and intelligent features will rapidly proliferate. AI shooting and automatic editing will gradually become standard, with more users willing to pay extra for these functions. Ecosystem experiences will become the core of competition, with the multi-device interconnected ecosystems built by smartphone manufacturers setting an example, prompting leading brands like Insta360 and DJI to accelerate their ecosystem openness.

Overall, technology is not afraid of disruptors; instead, the era of incremental competition can better unleash innovative potential.

Therefore, we don't need to rush to discuss who will become the next market leader. When the core of industry competition shifts from hardware specification competition to multi-dimensional competition centered on AI-driven intelligent experiences, software ecosystem perfection, and differentiated innovation capabilities, the first true golden era for consumers has finally arrived.