Chang Jing Accelerates Roborock into Uncertainty: Ditching Lei Jun, Cashing Out 900 Million Yuan

![]() 11/21 2025

11/21 2025

![]() 521

521

Despite capturing significant market share, the leading robot vacuum manufacturer, Roborock, continues to grapple with revenue growth that does not translate into increased profits and negative cash flow. Its growth-through-investment model is now entering a period of uncertainty as it awaits listing.

Nearly five months have elapsed since Roborock submitted its prospectus to the Hong Kong Stock Exchange, yet the company remains stagnant. With only one month left before the prospectus expires, the clock is ticking.

Roborock has made every effort to go public. Founder Chang Jing has pledged not to reduce his shareholdings for 12 months, and the company has even sacrificed profits to boost revenue figures.

Despite these efforts, issues such as management cash-outs, shareholder reductions by associates of Lei Jun, and inconsistencies in identifying the controlling shareholder in filing materials have done little to alleviate investor concerns.

Roborock now finds itself at a critical crossroads in the capital market.

#1

Ditching Lei Jun to Become the 'Moutai of Robot Vacuums'

Roborock's success can be attributed to its decision to part ways with Lei Jun.

In 2011, Chang Jing embarked on his entrepreneurial journey, selecting mobile image recognition—a virtually untapped field at the time—from over 100 options and founding Mobojingling. The product quickly gained traction, amassing over 10 million users within a year before being acquired by Baidu for $12 million. Chang then joined Baidu as a senior manager.

Chang Jing referred to this venture as a 'practice round,' a step from zero to 0.1. The success of Mobojingling gave Chang the confidence and capital to continue his entrepreneurial pursuits.

In 2013, Chang purchased a robot vacuum cleaner. Disappointed by the decade-old industry's 'clumsy and blind' products and the tepid market response, he saw an opportunity and decided to enter the field.

In July 2014, Roborock was founded. Chang Jing dubbed this venture a 'crossover challenge.'

He partnered with several friends, forming a team with software expertise but nearly zero hardware experience. To address this gap, he made multiple visits to recruit Wan Yunpeng, Huawei's former project manager.

The company had a strong start, gaining favor from Xiaomi Ecosystem investors in its second month. In September 2016, leveraging Xiaomi's channels and supply chain, Roborock launched the Xiaomi-customized 'Mijia Smart Robot Vacuum.'

The product was an instant success.

However, reliance on Xiaomi led to low gross margins. In 2017, Chang made a pivotal decision to break away from Xiaomi and launch proprietary brands, 'Roborock' and 'Xiaowa Robot Vacuum.'

This transition proved highly successful. By the first half of 2020, Roborock's proprietary brand revenue had reached 85.12%, achieving 'de-Xiaomification.'

In February 2020, Roborock successfully listed on the STAR Market with an IPO price of 271.12 yuan per share, the highest in A-share history at the time.

Post-listing, Roborock's stock soared, reaching 1,494.99 yuan in 2021 and becoming the second-highest stock on the A-shares market after Moutai, earning it the nickname 'Moutai of Robot Vacuums.'

In 2024, Roborock led the global market with a 23.4% GMV market share and a 16.7% sales volume share in the smart robot vacuum sector.

In Chang Jing's view, Roborock's success hinged on two market dividends: joining Xiaomi's ecosystem for survival and later transitioning to proprietary brands while capitalizing on overseas expansion trends to gain both brand and market benefits.

After achieving success on the A-shares market, management and investors grew restless.

#2

Cashing Out 900 Million Yuan, Then Urging Investor Patience

Chang Jing led the share reduction efforts at Roborock.

In early 2023, Chang Jing held approximately 23.15% of Roborock. By September, he had reduced his stake by 1.3123 million shares, cashing out 392 million yuan for 'personal needs.'

In June 2024, Chang planned to transfer an additional 1.3157 million shares at 376.88 yuan per share, again citing 'personal financial needs.'

These two reductions netted Chang nearly 900 million yuan.

Beyond the founder, key shareholders also reduced their stakes. According to the 2024 annual report, four of the top ten shareholders lowered their holdings during the reporting period.

The employee stock ownership platform, Tianjin Roborock Era Enterprise Management Consulting Partnership, reduced its holdings by 200,000 shares, while founder Mao Guohua reduced his by 470,000 shares.

Early investors also cashed out. Tianjin Jinmi, affiliated with Lei Jun, reduced its holdings by 480,000 shares. Shunwei Capital, controlled by Lei Jun, exited the top ten shareholders list earlier.

The management and shareholder cash-outs put pressure on Roborock's stock. In 2022, its stock price halved, dropping by 57%.

Responding to investor concerns about the stock decline, Chang Jing said, 'We hope investors holding Roborock stock can be patient. This is a strategic transition and painful period, but it will bring changes for long-term development.'

The hashtag 'Chang Jing cashes out 900 million yuan, then urges investor patience' trended, sparking investor backlash. Chang reluctantly hid all his videos.

Continued shareholder reductions have cast uncertainty over Roborock's Hong Kong listing.

#3

Cash Flow Turns Negative for the First Time

In late June, Roborock submitted its prospectus to the Hong Kong Stock Exchange, primarily aiming for overseas expansion.

The prospectus outlined fundraising for two main priorities: overseas expansion and R&D, with overseas expansion ranked first.

Roborock is telling a scalability story.

Since last year, Roborock has sacrificed profits for growth. In the first three quarters of this year, revenue reached 12.066 billion yuan, up 72.22%, while net profit fell 29.51% to 1.038 billion yuan.

In contrast, competitor Ecovacs reported a net profit of 1.42 billion yuan, surging 130.6% year-on-year.

To achieve scale, Roborock self-funded to offset paused trade-in subsidies. This led to a 103% year-on-year increase in sales expenses to 3.18 billion yuan in the first three quarters.

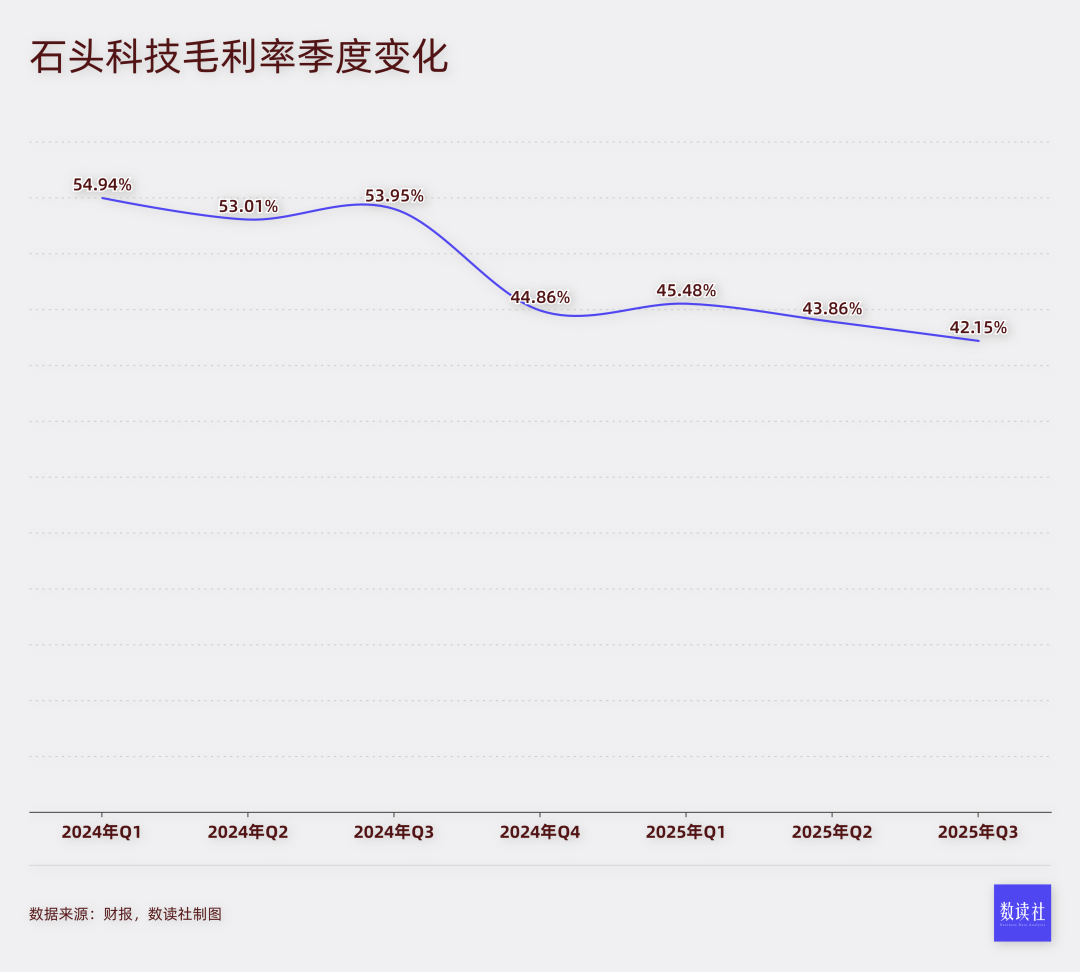

Gross margins also declined, reaching 42.1% in Q3 2025, down 11.8 percentage points year-on-year, and staying below 50% for four consecutive quarters.

Heavy investments resulted in a net cash outflow of 823 million yuan, with operating cash flow turning negative for the first time.

By the end of Q3, inventory climbed to 3.13 billion yuan, with finished goods dominating at 2.92 billion yuan, indicating significant inventory pressure.

Roborock's intense competition yielded results. According to IDC, it captured a 20.7% market share in the first half, up 3.3 percentage points year-on-year.

But such competition lacks meaningful differentiation.

Robot vacuums face the 'Red Queen Effect,' requiring continuous effort just to maintain their status.

To seize market share, robot vacuums now prioritize gimmicks over substance—from robotic arms to AI dialogue and emotion recognition—while failing to address basic cleaning dead zones, even increasing failure rates.

The robot vacuum sector, and the broader cleaning appliances market, lag behind major appliances in market size, allowing easy entry for external players. DJI, for example, entered the robot vacuum market and ranked sixth in a single quarter, according to Loctek Technology data.

Expanding overseas markets is crucial for Roborock. To accelerate entry into Europe and the Americas, it slashed prices on older models—e.g., the Q7 Max Plus dropped over 26% in Europe.

While the Hong Kong Stock Exchange, a global market, can enhance Roborock's brand, challenges like lack of market imagination, price war uncertainties, and management cash-outs hinder its secondary listing.

#4

'Straying from the Core'

Before disclosing its Hong Kong prospectus, Roborock announced Chang Jing's pledge not to reduce his holdings for 12 months.

This aimed to rebuild market trust.

However, investor concerns persist, largely due to Chang Jing's 'need for funds.'

At Roborock's peak, Chang ventured into new energy vehicles (NEVs), a notoriously capital-intensive sector.

In 2021, Chang, an avid off-roader, partnered with Weiqiao Pioneering Group to launch Ji Shi Automobile, targeting high-end off-road NEVs.

Ji Shi Automobile has completed six funding rounds, attracting investors like IDG Capital, Sequoia China, and Qiming Venture Partners. The largest disclosed funding, 1 billion USD, came from Weiqiao Pioneering.

Chang said entrepreneurship involves seeking niche blue oceans amid red seas. He identified the 'unmet' all-terrain luxury SUV market, filling the gap for models combining home comfort and off-road capability.

Car manufacturing demands immense capital. Ji Shi CEO Yan Feng admitted, 'We aimed to be a small, beautiful company, saving on R&D and staying lean.'

The Ji Shi 01 relies heavily on external components—its range extender system mirrors Li Auto's, while its intelligent driving hardware uses Hesai's LiDAR and software from Pony.ai and EasyMile. Dubbed 'LEGO cars' by insiders, it lacks independent capabilities and risk resilience.

In 2024, Ji Shi Automobile sold only 5,682 units, accounting for less than 1% of the niche market. In October, deliveries reached just 1,426 units, failing to meet market thresholds.

Chang called this 'the toughest entrepreneurship yet,' hoping Ji Shi survives a decade.

Survival requires sustained R&D, market investment, and manufacturing—burdens too heavy for the robot vacuum sector.

Whether Chang will continue cashing out to fund Ji Shi remains uncertain.

While preparing to list, the CSRC International Department requested Roborock clarify three issues:

Data Security: Explain how its app collects, stores, and shares user data with third parties.

Controlling Shareholder Identification: Resolve inconsistencies in the controlling shareholder designation in filing materials.

Foreign Investment Compliance: Confirm if its business scope involves sectors on the 'Negative List for Foreign Investment Access.'

Facing governance, data security, and compliance doubts, Roborock awaits listing as its growth-through-investment model enters a period of uncertainty.