Is Next Year a Better Time to Buy a Car? Insights from the Guangzhou Auto Show: High-End Intelligent Driving Is Now Within Reach, and Hybrid Options Are Increasingly Diverse!

![]() 11/27 2025

11/27 2025

![]() 577

577

As a leading indicator of China's automotive market, this year's Guangzhou International Auto Show unmistakably signals that the industry is undergoing a profound transformation. While new energy vehicles have firmly established themselves as the mainstream, the core of competition is shifting from the widespread adoption of electrification to the practical application of intelligent technologies and the exploration of diversified technology routes.

At this exhibition, new energy vehicle models made up an impressive 58% of the showcased vehicles. This statistic underscores the reality that China's market penetration rate for new energy vehicles has surpassed 50%, marking electrification as a transition from a mere trend to a tangible reality.

However, with electrification now a fundamental requirement, the diversification of technology routes has emerged as a new focal point. While battery electric vehicles (BEVs) continue to experience robust growth, extended-range electric vehicles (EREVs) and plug-in hybrid electric vehicles (PHEVs) are gaining traction as "key transitional solutions" that cater to diverse consumer needs. More automakers are adopting these technologies. For instance, XPENG's launch of the EREV version of the X9 and Geely Galaxy's V900, equipped with super AI extended-range technology, signal a market shift. This shift is from mere technological route competition to a deeper response to users' real-world usage scenarios.

Meanwhile, the competition in intelligent driving technologies has reached a fever pitch. The maturation of technology suppliers such as Huawei ADS and Momenta has accelerated the proliferation of high-level intelligent driving capabilities. Features like urban Navigation on Autopilot (NOA), once exclusive to high-end models, are now accessible in vehicles priced at 150,000 RMB or even as low as 120,000 RMB. The focus of competition in smart cockpits has shifted from hardware specifications to holistic ecosystem experiences. Systems like Huawei's HarmonyOS aim to create seamless "person-vehicle-home" connectivity for intelligent living.

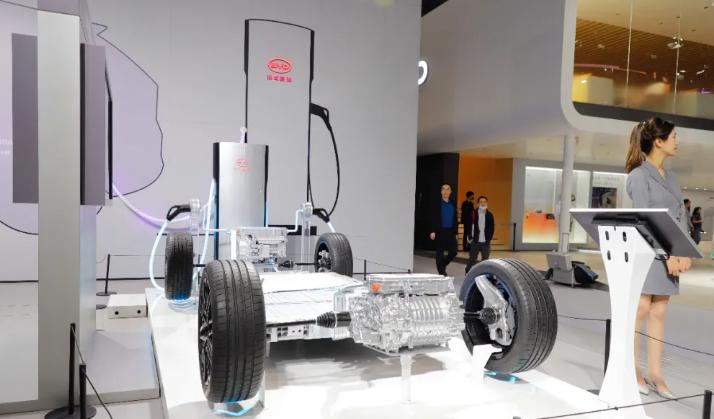

This transformation has also triggered a profound restructuring of the automotive industry's value chain. Core supply chain players like Huawei, CATL, and Momenta have moved from behind the scenes to the forefront. They are transitioning from mere "suppliers" to "co-creators" who redefine product competitiveness through technological empowerment. Faced with the leading edge of Chinese brands, joint ventures are bridging gaps by incorporating Chinese supply chains. For example, Audi's adoption of Huawei ADS, BMW and Mercedes-Benz's partnerships with Momenta, and Nissan Teana's integration of the HarmonyOS cockpit exemplify collaborations that transcend traditional supplier relationships, pioneering new models of industrial synergy.

At the market level, rationality and pragmatism have become the dominant themes. The "celebrity effect" of automotive executives is waning, with marketing efforts now emphasizing brand value and emotional connections with users. Product strategies are increasingly focused on niche markets, with large family SUVs/MPVs emerging as popular segments. Meanwhile, personalized "boxy" off-road vehicles like the Tank 400 and BYD Titan 7 are seeking new growth opportunities.

For consumers, these trends signify a completely new car-buying logic.

When choosing a powertrain, the decision between BEVs and EREVs/PHEVs is no longer about technological advancement but about meeting specific needs. BEVs offer a superior experience for those with convenient charging access and primarily urban commutes. On the other hand, high-quality EREVs/PHEVs are more practical for frequent long-distance travelers or residents in northern regions.

In terms of intelligence, intelligent driving is no longer a marketing gimmick but a core value that significantly impacts safety and user experience. With rapid technological advancements, high-level intelligent driving features are expected to become standard in vehicles priced around 150,000 RMB in the future. This will allow consumers to enjoy technological benefits at lower costs.

Overall, China's automotive market in 2025 is navigating through a cycle of "rational return." Beneath the surface of intense competition lies a profound industry restructuring. The focus of competition is shifting from "fuel vs. electric" to "ecosystem competition," and from pursuing single blockbuster models to cultivating user value. For automakers, the coming year will be a critical period that determines their fate. For consumers, it means a wealth of mature, intelligent, and high-value options. What's your take on the domestic automotive market? Share your thoughts in the comments below.