RoboSense's Q3 Report: Secures New Designated Cooperation Orders from Multiple Automakers, Anticipates Profitability in Q4

![]() 11/26 2025

11/26 2025

![]() 443

443

RoboSense is also projected to achieve single-quarter profitability in the fourth quarter.

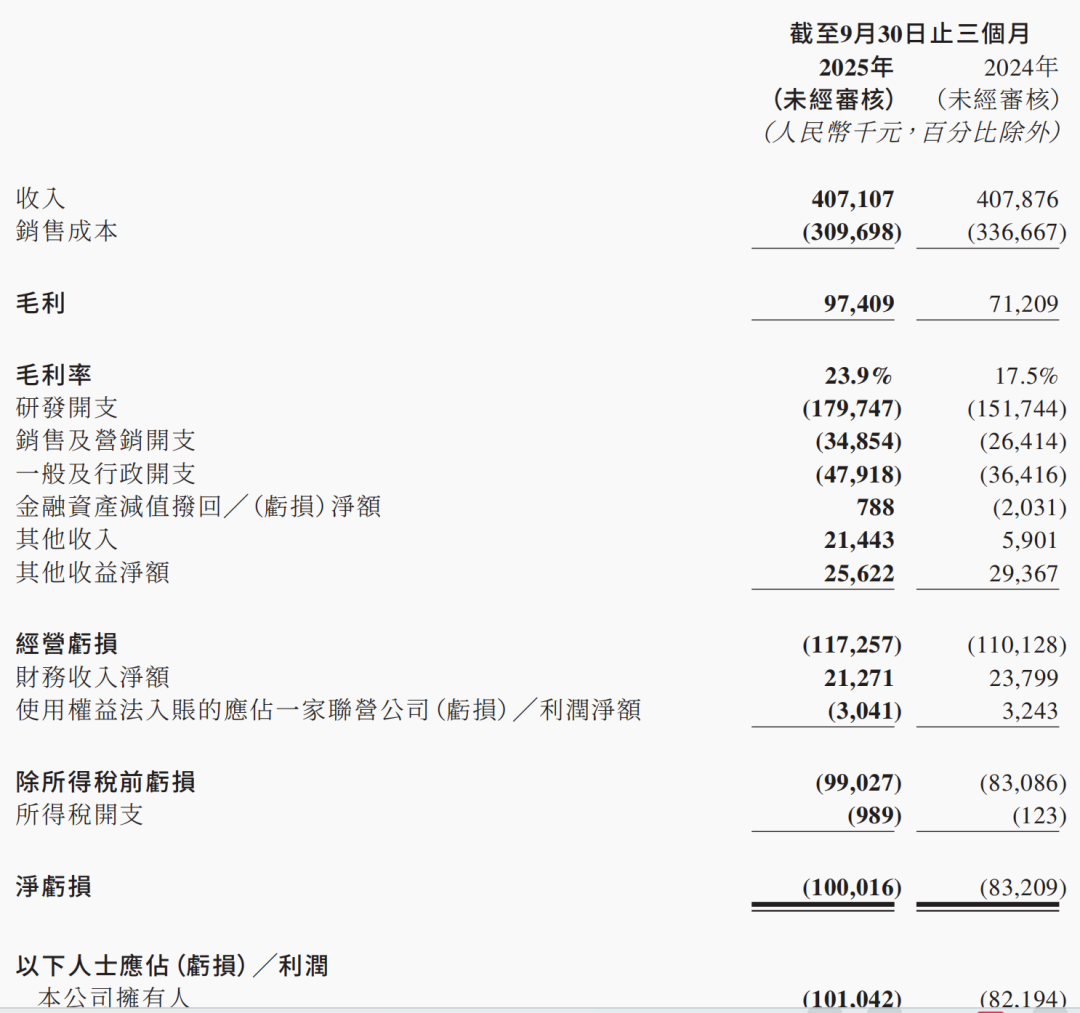

On November 25, RoboSense unveiled its financial results for the third quarter. During this period, the company generated total operating revenue of RMB 407 million, experiencing a slight 0.2% decrease from the RMB 408 million recorded in the same period last year, thereby maintaining a stable revenue scale. However, its performance in overseas markets was remarkable, with revenue growth surpassing 100% year-on-year. The gross profit for the corresponding period stood at approximately RMB 97 million, marking a roughly 36.8% increase compared to the previous year.

Despite this, RoboSense reported a net loss of RMB 100 million, wider than the RMB 83 million loss incurred in the same period of 2024. Nevertheless, when examining the situation over a longer timeframe, the net loss for the first half of 2025 was RMB 149 million. This indicates a significant narrowing of losses in the third quarter, reflecting a gradual improvement in the company's operational conditions.

Although revenue witnessed a slight year-on-year decline, the company demonstrated robust performance in terms of total LiDAR shipments, expansion of the robotics business, and acquisition of overseas customers. It achieved breakthroughs in customer acquisition, securing orders from some competitors and winning new designated cooperation partnerships with multiple overseas automakers. Domestically, collaborations with companies like Didi have also been steadily advancing.

Based on these developments, RoboSense has set a profitability target for the fourth quarter.

01

Explosive Growth in the Robotics Business

In the third quarter, RoboSense's total sales of LiDAR products reached 185,600 units, a 34.0% increase year-on-year. Behind this growth lies a transformation and optimization of the company's business structure.

Among these, the core business of LiDAR products for ADAS (Advanced Driver Assistance Systems) recorded sales of 150,100 units, a 14.3% increase year-on-year, accounting for 80.9% of total shipments and continuing to play a stabilizing role.

The real growth driver emerged from non-automotive sectors.

Sales of LiDAR products for robotics and other applications soared, with approximately 35,500 units sold in the third quarter, a staggering 393.1% increase year-on-year. This boosted their share of total shipments to 19.1%.

RoboSense's All-Solid-State Digital LiDAR for Robots, Officially Priced at RMB 4,999

This growth was also evident in revenue, with the robotics business performing equally impressively. The segment achieved product revenue of RMB 142 million, a 157.8% increase year-on-year, accounting for 35.0% of total revenue and becoming a significant business segment. This signifies that RoboSense has established a dual-drive business model encompassing both automotive and robotics sectors, enhancing both risk resistance and growth potential.

Improved profitability was another notable highlight.

In the third quarter, RoboSense's gross profit was RMB 97 million, a roughly 36.8% increase year-on-year, with a gross margin of 23.9%, a 6.4 percentage point increase from 17.5% in the same period of 2024.

Management explained in the announcement that the improvement in gross margin was primarily due to lower raw material procurement costs and the widespread application of its self-developed SOC processing chips, which are more cost-effective than FPGA chips sourced from third-party suppliers. This underscores the cost control advantages of self-developed chips.

02

Continuous Expansion of the Global Customer Network

In the third quarter, RoboSense made significant strides in market expansion, securing designated cooperation orders from multiple high-profile customers both domestically and internationally, laying a solid foundation for sustained revenue growth.

In November, RoboSense announced a series of designated cooperation wins from SAIC Audi, FAW Toyota, a joint venture brand of a leading European automaker (Volkswagen), and a North American new energy vehicle (NEV) manufacturer, among others, for multiple models. The total order volume exceeded one million units. To date, RoboSense has secured designated cooperation orders for 23 models from 12 overseas and Sino-foreign joint venture brands, covering core markets in the Asia-Pacific region, Europe, and North America.

Domestically, RoboSense has secured designated cooperation orders for 144 models from 32 automakers and Tier 1 suppliers, including Leapmotor and Great Wall Motors. Among these, the RoboSense EM platform has won designated cooperation orders for 56 models from 13 automakers, including 36 models from a global leading NEV manufacturer. Since its launch in April, the EMX has secured designated cooperation orders for 49 models, with mass production and delivery expected to concentrate in 2026.

The EM4, the industry's only mass-producible ultra-500-line digital LiDAR, has been deployed in multiple models, including the Zeekr 9X, IM LS9, and IM LS6.

As of September 30, RoboSense has achieved SOP (Start of Production) for 47 models across 15 customers.

Additionally, RoboSense secured a landmark order in the Robotaxi sector. In November 2025, RoboSense and Didi Autonomous Driving announced a designated cooperation for next-generation Robotaxi models. Under the agreement, RoboSense will provide perception solutions for Didi's Robotaxi models using its ultra-high-line digital primary LiDAR EM4 and all-solid-state blind-spot LiDAR E1.

Didi's Latest-Generation Robotaxi Model

Notably, each vehicle in this cooperation will be equipped with up to 10 digital LiDAR sensors, providing omnidirectional perception through the 'EM4+E1' combination, ensuring long-range precise identification and near-field blind-spot elimination.

Currently, over 90% of the world's core Robotaxi and Robotruck companies have established partnerships with RoboSense, including Didi Autonomous Driving, Baidu, Pony.ai, WeRide, and several leading North American L4 autonomous driving companies. With the accelerated development of the global Robotaxi market, RoboSense's digital LiDAR portfolio is poised to unlock significant long-term growth potential.

03

Q4 Guidance Clear: Single-Quarter Profitability

Regarding the market's top concern—profitability—RoboSense's management provided a clear outlook. The company aims to achieve single-quarter profitability in the fourth quarter of 2025, noting that this quarter will be a critical inflection point for sustained operational improvement.

The driving forces behind this goal come from four aspects.

First is the scaled delivery of digital products.

The performance in the third quarter of 2025 was mainly driven by legacy products, while the mass production and order backlog of digital products are key to future growth. Starting in the fourth quarter, RoboSense's digital products have entered scaled delivery. A strong indicator is that in October 2025, the company's monthly total LiDAR deliveries exceeded 120,000 units, a new all-time high. This data suggests that shipments and revenue in the fourth quarter are poised to reach new heights.

Second is cost control and continuous gross margin optimization.

With further increases in the adoption rate of self-developed chips and expanded production scale, RoboSense's product gross margins are expected to continue rising. The cost reductions in raw materials and production expenses driven by scale effects will further boost profitability.

Third is the increasing share of high-margin businesses.

The robotics business not only grew rapidly but also maintained a significantly higher gross margin (37.2% in the third quarter) compared to the ADAS business (18.1%). The rapid increase in this segment's share will strongly lift RoboSense's overall profitability.

Fourth is the gradual fulfillment of high-value overseas orders. Over one million units of overseas orders will enter mass production and delivery starting in 2026. While direct contributions to the fourth quarter will be limited, these orders provide a solid foundation for RoboSense's medium- to long-term profitability prospects.

RoboSense's biggest rival, Hesai Technology, has already achieved profitability, reporting adjusted net profit in the first quarter of 2025 and GAAP profitability in the second quarter.

The LiDAR industry has reached a stage where investment value is being realized. RoboSense's path to profitability is not far off.

-END-