Sales of Fit Plummet by Half; Starwish and Seagull Surpass 10,000 Monthly Sales as A0-Segment Market Undergoes 'Transformation'

![]() 11/26 2025

11/26 2025

![]() 542

542

The space revolution driven by electrification platforms, the decentralization of intelligent features, and breakthroughs in personalized design collectively constitute the core competitiveness of A0-segment models in the realm of 'over-class competition.'

While mid-sized pure electric SUVs such as the Tesla Model Y and BYD Song PLUS fiercely compete in the mid-to-high-end market, the A0-segment new energy vehicle market is quietly staging a 'comeback.'

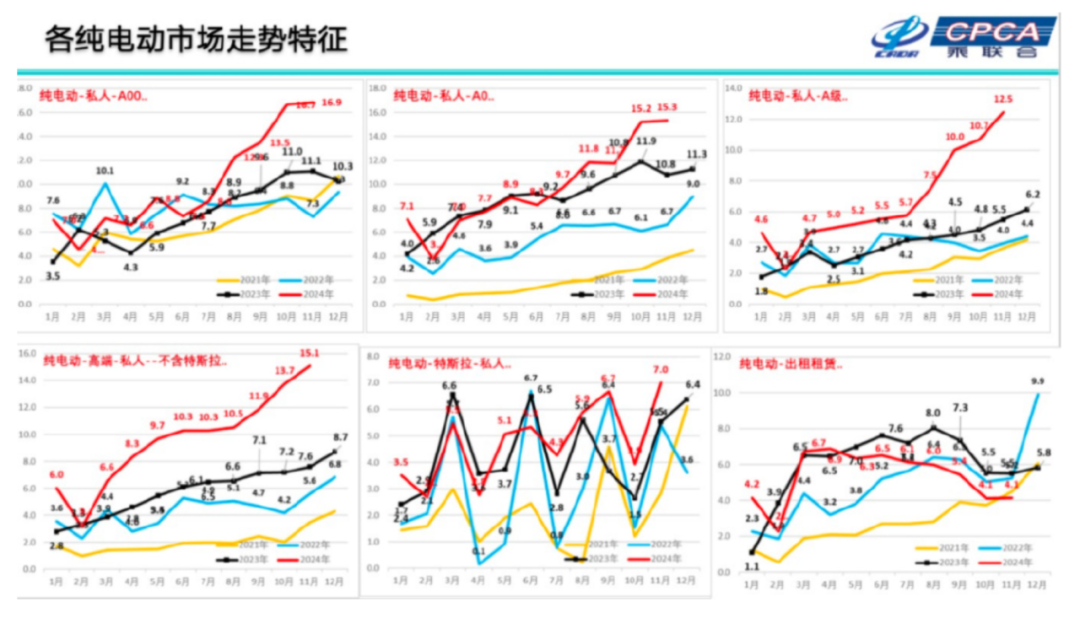

Latest data from the China Association of Automobile Manufacturers reveals that from January to September this year, sales of A00-segment and A0-segment new energy passenger vehicles reached 783,000 and 1.517 million units, respectively, marking year-on-year increases of 75% and 81.2%. These segments have emerged as the brightest growth poles in the new energy vehicle market.

'I once considered A0-segment cars as mere 'transitional products,' but now I see them as the real deal,' remarked Zhang Ting, a post-95 consumer who recently purchased a Seagull at a BYD 4S store in Beijing's Chaoyang District, highlighting the key to the market's transformation.

Unlike the fuel vehicle era, breakthroughs in new energy technology have liberated A0-segment vehicles from the constraints of 'limited space' and 'short range.' Take the BYD Seagull, for instance; its blade battery boasts an energy density of 140Wh/kg, delivering a CLTC range of 405 kilometers, while the price drops to 73,800 yuan, effectively breaking through consumer psychological barriers.

Following Geely Starwish's achievement of over 40,000 units in sales for four consecutive months and over 50,000 units in September, Geely Galaxy unveiled the 2026 Starwish model on October 10th, with the official price reduced to 65,800 yuan.

The sustained efforts of popular models will undoubtedly play a pivotal role in boosting terminal sales. Currently, an increasing number of brands are focusing on the A0-segment electric vehicle market.

Why is the A0-segment market experiencing a resurgence?

In stark contrast, the A0-segment fuel sedan market has been relegated to the sidelines. Once-popular models like the Volkswagen Polo and Honda Fit have gradually faded amidst the wave of consumption upgrades.

In 2022, Polo's annual sales plummeted to 27,000 units, a 64% year-on-year decline; Fit sales dwindled to only 38,000 units, a 51% decrease. These once-popular urban elves now see their market share continuously shrinking under the pressure of A-segment sedans and SUVs, labeled as 'transitional models' and 'commuter tools' by consumers.

The reason for their decline is straightforward: A0-segment fuel sedans have long struggled to overcome the limitations of 'small space' and 'low configuration.'

Take the Volkswagen Polo as an example; its body length is merely 4,053mm, with an axle base of 2,564mm, resulting in cramped rear space where adults' knees almost touch the front seats. In terms of configuration, low-end models even lack a reverse radar, and the central control screen is only 6.5 inches, showing a significant gap compared to A-segment peers.

Although the Honda Fit is renowned as the 'Space Magician,' its internal space optimization is nearing its limit due to the constraints of the fuel vehicle platform. The 2023 Fit has a trunk capacity of only 327L, which can be expanded to 1,213L with the rear seats folded down, but it still feels cramped in actual use. Additionally, the high fuel consumption of fuel vehicles also deters consumers amidst rising fuel prices.

With the equalization of electrification technology and the restructuring of demand, the A0-segment sedan market has undergone seismic changes.

In 2025, the A0-segment electric vehicle market has witnessed the emergence of a series of popular models, including the Geely Starwish, BYD Seagull, and Dolphin.

From an external perspective, the explosion of the A0-segment electric vehicle market is essentially a restructuring of consumer demand. In the fuel vehicle era, consumers purchased A0-segment cars mainly due to budget constraints, whereas in the electric vehicle era, consumers place greater emphasis on product intelligence and personalization.

Xu Huxiong, Global Partner at Roland Berger, pointed out, 'Small pure electric sedans are redefining urban travel experiences through over-class competition, with a user base far broader than in the traditional fuel vehicle era.'

Data indicates that the user base for small pure electric sedans has expanded from the initial 'commuting necessity' to a diverse group including young white-collar workers, retirees, homemakers, and even fishing enthusiasts.

Furthermore, the strategy of 'over-class competition' is reshaping the market landscape.

Industry insiders believe that the emergence of electrification platforms has fundamentally transformed the product strength of A0-segment models, not only achieving significant improvements in internal space but also enabling personalized design, safety performance upgrades, and the decentralization of intelligent functions through continuous investment in technology research and development by automakers, naturally winning widespread consumer favor.

The Geely Starwish has successfully captured the market with its differentiated configurations such as rear-wheel drive + multi-link suspension and Flyme Auto intelligent cockpit; the BYD Seagull and Dolphin have consistently ranked among the top sellers, while the ARCFOX T1 has also shown strong performance, featuring an 800V high-voltage platform that supports a 1.66C fast-charging rate, providing 120km of range after just 10 minutes of charging, addressing the range anxiety of electric vehicle users; the newly launched Changan Qiyuan Q05 not only sets a new standard for price-to-performance ratio but also brings high-end configurations like LiDAR to models under 100,000 yuan for the first time...

From Marginal Market to Core Battlefield

'Technological progress is the key factor driving vehicle sales growth,' said Cui Dongshu, Secretary-General of the China Passenger Car Association.

Roland Berger's research found that small pure electric sedan users are more easily influenced by word-of-mouth and prioritize applicability and cost-effectiveness in product selection. With the emergence of more popular models, the reputation of A0-segment small cars is continuously improving, leading more automakers to invest resources in developing A0-segment products. The abundance of products meets diverse consumer choices and further stimulates the terminal consumer market.

Besides the frequent launch of new products and changes in consumption structure, precise policy support also forms the 'triple impetus' driving the continuous rise in A0-segment vehicle sales.

'Policy adjustments are guiding consumption towards energy conservation and environmental protection, reflecting market demand and the inevitable requirement for the green development of the automotive industry,' said an industry insider in an interview.

Take the upcoming adjustment of the new energy vehicle purchase tax policy as an example; using tax leverage to guide consumers towards more energy-efficient models has significantly promoted the development of micro and small electric vehicles.

In the terminal consumer market, the 'countdown effect' of policy adjustments is particularly evident. A salesperson at a domestic brand 4S store revealed to reporters, 'After the announcement of the purchase tax incentive rollback, the number of customers inquiring about A0-segment models has significantly increased, with many wanting to complete their purchase before the policy adjustment.'

Cui Dongshu analyzed that the anticipated rollback of the new energy vehicle purchase tax exemption policy has driven consumers to release their purchasing demand in advance, becoming a significant driver of the current surge in A0-segment vehicle sales.

It's worth noting that the explosion of the A0-segment vehicle market is not solely driven by policies. As mentioned earlier, the space revolution brought by electrification platforms, the decentralization of intelligent configurations, and breakthroughs in personalized design collectively form the core competitiveness of A0-segment models in 'over-class competition.'

When policy dividends resonate with product upgrades, the A0-segment vehicle market is showcasing unprecedented vitality.

However, with the explosion of the A0-segment electric vehicle market, competition is also intensifying.

In 2025, the A0-segment electric vehicle market has entered a phase of 'involution,' with automakers vying for market share through price cuts and feature upgrades. For example, the Geely Starwish launched limited-time discounts upon its release; the BYD Seagull enhanced its product competitiveness by introducing new configuration models; after JD entered the 'car-making' arena, its first model, developed in collaboration with CATL and GAC, is also targeted at the A0-segment market.

'In the next three years, the A0-segment pure electric vehicle market will maintain an average annual growth rate of 30%, potentially reaching 2 million units by 2027,' said an analyst. This growth will come not only from new demand but also from the replacement of fuel vehicles.

Undoubtedly, the future A0-segment electric vehicle market will also show a trend of differentiation.

On one hand, leading automakers will consolidate their market positions through technological upgrades and brand building; on the other hand, smaller automakers may seek survival space through differentiated competition and niche market entry. Additionally, with the decentralization of features like 800V high-voltage platforms and urban NOA, the intelligence level of A0-segment electric vehicles will further improve, offering consumers richer experiences.

It's worth mentioning that automakers doubling down on the A0-segment electric vehicle track are not only targeting the domestic market but also accelerating their overseas expansion.

From being a fuel vehicle liability to an electric vehicle hit, the renaissance of the A0-segment sedan market is the result of technological equalization, demand restructuring, and strategic positioning. With the continued advancement of the electrification wave, the A0-segment sedan market is expected to embrace broader development prospects.

As BYD Chairman Wang Chuanfu said, 'A0-segment cars are not a compromise for the low-end market but the vanguard of new energy popularization.'

Note: Images are sourced from the internet. If there is any infringement, please contact us for deletion.

-END-