Who Are the 'Seven Sisters' in China's Tech Industry?

![]() 11/27 2025

11/27 2025

![]() 638

638

China is on the cusp of unveiling its own 'AI Seven Giants'.

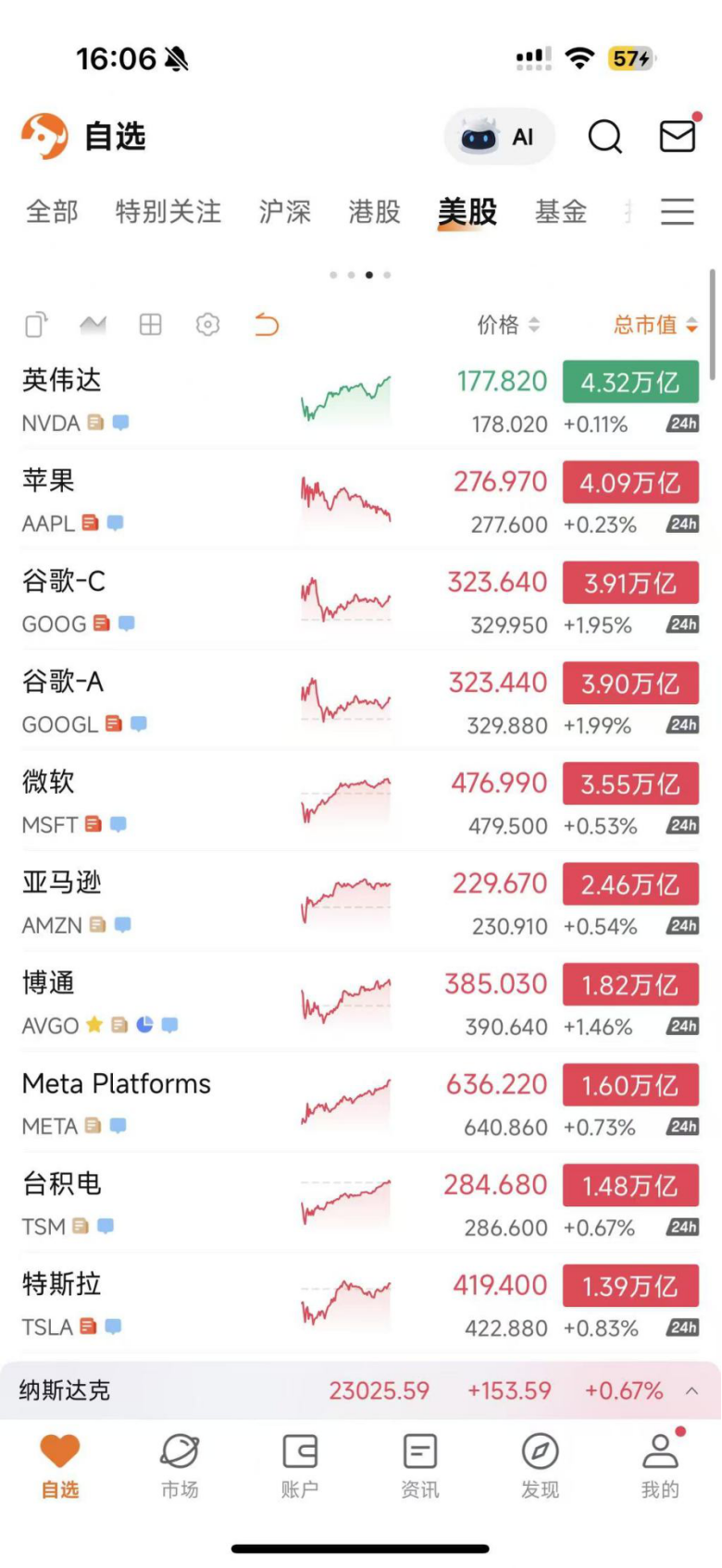

In late October, the Federal Reserve announced its second interest rate reduction of the year, slashing rates by 25 basis points, and stated its intention to pause quantitative tightening (QT) starting in December. This move propelled U.S. stocks to steady gains, with the Nasdaq reaching a record high of 24,019.99. Leading tech stocks maintained their upward trajectory, although they experienced minor corrections after reaching new peaks. Nevertheless, their market valuations remain substantial: Nvidia, Apple, Google, and Microsoft each boasted market capitalizations of $4 trillion, with their combined value surpassing the total market cap of A-shares (*As of October 28, 2025, the A-share market comprised 5,444 listed companies with a total market cap exceeding 118 trillion yuan, approximately $16.6 trillion). Following these four behemoths, Amazon, Broadcom, Meta, TSMC, and Tesla also reached the $2 trillion market cap milestone.

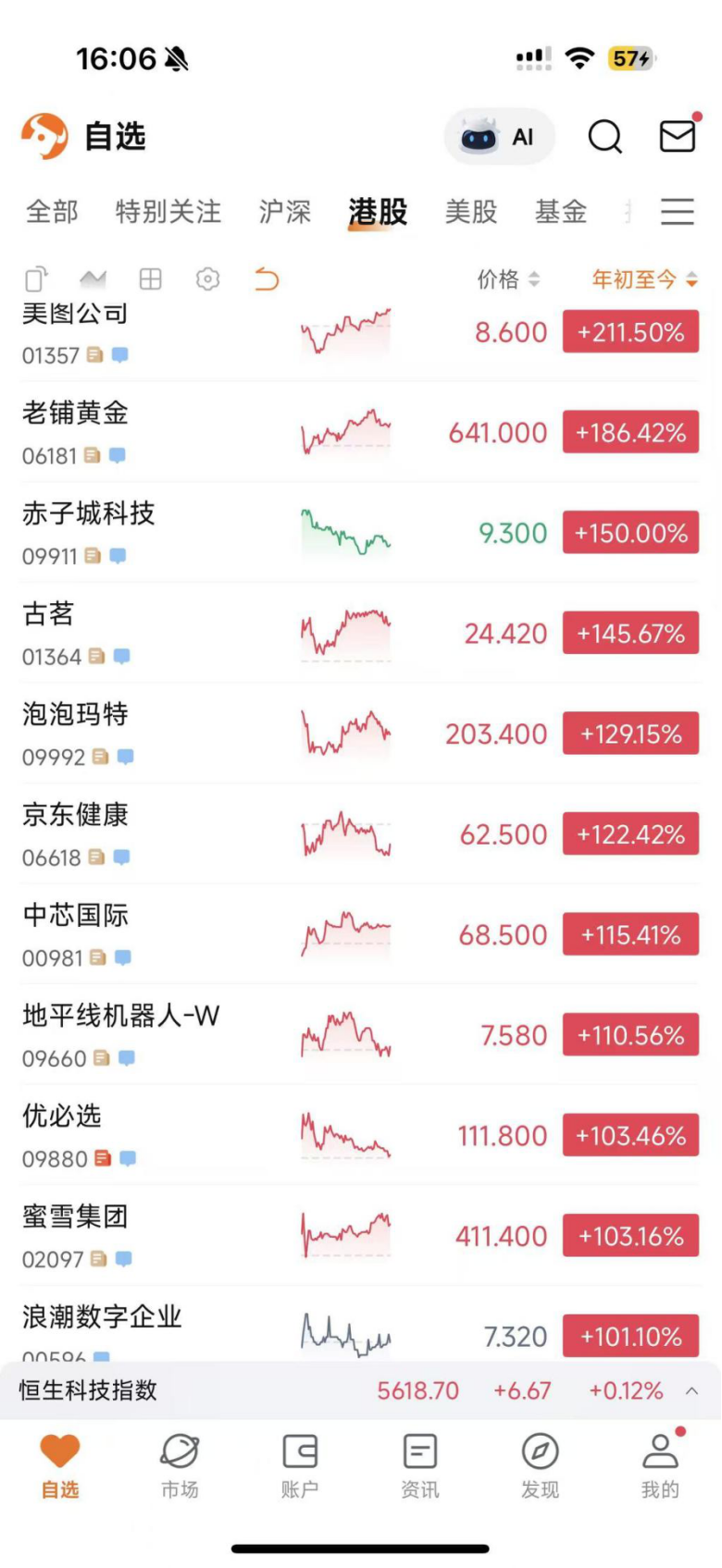

When examining the stock performance of Chinese tech companies, there remains a significant gap compared to their U.S. counterparts in absolute terms, with no trillion-dollar companies emerging in China yet. However, from the perspective of stock price appreciation, 2025 has been a 'banner year.' As of the Hong Kong stock market close on November 26, Alibaba's cumulative gains reached 92.42%, with its market cap hitting $379.9 billion. Additionally, other Chinese tech companies such as XPeng, SMIC, Horizon Robotics, Tencent, and Cambrian Technologies have all witnessed impressive gains (76.53%, 116.04%, 110%, 50.55%, and 99.8%, respectively).

The collective resurgence of Chinese tech companies in 2025 is intricately linked to the return of global capital. Recently, Nasdaq introduced the CNQQ (Rayliant-ChinaAMC Transformative China Tech ETF), an index ETF product focusing on high-quality Chinese tech companies. Key holdings include Alibaba, Tencent, CATL, and Cambrian Technologies, reflecting the trend of Chinese tech companies becoming coveted assets in the global market. For global investors, the question is no longer whether to invest in China's tech sector but which companies to select. There is ongoing debate about whether China's tech industry will produce a leading group akin to the 'Magnificent Seven' of U.S. stocks.

A thriving tech industry necessitates more than just a single standout performer; it requires a diverse ecosystem to flourish.

The ebb and flow of the tech sector in capital markets have always been intertwined. As early as 2013, Jim Cramer, a renowned U.S. financial show host, proposed the FANG concept, arguing that Facebook, Amazon, Netflix, and Google represented the future of the tech industry. At the time, the internet was considered a 'hot trend,' with FANG corresponding to the four core sectors of social networking, e-commerce, streaming media, and search engines. In 2017, Cramer expanded the group to include Apple, which had significantly benefited from the mobile internet boom, renaming it FAANG. Since then, FAANG has served as a bellwether for the tech industry, with Wall Street closely monitoring the impact of these five giants on the market. At its peak in late 2022, FAANG accounted for over 25% of the total market cap of the S&P 500.

However, as the mobile internet dividend faded, the market performance of the FAANG group began to diverge. In October 2021, Facebook, which had aggressively bet on XR, blockchain, and the metaverse, rebranded as Meta. Its stock price plummeted by 76% in 2022. Fortunately, Meta adapted by abandoning its metaverse strategy and shifting its focus entirely to AI, securing a position in the subsequent AI boom.

With the emergence of ChatGPT in late 2022, AI took center stage as the dominant force in the tech industry. In May 2023, Bank of America coined the term 'Magnificent Seven' to describe the seven top-performing large-cap tech stocks driving the S&P 500's gains. Netflix, a former key player, was excluded as its market cap fell below $500 billion, while Microsoft, Tesla, and Nvidia rose to prominence. The 'Magnificent Seven' are all AI-driven tech companies, with a combined market cap of $21.24 trillion.

It is evident that significant gains in tech stocks often involve multiple leading players, as the tech industry relies on a clear division of labor across its ecosystem. Progress hinges on open collaboration and cannot be dominated by a single company. Netflix's decline underscores that a thriving tech sector requires diversity, while the 'Magnificent Seven' have expanded their market share by leveraging AI technology. According to a 2025 McKinsey report, these companies control 70% of the global cloud computing market and 85% of AI patents.

China's tech industry has followed a similar trajectory of collective growth. During the internet era, BAT (Baidu, Alibaba, Tencent) were the dominant players, while the mobile internet era saw the rise of TMD (ByteDance, Meituan, Didi). Later, with ByteDance's ascent, the new BAT (ByteDance, Alibaba, Tencent) emerged as China's tech triumvirate. Over the years, China's leading tech companies have grown through competition and collaboration.

The question now is: Who will be the key players in China's tech sector during the AI era? Which companies will form China's 'Seven Sisters'? Based on the performance of Chinese stocks in 2025, companies that have firmly committed to AI research, development, and application have performed well, with AI becoming a driving force for China's tech industry. CNQQ index components like Alibaba and Cambrian Technologies have seen significant gains, indicating that emerging tech companies focused on R&D have greater growth potential.

How Does CNQQ, the 'Chinese Nasdaq 100 ETF,' Connect Global Investors?

CNQQ aims to become China's version of the Nasdaq 100 ETF. It adopts a non-traditional market cap-weighted approach, incorporating a company's three-year R&D expenditure ratio into its total and float-adjusted market cap calculations. The top 100 stocks are selected based on adjusted market cap, with component weights determined by adjusted float-adjusted market cap and capped at 10%.

In essence, CNQQ considers both fundamental performance (e.g., market cap) and technological innovation capabilities. The former represents the past, while the latter determines the future. Among the top ten holdings, in addition to internet giants like Alibaba and Tencent, which have the potential to reach trillion-dollar valuations, there are also stars like CATL and Cambrian Technologies. These companies are heavily invested in R&D and lead innovation in their respective sectors. Additionally, they are strategically focusing on AI, making many CNQQ components comparable to China's versions of Google, Meta, Tesla, Apple, and OpenAI. It is highly plausible that China's own 'Seven Sisters' will emerge from this group.

Compared to investing in a single tech company, which offers high potential returns but also high risk, ETFs that allow investors to 'bet on the sector, not the horse' are gaining traction. Products like the Hang Seng Tech Index ETF in Hong Kong have delivered steady and impressive returns, with gains of 25.6% year-to-date in 2025. CNQQ enables global investors to directly access high-quality Chinese tech assets across A-shares, Hong Kong stocks, and other markets, offering around-the-clock trading opportunities (e.g., monitoring CNQQ during U.S. daytime and investing in other indices at night).

CNQQ facilitates 24-hour 'sun never sets' trading of China's top tech assets, broadening financing channels for Chinese tech companies and providing global investors with efficient access to China's most innovative companies. The emergence of CNQQ is no coincidence, as the value of Chinese tech assets is increasingly recognized by investors in 2025.

China's Tech Industry Potential Is Recognized, and Its 'Seven Sisters' Are Emerging.

In 2025, Chinese tech companies have performed well in capital markets, with not only a broad recovery in listed companies' stock prices but also rising valuations for pre-IPO giants like ByteDance, Xiaohongshu, and Ant Group. Global investors are increasingly optimistic about Chinese tech companies, increasing their stakes and bets on the sector.

For example, Alibaba, which has transformed from an 'e-commerce giant' into an 'AI tech company,' has attracted interest from top global investors. Recent disclosures show that Cathie Wood's Ark Investment made its first Alibaba purchase in four years, while Michael Burry, the protagonist of 'The Big Short,' bought call options on Alibaba in the second quarter. By the third quarter, Hillhouse Capital, led by Zhang Lei, had significantly increased its Alibaba holdings, making it the second-largest position. In 2025, Alibaba's frequent media appearances have focused on AI businesses like Kuake and Qianwen, prompting capital markets to reevaluate its value.

It is not just Alibaba that global investors are taking seriously but the entire Chinese tech sector. Citigroup recently upgraded its rating on Chinese stocks to 'overweight' while downgrading European stocks to 'neutral.' In its report, Citigroup expressed greater optimism about Chinese stocks due to the AI boom and strong local capital inflows. Morgan Stanley's chief China strategist, Wang Ying, told the media that after June 2024, corporate earnings for Chinese listed companies gradually improved, with most companies in sectors like finance, internet, hard tech, pharmaceuticals, raw materials, advanced manufacturing, and automation showing optimistic earnings revisions.

I believe global investors are paying attention to China's tech sector for several reasons:

1. Due to internal and external factors like trade friction, Chinese assets were undervalued for an extended period. In 2025, Zhu Xiaohu wrote on WeChat that '2025 marks the beginning of a comprehensive revaluation of Chinese assets,' a sentiment shared by many investors. This led to a wave of 'Chinese asset revaluation' in the market after the Spring Festival.

2. China offers vast potential for AI adoption, with Chinese tech companies playing a key role in the AI landscape. China provides abundant resources such as scenarios, data, and talent for AI development. At the foundational level, companies like Baidu and Alibaba have been early adopters of AI technologies like deep learning and large language models, while newcomers like DeepSeek have emerged. In terms of application, Chinese tech companies excel at innovation tailored to real customer needs, supported by favorable policies and market conditions. As a result, China has produced unexpected dark horses and innovative applications in areas like AI-powered vehicles, RoboTaxis, batteries, AI hardware, smart appliances, humanoid robots, chips, and large language models.

In November, NVIDIA founder and CEO Jensen Huang told the media, 'China's local tech companies can adopt domestic AI chip alternatives at lower costs, and China offers a more favorable regulatory environment for data centers and lower energy costs. I expect China to outperform the U.S. in the AI race.'

3. China has a large, high-quality domestic market. As one of the world's largest single markets, China offers immense investment potential. Moreover, its commitment to high-quality development, anti-internal-competition policies, and focus on sustainable growth make it a more attractive long-term investment destination.

4. China's globalization capabilities have significantly improved, with Chinese innovation accelerating its global expansion. During the mobile internet era, Chinese tech companies primarily focused on the domestic market. In the AI era, global players like ByteDance (TikTok), Temu (Pinduoduo), Shein, Dreame, Newborn Town, and XPeng have emerged, with going global becoming a consensus among more companies. This trend will substantially raise the growth ceiling for Chinese assets.

As China's tech sector, particularly AI, continues to boom and Chinese companies expand globally, more global investors will focus on or heavily invest in Chinese tech assets. Indexes like CNQQ, which track high-quality Chinese assets, will emerge, lowering barriers for global investors and helping Chinese companies access global resources more efficiently, thereby achieving higher-quality growth.

Special Note: Invest with Caution. This article represents personal views only and does not constitute investment advice.

Chinese Stocks, Alibaba, AI, Tencent, Cambrian Technologies

Source: Leikeji

Images courtesy of 123RF Royalty-Free Image Library