C-end Market: Game Sees Reinvestment

![]() 11/27 2025

11/27 2025

![]() 630

630

Over 10 Million Downloads in Just One Week, Far Outpacing ChatGPT: The White House Is in a Flurry...

Lately, whether you're scrolling through social media or browsing the App Store, you've probably been inundated with an app called Qianwen.

On the day of the public beta launch of the Qianwen APP, it swiftly ignited heated discussions both at home and abroad, within and beyond the industry. Within a mere 24 hours, the servers experienced multiple crashes. However, Qianwen managed to restore stability by swiftly expanding capacity through Alibaba Cloud in an emergency response.

Thus, the grand narrative of 'crafting an AI super native application for C-end users' has unfolded, fully unveiling Alibaba's ecological ambitions.

Qianwen's Evolution

What Exactly Is 'Qianwen'?

This is an app recently launched by Alibaba, built upon the Qwen3 open-source model. However, those well-versed in AI products would recognize that it's not entirely new but rather a reimagined version of 'Tongyi Qianwen.'

In April 2023, Alibaba Cloud unveiled the Tongyi Qianwen large model, bearing the English name Qwen and the Chinese name Tongyi Qianwen, under the Alibaba Cloud banner. In September, the Tongyi Qianwen App made its official debut, led by Zhou Jingren. Last May, Tongyi Qianwen was rebranded as Tongyi.

From a user base perspective, Tongyi's performance has fallen short of expectations. QuestMobile data reveals that among the top three AI applications in China by monthly active users in September this year, Doubao, DeepSeek, and Tencent Yuanbao secured the first, second, and third spots, respectively, with MAUs of 172 million, 145 million, and 32.86 million. Tongyi ranked tenth, with a mere 3.06 million monthly active users.

A turning point in its destiny soon arrived. On November 13, 2025, news surfaced about Alibaba's covert launch of the Qianwen project. The following day, on November 14, the Tongyi App was officially renamed the Qianwen App, with the version number leaping from 3.60.0 to 5.0.0.

Notably, the new Qianwen project falls under the purview of Alibaba's Intelligent Information Business Group, but its coordination has escalated to the level of the Alibaba Group. The renaming and launch received personal approval from Alibaba Group CEO Wu Yongming.

On November 17, Alibaba's Qianwen App public beta went live, integrating the 'world's top open-source model' Qwen3 and claiming to go head-to-head with ChatGPT.

Qwen3 has garnered global attention, achieving two major milestones. Firstly, it's a fully open-source model series under the permissive Apache 2.0 license, enabling free modification and commercial use. Secondly, it genuinely implements a hybrid inference mode, empowering users to seamlessly switch between thinking and non-thinking modes. The performance of its 4B parameter model rivals that of the previous 72B model. Whether in benchmarking or recent large model applications in stock trading and cryptocurrency, it has delivered impressive results. According to Jensen Huang, Qwen3 has become an indispensable part of Silicon Valley's AI infrastructure.

However, some industry insiders point out that Qwen3 still has notable shortcomings in hardcore programming, complex multi-task adaptation, and other scenarios.

The Qianwen App, armed with Qwen3, positions itself as an AI-native C-end super entry point, serving as a powerful solution in Alibaba's top-tier design for AI TOC.

Sudden 'Reinvestment'

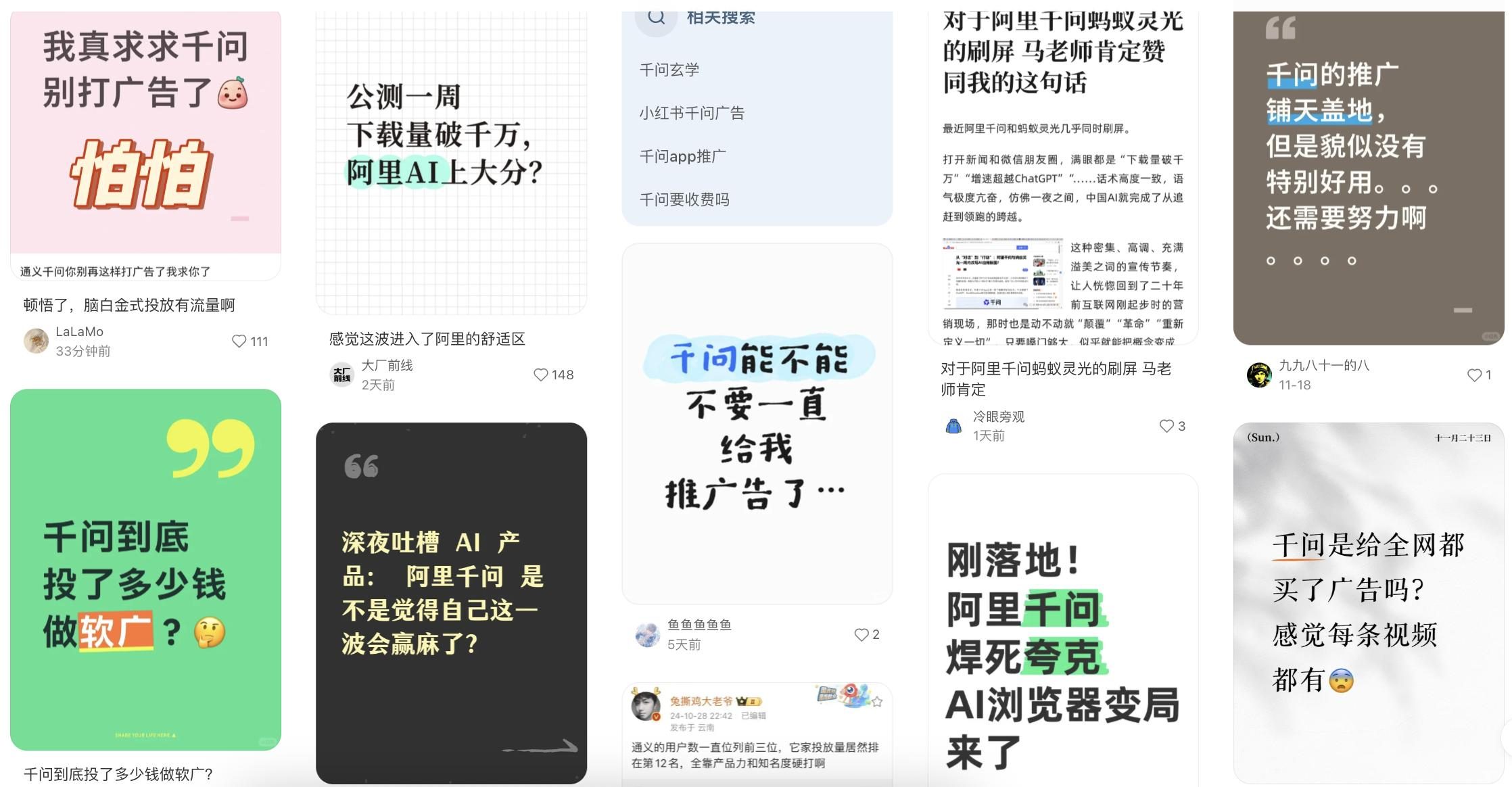

Following the rebranding and launch, a massive promotional campaign ensued. Technology, once reserved and understated, transformed into a high-profile and frenetic spectacle. With substantial financial backing and extensive marketing, tech influencers with thousands of followers, along with finance, entertainment, and education influencers boasting tens of thousands or even hundreds of thousands of followers, all promoted Qianwen simultaneously. Nearly every user who had searched for AI-related content was bombarded multiple times. The number of ASA bidding keywords for Qianwen also skyrocketed, jumping from the thousands to the tens of thousands.

The content predominantly consisted of template introductions that AI applications had already employed numerous times, along with simple applications like assisting users in buying tickets, making reservations, and shopping. As for how it differs from chatbots like ByteDance's Doubao, Tencent's Yuanbao, or Deepseek, users remained perplexed. It was as if everyone had it, so they felt compelled to have it too.

The intensity of this promotional wave left users collectively exclaiming, 'Overnight, it's everywhere. Did Qianwen launch a full-scale internet advertising campaign?' Some users were puzzled, questioning, 'Isn't this an app that's been around for a while? Why is it being promoted again?' and 'Aren't Qianwen and Quark redundant?'

On November 24, Alibaba Group announced that the Qianwen App had surpassed 10 million downloads within one week of its public beta, marking a significant milestone. In comparison, ChatGPT took 40 days, and DeepSeek took 20 days to reach the same milestone. Whether this download count is cumulative or starts from scratch remains ambiguous.

Would the White House be intimidated by a chatbot available only in China? A review of the original Financial Times report reveals that the White House's concerns stem from Alibaba Cloud's infrastructure, data flow, and potential civil-military integration issues, rather than the public relations narrative of Qianwen frightening the White House.

As for Quark, which previously carried Alibaba's AI TOC vision, sources close to Alibaba indicate that 'Alibaba will now focus on developing Qianwen and integrate it into Quark.'

The new version of the Quark AI browser is built on Qianwen's foundation and can activate the Qianwen AI assistant without requiring the app to be opened. Their strong synergy means Qianwen is also expanding to the PC end, opening up a new battlefield. This might be Alibaba's dual insurance strategy for the C-end market.

The Battle for Entry Points: A Must-Win

Qianwen and Quark are being thrust to the forefront to compete for the super traffic entry point in the AI era, as controlling the AI assistant means controlling the initiative to connect various services.

Alibaba's latest financial results also underscore the significance of AI. In the third quarter, Alibaba Cloud Intelligence Group's revenue reached 39.824 billion yuan, up 34% year-on-year, making it the fastest-growing business segment, primarily driven by growth in public cloud business revenue. Xu Hong also mentioned that over the past four quarters, Alibaba has invested approximately 120 billion yuan in AI + cloud infrastructure capital expenditures and will continue to invest 380 billion yuan in AI infrastructure construction.

At the earnings briefing, Wu Yongming further shared the latest progress in Alibaba's AI strategy. In the AI to B sector, Alibaba aims to be the world's leading full-stack AI service provider, catering to the growing AI needs of various industries. In the AI to C sector, based on leading AI models and Alibaba's ecological advantages, it will create AI super native applications for C-end users, promoting AI from industries to the masses.

On the B-end, Alibaba has achieved rapid growth in its own business and significant accomplishments in cloud services, cross-border e-commerce, enterprise office solutions, and more, leveraging its full-stack technical capabilities.

However, in the C-end AI applications, Alibaba has been relatively sluggish compared to domestic vendors like Doubao, DeepSeek, and Yuanbao, missing out on the best growth opportunities.

Nevertheless, Alibaba believes it's not too late to reinvest resources in creating Qianwen as a super entry point.

Currently, no domestic AI application has stably broken through the 100 million DAU mark to become a national-level AI application. From a product perspective, most are still in their infancy and lack problem-solving capabilities.

Alibaba's model capabilities are widely recognized as robust, but its repeated setbacks in social and content-oriented ToC fields have hindered its ability to translate these capabilities into compelling products. While it has no shortage of landing scenarios for shopping, payment, office, travel, and search, their strong tool attributes lead users to leave after use, and there are also shortcomings in ecosystem synergy.

As for whether Qianwen and even Quark can become China's version of ChatGPT or even surpass it, ambition alone is insufficient. The first priority is to refine and polish the product. With a superior product, traffic will naturally follow.