Google AI Makes a Triumphant Return as Single-Quarter Revenue Surpasses $100 Billion

![]() 11/28 2025

11/28 2025

![]() 575

575

Graphic & Text | Sister Tang

In the third quarter of 2025, Google achieved a historic milestone by posting its first-ever quarterly revenue exceeding $100 billion. This tech behemoth, often perceived as a late entrant in the AI race, is demonstrating at a remarkable pace that it is not merely keeping pace but could very well emerge as the most underrated victor of the entire AI era.

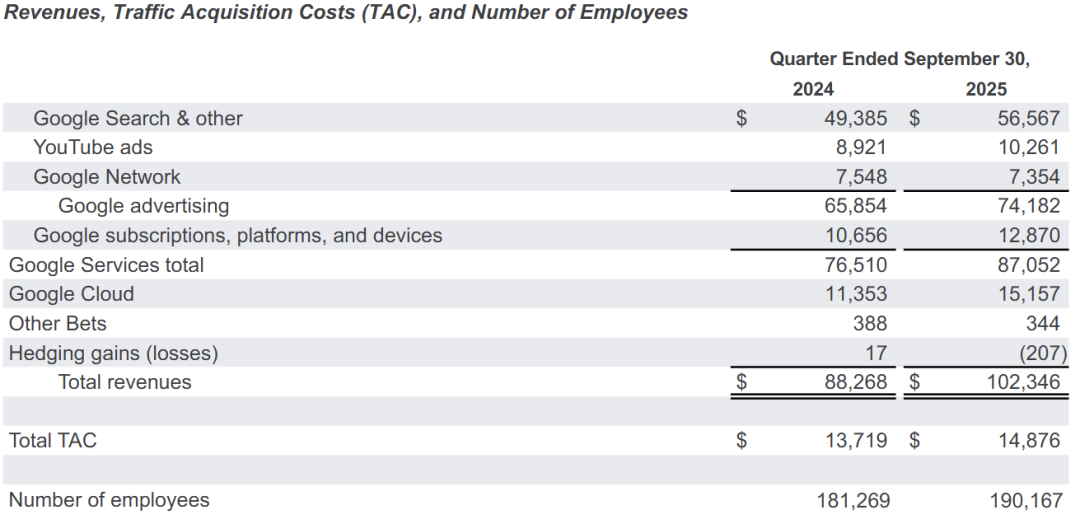

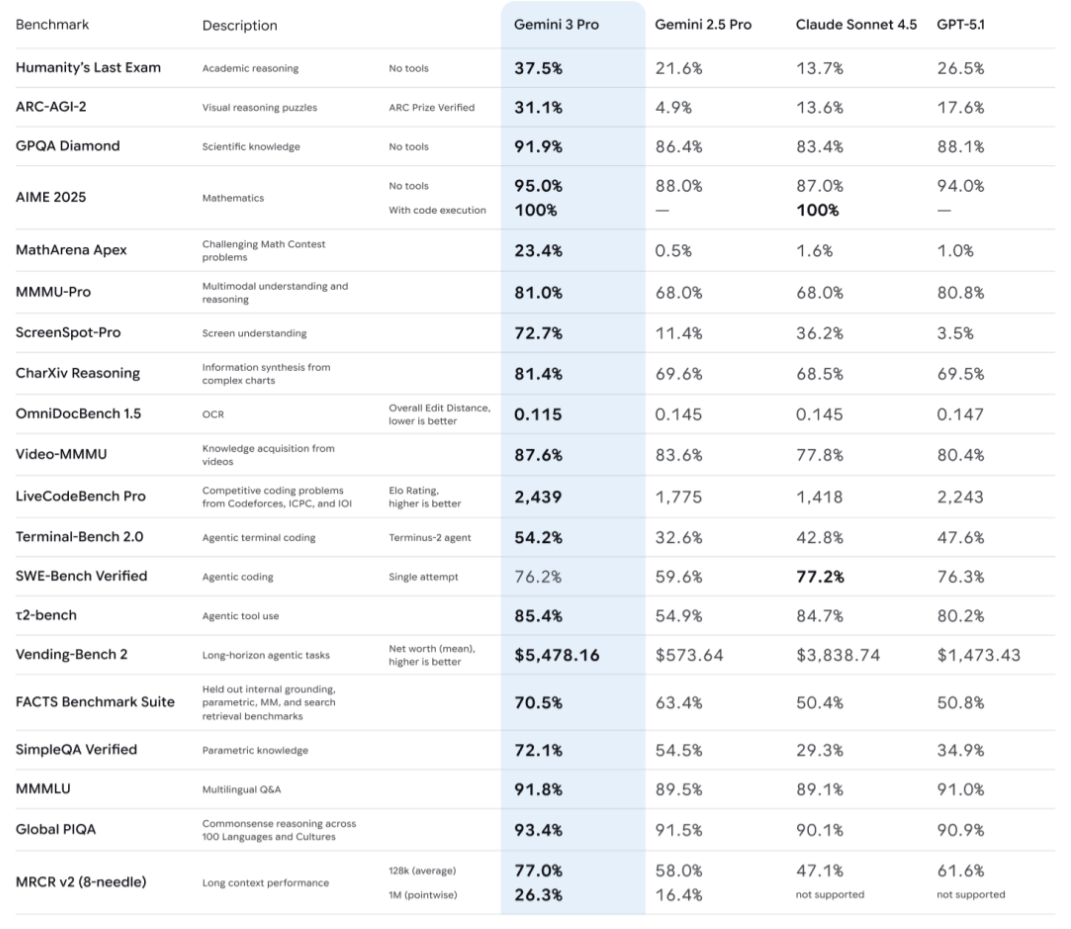

With quarterly revenue reaching $102 billion, marking a 16% year-over-year increase, all of Google's business segments delivered robust performances. Google Cloud, which has long been overshadowed by AWS internationally, experienced explosive growth of 34%. The newly launched Gemini 3 outperformed GPT-5 across various independent benchmarks, securing top positions. Numerous user experiences from both international and domestic markets underscore its real-world performance and capabilities.

Moreover, as a newcomer to the chip industry, Google's chip business has achieved significant milestones. The company is reportedly in discussions with META to provide access to its self-developed Tensor AI chips. Additionally, Google aims to directly sell TPU chips to a broader customer base and plans to commence leasing TPU computing power through Google Cloud as early as 2026, further solidifying its competitive edge against NVIDIA.

We have been closely monitoring Google's progress for nearly two years. Last year, concerns arose that large language models would disrupt traditional search businesses. However, Google has adeptly integrated AI into its vast product ecosystem, not only maintaining a 90% market share in search engines but also thriving across YouTube, Android, cloud computing, and now the chip sector.

This full-stack AI strategy, combined with its unique TPU hardware advantages and a massive data moat, is constructing an ecosystem that competitors find challenging to replicate.

01 Fundamentals Strongly Bolster Valuation

From $50 billion in quarterly revenue five years ago to $102 billion today, Google has doubled its revenue in just five years, showcasing rare sustained growth for a large tech company. This reflects synergistic growth across its business segments.

Breaking down the figures, Google Services (including Search, YouTube, and other services) contributed $87 billion in revenue, up 14% year-over-year, remaining the company's primary revenue generator. Search ad revenue grew by 15%, while YouTube ad revenue also increased by 15%, both surpassing the single-digit growth of the digital ad market. This outperformance indicates that Google is not only maintaining its market share but expanding its lead.

Google Cloud emerged as the fastest-growing segment, with Q3 revenue of $15.16 billion, up 34% year-over-year, and an annualized run rate exceeding $60 billion. More significantly, the cloud business achieved an operating profit of $3.59 billion, with the operating margin improving from 17.1% to 24%. This rapid profitability enhancement far exceeded analyst expectations, proving that the cloud business has entered a phase of scale-driven growth.

From a profitability standpoint, despite a decline in the overall operating margin due to an EU Commission fine, it remains above 30%, only 2 percentage points lower year-over-year. The net profit margin exceeded 34%, with net profit up 33% year-over-year. Earnings per share reached $2.12, up 31% year-over-year, significantly surpassing the analyst consensus of $1.85.

Cash flow remained robust. Operating cash inflow over the past 12 months reached $112.31 billion. Even after deducting the annual capital expenditure budget of $91–93 billion, free cash flow remains substantial. This large-scale capital investment aims to secure a leading position in AI infrastructure, with a high safety margin given Google's comprehensive AI-driven gains.

Of the massive capital expenditures in 2025, a significant portion will be allocated to server procurement, primarily AI training chips like GPUs and TPUs, as well as continued investment in data centers and network construction. This investment structure is clearly targeted at enhancing cloud services and AI capabilities. Consequently, depreciation expenses rose from $4 billion last year to $5.6 billion.

From a revenue mix perspective, Google's income sources are becoming increasingly diversified, with YouTube, cloud, and other businesses contributing more significantly.

Cloud business customer metrics are particularly impressive. The number of new customers grew by 34% year-over-year, with over 70% of existing customers utilizing AI products. Revenue from products based on generative AI models surged by 200%. In Q3, the number of deals exceeding $1 billion surpassed the total of the past two years, with 13 product lines achieving annual recurring revenue (ARR) exceeding $1 billion. These figures demonstrate that the cloud business is not only acquiring customers rapidly but also significantly increasing average deal sizes.

The most striking figure is the cloud business's $155 billion order backlog, up 46% quarter-over-quarter and 82% year-over-year. This equates to 2.5 years of cloud revenue, providing massive support for future growth. Management emphasized during the earnings call that these orders primarily stem from AI infrastructure demand, with average contract terms of 3–5 years.

From a valuation perspective, Google's forward Non-GAAP P/E ratio stands at 27x, lower than Microsoft's and Amazon's. Considering its 16% revenue growth and 31% profit growth, the current valuation is not expensive. Wall Street analysts expect Google's EPS to grow by 5% in 2026 and 14% in 2027. Given AI's potential to boost profit margins, actual growth may exceed expectations.

Overall, Google's financial data reflects a mature tech giant rejuvenated in the AI era. The $100 billion quarterly revenue milestone is not an endpoint but a new beginning. As AI technology further permeates each business line, profit margins still have room to rise. Google will demonstrate through action that even at such a massive scale, innovation-driven growth stories will continue.

02 Technology Constructs Long-Term Competitive Barriers

Google's AI journey commenced at a pivotal turning point.

When OpenAI's ChatGPT emerged in late 2022, the market believed Google's search empire would be disrupted, with investors fearing the search giant could become the Nokia of the AI era. However, just two years later, the release of Gemini 3 surpassed the highly anticipated GPT-5 on multiple metrics.

Testers discovered that the Gemini 3.0 model could accomplish tasks previously deemed impossible—building complete websites from a single prompt, generating interactive 3D scenes, and even creating basic operating system interfaces. Many deep users of large models stated that Gemini 3.0 felt like “jumping from a bicycle to a sports car,” whereas GPT-5 was perceived as more of an incremental update, with its new features even facing criticism.

From a business perspective, what truly distinguishes Google is its ability to seamlessly integrate cutting-edge AI into the daily lives of 2 billion users.

For instance, when users search on Google, AI automatically comprehends query intent and provides comprehensive answers. AI-powered query volume has increased by over 10%, not cannibalizing traditional search but expanding usage scenarios. Moreover, each user interaction trains the model, creating a self-reinforcing cycle.

The AI integration within the Android ecosystem showcases another possibility. Circle to Search enables 300 million device users to circle any content on the screen for search, while Gemini Live functions as an omnipresent smart assistant. This deep integration means Google's AI is not an app users need to actively open but an invisible assistant embedded in the system.

Of course, in this AI arms race, computing power is also decisive. On one hand, Google purchases large quantities of NVIDIA GPUs to meet short-term demand; on the other, it accelerates its self-developed TPUs to secure long-term autonomy. The Ironwood TPU achieves a 10x performance leap over v5, representing not just a technical breakthrough but a declaration of strategic independence. While the world scrambles for NVIDIA chips, Google already has a contingency plan.

The value of TPUs is validated by Anthropic's choice. This OpenAI competitor committed to using 1 million Google TPUs instead of NVIDIA GPUs. Behind this decision lies recognition of TPUs' cost-effectiveness in large-scale training. Google is becoming a core supplier of AI infrastructure, much like NVIDIA dominates the GPU market.

From underlying chips to development frameworks, from AI models to end-user applications, Google controls the entire tech stack. This vertical integration not only enhances efficiency but also enables rapid responses to market demands. When customers require customized AI solutions, Google can optimize at every layer, something competitors relying on third parties cannot achieve.

Combined with full-stack control over AI, Google's data—billions of daily searches, 500 hours of video uploaded to YouTube every minute, and hundreds of millions of Android devices in use—constitutes the world's richest multimodal dataset. Critically, this data is growing exponentially. While Meta relies on public data to train Llama and OpenAI even purchases training data, Google's data moat becomes increasingly apparent.

What impresses us most is how Google's entire organization has evolved in the AI era. What was once seen as a search disruptor—conversational AI—has been skillfully integrated into the search experience, fundamentally transforming Google's revenue structure. This crisis response strategy is more valuable than any technical breakthrough.

03 Conclusion

Currently, among domestic companies, Alibaba is the only publicly traded firm that can come close to Google in terms of scale and AI integration, followed by Baidu.

While both companies have revealed self-developed chips, Alibaba's larger revenue scale and more diversified business allow AI to participate in and empower more business lines. From Google's progression, AI serves as an exponential growth engine for large-scale tech enterprises.

However, it's worth noting that recent market volatility in U.S. and Hong Kong stocks has affected Google as well. As a highly suitable candidate for long-term allocation, Google's investment value lies more in its ability to navigate market cycles. It's well-suited for building positions during market corrections, using time to capture growth opportunities and patiently awaiting the full commercialization of AI.

Disclaimer: This article is for learning and communication purposes only and does not constitute investment advice. Welcome to like, share, and forward. Your support fuels our updates! Related Reading: The Second Half of the Hong Kong Stock Bull Market: Not About Courage, But About Understanding A Deep Dive into the True Sources and Misconceptions of 'U.S. Stock Liquidity'