Humanoid robots have initiated a mass production challenge

![]() 11/28 2025

11/28 2025

![]() 478

478

Layout by Xiaoxi

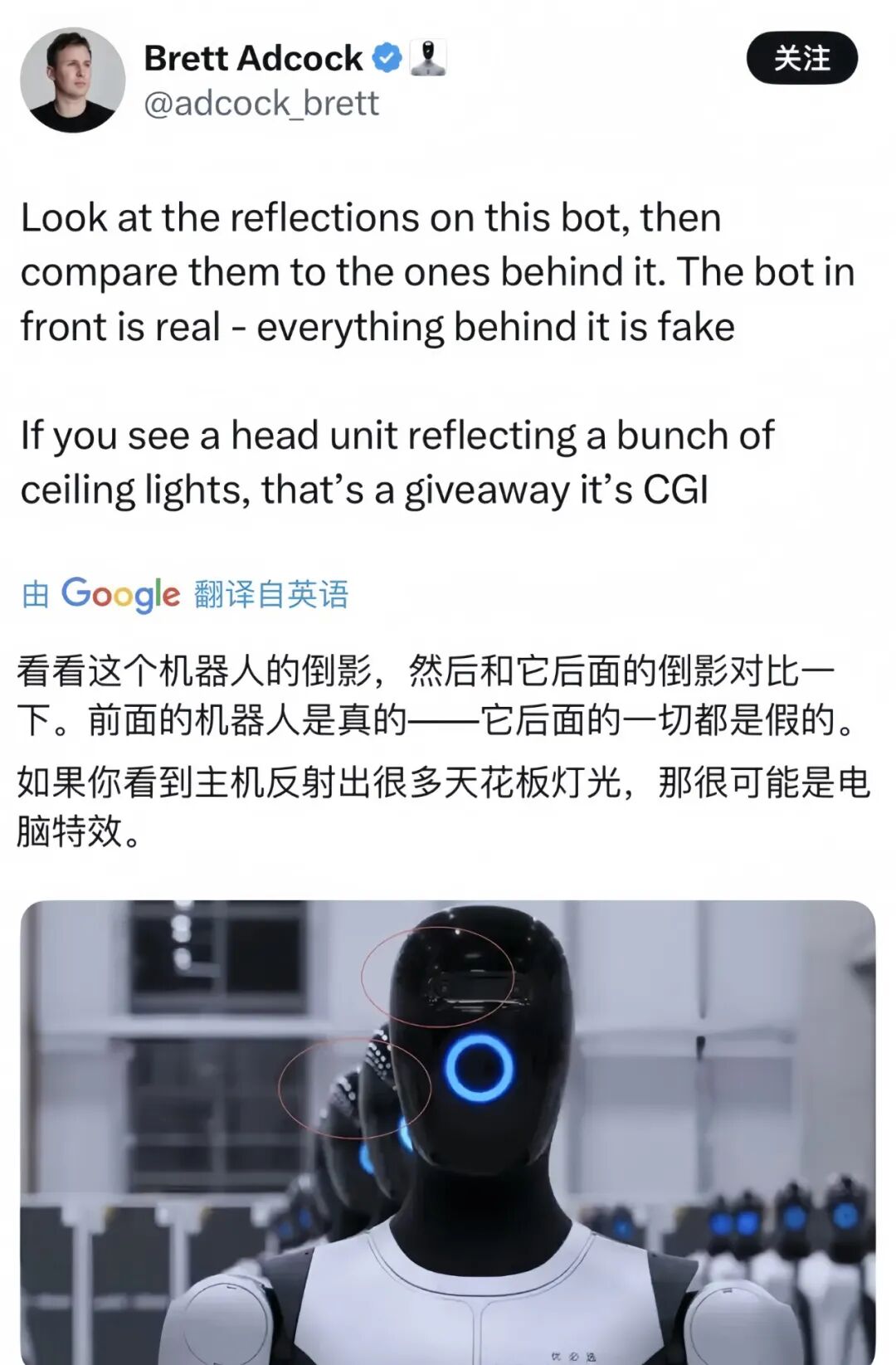

The rapid development of robots has inevitably sparked skepticism. Not long ago, Xiaopeng's humanoid robot was questioned for being portrayed by a real person. Shortly after, UBTECH faced similar doubts from its peers across the ocean.

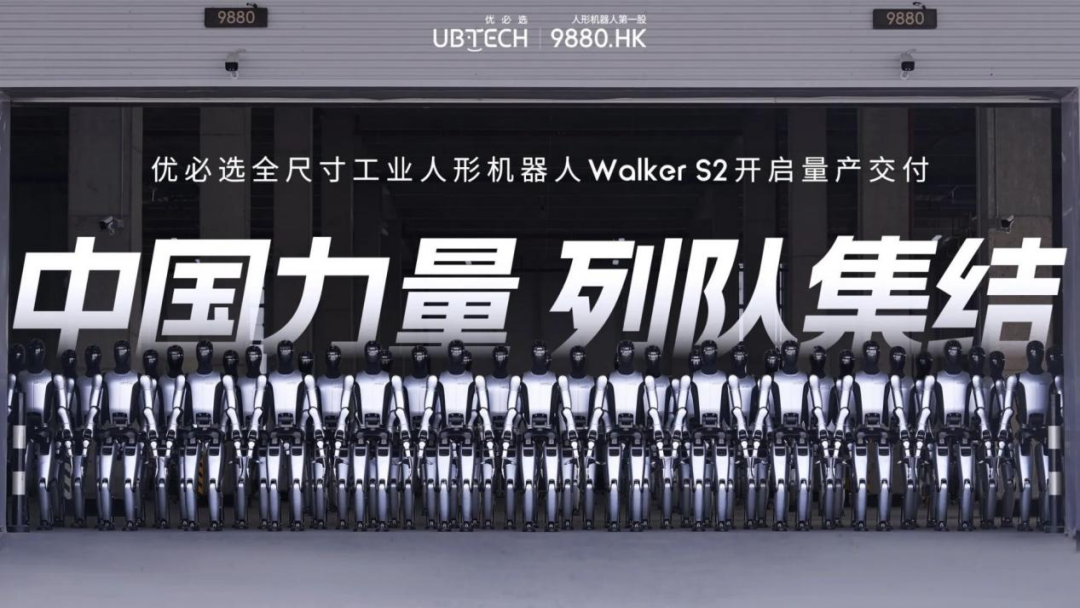

Brett Adcock, founder of the American humanoid robot company Figure, publicly questioned on social media the large-scale delivery capability of UBTECH, China's first publicly traded humanoid robot company. A blurry video screenshot accompanied by the phrase 'likely computer-generated effects' quickly stirred up controversy in the industry.

In response to the 'smear campaign,' UBTECH reacted swiftly and forcefully: releasing unedited, full-speed video footage with original audio, clearly depicting the actual scene. This passive PR crisis was transformed into a powerful 'muscle flex.'

In fact, this cross-border confrontation is not merely a case of commercial mischief but rather resembles the 'starting gun' for the Sino-US robot mass production competition, revealing a fundamental shift in the competitive paradigm of the entire industry.

While Silicon Valley elites are still debating the technical routes of 'hydraulic drive' versus 'motor drive,' Chinese players have shifted course, moving the race's finish line from 'presentation PPTs' to 'factory assembly lines.' For the global humanoid robot industry, the decisive battle around scalable delivery and commercialization has quietly begun.

| Collective IPO Rush, Yet Delivery Woes Persist |

The capital market serves as the best indicator of industry enthusiasm. From 2024 to 2025, China's robot sector has witnessed an unprecedented surge in IPO efforts, with the core of this wave being the new 'embodied intelligence' forces represented by humanoid robots.

The players rushing towards IPOs each possess unique strengths and strategic focuses, collectively forming the vanguard matrix of China's humanoid robot ecosystem:

As an undeniable pioneer, UBTECH, founded in 2012, holds the world's largest portfolio of humanoid robot patents. By 2024, its total global authorized patents reached 2,680, with invention patents accounting for over 57%.

From early educational and consumer-grade robots to its current full commitment to the industrial-grade Walker series for automotive manufacturing and other scenarios, UBTECH has developed full-stack technical capabilities for humanoid robots. Its strategic core is 'scenario implementation,' attempting to create a large-scale commercial application entry point in the industrial sector.

▲ Note: Image sourced from UBTECH Technology

▲ Note: Image sourced from UBTECH Technology

Unitree Technology is a tech geek renowned for its hardware prowess. In 2024, the company sold 23,700 quadruped robots globally, accounting for 69.75% of the market share. With this absolute leading position, Unitree has accumulated a deep technical moat and cost control capabilities in core components such as motors and controllers.

Although the humanoid robot H1 was a latecomer, its mature supply chain and technical accumulation allowed it to quickly gain a foothold, focusing on cost-effectiveness and athletic performance. Meanwhile, H1 also rapidly gained popularity through its stunning performances on the Spring Festival Gala stage and marathon events.

▲ Note: Image sourced from Unitree Technology

▲ Note: Image sourced from Unitree Technology

Zhiyuan Robotics is an 'AI brain' faction with inherent star power. From its inception, it has positioned 'embodied intelligence' as its core label. To date, Zhiyuan has developed three major series: Expedition, Elf, and Lingxi, covering various commercial scenarios such as interactive services and industrial Smart Manufacturing (intelligent manufacturing).

It is dedicated to building the robot's 'brain,' believing that an intelligent 'brain' is the key to triggering applications. Therefore, its robots possess stronger environmental perception, task understanding, and autonomous decision-making capabilities.

Leju Robotics, on the other hand, is a 'vertical expert' deep cultivation (deeply rooted) in specific scenarios. It pioneered the whole-body momentum control algorithm, covering diverse scenarios, and stabilized robot performance through technological iterations in 'hardware-control-perception.' Its full-sized humanoid robot, Kuafu, has now been delivered to the FAW Hongqi automobile factory.

These players outline the vibrant landscape of China's humanoid robot industry. However, behind this prosperity lies a common dilemma that all players cannot avoid—delivery.

Despite frequent mentions, the current delivery of humanoid robots remains more symbolic than practically valuable in terms of commercialization. Even if Unitree's H1 showcased synchronized dancing on the Spring Festival Gala stage, its essence is still a small-scale 'performance match' for technological display to the capital market, rather than large-scale value creation deeply integrated into production processes.

Similarly, although UBTECH's announcement of entering automotive factories marks a crucial step, the initially deployed robots are not only limited in quantity but also primarily serve as 'demonstration posts' and 'data collectors.'

No humanoid robot has yet found a mass production path that can be widely replicated and brings clear return on investment to customers, which is the core pain point of the current industry. From laboratories to exhibitions and then to demonstration production lines, robots have taken a crucial first step. However, there is clearly a long way to go before they can become tireless 'employees' working '7x24 hours' in factories and truly integrate into production rhythms.

| Breaking Through Amid Traditional Business Pressures: Betting on the Second Curve |

In this delivery competition, UBTECH is undoubtedly a swift and uncompromising runner. To understand its near-obsessive pursuit of delivery, one must first examine its financial reality.

Before becoming the 'first publicly traded humanoid robot company,' UBTECH was more widely recognized as the 'education robot giant.' For years, the majority of its revenue came from its To B and To C education robot businesses, represented by the Alpha and Jimu series. In the first half of 2025, UBTECH's educational intelligent robots and solutions generated 240 million yuan in revenue, accounting for 38.6% of the company's total revenue.

▲ Note: Image sourced from UBTECH Technology

▲ Note: Image sourced from UBTECH Technology

This business line initially helped UBTECH accumulate market presence and brand awareness. However, its 'ceiling' is also evident: limited market size, severe product homogenization, low gross margins, and gradually diminishing growth.

Meanwhile, its research and development (R&D) expenses have remained consistently high, with the R&D expense ratio once exceeding 50%. This means that for every yuan of revenue, the company had to invest over 0.5 yuan into R&D. Even in the first half of 2025, when this figure dropped to 35.1%, it still remained at a relatively high level in the industry.

As a result, UBTECH's financial report showed that although its revenue reached 1.35 billion yuan in 2024, its net loss exceeded 1.124 billion yuan.

This 'bleeding' R&D approach has indeed established its leading advantage in full-stack humanoid robot technology. However, on the other hand, it has also continuously pressured the company's financial situation.

For the capital market, a company sustained by low-margin educational products and continuously incurring huge losses obviously cannot support the high valuation of being the 'first publicly traded humanoid robot company.' UBTECH's story urgently needs an exciting new chapter. Fully committing to industrial humanoid robots represented by the Walker S has become an inevitable choice for UBTECH.

This is not just a technological upgrade but a strategic gamble concerning survival. It carries UBTECH's infinite hope for exploring a 'second growth curve.' On this new curve, every move in the race for delivery holds significant importance.

Delivery proves to the market that UBTECH's humanoid robots are not 'futures' Staying at the conceptual stage (stuck in the conceptual stage) but 'spot goods' capable of entering factories. This can not only stabilize stock prices and boost confidence but also completely break free from dependence on traditional businesses through a new grand narrative, reshaping the company's valuation logic.

Therefore, when its American counterparts questioned its delivery capability, UBTECH's strong response was not surprising. After all, this touches not on a matter of face but on the foundation of its entire business strategy. For UBTECH, which has already stood under the spotlight of the capital market, the progress bar of delivery is its lifeline.

| Capital Cooling Down: Commercialization as the Ultimate Goal |

If UBTECH's dilemma reflects the situation of an individual listed company, then looking globally, the entire humanoid robot industry is undergoing a profound revaluation. A notable trend is that capital is gradually 'cooling down,' and investors' patience is increasingly limited.

In the past few years, robot companies could easily obtain tens of millions or even hundreds of millions of dollars in financing by showcasing cool technological demos or having celebrity founder teams. At that time, most investors were chasing technological dreams and disruptive possibilities.

However, as the tide recedes and countless 'conceptual robots' ultimately fail to leave the laboratory, investors have also begun to return to the essence of business. Their questions have become increasingly practical: 'What can robots do?' 'Why are customers willing to pay?' 'How long will it take to recover the costs?'

UBTECH's situation as a listed company is a microcosm of the industry's pressures. Every move it makes is under the magnifying glass of the market. Delivery progress, customer orders, gross margin levels, and profitability expectations—every number can trigger violent fluctuations (sharp fluctuations) in stock prices. Therefore, it must find a balance between 'continuously burning money on R&D' and 'quickly achieving self-sufficiency.'

The industry's evaluation criteria have shifted from technological advancement to commercial viability. The arrival of this transformative 'examination' is signaled by two clear trends.

The collective rush of Chinese robot companies towards IPOs is itself evidence of capital becoming more cautious. Whether it's Unitree, Zhiyuan, or Leju, their choice to go public Of course (certainly) involves considerations of seizing a first-mover advantage. However, a deeper reason also lies in the increasing difficulty of financing in the primary market.

Faced with the lengthy R&D cycles of humanoid robots, high hardware costs, and the enormous investment required for scalable production, going public through IPOs to enter the secondary market and conduct a large-scale 'blood transfusion' is almost the only way to ensure survival until the 'final round.' Only in this way can they 'stockpile resources' to cope with the even more brutal 'money-burning' battles and market expansions ahead.

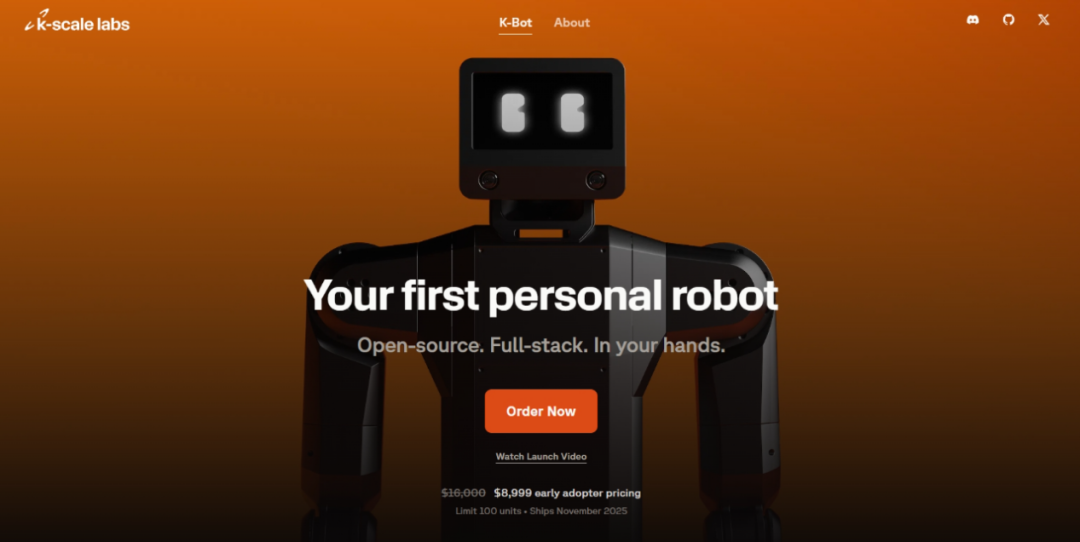

The emergence of 'negative examples' on the other side of the Pacific has also sounded an alarm for industry practitioners. In April 2025, the American AI companion robot company Embodied officially shut down. In November, K-Scale Labs, a Silicon Valley humanoid robot company established just a year earlier with a valuation once reaching $50 million, announced its closure.

▲ Note: Image sourced from K-Scale Labs

▲ Note: Image sourced from K-Scale Labs

From the IPO frenzy of Chinese companies to the Fallen in despair (dismal collapse) of Silicon Valley stars, these landmark events proclamation (declare) that the era of financing solely based on technological stories has ended globally. Scalable delivery is the way out: Not long ago, Musk announced plans to establish a factory in Fremont to produce one million robots annually; Germany's Agile Robots SE will commence serialized production of industrial-grade humanoid robots starting in early 2026; the American Figure AI company launched the humanoid robot Figure 03 and plans to produce a cumulative total of 100,000 units within four years.

Domestically, XPENG Motors recently announced plans to achieve scalable mass production of its humanoid robot IRON by the end of 2026; Zhiyuan Robotics, leveraging the mature industrial chain system in the Yangtze River Delta, plans to deploy 100,000 units within the next three years; Leju's humanoid robots are expected to reach an annual production capacity of 200 units, with a full-year mass production target in the thousands.

In UBTECH's delivery controversy, the American counterparts' accusations reflect not so much disdain for Chinese technology but rather anxiety over China's rapid mass production speed.

After all, the ultimate battleground for humanoid robots no longer lies in the spotlight of product launches or comparisons of technical parameters. Whoever can first establish a viable commercial landing path from 'technology-product-commodity' will survive in this century-old gamble and define the rules of the next era. Image sourced from the internet. Infringement notice: If there is any infringement, please contact us for deletion.